Property Tax Spartanburg South Carolina

Property Tax if assessed at 6. Property tax is administered and collected by local governments with assistance from the SCDOR.

720 California Ave Spartanburg Sc 29303 Realtor Com

720 California Ave Spartanburg Sc 29303 Realtor Com

Real and personal property are subject to the tax.

Property tax spartanburg south carolina. Approximately two-thirds of county-levied property taxes are used to support public education. Spartanburg County collects on average 064 of a propertys assessed fair market value as property tax. So while the 064 average effective rate in Spartanburg County is higher than the state average of 055 the amount actually paid by homeowners in the county is lower than the state mark.

GIS stands for Geographic Information System the field of data management that charts spatial locations. The median annual property tax payment in Spartanburg County is just 854 per year. Non Owner Occupied Residential Property In this example the property tax assessed a Non Owner Occupied is 152280 higher over 3 times higher than if it was assessed as Owner Occupied.

The Treasurer also invests any funds not needed for immediate disbursement. Spartanburg County Treasurer is no longer accepting 2020 real property tax payments. The actual amount of savings depends on the school district in which the property is located.

Historic Aerials 480 967. The scope of work performed by the Spartanburg County Assessor is based on requirements of the South Carolina Code of Laws South Carolina Department of Revenue South Carolina Property Tax Regulations and county ordinances. The credibility of the assessors assignment and the data is measured in the context of the intended use.

Spartanburg County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by property tax collections. The Spartanburg County - SC Tax Office disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data. The credibility of the assessors assignment and the data is measured in the context of the intended use.

The median property tax on a 11630000 house is 58150 in South Carolina. The median property tax also known as real estate tax in Spartanburg County is 74800 per year based on a median home value of 11630000 and a median effective property tax rate of 064 of property value. The Tax Collectors Office collects delinquent taxes and special taxes on real estate mobile homes watercraft South Carolina Department of Revenue assessed charges and other personal property.

March 232020 Spartanburg County will waive all CreditDebit card fees until further notice. Spartanburg Mapping GIS. Multiply the purchase price by the South Carolina state tax rate of 4 percent.

The median property tax in Spartanburg County South Carolina is 748 per year for a home worth the median value of 116300. Go to Data Online. Government and private companies.

GIS Maps are produced by the US. The scope of work performed by the Spartanburg County Assessor is based on requirements of the South Carolina Code of Laws South Carolina Department of Revenue South Carolina Property Tax Regulations and county ordinances. Spartanburg Tax Collector 864 596 - 2597.

Spartanburg County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Spartanburg County South Carolina. NETR Online Spartanburg Spartanburg Public Records Search Spartanburg Records Spartanburg Property Tax South Carolina Property Search South Carolina Assessor. Looking for a place with low property taxes in South Carolina.

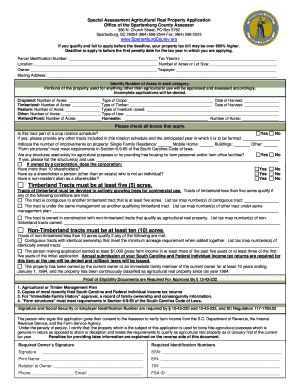

If you are eligible for the owner occupied legal residence special assessment or the agricultural use special assessment and fail to file the proper application your tax liability may be over three times higher because it will be classified at the other real property rate. Remember that 4 percent translates into a decimal of04 when making computations. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Spartanburg County Tax Appraisers office.

The Spartanburg County Treasurer an elected official collects real personal motor vehicle inventory and other taxes and oversees their disbursement to all county municipal school and special service districts. The Spartanburg County Tax Collectors Office located in Spartanburg South Carolina is responsible for financial transactions including issuing Spartanburg County tax bills collecting personal and real property tax payments. Create an Account - Increase your productivity customize your experience and engage in information you care about.

Step 3 Multiply the value that was received in step two by the millage rate for your area of Spartanburg. For inquiries regarding real property tax for 2020 and prior please contact the Tax. Spartanburg County South Carolina.

If taxes arent collected the office holds annual tax sales in accordance with Title XII of the South Carolina. Municipalities levy a tax on property situated within the limits of the municipality for services. Spartanburg will never call text or email you asking for any personal information such as bank account or credit card number account PIN or password or Social Security number.

