Homestead Property Tax Credit New Jersey

By Samantha Marcus NJ Advance Media for. 2015 2016 2017 Phone Inquiry.

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

In this case if you are itemizing you simply add up your four quarterly payments and deduct the actual cash you paid out in the year.

Homestead property tax credit new jersey. Homestead benefits are provided to seniors and disabled residents making up to 150000 annually and to other homeowners making up to 75000 annually. The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the property taxes paid on your primary residence for. The deduction amount is determined based on your taxable income filing status and the amount of property tax paid.

Taxpayers will likely receive Homestead property tax credits on their February and May tax bills. We can deduct any amount you owe from future Homestead Benefits or Income Tax refunds or credits before we issue the payment. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year. Most people who qualify for the rebate will get it as a credit on their property tax bills issued by their local tax collector. You owned and occupied a home in New Jersey that was your principal residence on October 1 2017.

The Homestead Benefit program provides property tax relief to eligible homeowners. The Homestead credit is a popular property tax relief program for about 580000 seniors disabled or low-income homeowners. In recent years however New Jersey has provided the Homestead Rebate in the form of a credit against the property taxes due in May of the current year Wolfe said.

A first installment was funded. Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property taxes or through rent. Renters can calculate 18 of the rent as property taxes paid.

The state treasurer said in a. Online Inquiry For Benefit Years. An estimated 579900 New Jersey homeowners are receiving benefits that are intended to offset property taxes paid in 2016 but theres a wrinkle with that too.

1-877-658-2972 toll-free within NJ NY PA DE and MD 2017 benefit only. If you were not a homeowner on October 1 2017 you are not eligible for a Homestead Benefit even if you owned a home for part of the year. Certain seniordisabled homeowners who were not required to file a 2017 New Jersey Income Tax return will have their Property Tax Credit included with the Homestead Benefit.

The New Jersey homestead rebate is a property tax credit that the state pays to municipalities on behalf of eligible homeowners to help reduce their property tax bills. You may be eligible if you met these requirements. You are eligible for a property tax deduction or a property tax credit only if.

Under Age 65 and not Disabled Homeowners. According to the New Jersey Department of Treasury Division of Taxation The Senior Freeze Program reimburses eligible senior citizens and disabled persons for. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes.

And over the past five years the average New Jersey property-tax bill has increased by 563 easily swamping todays average Homestead benefits which. Most receive the benefits as a direct credit. The deadline to file the latest Homestead Benefit application for Tax Year 2017 was December 2 2019.

You can get information on the status amount of your Homestead Benefit either online or by phone. Homeowners who owned and occupied their principal residence in New Jersey on October 1 2006 and had New Jersey gross income for 2006 of 250000 or less will be eligible for a 2006. Amounts you receive under the Homestead Benefit Program are in addition to the States other property tax relief programs.

75000 or less for homeowners under age 65 and not blind or disabled. The New Jersey Homestead Property Tax Credit Act which was signed into law on April 3 2007 provides benefits for both homeowners and tenants. Service Fee Housing is a program where there is an agreement between a municipality and a rental property owner to pay a service fee instead of property taxes.

Homeowners may be able to deduct the lesser of all of your property tax or 15000. Therefore no matter how much rent is paid only 10 of the rent can be claimed for the homestead property tax credit. The property tax credit is a 50 refundable credit.

