How Is Personal Property Tax Calculated In Jackson County Missouri

The Missouri Department of Revenue Taxation Division administers Missouri tax law. Your family has to pay more than 600 each year in personal property taxes for your vehicles.

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

If you live in a state with personal property tax consider the long-term cost when you buy a vehicle.

How is personal property tax calculated in jackson county missouri. Louis County and is 042 above Missouris state average effective property tax rate of 093. Once market value has been determined the assessor calculates a percentage of that value to arrive at the assessed value. The result of this process is to set the market value and thus the assessed valuation of property in Jackson County.

Taxes not paid in full on or before December 31 will accrue interest penalties and fees. Your assessment list is due by March 1st of that year. For personal property it is determined each January 1.

33 13 All property except that listed below. Occasionally the parcel number for a real estate. Jackson County calculates the property tax due based on the fair market value of the home or property in question as determined by the Jackson County Property Tax Assessor.

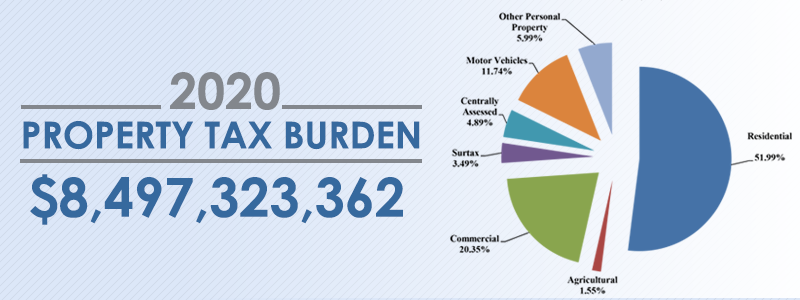

To pay your taxes Click here. In Jackson County Missouri residents pay an average effective property tax rate of 135. Each property is individually t each year and any improvements or additions made to.

Personal Property Tax Assessed Value100 x. The format for Personal Property is all 9 digits no dashes. This application is for research purposes only and cannot be used to pay taxes.

Personal property is assessed valued each year by the Assessors Office. Real Estate Property Tax Taxable Value100 x Levy Rate The Collections Department cannot lower your assessed value levy rate or tax bill amount. The median property tax on a 12990000 house is 136395 in the United States.

Your real estate property tax is calculated by dividing the taxable value of the property by 100 and then multiplying that value by the levy rate for your area. The taxable value of your property is listed on your tax bill. Motorized vehicles boats recreational vehicles owned on January 1st of that year.

Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County. Your personal property tax is calculated by dividing the assessed value of the property by 100 and then multiplying that value by the levy rate for your area. Personal property tax is collected by the Collector of Revenue each year on tangible property eg.

To find the amount of taxes due divide the assessed value by 100 and then multiply the result by the tax rate. The median property tax on a 12990000 house is 118209 in Missouri. Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone.

Total Personal Property Tax. 19 Mobile homes used as. State statutes require a penalty to be added to your personal property tax bill if.

The adjustment factors are as follows. For real property the market value is determined as of January 1 of the odd numbered years. I am looking for a way to calculate what my personal property tax will be on my car for the state of Missouri Is there a calculator that anyone is aware of.

Assessed value is a percentage of market value. Assessor - Personal Property Assessment and RecordsAssessor - Real Estate Assessment and AppraisalAssessor - Real Estate Records Summary Provides formulas used to calculate personal property residential real property and commercial real property. You pay tax on the sale price of the unit less any trade-in or rebate.

The median property tax on a 12990000 house is 164973 in Jackson County. The format for Real Estate is xx-xxx-xx-xx-xx-x-xx-xxx. Such assessed valuation and levies set by Jackson County and other taxing authorities like cities and school districts are used to calculate the property taxes that fund those taxing authorities.

The millage rate is adjusted each year based upon the countycity budget needs. Any information that you omit may result in additional fees being owed. Overview of Jackson County MO Taxes.

That rate is the second-highest in the state after St. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Jackson County. Subtract these values if any from the sale price of the unit and enter the net price in the calculator.

Market value of vehicles is determined by the October issue of the NADA. In order to calculate the assessed value multiply the market value by the adjustment factor which applies to the item of property being considered. Missouri Personal Property Tax Calculator.

Motor Vehicle Trailer ATV and Watercraft Tax Calculator The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year. This calculation is only an estimate based on the information you provide.

116 rows Once market value has been determined the Missouri assessment rate of 19 is applied.

Jackson County Mo Property Tax Calculator Smartasset

Jackson County Mo Property Tax Calculator Smartasset

Https Www Jacksongov Org Documentcenter View 118 Business Personal Property Tax Exemption 2021 Application Pdf

Https Dor Mo Gov Pdf Proptax Pdf

Autumn On The Gasconade River Gasconade County Missouri 7583 Landscape Photographers Landscape Fine Art Landscape

Autumn On The Gasconade River Gasconade County Missouri 7583 Landscape Photographers Landscape Fine Art Landscape

![]() Attention All Sales And Use Tax Filers

Attention All Sales And Use Tax Filers

Https Dor Mo Gov Forms Missouri Titling Manual Pdf

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Https Dor Mo Gov Forms 426 Pdf

America S 10 Cheapest States To Live In States In America America States

America S 10 Cheapest States To Live In States In America America States

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Assessment Notices Jackson County Mo

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home