How To Find Property Id Number On 1098

Click images for larger versions STEP 1. Finding Property Tax ID Numbers If the ID number you need to find is for a property you own you may already have the number in your files.

/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

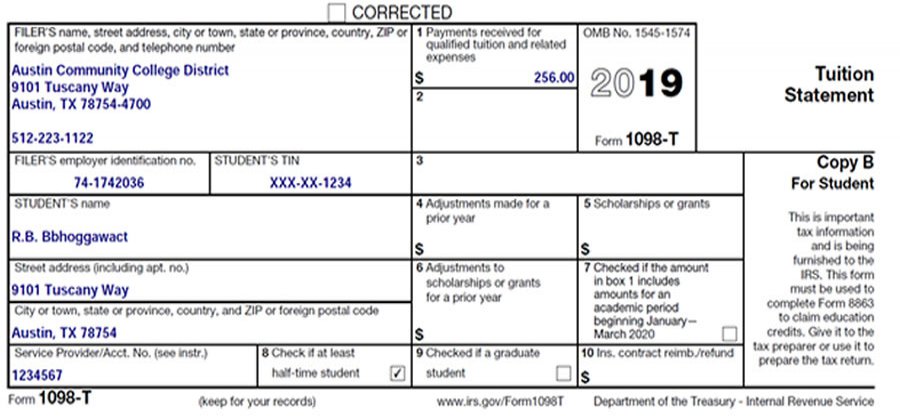

And that is the second box from the top of the form to the left right above STUDENTS name.

How to find property id number on 1098. You can search by Owner Name Last Name First Name Business Name Account Number Enter the 10-digit account number including the - Ex. Your PIN can also be found on. It should be listed in the box to the left of the form that says FILERS federal identification no.

The 600 threshold applies separately to each mortgage so you are not required to file Form 1098 for a mortgage on which you have received less than 600 in interest even if an individual paid you over 600 in total on multiple mortgages. However if you are unable to find it refer to our map search and either. Youll find a link to your 1098 form in the Year-end Statements section.

However if youre the owner of the house the easiest way is by looking on your deed or most recent property tax bill. Use the two-digit area number 12 in the sample to identify your township on the Cook County map. See part L in the 2021 General Instructions for.

This of course is only easy if you happen to have your current bill or deed handy. Enter 10527 in the Site ID field. Properties can usually be searched for with the property index number address or other property characteristics.

You may also get this number from your county assessors office. Additionally the IRS encourages you to designate an account number for all Forms 1098 that you file. Go to the property search portion of your county website.

If you meet the guidelines for receiving a 1098 form you can sign in to Online Banking select your mortgage account and then select the Statements Documents tab. This number is located on your county tax bill or assessment notice for property tax paid on your principal residence during the tax year for which you are filing your return. June 6 2019 538 AM.

These expenses can be. The account number is required if you have multiple accounts for a payerborrower for whom you are filing more than one Form 1098. For other 1099 tax forms.

Depending on the county this can be found under the assessor or auditor portion of the website. The easiest way to find your PIN is to look it up on the Chief County Assessment Offices Property Tax Assessment Information by Address page. The number that most taxpayers care about is found at box 1 circled in red.

Enter your search criteria in the Property Search box below. The ID number will then be displayed for you. You can also call the department at 847-377-2050 or contact your township assessors office.

123456-7890 or Location Address Address should be entered as it appears on the Real Estate Tax Notice for the closest match. Enter the last four digits of your social security number or the password you previously created in the Password field Click the Login button. Property tax is set by and paid to the county where your property is located.

You can find a propertys tax ID number in several ways. You can find your ID number on your property tax notices usually on the top left of your tax notice. If you have not received them by February 15 please contact us.

File a separate Form 1098 for each mortgage. Look within the township area identified in Step 1 to find your two-digit section number. Form 1098 is a form filed with the Internal Revenue Service IRS that details the amount of interest and mortgage-related expenses paid on a mortgage during the tax year.

The form 1098 looks like this. Box 1 reports the total amount of home mortgage interest paid to your lender. If your property tax is paid through your mortgage you can contact your lender for a copy of your bill.

Your PIN will be displayed at the top of the search results page and labeled PARID. Enter your Louisiana Tech Student ID without the dashes in the Username field. Click on ViewPrint 1098-T.

I search your address or ii enter the homeowners name. Where do I find the Federal ID on 1098-T. You may at your option file Form 1098 to.

Look on your last tax bill the deed to your property a.

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

What To Bring To Do Your Taxes Tax Prep Checklist Tax Prep Tax Appointment

What To Bring To Do Your Taxes Tax Prep Checklist Tax Prep Tax Appointment

Understanding Your Tax Forms 2016 Form 1099 A Acquisition Or Abandonment Of Secured Property Tax Forms Rental Agreement Templates Resignation Letter Format

Understanding Your Tax Forms 2016 Form 1099 A Acquisition Or Abandonment Of Secured Property Tax Forms Rental Agreement Templates Resignation Letter Format

Form 1099 S Substitute 2017 2018 Irs Forms Federal Taxes Estate Tax

Form 1099 S Substitute 2017 2018 Irs Forms Federal Taxes Estate Tax

1098 T Student Financial Services

1098 T Student Financial Services

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

/Form1098-5c57730f46e0fb00013a2bee.jpg) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Tax Tips For Bloggers Tax Preparation Tax Checklist Tax Help

Tax Tips For Bloggers Tax Preparation Tax Checklist Tax Help

Feeling Happy Wallpaper Number 1098 Good Morning Cards Good Morning Quotes Good Morning Motivation

Feeling Happy Wallpaper Number 1098 Good Morning Cards Good Morning Quotes Good Morning Motivation

Tax Reporting 1098 T Austin Community College District

Tax Reporting 1098 T Austin Community College District

Labels: number

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home