How Do Personal Property Taxes Work In Arkansas

The statewide property tax deadline is October 15. The Collectors office collects property taxes to help support schools cities roads jails and county expenses based on millage rates set by local governments and voters.

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Personal property taxes are applied to items such as vehicles trailers motorcyles etc.

How do personal property taxes work in arkansas. I dont know about Illinois but Arkansas seems to have an out of date tax system. Nonexempt personal property multiplying the assessed value of property by FSPPC114. Type personal property taxes exactly as listed in the Search box in the top right corner Click jump to personal property taxes and this will take you to the Property Taxes Paid on Boats and Planes but this is for automobiles as well.

Look up excise taxes by address and zip code to determine your local tax rate. Real Property Tax Owed Personal Property Tax Owed Property Tax Owed City Resident 250 100 350. Administration of Arkansas Property Tax.

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Homeowners in Arkansas may receive a homestead property tax credit of up to 375 per year. Personal Income Tax Rates Effective January 1 2020.

But now one state lawmaker is seeking to get rid of personal property tax via constitutional amendment. At least Arkansas has enough common sense not to have automobile inspections or smogging. If you lived in a state with personal property taxes you might also have to pay personal property taxes on your farming equipment and your livestock.

Most counties provide online property tax payments which you can find by visiting argovtax. Answer Yes and follow the prompts to enter the tax you paid. Property tax is an important source of.

While property taxes in Arkansas are primarily a local function there are good reasons to think of some real property taxes as state-level taxes even though legally they are local taxes. Taxes in Arkansas Personal Property Tax and Real Estate Taxes. Personal Income Tax Resident and non-resident individuals estates and trusts deriving income from within the state are subject to a tax on their net income at the following rates.

IFTA Tax Report Generator. Pay Your Personal Property Taxes Online. Specifically Amendment 74 to the Arkansas Constitution narrowly approved by voters in 1996 requires all school districts to set a minimum 25 mills property tax.

052 of home value. Computation of personal property tax owed. And are paid to your county collector.

The homestead property may be owned by a revocable or irrevocable trust. Online payments are available for most counties. In the state of Arkansas residential property is taxed at the state county city and school district level.

Be sure to pay before then to avoid late penalties. Taxes are based off the propertys appraised value or market value. The credit is applicable to the homestead which is defined as the dwelling of a person used as their principal place of residence.

The majority of the states counties have median annual property tax payments below 800. Pay-by-Phone IVR 1-866-257-2055. Tax amount varies by county.

These taxes are about 1 of the value of your home car and other items that you may own. Assessed Value Tax Rate Property Tax Owed City Resident 2000 50 mills 100. But you could take out the office furniture which is something that many states do tax.

Log into the Arkansas Motor Carrier System to generate an IFTA tax report. 2019 TAXES ARE NOW DELINQUENT. Check with your local assessor to see if.

Personal Property should be itemized and reported to the assessor by May 31 to avoid a late assessment penalty of 10. If you lived on a farm the land would be taxed under real estate property taxes. Real estate taxes are also paid to the county collector and many provide online payments as.

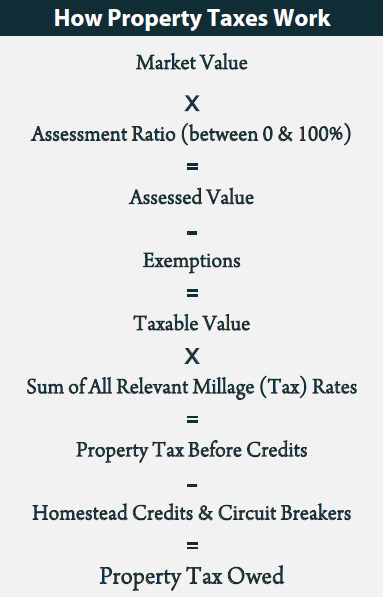

In Arkansas all real and personal property is assessed 20 of market value. Managed by your County Collector. Generated by the property tax is used to finance computation and collection of the property tax.

Find your county look up what you owe and pay your tax bill online in most counties. Personal Property is assessed annually and its value determined as of January 1 of each assessment year. So if you owned a property with a market value of 100000 you would only be required to pay property taxes on 20000.

Non-City Resident 2000 45 mills 90. Computation of total property tax owed. The vehicle assessment that you submit each year is used to calculate your personal property taxes in the county in which you reside.

Arkansans are required to pay personal property taxes every year. Counties in Arkansas collect an average of 052 of a propertys assesed fair market value as property tax per year. Local Tax Rate Lookup.

Want to avoid paying a 10 late penalty. When you buy a car boat RV or motorcycle in Arkansas youre charged sales tax at the point. Personal property tax is probably just enough money to pay the employees that collect them.

Each year that you pay property taxes you are paying for the previous years assessment. The median property tax in Arkansas is 53200 per year for a home worth the median value of 10290000. Property taxes in Arkansas are lower than in most of the rest of the country.