The median property tax on a 11630000 house is 74432 in Spartanburg County. Go to Data Online. As of 500 pm.

South Carolina is ranked 1948th of the 3143 counties in the United States in order of the median amount of property taxes collected.

463 N Forest St Spartanburg Sc 29303 Realtor Com

463 N Forest St Spartanburg Sc 29303 Realtor Com

Montgomery Building Spartanburg South Carolina Wikipedia

Montgomery Building Spartanburg South Carolina Wikipedia

City Of Spartanburg South Carolina Neighborhoods

City Of Spartanburg South Carolina Neighborhoods

Relocating To Spartanburg Sc Guide To Moving To Spartanburg Sc

Relocating To Spartanburg Sc Guide To Moving To Spartanburg Sc

City Of Spartanburg South Carolina Pay Municipal Court Fines

City Of Spartanburg South Carolina Pay Municipal Court Fines

345 Bryant Rd Spartanburg Sc 29303 Realtor Com

345 Bryant Rd Spartanburg Sc 29303 Realtor Com

Outlet Rd Spartanburg Sc 29303 Land For Sale Loopnet Com

Outlet Rd Spartanburg Sc 29303 Land For Sale Loopnet Com

100 W Cleveland St Spartanburg Sc 29301 Realtor Com

100 W Cleveland St Spartanburg Sc 29301 Realtor Com

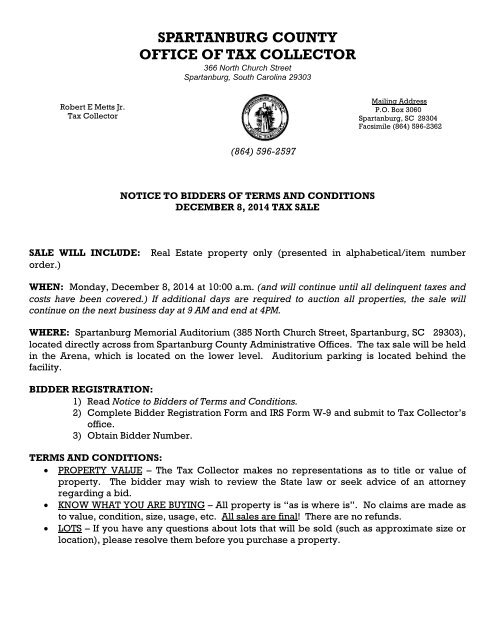

Office Of Tax Collector Spartanburg County

Office Of Tax Collector Spartanburg County

851 Mike Cir Spartanburg Sc 29303 Realtor Com

851 Mike Cir Spartanburg Sc 29303 Realtor Com

176 Silver Hill St Spartanburg Sc 29302 Realtor Com

176 Silver Hill St Spartanburg Sc 29302 Realtor Com

101 Campus Suites Dr Spartanburg Sc 29303 Realtor Com

101 Campus Suites Dr Spartanburg Sc 29303 Realtor Com

City Of Spartanburg South Carolina Podcast Explaining The Plan To Replace And Redevelop Highland S Norris Ridge Apartments

City Of Spartanburg South Carolina Podcast Explaining The Plan To Replace And Redevelop Highland S Norris Ridge Apartments

120 Connecticut Ave Spartanburg Sc 29302 Realtor Com

120 Connecticut Ave Spartanburg Sc 29302 Realtor Com

Covid 19 Information Spartanburg County Sc

155 Fernridge Dr Spartanburg Sc 29307 Realtor Com

155 Fernridge Dr Spartanburg Sc 29307 Realtor Com

1610 Houston Dr Spartanburg Sc 29307 Realtor Com

1610 Houston Dr Spartanburg Sc 29307 Realtor Com

Relocating To Spartanburg Sc Guide To Moving To Spartanburg Sc

Relocating To Spartanburg Sc Guide To Moving To Spartanburg Sc

Homestead Exemption Spartanburg Sc Fill Online Printable Fillable Blank Pdffiller

Homestead Exemption Spartanburg Sc Fill Online Printable Fillable Blank Pdffiller

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home