Https Www State Nj Us Treasury Taxation Pdf Homestead Hownerappins Pdf

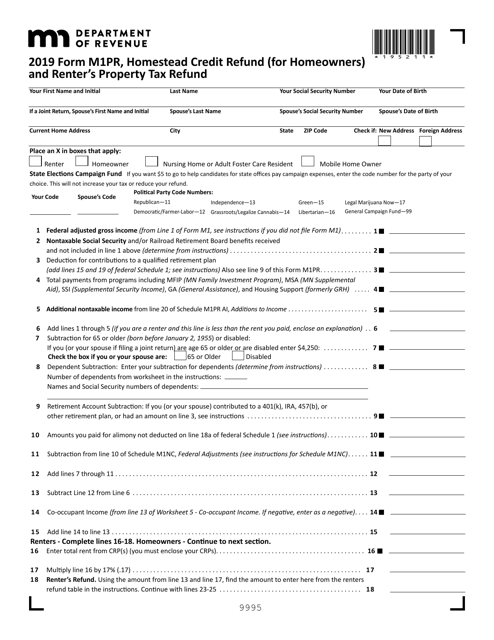

Form M1pr Download Fillable Pdf Or Fill Online Homestead Credit Refund For Homeowners And Renter S Property Tax Refund 2019 Minnesota Templateroller

Form M1pr Download Fillable Pdf Or Fill Online Homestead Credit Refund For Homeowners And Renter S Property Tax Refund 2019 Minnesota Templateroller

Https Www Rockawaytownship Org 218 Property Tax Relief

New Jersey Property Tax Relief Goes Down As One Tax Break Goes Up Government Finance Officers Association Of Nj

New Jersey Property Tax Relief Goes Down As One Tax Break Goes Up Government Finance Officers Association Of Nj

Nj Property Tax Relief For Seniors Property Walls

Nj Property Tax Relief For Seniors Property Walls

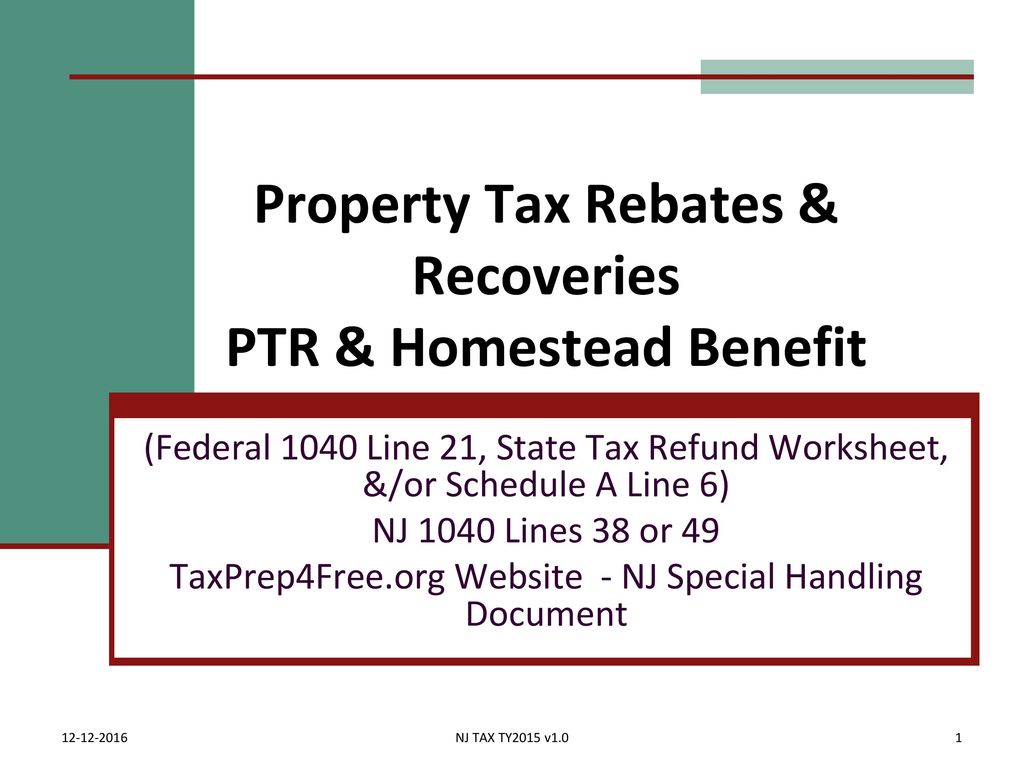

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Shortchanging Homestead Benefit A Nj Tradition Nj Spotlight News

