Property Tax Rate Los Angeles County 2020

Updated 212020 How Much Are Conejo Valley Property and Sales Taxes. To address the concerns of not being able to record intergenerational transfers before 2162021.

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

Please call 213893-7935 or visit us at 225 N.

Property tax rate los angeles county 2020. Estimate taxes for a recently purchased property. The Auditor-Controller groups taxable properties into Tax Rate Areas TRAs. On or before this date Notice of Lien is sent to inform property owner that lien is being filed for unpaid unsecured property taxes.

You may fax your request to 213 633-5004 or mail to 225 North Hill Street Room 160 Los Angeles California 90054-0970. FEBRUARY 15 Deadline for filing homeowners exemption claim 7000 assessment. The Taxpayers Guide is presented to provide data on the various levies throughout the County of Los Angeles for County School and Special District Purposes.

The median property tax in Los Angeles County California is 2989 per year for a home worth the median value of 508800. Adjusted Annual Secured Property Tax Bill. Tax Rate Area Lookup.

The TRAs are numbered and appear on both secured and unsecured tax bills. IMPORTANT - Property Tax Payments. Here are some answers for the most frequently asked questions asked by Los Angeles County property owners.

Read more DCBA Launches New Financial Navigator Services. The first installment of real estate taxes is DUE DELINQUENT after 500 pm on December 10. The property tax amounts currently due for the 2019-2020 Annual Secured Property Taxes have a lien date of January 1 2019 and therefore no reduction will be made to the current bill.

If November 30 falls on a Saturday Sunday or a legal holiday an application is valid if either filed or postmarked by the next business day. Los AngeLes County offiCe of the Assessor 2020 AnnuAL report assessorlacountygov 6 things to know As A NEw PROPERTy OwNER TAx RATE Property is taxed at 1 percent of its assessed value determined by the Assessor but your tax bill may include other line items such as assessments for school bonds or parcel taxes for fire and water districts. Los Angeles County Treasurer and Tax Collector Mails LATEST NEWS.

FEBRUARY 1 Second installment of real estate taxes is due delinquent after 500 PM on April 10. Los Angeles County has one of the highest median property taxes in the United States and is ranked 160th of the 3143 counties in order of median property taxes. The Guide contains information to assist the taxpayer to understand the legal requirements covering the assessment of property payment of taxes.

Los Angeles County collects on average 059 of a propertys assessed fair market value as property tax. We are located on the first floor in Room 122. The Assessors Identification Number AIN is a ten-digit number assigned by the Office of the Assessor to each piece of real property in Los Angeles County.

All County Office Buildings are closed effective Monday March 16 2020 until further notice. Should you have questions related to decline-in. 2020-21 Secured Property Taxes Second Installment Period.

That the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. The Office of the Los Angeles County Assessor will consider the execution and notarization date notarial execution on the document to. Please include address and mobile home location decal number current registered owner serial number name of buyer mailing address and daytime telephone number.

Los Angeles County Auditor-Controller-Property Tax-Tax Rates. As a home buyer you need to know how much our local taxes are and what is the difference between Ventura County and Los Angeles County. Los Angeles County Treasurer and Tax Collector Reminds Property Owners of Upcoming Second Installment Delinquency Date.

If November 30 falls on a Saturday Sunday or a legal holiday an application. The Board of Supervisors sets the tax rates that are calculated in accordance with Article 13 a of the. Last day to file an ASSESSMENT APPEAL APPLICATION for reduction of assessment made in regular period in Los Angeles County.

Last day to file ASSESSMENT APPEAL APPLICATION for reduction of assessment made in regular period in Los Angeles County. 1788 rows Los Angeles. The median Los Angeles County homeowner pays 3938 annually in property taxes.

Delinquent Unsecured Tax information is only available by telephone or in person. The average effective property tax rate in San Diego County is 073 significantly lower than the national average. Hill Street Los Angeles CA 90012.

2020-21 Secured Property Taxes Second Installment Period. This ten-digit AIN is made up of a four-digit Map Book Number 1234 a three-digit Page Number 567 and a three-digit Parcel Number 890. Along with the countywide 072 tax rate homeowners in different cities and districts pay local rates.

MARCH 1 Annual mailing of personal property tax bills begins. Filing business personal property statement opens BOE541-L deadline April 1. When you are looking to buy a home taxes play a role in what you can afford.

