Homestead Property Tax Credit Virginia

The filing deadline for a 2020 claim is April 15 2025 for most claimants. The homestead exemption is limited to 5000 in value Virginia Code 34-4.

Va Property Tax Exemption Guidelines On Va Home Loans

Va Property Tax Exemption Guidelines On Va Home Loans

A Homestead Deed must be filed on or before the fifth day after the date of the meeting of creditors or the exemption will not be allowed by the Bankruptcy Court Virginia Code 34-17.

Homestead property tax credit virginia. You will need to have the credit certified by DHR. You or your spouse if married have earned income during the year You or your spouse if married are disabled or You or your spouse if married are 62 years of age or older at the end of 2020. But if you were eligible for a homestead tax exemption of 50000 the taxable value of your home would drop to 150000 meaning your tax bill would drop to 1500.

Under federal law to claim the homestead exemption you must have purchased the home a minimum of 40 months before filing your bankruptcy petition. If a resident is sixty-five years of age or older or a married couples files for an exemption together up to 10000. The property you claim must be your primary residence.

Visit their website and follow their application process. In order to claim the homestead credit you or your spouse must meet certain qualifications including one of the following. Property tax exemption for certain veterans.

The tax break is also offered for totally and permanently disabled citizens in West Virginia. The claim must be based only on hisher prorated share of the taxable value and property taxes or rent paid and hisher own total household resources. -- An exemption from ad valorem property taxes shall be allowed for the first 20000 of assessed value of a homestead that is used and occupied by the owner thereof exclusively for residential purposes when such owner is sixty-five years of age or older or is certified as being permanently and totally disabled provided the owner has been or.

However Virginia requires residents seeking homestead exemptions to use Virginias specific state exemption laws. Provisions in Amendment 79 will also freeze the current assessed value for taxpayers that are either disabled or 65 years or older. In order to qualify for the Homestead Excess Property Tax Credit HEPTC your property taxes paid in 2020 must have exceeded 4 of your income in 2020.

The Homestead Excess Property Tax Credit provides a refundable credit of up to 1000 for low-income property owners whose real property tax less senior citizen tax credit paid on your OWNER-OCCUPIED home exceeds 4 of your income gross household income including social security benefits. You must complete the schedule below to determine the amount of your credit. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability.

The maximum refundable tax credit is 1000. In order to qualify for the Homestead Excess Property Tax Credit you must meet certain financial guidelines based on the number of people living in your home and you must have paid more than 4 of your income in real property tax on your owner-occupied home located in West Virginia. To keep things simple lets say the assessed value of your home is 200000 and your property tax rate is 1.

Virginia homestead laws allow residents to designate up to 5000 worth of real estate including mobile homes as a homestead plus 500 for each dependent. Your property tax bill would equal 2000. Shared Housing - If two or more individuals share ownership and occupy the homestead or are contracted to pay rent and occupy the rental property each may file a homestead property tax credit.

Also known as Amendment 79 it was passed by the voters in November 2000 and allows eligible homeowners to receive up to a 375 credit on their real estate tax bill. The tax reduction only applies to home owners. If you have owned the house for less than 40 months you will have to use the homestead exemption for your previous state of residence.

Homestead Excess Property Tax Credit. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. Review the credits below to see what you may be able to deduct from the tax you owe.

If you do qualify for a credit you must submit a copy of your 2020 property tax bill if you owned and occupied your home or an original rent certificate signed by your landlord if you rented your home along with your Schedule H or H-EZ. Any amount of credit claimed under the Senior Citizen Tax Credit program will reduce the amount of credit you can claim under the Homestead Excess Property Tax Credit. The maximum credit cannot exceed 1000.

Claim the credit on your Virginia tax return for the year DHR certified the rehabilitation. To apply for the credit. It went into effect on January 1 2011.

More about the West Virginia Form IT140 Schedule HEPTC1 Individual Income Tax Tax Credit TY 2020 There is a personal income tax credit for OWNER-OCCUPIED residential real property taxes paid in excess of 4 of your income. Twenty thousand dollar homestead exemption allowed. You can claim a credit of up to 5 million.

Pursuant to subdivision a of Section 6-A of. What is the Homestead Tax Credit. The West Virginia Homestead Act provides a property tax break for citizens 65 years of age and older.