Shortchanging Homestead Benefit A Nj Tradition Nj Spotlight News

Http Www Nj Gov Treasury Taxation Pdf Hrsavercal Pdf

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Tell Gov Murphy Don T Cut The Senior Freeze Or Homestead Tax Relief Programs Senatenj Com

Tell Gov Murphy Don T Cut The Senior Freeze Or Homestead Tax Relief Programs Senatenj Com

Shortchanging Homestead Benefit A Nj Tradition Nj Spotlight News

Shortchanging Homestead Benefit A Nj Tradition Nj Spotlight News

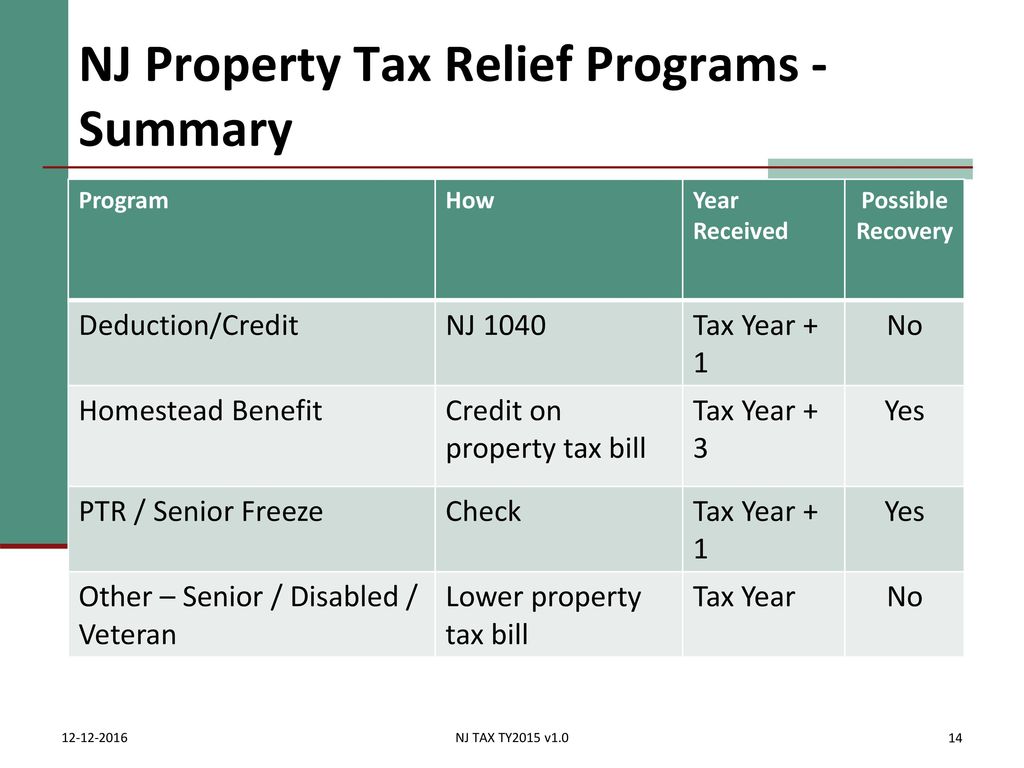

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Nj Property Tax Relief For Seniors Property Walls

