Estimating Property Value Based Rental Income

To estimate property values based on rental income investors can use the gross rental multiplier GRM which measures the propertys value relative to its rental income. Three factors determine a propertys value as a rental investment.

How To Calculate Rental Property Cash Flow A Comprehensive Guide Cash Flow Statement Positive Cash Flow Cash Flow

How To Calculate Rental Property Cash Flow A Comprehensive Guide Cash Flow Statement Positive Cash Flow Cash Flow

While it sounds a little tricky it really is quite easy as long as you have access to some basic information.

Estimating property value based rental income. Gross scheduled income the number of units times. Its rent price and operating expenses such as maintenance costs homeowners insurance and property taxes. To calculate a GRM divide the propertys price by its yearly rent for example a.

A six-unit apartment project might yield 30000 net profit from rentals. To come up with the Zillow Rent Zestimate we look at. Current Market Value Capitalization Rate Net Operating Income Your operating data should include annual NOI Net Operating Income numbers.

The homes physical attributes and amenities like square footage and number of bedrooms and bathrooms Comparable rental properties and the market rental rates in the area. NOI is calculated by summing gross rents and other income generated by the property and then subtracting all expenses. To that end we created rent price and expense automated valuation models AVMs to predict these values.

The Gross Rent Multiplier GRM is a capitalization method used for calculating the approximate value of an income producing commercial property based on the propertys gross rental income. Expenses include any and everything required to operate the property such as. Determine the capitalization rate from a recent comparable sold property.

The comparison method uses recent sale prices of comparable properties to determine the buildings estimated value. The vacation rental income calculator estimates the vacation rental occupancy rate based on actual Airbnb analytics and data gathered from the neighborhood where your rental property is located. In this article well look at both measures along with the appropriate formulation you can use to arrive at a propertys market value the next time youre working with rental income property.

How Do We Determine a Propertys Value as a Rental Estimate. To calculate divide the property price by the annual rental income. Rental Property Cash Flow Real estate income can be estimated by analyzing the cash flow of an income property.

Cash on Cash Return. The occupancy rate indicates the number of days that your rental property is expected to be occupied by tenants in a year. Depending on your rental income you can have positive cash flow negative cash flow or break even.

Dividing the annual gross rents of the building by the gross rent multiplier or dividing the net income by the capitalization rate. For example a home valued at. To determine how much rent to charge a tenant many landlords use the 1 rule which suggests charging 1 of the homes value for rent.

Rental property cash flow refers to the difference between rental property income and rental expenses. The Rent Zestimate tool helps provide a rent estimate by address. The income method calculates the commercial property value from rent revenue in one of two ways.

The gross rental multiplier is a valuation metric that looks at a property relative to its rental income. Lets say your comparable sold for 250000. The GRM can then be utilized as a benchmark when evaluating comparable income properties.

Now divide that net operating income by the capitalization rate to get the current value result. Gross rent multiplier or GRM measures the ratio between a rental propertys gross scheduled income and its stated price.

Investment Property Analyzer Rental Property Calculator Etsy Investment Property Capitalization Rate Investing

Investment Property Analyzer Rental Property Calculator Etsy Investment Property Capitalization Rate Investing