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

Unsecured Property Tax Los Angeles County Property Tax Portal

Unsecured Property Tax Los Angeles County Property Tax Portal

Orange County Ca Property Tax Calculator Smartasset

Orange County Ca Property Tax Calculator Smartasset

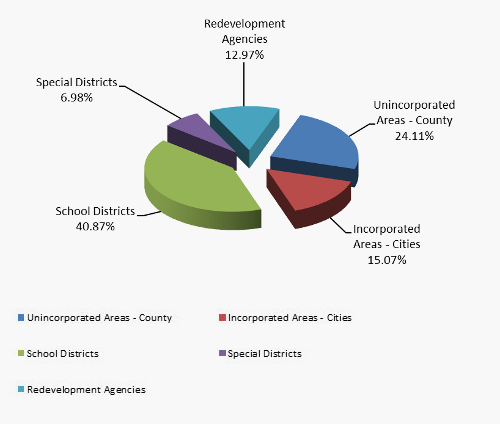

California Property Taxes Explained Big Block Realty

California Property Taxes Explained Big Block Realty

Property Taxes Overview Los Angeles County Office Of The Assessor

Property Taxes Overview Los Angeles County Office Of The Assessor

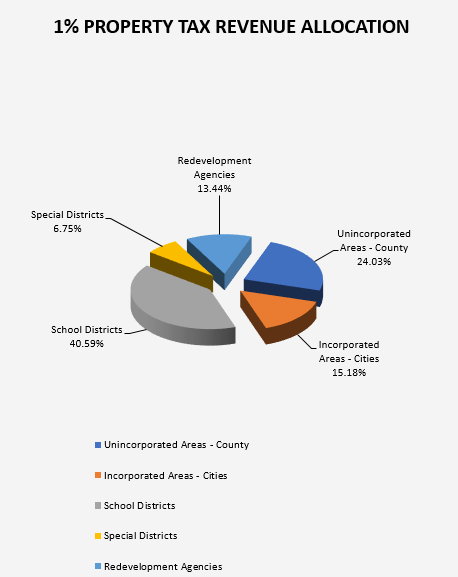

Revenue Allocation Summary Auditor Controller

Revenue Allocation Summary Auditor Controller

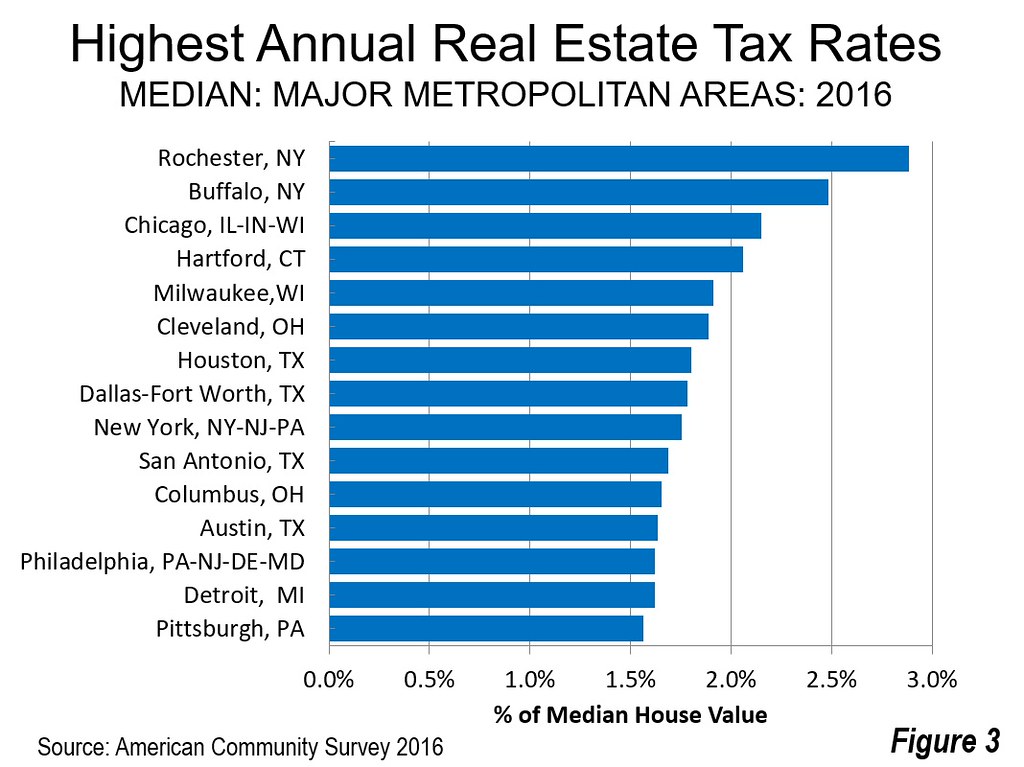