Nj Property Tax Relief For Seniors Property Walls

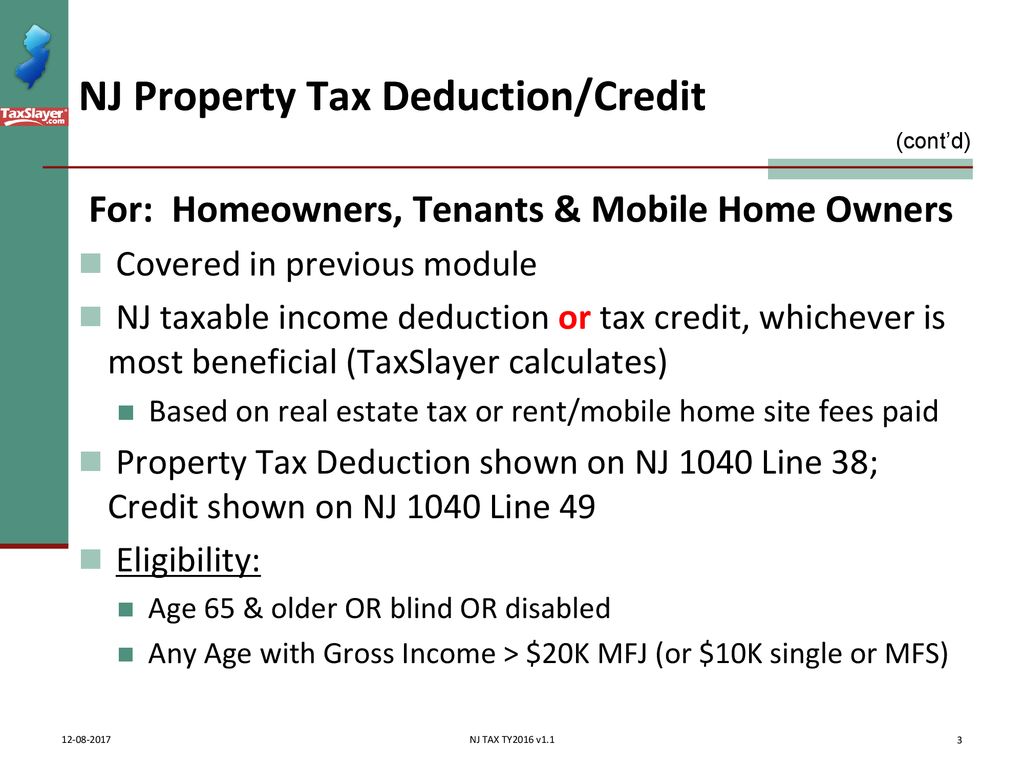

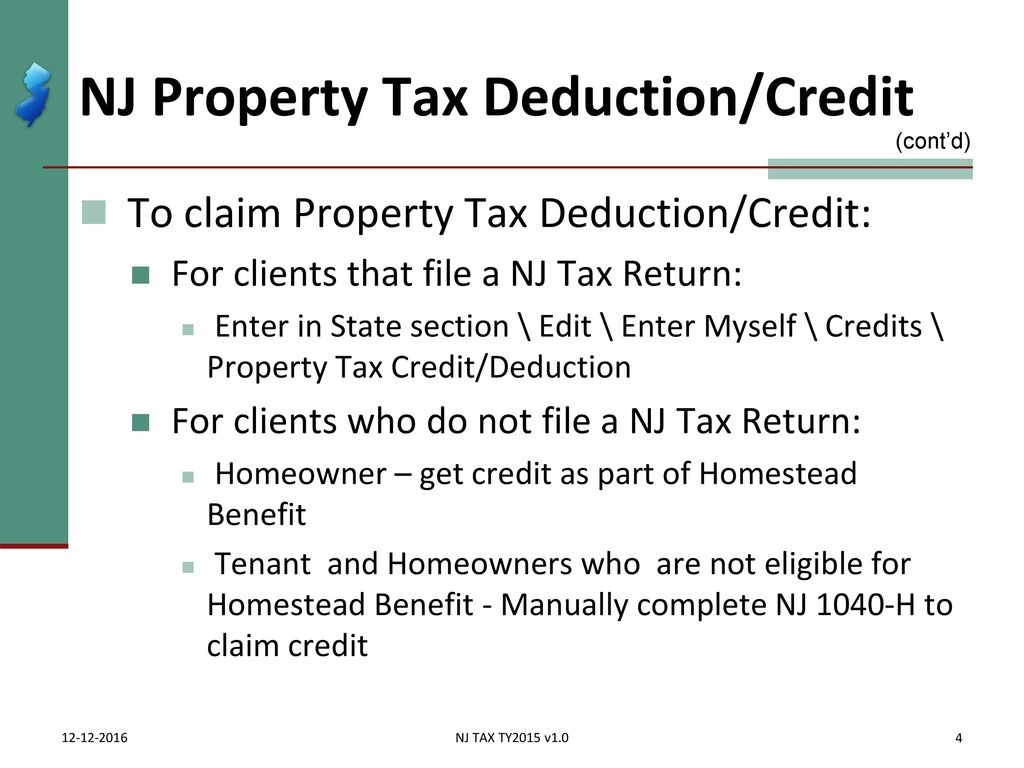

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download

Out Of Date Data Shortchanges Recipients Of Homestead Tax Rebates Nj Spotlight News

