Jackson County Property Tax House

Planning Board Clerk 518-441-8641. Payment is due on.

Jackson County Tax Assessor S Office

Jackson County Tax Assessor S Office

Pay your property taxes or schedule future payments.

Jackson county property tax house. Both drop boxes will close at midnight. Learn more about appraisals homestead exemptions land records personal property and real estate taxes. 2nd Half Taxes due postmarked by May 10th 2020.

Please note that the online payment website will close at 11 pm December 31. County Treasurer Linda Gerhardt. 400 New York Avenue Courthouse - Room 206 Holton Kansas 66436.

Keep track of properties and upcoming bills online. July 1 October 1 January 1 and April 1. You may obtain a duplicate of your original property tax receipt for free online.

No you may mail your payment payable to Jackson County Collector pay in person at one of the Countys Collection Department Offices or our satellite offices or you may also pay your property taxes on-line through the internet 24 hours a day. Do not place cash in either drop box. Semi-annually 2 times a year.

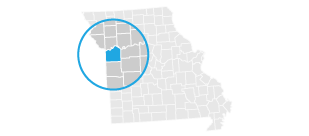

Access Your Property Tax. Download an official app of Jackson County Missouri myJacksonCounty. Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone.

Jackson County is one of 17 counties in Mississippi with separate tax assessors and collectors offices since the Countys total assessed value is above 65 million. If a tax bill is not received by December 10 contact the Collectors Office at 816-881-3232. Quarterly 4 times a year.

Bills are generally mailed and posted on our website about a month before your taxes are due. Property values tax computation or appraisal contact Assessment at 541-774-6059. The public may sign up for any exemptions that they qualify for in the auditors office where it will be placed on their property taxes before taxation.

A drop box for property tax payments is located at the west door of the Jackson County Courthouse in Kansas City 415 E 12th Street and at the front door of the Historic Truman Courthouse in Independence 112 W Lexington. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Make checks payable to.

Online Property Tax Payments Now Available - 1st Half Taxes due postmarked by December 20th 2019. Jackson County Iowa Treasurer. The auditors office is the keeper of each owners deductions for property taxes.

Revenue CommissionerPay TaxRenew Tags. A homeowner or an individual over the age of 65 is eligible for certain deductions in the assessed value. About the Taxes Taxes are a lien against the real estate and remains with the property not the specific owner of that property.

Tax amounts owed or paid and questions about interest and penalties contact Taxation at 541-774-6541 Zoning code compliance or building permit questions contact Development Services at 541-774-6900. The 2020 Jackson County property tax due dates are May 10 2021 and November 10 2021. The office of Tax Collector was established by the Mississippi Constitution Article 5 Section 135.

Payment is due on. Tax bills are mailed once a year with both installments remittance slips included Spring and Fall. How much is a duplicate receipt.

Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. No Reminder billing will be submitted for the Fall installment. Property Tax Bills Payment Information Tax Rates Requirement to Pay by Electronic Funds Transfer EFT Requirement Due Dates.

Skip the trip to the court house and pay your property taxes on the go. Skip to Main Content COVID-19 INFO Jackson County Services related to COVID-19 Updated. Based on the January 1 2019 ownership taxes are due and payable the following year in two equal installments.

The Treasurer is responsible for the receipt m anagement disbursement f inancial reporting bonds and investment of all monies paid to the County serves as agent for the State of Iowa Department of Transportation State of Iowa Department of Revenue and Finance and State of Iowa Department of Driver Services. Town Supervisor 518-854-7883 jskelliewashing toncountynygov. July 1 and January 1.

Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. You may also obtain a duplicate of your original property tax. Anyone who has paid Jackson County personal or real estate property taxes may get a duplicate tax receipt.

Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone.

Property Deeds Jackson County Oregon

Property Deeds Jackson County Oregon

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Jackson County Mo Property Tax Calculator Smartasset

Jackson County Mo Property Tax Calculator Smartasset

City Owned Property Sales Jackson Mi Official Website

Jackson County Real Estate Jackson County Mo Homes For Sale Zillow

Jackson County Real Estate Jackson County Mo Homes For Sale Zillow

Property Deeds Jackson County Oregon

Property Deeds Jackson County Oregon

Mobile Homes For Sale In Jackson County Mi Homes Com

Mobile Homes For Sale In Jackson County Mi Homes Com

Tax Assessor Jackson County Ms

Property Data Online Jackson County Oregon

Property Data Online Jackson County Oregon

Assessment Notices Jackson County Mo

Jackson County Mo Delinquent Tax Sale Urban Neighborhood Initiative

Jackson County Mo Delinquent Tax Sale Urban Neighborhood Initiative

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home