Property Tax Deadline 2020 Washington State

If your taxes are still delinquent on June 1st you are subject to a 3 penalty. They appear to be the first county to make the announcement on March 26th.

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Here you can check your filing due dates to make sure your tax return gets in on time.

Property tax deadline 2020 washington state. Property taxes make up at least 94 percent of the states General Fund which. Due to the financial hardships caused by the COVID-19 pandemic King County Executive Dow Constantine has extended the first-half 2020 property tax deadline to June 1. First half or full amount due on or before April 30 second half on or before October 31.

Voter-approved property taxes imposed by school districts. You must complete payment by. Your payment due date is.

In 2018 the Legislature made additional changes to lower the levy rate for taxes in 2019. After April 30th property taxes are considered delinquent and subject to 1 interest per month. Your payment due date is.

April 30th First half of property taxes due If taxes are less than 50 full. You must complete payment by. 88 rows KEY DATES 2020.

Road Improvement District 18 -- Due February 12. 1 of the assessment year for taxes due and payable in the following tax year RCW 8436005 and RCW 8440020. This executive order only applies to individual residential and commercial taxpayers who pay property taxes themselves rather than through their mortgage lender.

Its important to know when your taxes need to be filed. Your payment due date is. There could be some benefit in extending these property tax payment due dates as long as the state of emergency exists in Washington State.

Your payment due date is. Spokane County has extended the deadline to June 15 th 2020. A new law allows businesses that can document a 25 percent reduction in revenue attributable to real property for 2020 compared to 2019 can apply for a extension of payment on 2021 real property taxes through Dec.

Special Assessments All the following special assessments assessments are included on your global tax statement and have the same due dates as Real Property tax. County Road Improvement District. But residential and commercial taxpayers who pay the taxes themselves rather than through mortgage lenders now will have.

You must complete payment by. AP Pierce County Assessor-Treasurer Mike Lonergan announced Monday that due date for first-half property tax payments would be extended to June 1. Completion of Application for Senior Citizen and Disabled Persons Exemption from Real Property Taxes.

No interest will be charged on payments received by that date. Property taxes imposed by the state. 2020 Property Tax Calendar January All taxable real and personal property is valued as of Jan.

1 day agoThe first half of property taxes or an application for an extension of payment from eligible businesses is due on April 30. Pacific County extends deadline to June 1 2020 see newspaper article here. You must complete payment by.

Interest continues to accrue until the taxes are paid in full. State funding for certain school districts. Dear Taxpayer Tax bills will soon be arriving in your mailboxes.

After a significant reduction in 2019 2020 brings increases for most taxpayers which are largely a result of state legislation. The due date for property taxes from the first half of 2020 is April 30. Where does your property tax go.

For most homeowners that pay their taxes with their mortgage payment however there wont be any relief. The federal deadline for individual filing and payments has been extended until May 17 2021 but if you make estimated tax payments those payments are still due Thursday April 15 2021. Beginning in 2020 Income Threshold 3 is based on the county median household income of the county where the residence is located.

King Pierce and Snohomish County have extended the payment due date for property taxes to June 1 st 2020. Your property tax bill reflects your propertys share of the state county and other taxing districts. This is a good policy decision.

Personal property listing forms are mailed by this date RCW 8440040. Washington State DOL WA_DOL March 26 2020 In addition to the property tax extension for King and Thurston counties the national filing deadline for. 2015 Electronic funds transfer EFT 2021.

