Cook County Assessor Property Tax Refund

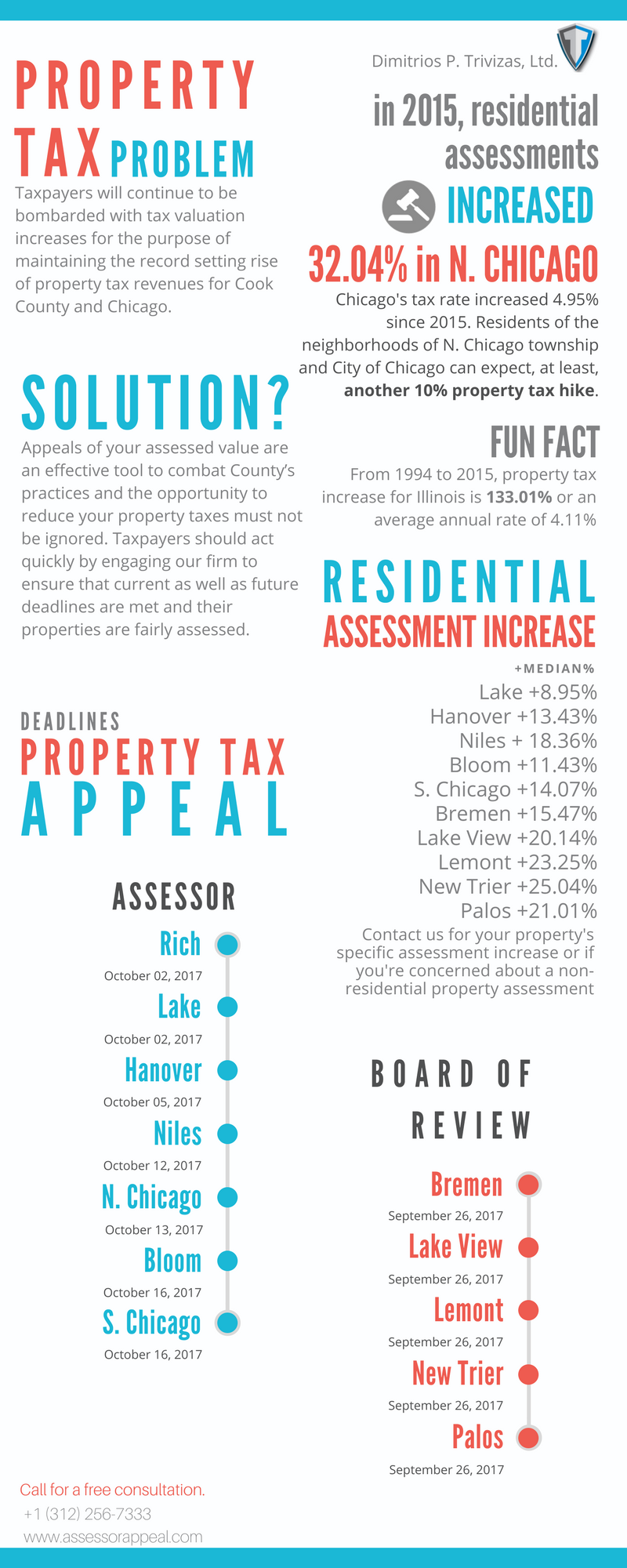

Cook County Treasurer Maria Pappas joins guest host Dane Neal to talk about the news that more than 8500 homeowners who overpaid their First Installment taxes are set to receive 128 million in refunds. A Rated Better Business Bureau Accredited Business Illinois Corporation Cook County Assessor Registered Property Tax Appeal Representative.

Cook County Property Tax Assessment Appeal Property Walls

Cook County Property Tax Assessment Appeal Property Walls

PROPERTY TAX RELIEF Appeals Overpayments Refunds.

Cook county assessor property tax refund. Under the Constitutions provisions the Assessor-Collector is personally liable for the funds collected and deposited in separate bank accounts under his control. 2021 CCAO Practitioners Information Available. County Clerk - Recordings.

For prior tax years and status please check with the Cook County Clerks Office for more information. The 2021 CCAO Practitioners Meeting was held on March 31 2021. For prior tax years and status please check with the Cook County Clerks Office for more information.