Real Property Tax Exemptions for Veterans On November 2 2010 by the citizens of the Commonwealth of Virginia ratified a proposed amendment adding Section 6-A to the Constitution of Virginia.

You Re A Homeowner Take Advantage Of Homestead Exemption Atlanta Ben

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

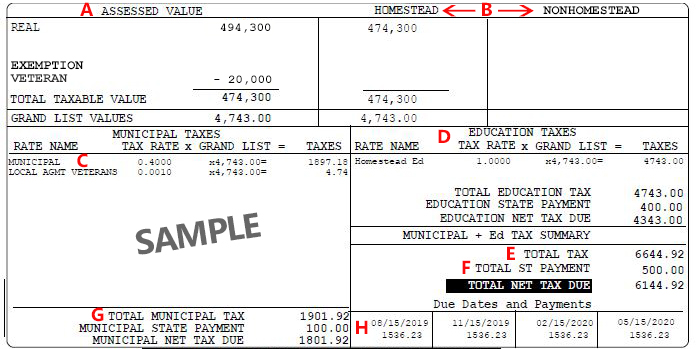

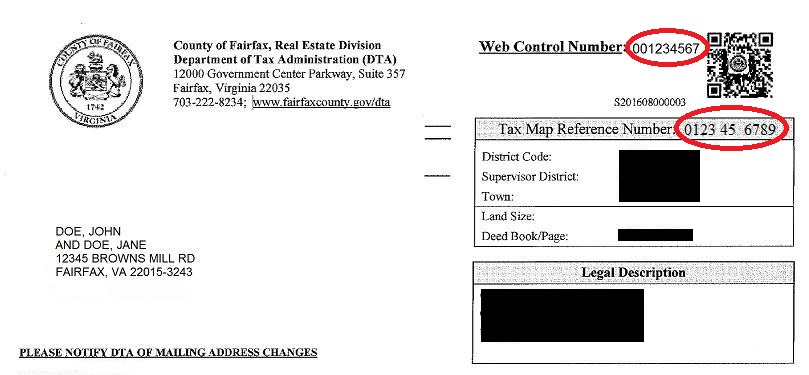

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Property Tax Relief For Income Qualified Homeowners Local Housing Solutions

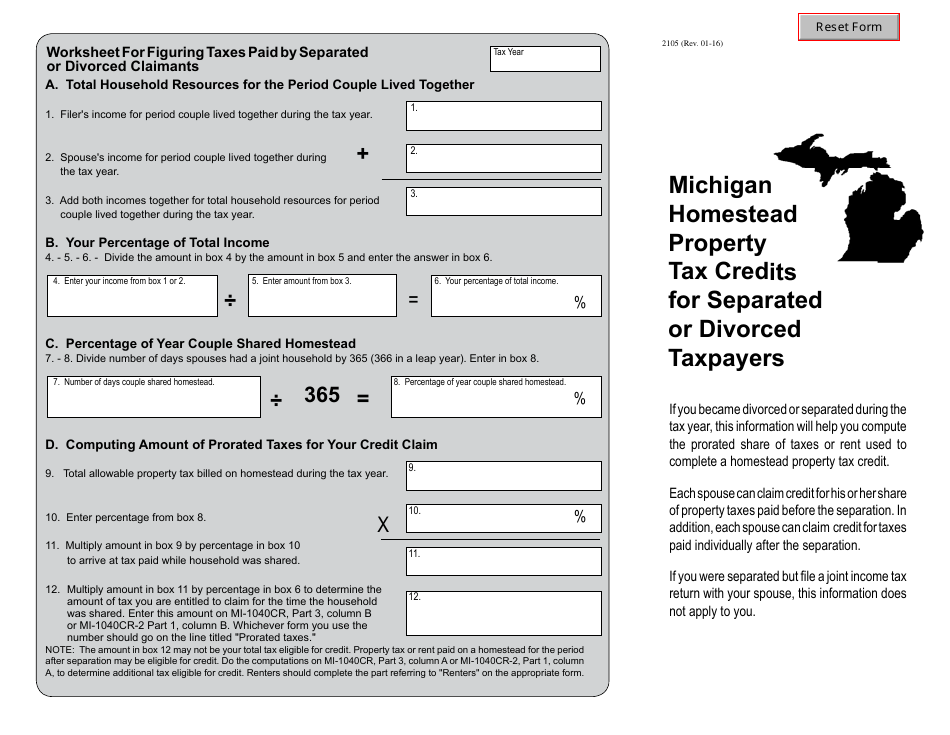

Form 2105 Download Fillable Pdf Or Fill Online Michigan Homestead Property Tax Credits For Separated Or Divorced Taxpayers Michigan Templateroller

