Do I Have To Pay Property Tax On A Leased Car In Connecticut

Excise taxes in Maine Massachusetts and Rhode Island. While CT does have a credit for property taxes paid on a primary residence motor vehicle or both - the law has changed for 2017 and 2018 see Connecticut Enacts Budget Legislation The credit is now limited to Connecticut residents who paid qualifying property tax on their residence andor motor vehicle AND one or more of the following statements apply.

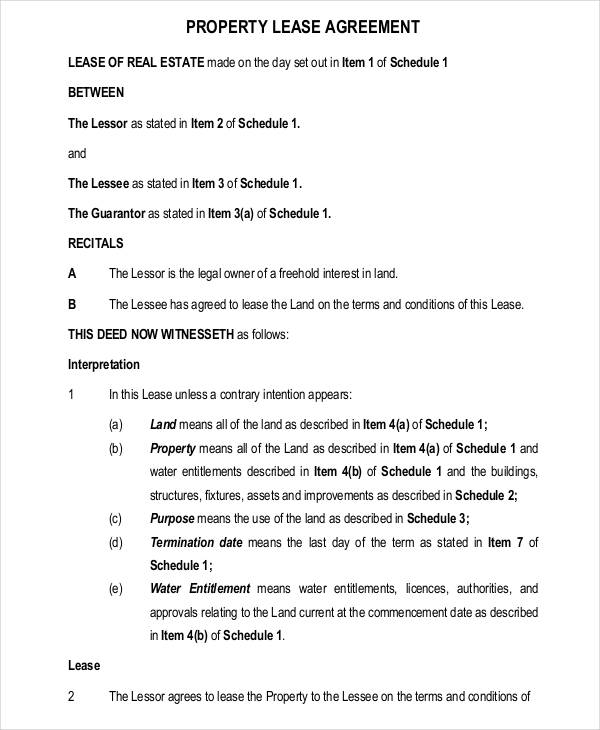

Simple One Page Lease Agreement Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

Simple One Page Lease Agreement Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

Only five states do not have statewide sales taxes.

Do i have to pay property tax on a leased car in connecticut. Local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise. You may take credit against your 2017 Connecticut income tax liability for qualifying property tax payments you made on your primary residence privately owned or leased motor vehicle or both to a Connecticut political subdivision. Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in your lease contract.

The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing agency or dealer. The owner of the vehicle iswas GMAC. Leased and privately owned cars are subject to property taxes in Connecticut.

But yes unfortunately one way or the other you will still need to pay property taxes for a leased vehicle. Montana Alaska Delaware Oregon and. Sales taxes on cars are often hefty so you may try to avoid paying them.

And motor vehicle registration fees in New Hampshire. You must complete section 6 if tax exemption is claimed on the Application for Registration and Title form H-13B. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure.

According to Connecticuts Department of Motor Vehicles DMV you must pay a 635 percent sales. Since the leasing company owns the vehicle you are leasing they are responsible for these taxes however the cost is usually passed on to the lessee. 170 rows Motor Vehicles are subject to a local property tax under Connecticut state law.

Since the lease buyout is a purchase you must pay your states sales tax rate on the car. When you lease a vehicle the car dealer maintains ownership. Areas such as South Florida are known to be great for leasing a car since these regions have the highest auto leasing rates in the country.

The state charges a 6 sales tax. In addition to taxes car purchases in Connecticut may be subject to other fees like registration title and plate fees. The taxing process for motor vehicles is the same for other taxable property in Connecticutthe tax rate of the property is assessed at 70 of fair market value which is determined by a local assessor.

For vehicles that are being rented or leased see see taxation of leases and rentals. CONNECTICUT Connecticut car owners including leasing. Knowing Connecticuts sales tax on cars is useful for when youre buying a vehicle in the state.

New Connecticut Residents - New Connecticut residents are not required to pay sales tax if the vehicle was registered in the same name in another state for at least 30 days prior to establishing Connecticut residency. As of September 2011 Oregon Alaska New Hampshire Montana and Delaware do not assess a sales tax on consumers but if you live in one of these states you may be subject to local taxes. Im currently leasing a car from Nissan and this year they paid my registration fees to the Department of Motor Vehicles and then billed me for the 571 tax on that.

They are not subject to local taxes in New Jersey New York and Vermont. The leasing company will pay the appropriate property tax to the town the car is registered in. However the total sales tax can increase by more than 15 depending on the area or county.