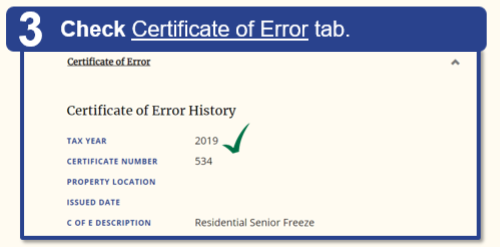

Mandates and Key Activities. Once certified the Cook County Treasurers office will issue the refund within 10 days. When provided the proposed values of PINs that are the subject of a tax objection complaint the site is designed to calculate the refund amounts available as of the date of.

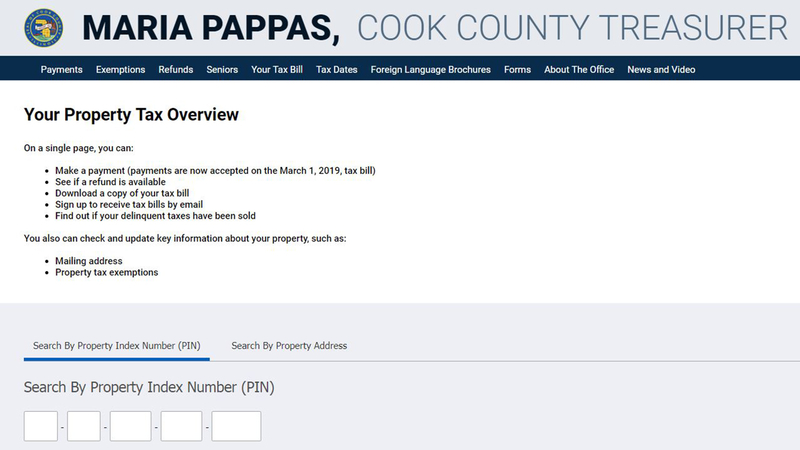

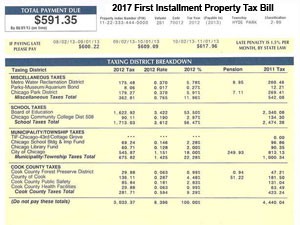

Assessed values are set on real estate as a basis for levying taxes and determining the distribution of property tax levies among taxpayers. More than 8500 homeowners who overpaid their First Installment taxes are set to receive 128 million in refunds without filing an application Cook County Treasurer Maria Pappas said today. After four years unclaimed refunds may be turned over to the Countys General Fund through a process called escheatment While escheatment is the legal alternative the Tax Collectors primary goal is to return tax overpayments to their rightful owners.

Already Pappas said theyve helped 22000 property owners get off the 2018 tax sale list and issued 435 million in refunds to majority-Black suburbs and. 118 North Clark Street Third Floor Room 320 Chicago IL 60602. Iii the tax.

More than 8 million in property tax refunds will be sent over the next few weeks to nearly 30000 Cook County homeowners who have overpaid since 2013. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. The refunds totaling 83 million will be sent automatically to 29752 homeowners who have overpaid in the past five years according to a statement from the Cook County treasurers office.