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

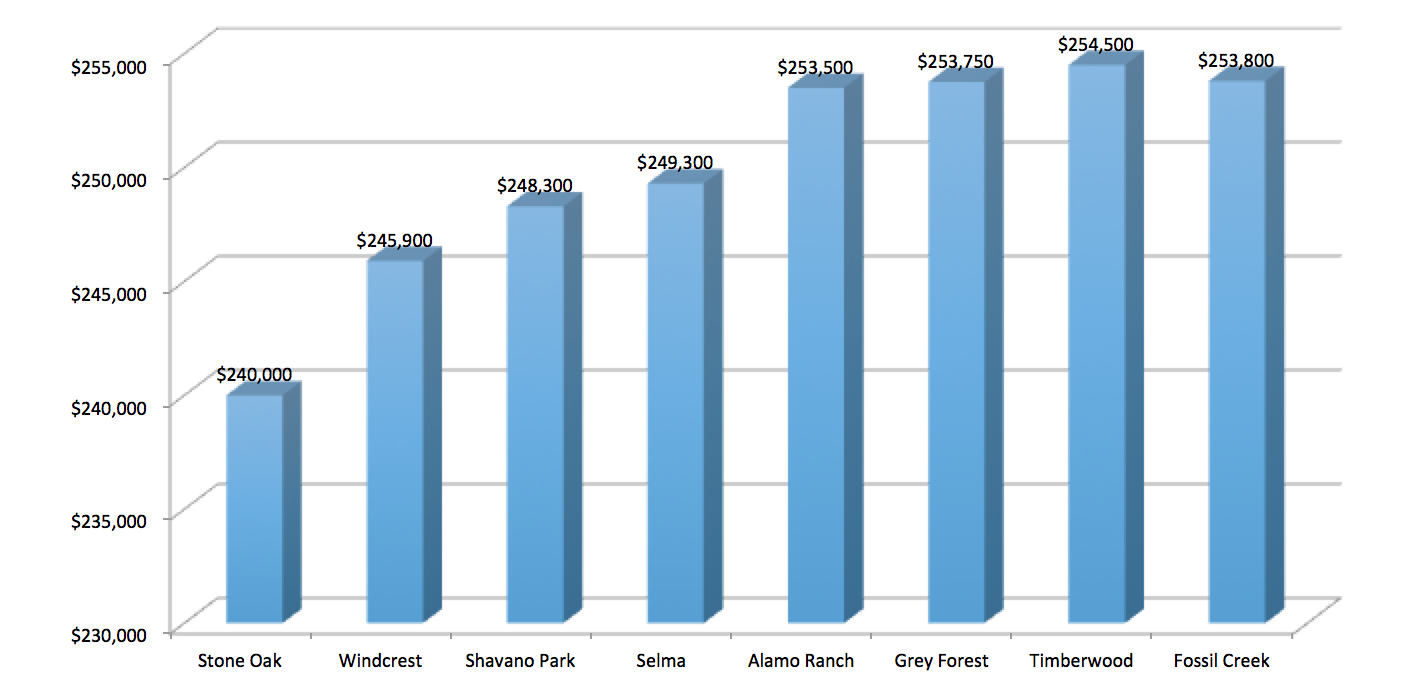

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Understanding California S Property Taxes

Understanding California S Property Taxes

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Manhattan Beach Property Taxes

Manhattan Beach Property Taxes

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal

Why Are Texas Property Taxes So High Home Tax Solutions

Why Are Texas Property Taxes So High Home Tax Solutions

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Revenue Allocation Summary Auditor Controller

Revenue Allocation Summary Auditor Controller

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home