Heres how it works. If you do pay the personal property tax you can deduct it on your taxes if you itemize. The property tax is either included in the overall vehicle payment or added as a separate fee.

Connecticut collects a 6 state sales tax rate on the purchase of all vehicles. Check with your states tax or revenue department. In most cases the agreement made between the dealer or leasing agency and the person leasing the vehicle will pass the cost of property taxes on to the lessee most frequently as part of the monthly.

You can find these fees further down on the page. Why Do You Have to Pay a Car Tax. This means you only pay tax on the part of the car you lease not the entire value of the car.

Transfer or Sale Between Immediate Family Members. The most common method is to tax monthly lease payments at the local sales tax rate. For leased vehicles similar rules apply.

Take comfort in knowing that your vehicle taxes are being used for the greater overall good of your community and will benefit you in the long run. The easiest and most straightforward way to do so is to buy a car in a state with no sales taxes and register the vehicle there. Generally property tax bills.

Call your leasing company and they should. Alaska Juneau only Arkansas Connecticut Kentucky Massachusetts Missouri Rhode Island Texas Virginia West Virginia. If you are a lessee and your vehicle is garaged in one of the following states you may be responsible for paying state or local property taxes.

This is very unusual.

Commercial Lease Agreement Free Business Lease Word Pdf

Commercial Lease Agreement Free Business Lease Word Pdf

Free 39 Sample Lease Agreement Forms In Pdf Ms Word

Free 39 Sample Lease Agreement Forms In Pdf Ms Word

Formula De A Avea O Proprietate Care O Platesti In Rate Pina Aduni Suma Guma Pium Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

Formula De A Avea O Proprietate Care O Platesti In Rate Pina Aduni Suma Guma Pium Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

Little Red Fox 5035 Connecticut Ave Nw Washington D C Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

Little Red Fox 5035 Connecticut Ave Nw Washington D C Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Free 60 Lease Agreement Forms In Pdf Ms Word

Free 60 Lease Agreement Forms In Pdf Ms Word

Ms Word Rental Agreement Template Word Document Templates Rental Agreement Templates Room Rental Agreement Rental

Ms Word Rental Agreement Template Word Document Templates Rental Agreement Templates Room Rental Agreement Rental

Real Estate Power Of Attorney Form Power Of Attorney Form Connecticut Real Estate Power Of Attorney

Real Estate Power Of Attorney Form Power Of Attorney Form Connecticut Real Estate Power Of Attorney

Warning Of Default On Commercial Lease Template Lease Commercial Commercial Property

Warning Of Default On Commercial Lease Template Lease Commercial Commercial Property

Rental Lease Agreement Templates Free Real Estate Forms Lease Agreement Rental Agreement Templates Lease Agreement Free Printable

Rental Lease Agreement Templates Free Real Estate Forms Lease Agreement Rental Agreement Templates Lease Agreement Free Printable

Rent To Own Agreement Create A Free Lease To Own Lease Agreement

Rent To Own Agreement Create A Free Lease To Own Lease Agreement

California Rental Lease Agreement Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

California Rental Lease Agreement Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

California Commercial Real Estate Lease Agreement Special Free California Association Of Realtors C A R Lease Ve F803 Real Estate Lease Lease Agreement Lease

California Commercial Real Estate Lease Agreement Special Free California Association Of Realtors C A R Lease Ve F803 Real Estate Lease Lease Agreement Lease

Commercial Lease Agreement Template 2021 Official Pdf

Commercial Lease Agreement Template 2021 Official Pdf

Lease Agreement Template Woodwork Plans Residential Lease Agreement Template Lease Agreement Rental Agreement Templates Room Rental Agreement

Lease Agreement Template Woodwork Plans Residential Lease Agreement Template Lease Agreement Rental Agreement Templates Room Rental Agreement

Courtesy Car Agreement Form Template Simple Guidance For You In Courtesy Car Agreement Form Rental Agreement Templates Car Rental Car Hire

Courtesy Car Agreement Form Template Simple Guidance For You In Courtesy Car Agreement Form Rental Agreement Templates Car Rental Car Hire

Free Commercial Lease Free To Print Save Download

Free Commercial Lease Free To Print Save Download

Free 60 Lease Agreement Forms In Pdf Ms Word

Free 60 Lease Agreement Forms In Pdf Ms Word

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home