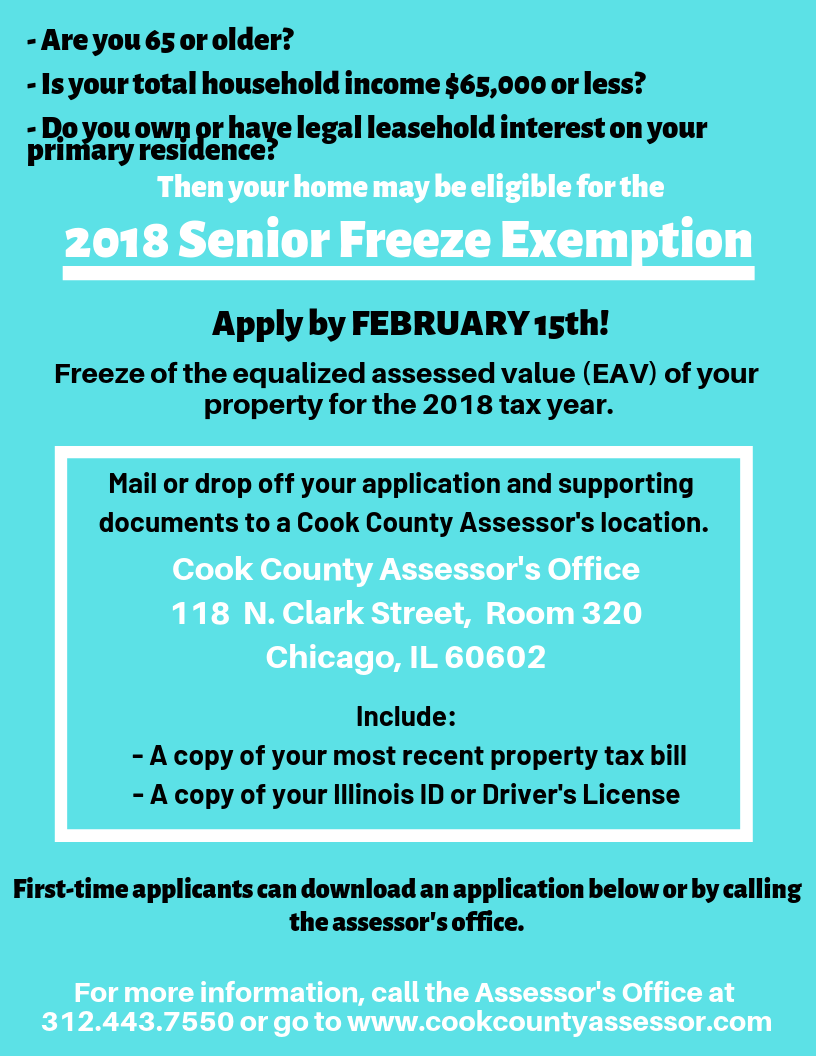

Ii address of the property. The Cook County Treasurers Office website was designed to meet the Illinois Information Technology Accessibility Act. Services for Seniors.