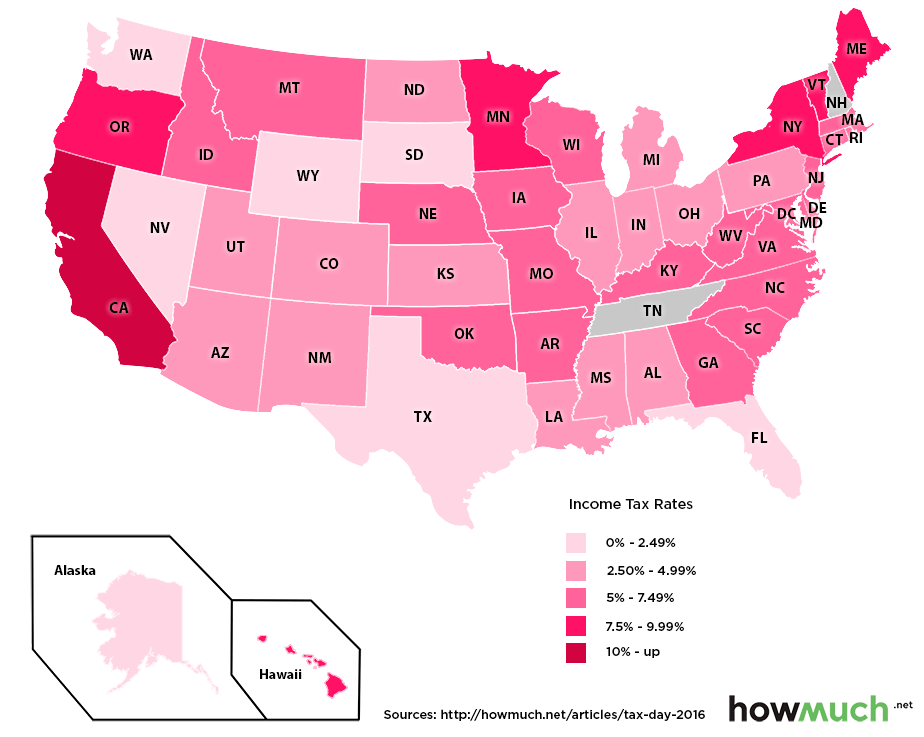

Which U S States Have The Lowest Income Taxes

Which U S States Have The Lowest Income Taxes

States With No Estate Tax Or Inheritance Tax Be Strategic Where You Die

States With No Estate Tax Or Inheritance Tax Be Strategic Where You Die

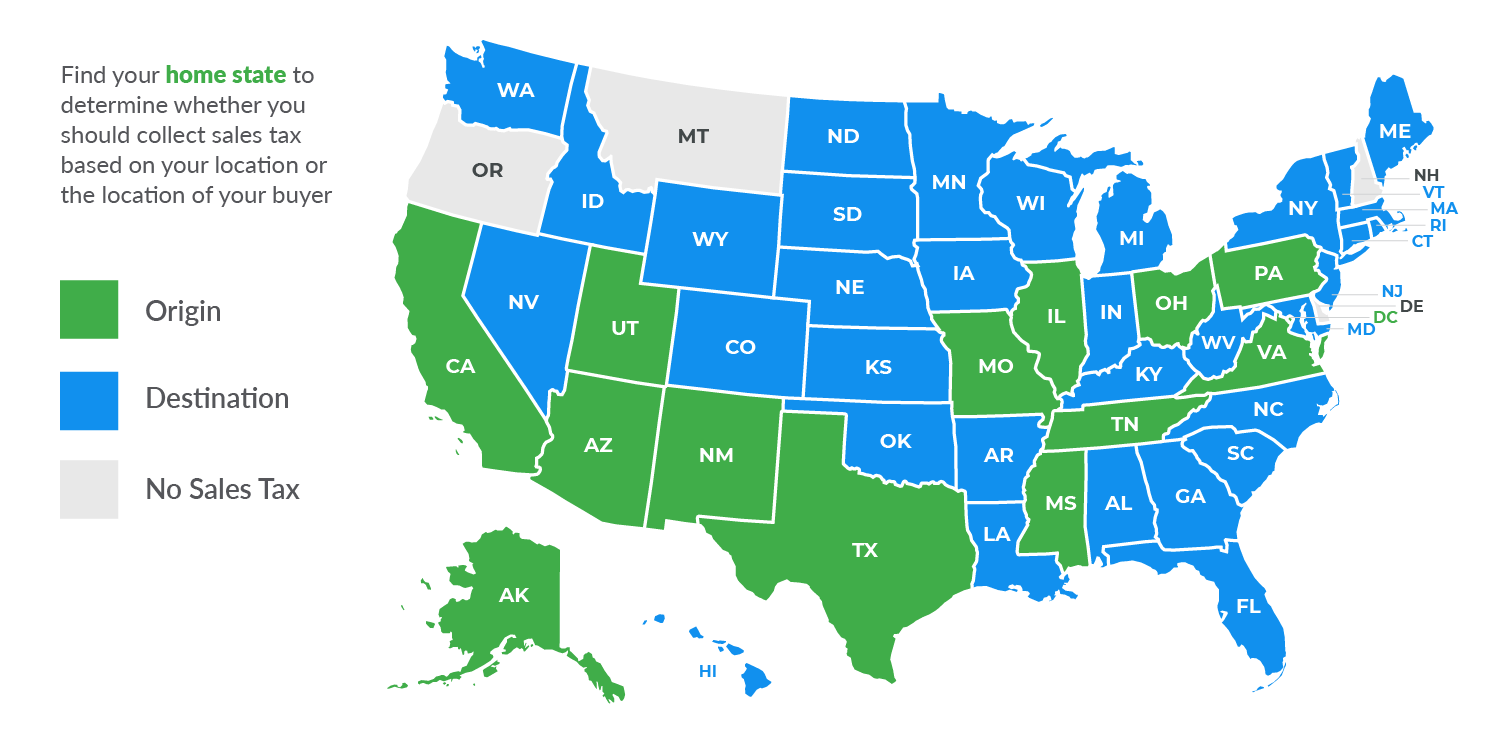

Origin Based And Destination Based Sales Tax Collection 101taxjar Blog

Origin Based And Destination Based Sales Tax Collection 101taxjar Blog

The States Where People Are Burdened With The Highest Taxes Zippia

The States Where People Are Burdened With The Highest Taxes Zippia

Unable To Pay Tax Debt On Time Here S A Quick Guide To Irs Payment Plans Irs Payment Plan Tax Debt Irs