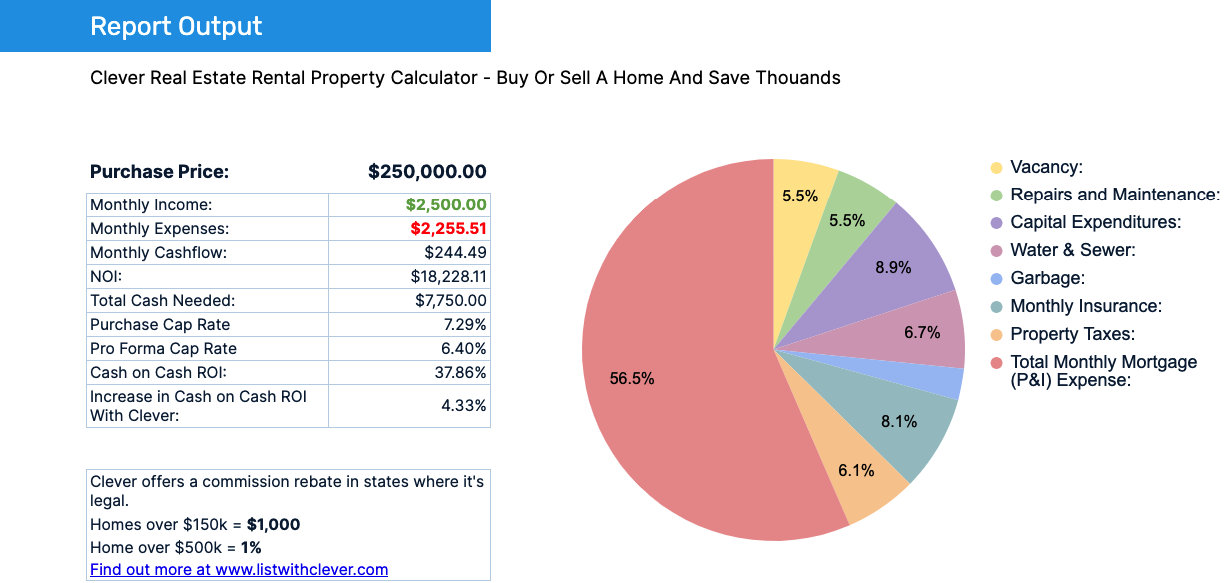

Rental Property Calculator Most Accurate Forecast Clever Real Estate

Rental Property Calculator Most Accurate Forecast Clever Real Estate

The Trade Up Plan How To Retire In 8 Years Using Tax Free Exchanges Real Estate Investing Rental Property Real Estate Rentals Rental Property Investment

The Trade Up Plan How To Retire In 8 Years Using Tax Free Exchanges Real Estate Investing Rental Property Real Estate Rentals Rental Property Investment

Short Term Buy Hold The Buy 3 Sell 2 Keep 1 Plan Real Estate Investing Rental Property Real Estate Rentals Real Estate Tips

Short Term Buy Hold The Buy 3 Sell 2 Keep 1 Plan Real Estate Investing Rental Property Real Estate Rentals Real Estate Tips

Rental Property Analysis Spreadsheet Investment Property Rental Property Investment Investment Property For Sale

Rental Property Analysis Spreadsheet Investment Property Rental Property Investment Investment Property For Sale

Landlords Spreadsheet Template Rent And Expenses Spreadsheet Etsy Being A Landlord Spreadsheet Template Rental Property Management

Landlords Spreadsheet Template Rent And Expenses Spreadsheet Etsy Being A Landlord Spreadsheet Template Rental Property Management

The Rental Income Property Calculator First Step Fortune In 2020 Real Estate Investing Rental Property Income Property Rental Property Investment

The Rental Income Property Calculator First Step Fortune In 2020 Real Estate Investing Rental Property Income Property Rental Property Investment

Investment Property Analyzer Rental Property Calculator Investment Property Roi Investment Property Investing Rental Property

Investment Property Analyzer Rental Property Calculator Investment Property Roi Investment Property Investing Rental Property

3 Ways To Work Out A Rental Yield Wikihow

3 Ways To Work Out A Rental Yield Wikihow

The Rental Income Property Calculator First Step Fortune Rental Income Income Property Real Estate Investing Rental Property

The Rental Income Property Calculator First Step Fortune Rental Income Income Property Real Estate Investing Rental Property

Airbnb Bookkeeping Airbnb Excel Template Rental Income Property Management Rental Property Management

Airbnb Bookkeeping Airbnb Excel Template Rental Income Property Management Rental Property Management

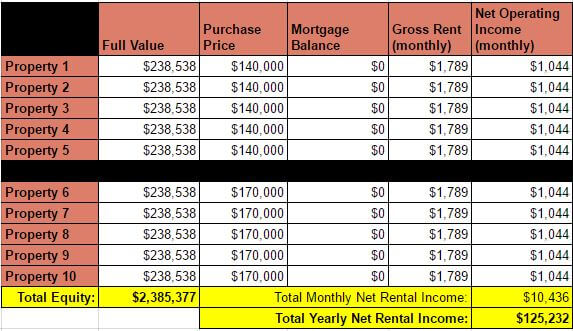

Case Study 100 000 Per Year Rental Income Coach Carson

Case Study 100 000 Per Year Rental Income Coach Carson

Brrrr Strategy For Real Estate Investing A Complete Guide Fearless Frankie Real Estate Investing Investing Investing Strategy

Brrrr Strategy For Real Estate Investing A Complete Guide Fearless Frankie Real Estate Investing Investing Investing Strategy

Free Rental Property Management Spreadsheet In Excel Rental Property Management Rental Property Rental Property Investment

Free Rental Property Management Spreadsheet In Excel Rental Property Management Rental Property Rental Property Investment

Tenant Payment Ledger Remaining Balance Rent Due Calculator 25 Properties Rental Property Management Rental Income Rental Property

Tenant Payment Ledger Remaining Balance Rent Due Calculator 25 Properties Rental Property Management Rental Income Rental Property

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Management Rental Property Real Estate Investing

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Management Rental Property Real Estate Investing

Gross Rent Multiplier Definition And Examples Rental Property Income Property Rent

Gross Rent Multiplier Definition And Examples Rental Property Income Property Rent

The Irv Formula Formula Rental Company Investing

The Irv Formula Formula Rental Company Investing

Rental Property Calculator Quick Overview Rental Property Real Estate Investing Property

Rental Property Calculator Quick Overview Rental Property Real Estate Investing Property

Labels: estimating, property, rental, value

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home