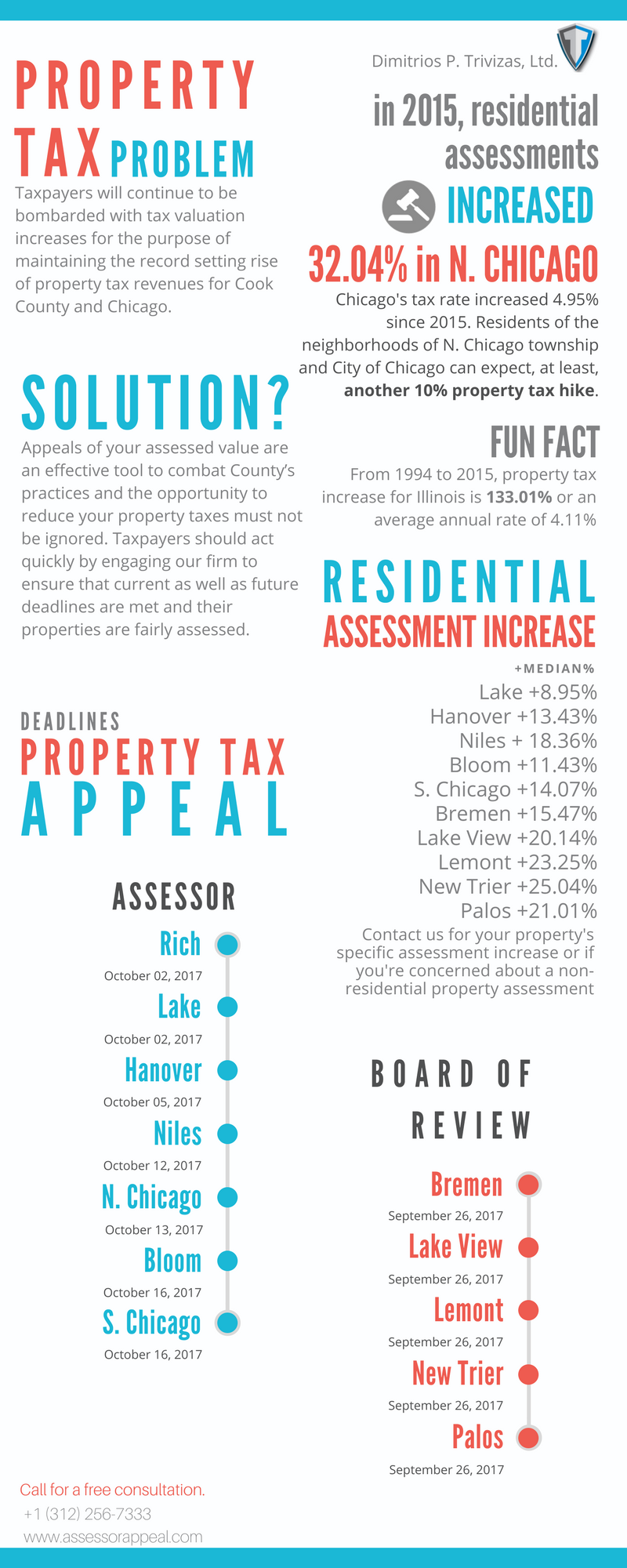

Property Tax Portal Cook Countys Resources and Response to Coronavirus COVID-19 The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. The Cook County Treasurers office says thousands of people are owed property tax refunds and its as simple as entering your address on the treasurers. Find Your Own Property Tax Refunds Using New Cook County Website.

Please remember to put on the face of the check and NOT on the check stub the. Friday October 9 2020 CHICAGO WLS -- Cook County Treasurer Maria Pappas says her office owes thousands of property tax refunds but they need help finding homeowners to pay. 203 N LaSalle St 2100 Chicago IL 60601.

Welcome to the Cook County Treasurers Tax Objection Calculator This site may be used by attorneys or their agents to submit requests for tax objection refund calculations. The mission of the Cook County Assessors Office is to serve the public both professionally and responsibly by establishing uniform and accurate property assessments. Since we launched the automatic refund program in July 2018 110000 property owners have received about 564 million in refunds without an application Pappas said.

For an exemption-related Certificate of Error it will take up to 60 days for the Assessors Office to certify your Certificate of Error Recommended Tax Bill. You have four years to claim a refund. The County Tax Assessor-Collector is an office created by the Texas Constitution.

Homeowners have until April 9 to apply for property tax exemptions. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Once certified the Cook County Treasurers office will issue the refund within 10 days.

Property Tax Appeal Board Refunds. In compliance with Cook County Ordinance 07-O-69 if you are a mortgage lender or any business organization that services real estate loans for example a title insurance company you must include along with your refund application and proof of payment a separate check in the amount of 50 for EACH refund application that you submit to this Office. If you do not know your PIN use the Search by Property Address link.

Cook County To Release 10000 New First Dose COVID-19 Vaccine Appointments FridayCook County Health will release. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website. If you do not know your PIN use the Search by Property Address link.

Fritz Kaegi Cook County Assessor.