Real Estate Taxes Vs Property Taxes H R Block

Real Estate Taxes Vs Property Taxes H R Block

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

Understanding Property Taxes Lotnetwork Com

Understanding Property Taxes Lotnetwork Com

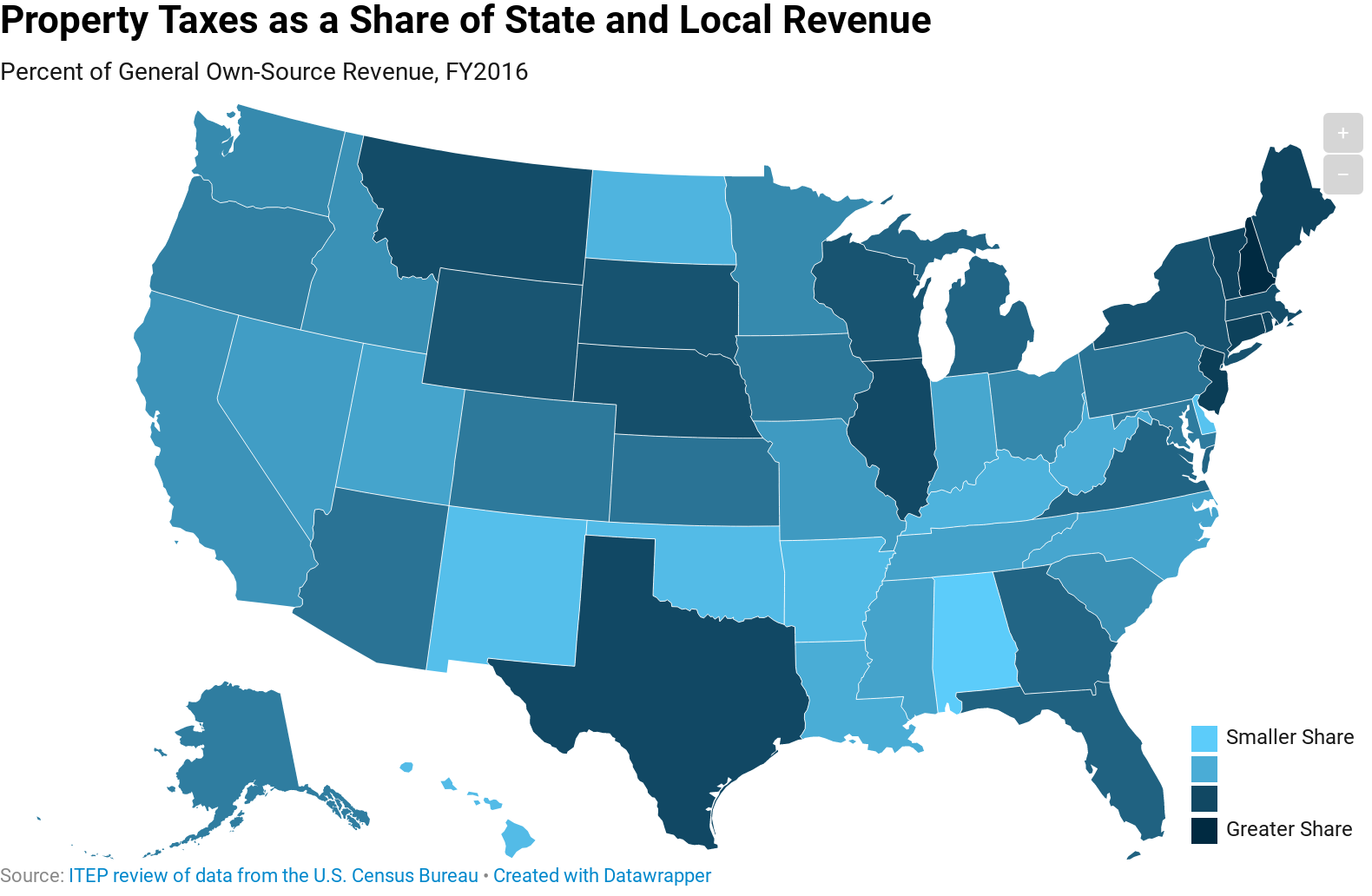

How Heavily Does Your State Rely On Property Taxes Itep

How Heavily Does Your State Rely On Property Taxes Itep

Things That Make Your Property Taxes Go Up

Things That Make Your Property Taxes Go Up

Property Taxes On Owner Occupied Housing Property Tax Buying Property Infographic

Property Taxes On Owner Occupied Housing Property Tax Buying Property Infographic

Https Www Arcountydata Com Docs Uofa Admin Of Ark Property Tax Pdf

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Louisiana Amendment 5 Payments In Lieu Of Property Taxes Option Arklatexhomepage

Louisiana Amendment 5 Payments In Lieu Of Property Taxes Option Arklatexhomepage

Understanding Property Taxes Lotnetwork Com

Understanding Property Taxes Lotnetwork Com

Property Taxes In Massachusetts Everything You Need To Know

Property Taxes In Massachusetts Everything You Need To Know

States With The Highest And Lowest Property Taxes Homes Com Property Tax States State Tax

States With The Highest And Lowest Property Taxes Homes Com Property Tax States State Tax

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home