California Property Tax Going Up

The TCJA capped the state and local. Look Up Secured Property Tax.

How To Transfer California Property Tax Base From Old Home To New

How To Transfer California Property Tax Base From Old Home To New

Property tax increase pending in November ballot initiative A measureProposition 15that would revise the rules for property taxes in California will be on the November 2020 ballot.

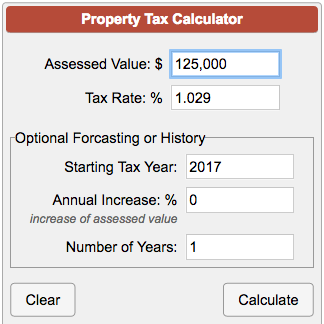

California property tax going up. Property tax is based on your town state or municipalitys tax rate as well as your property value. If you are a new home buyer dont be surprised to see higher property tax bills if your house value goes up. The tax type should appear in the upper left corner of your bill.

You have make an appeal to the assessor on why your home value is down so they can reassess. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year. Look Up Unsecured Property Tax.

But what constitutes new construction and how much will the taxes go up. Under California property tax law new construction is. If a tax amount is still unpaid after June 30 additional charges at the rate of 15 per month 18 per year are added until the full amount is paid.

And secondly it restricts increases in assessed value to 2 per year. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes. Changes to either of these tend to be what drives property taxes up.

The Trump Tax plan will means billions in lost tax deductions for the millions of home owners in California. Enter Property Parcel Number APN. Look Up Supplemental Property Tax.

Assessor Auditor-Controller Treasurer and Tax Collector and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County. Or once your county reassesses the value of the land in your area you could see an uptick in your property taxes. There is a 10 penalty or late fee if the tax amounts are paid after the deadline dates and 10 in costs added if the April 10th installment is paid late.

Property tax doesnt typically go down. Enter Property Address this is not your billing address. These two rules combine to keep Californias overall property taxes below the national average which in turn keeps your bills low.

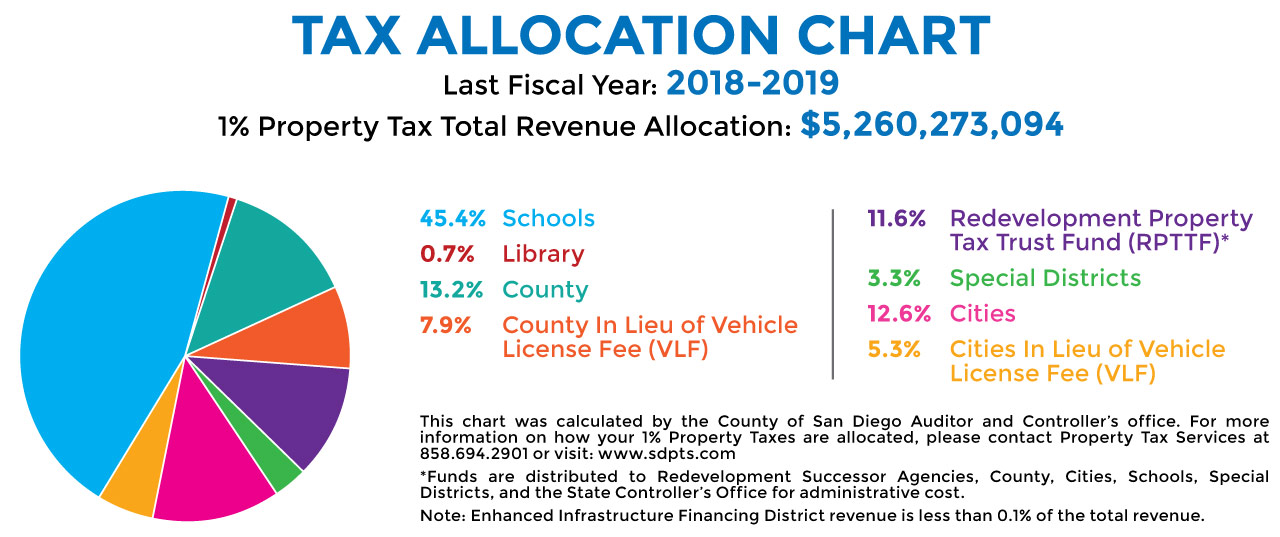

First it limits general property taxes not including those collected for special purposes to 1 of a propertys market value. Californias tax rate could jump from 133 to a whopping 168. There are several things that make your property taxes go up.

According to ATTOM Data Solutions property taxes on single-family homes in 2018 totaled 3046 billion a 4 increase from 2017. If it passes it could cause some Californians to hop in their Teslas and head. Under Proposition 13 property is assessed for tax purposes at the purchase price and the assessed value cannot be raised more than two percent per year unless there is a change of ownership or new construction.

The tax is generally due on an annual basis and the amount fluctuates based on changes to your property value. For payments made online a convenience fee of 25 will be charged for a credit card transaction. The median property tax in California is 283900 per year for a home worth the median value of 38420000.

No fee for an electronic check from your checking or savings account. The average tax bill in 2017 was 3400.

Property Taxes Overview Los Angeles County Office Of The Assessor

Property Taxes Overview Los Angeles County Office Of The Assessor

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

California 13 3 Tax Rate May Be Raised To 16 8 Retroactively

California 13 3 Tax Rate May Be Raised To 16 8 Retroactively

How To Transfer California Property Tax Base From Old Home To New

How To Transfer California Property Tax Base From Old Home To New

04 What Is Prop 13 Los Angeles County Office Of The Assessor

04 What Is Prop 13 Los Angeles County Office Of The Assessor

Proposed Tax Law Amendment In California Could Greatly Affect Commercial Industrial Properties Propertyshark Real Estate Blog

Proposed Tax Law Amendment In California Could Greatly Affect Commercial Industrial Properties Propertyshark Real Estate Blog

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

California Prop 19 Property Tax Break Explained Youtube

California Prop 19 Property Tax Break Explained Youtube

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

How School Funding S Reliance On Property Taxes Fails Children Npr

How School Funding S Reliance On Property Taxes Fails Children Npr

Why Did My Property Tax Bill Increase So Dramatically Property Tax Estate Tax Tax

Why Did My Property Tax Bill Increase So Dramatically Property Tax Estate Tax Tax

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

Proposition 19 Explained Changes Certain Property Tax Rules Abc7 Youtube

Proposition 19 Explained Changes Certain Property Tax Rules Abc7 Youtube

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

2019 Property Tax Bills Mailed

2019 Property Tax Bills Mailed

California Prop 15 Commercial Property Tax Increase Explained In 1 Minute Youtube

California Prop 15 Commercial Property Tax Increase Explained In 1 Minute Youtube

P The Chicago Tribune Has A Map That Outlines Areas Of Chicago That Appear To Be Hardest Hit By A Average 13 Percent Property Property Tax Chicago Tribune Tax

P The Chicago Tribune Has A Map That Outlines Areas Of Chicago That Appear To Be Hardest Hit By A Average 13 Percent Property Property Tax Chicago Tribune Tax

Labels: california, going, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home