Form 2105 Download Fillable Pdf Or Fill Online Michigan Homestead Property Tax Credits For Separated Or Divorced Taxpayers Michigan Templateroller

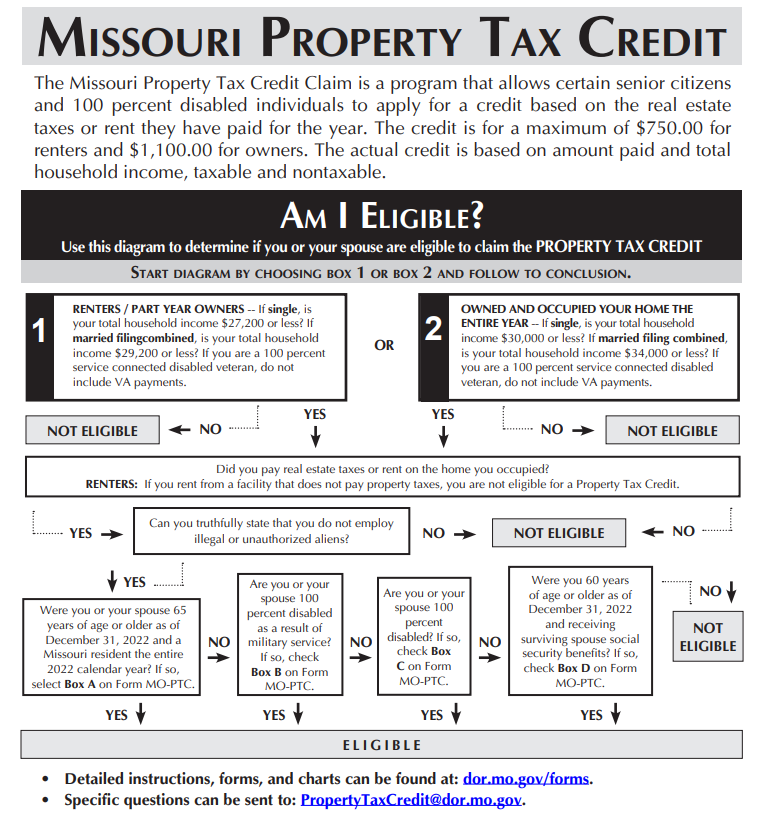

Property Tax Claim Eligibility

Property Tax Claim Eligibility

What Is The Virginia Homestead Exemption Fisher Sandler Llc

What Is The Virginia Homestead Exemption Fisher Sandler Llc

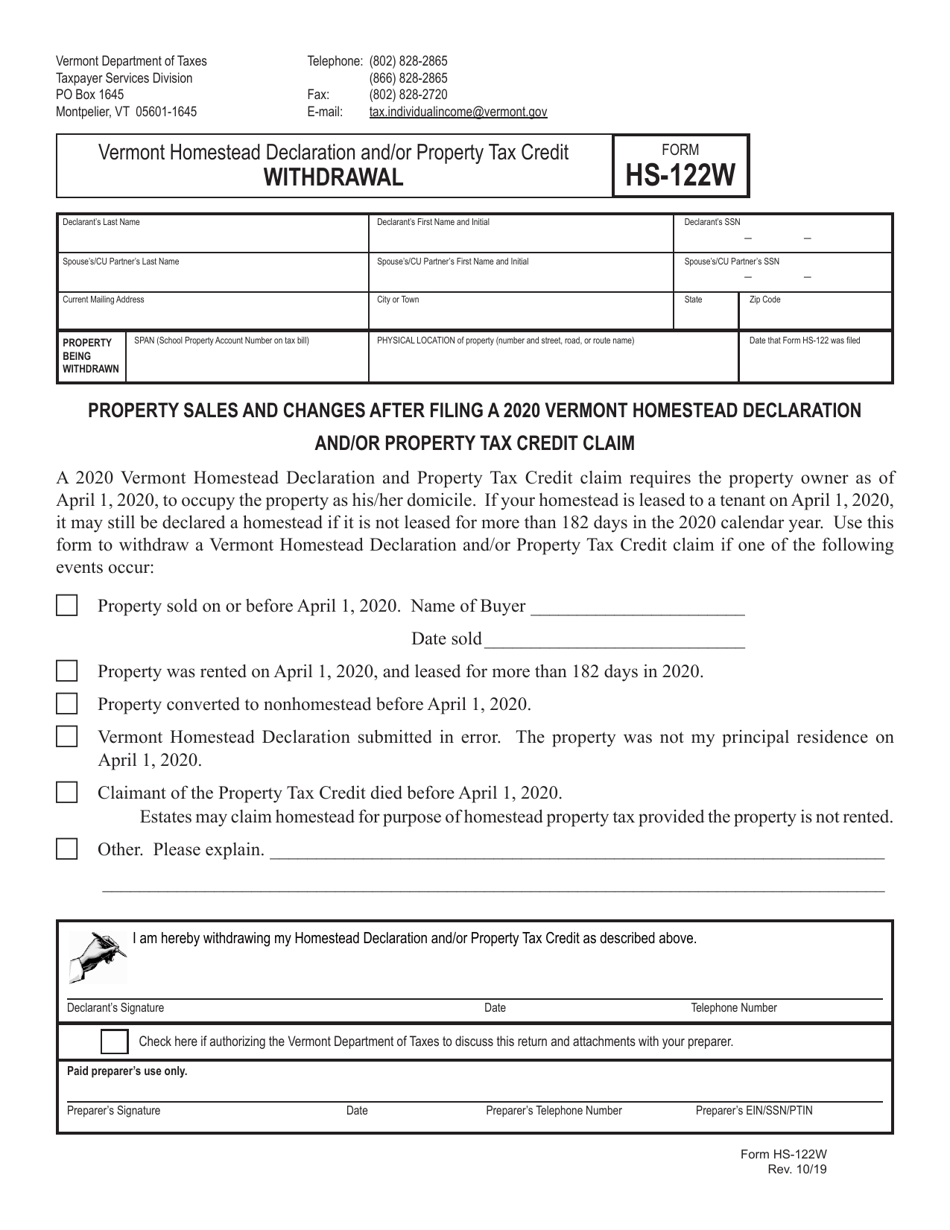

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Homestead Exemptions By U S State And Territory

Homestead Exemptions By U S State And Territory

Va Property Tax Exemption Guidelines On Va Home Loans

Va Property Tax Exemption Guidelines On Va Home Loans

2008 Individual Tax Return Instructions