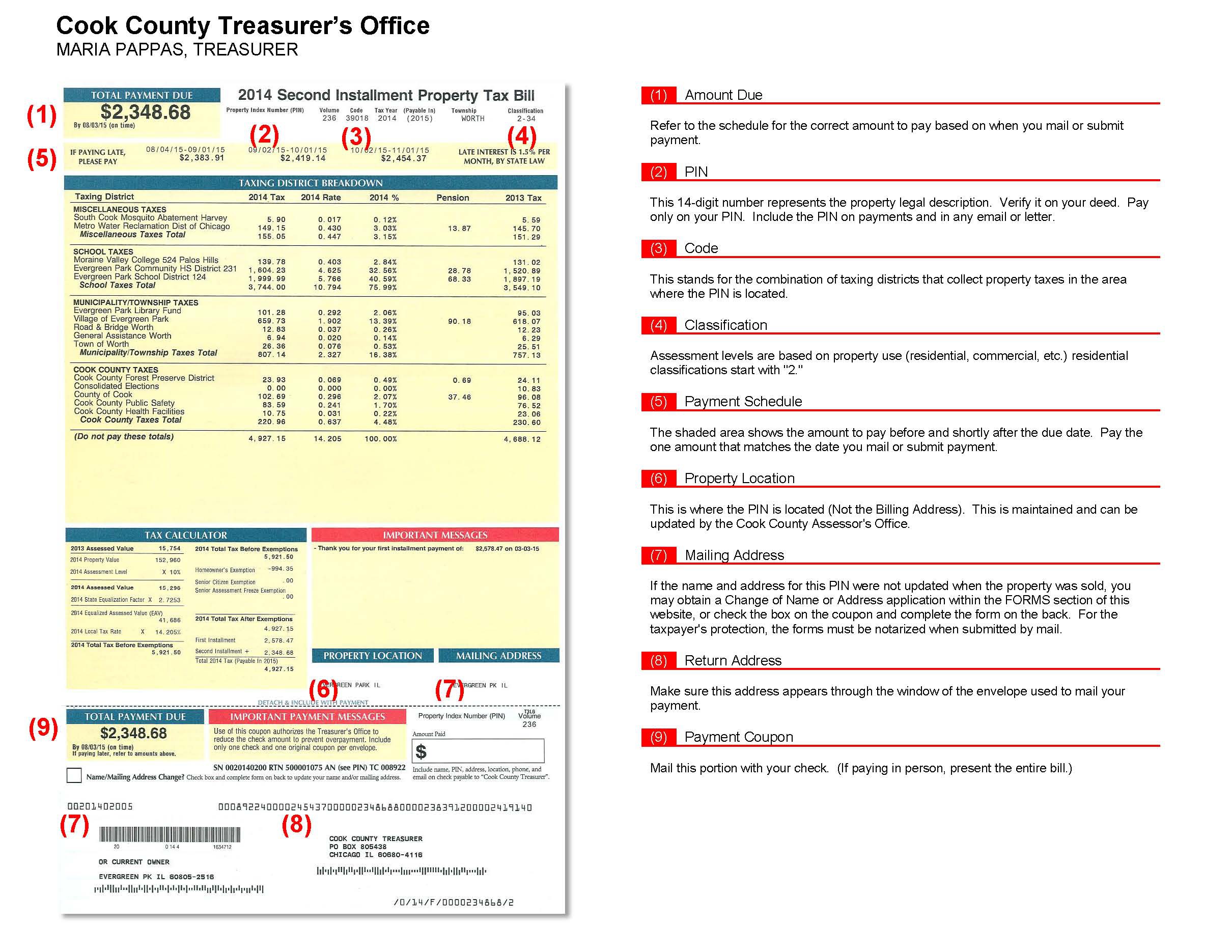

Cook County Property Tax Bill How To Read Kensington Chicago

Cook County Property Tax Bill How To Read Kensington Chicago

The Cook County Property Tax System Cook County Assessor S Office

Cook County Property Tax Refunds Village Of Alsip

Cook County Property Tax Refunds Village Of Alsip

Senior Ze Ze Fill Online Printable Fillable Blank Pdffiller

Senior Ze Ze Fill Online Printable Fillable Blank Pdffiller

Cook County Property Tax Portal

Cook County Property Tax Portal

Property Tax Assistance Cook County Assessor S Office

Property Tax Assistance Cook County Assessor S Office

Property Tax Assistance Cook County Assessor S Office

Property Tax Assistance Cook County Assessor S Office

Property Tax Assistance Cook County Assessor S Office

Cook County To Refund Homeowners 8 3m In Property Tax Overpayments Wgn Tv

Cook County To Refund Homeowners 8 3m In Property Tax Overpayments Wgn Tv

Where Do Cook County Property Taxes Go Kensington

Where Do Cook County Property Taxes Go Kensington

Cook County Property Tax Appeal Deadlines Due Dates 2021 Kensington Research

Cook County Property Tax Appeal Deadlines Due Dates 2021 Kensington Research

Homeowners Are You Missing Exemptions On Your Property Tax Bills Cook County Assessor S Office

Homeowners Are You Missing Exemptions On Your Property Tax Bills Cook County Assessor S Office

Deadline Extended For Property Tax Exemptions Alderman Tom Tunney 44th Ward Chicago

Deadline Extended For Property Tax Exemptions Alderman Tom Tunney 44th Ward Chicago

Cook County Treasurer S Office Chicago Illinois

Cook County Treasurer S Office Chicago Illinois

Cook County Property Tax Refunds Village Of Alsip

Cook County Property Tax Refunds Village Of Alsip

Cook County Homeowners Deserve Property Tax Relief Chicago Reporterchicago Reporter

Cook County Homeowners Deserve Property Tax Relief Chicago Reporterchicago Reporter

Cook County Homeowners Paying Too Much In Property Taxes

Cook County Homeowners Paying Too Much In Property Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home