Unable To Pay Tax Debt On Time Here S A Quick Guide To Irs Payment Plans Irs Payment Plan Tax Debt Irs

Blog Akopyan Amp Amp Company Cpa Seattle Accounting Firm Taxes Payroll Budget Planning Accounting Firms Blog

Blog Akopyan Amp Amp Company Cpa Seattle Accounting Firm Taxes Payroll Budget Planning Accounting Firms Blog

States With No Income Tax H R Block

States With No Income Tax H R Block

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

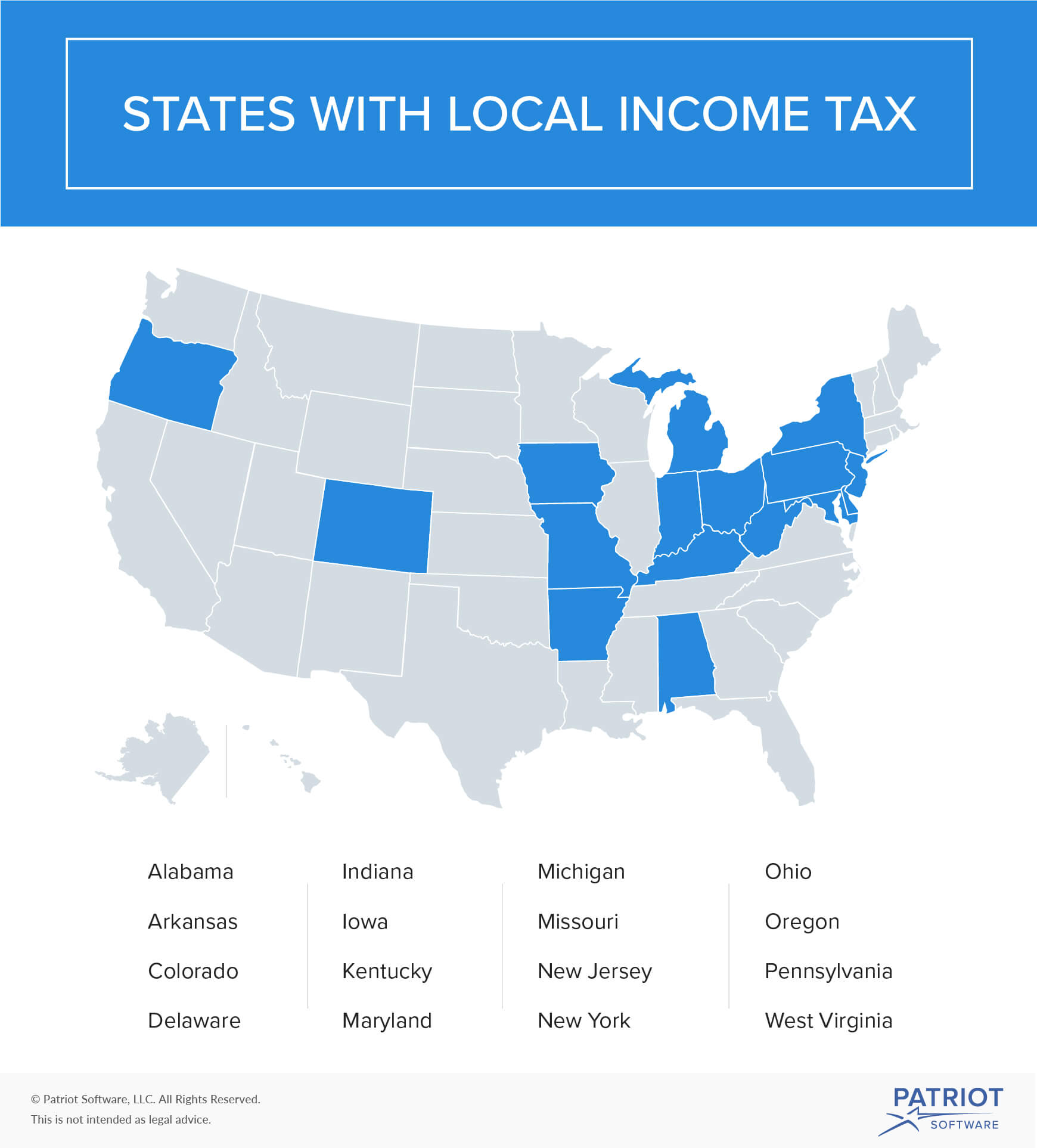

What Is Local Income Tax Types States With Local Income Tax More

What Is Local Income Tax Types States With Local Income Tax More

Here S How Biden S Tax Plan Would Affect Each U S State

What Is The Washington State Vehicle Sales Tax New Cars Cars For Sale Car Dealer

What Is The Washington State Vehicle Sales Tax New Cars Cars For Sale Car Dealer

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Property Tax Wa State Building A House Living In Washington State Building

Property Tax Wa State Building A House Living In Washington State Building

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Which U S States Have The Lowest Income Taxes

Which U S States Have The Lowest Income Taxes

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Where S My State Refund Track Your Refund In Every State

Where S My State Refund Track Your Refund In Every State

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home