2008 Individual Tax Return Instructions

What Is Michigan S Homestead Property Tax Credit Kershaw Vititoe Jedinak Plc

What Is Michigan S Homestead Property Tax Credit Kershaw Vititoe Jedinak Plc

Scam Pretends To Offer Homestead Tax Exemption

Scam Pretends To Offer Homestead Tax Exemption

What Is A Homestead Tax Exemption Smartasset

What Is A Homestead Tax Exemption Smartasset

Real Estate Tax Frequently Asked Questions Tax Administration

Real Estate Tax Frequently Asked Questions Tax Administration

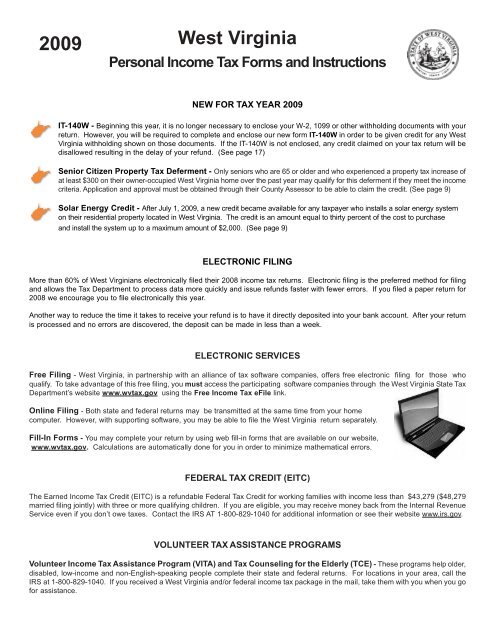

Personal Income Tax Forms And Instructions State Of West Virginia

Personal Income Tax Forms And Instructions State Of West Virginia

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home