Out Of Date Data Shortchanges Recipients Of Homestead Tax Rebates Nj Spotlight News

Senior Freeze Hazlet Township Nj

Nj Property Tax Deduction Income Limit Property Walls

Nj Property Tax Deduction Income Limit Property Walls

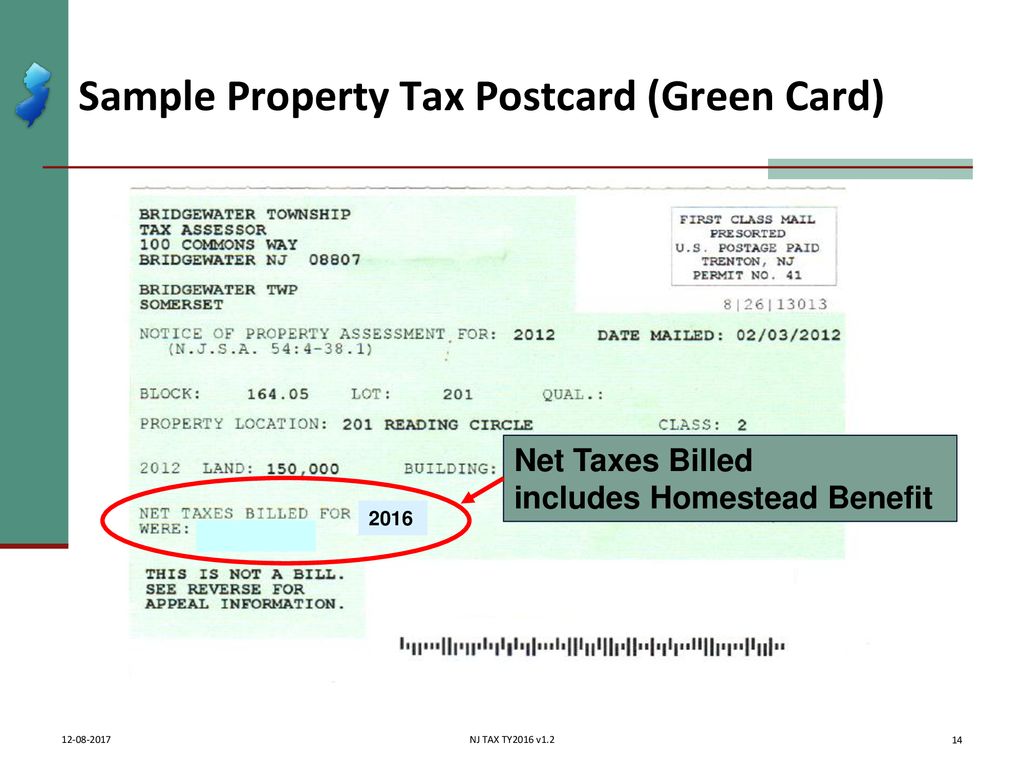

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home