Ad Valorem Property Tax Definition

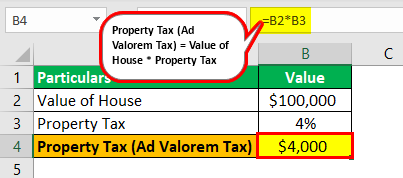

Property taxes-also called ad valorem taxes-are locally assessed taxes. The county appraisal district appraises property located in the county while local taxing units set tax rates and collect property taxes based on those values.

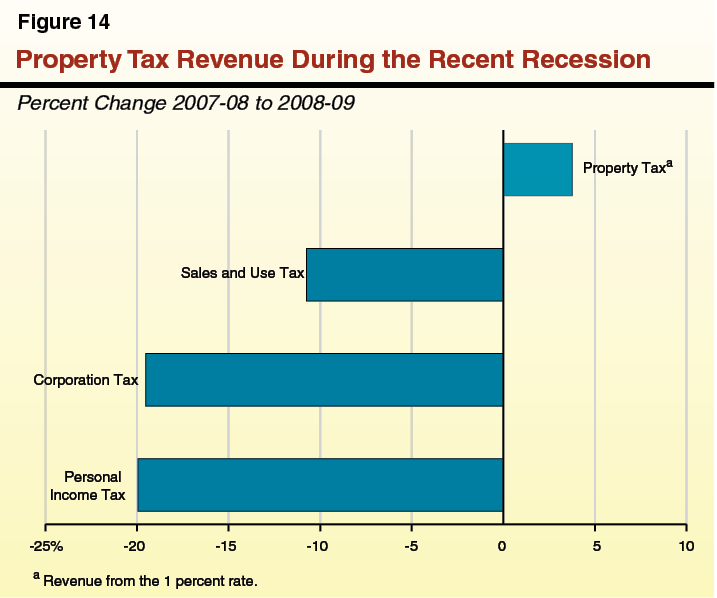

Understanding California S Property Taxes

Understanding California S Property Taxes

Imposed at a rate based on a percent of value an ad valorem tax on real estate History and Etymology for ad valorem Latin according to the value.

Ad valorem property tax definition. Most commonly property tax is a real estate ad-valorem tax which can be considered a regressive tax. It has been an ad valorem tax meaning based on value since 1825. Legal Definition of ad valorem.

Property Tax Real Property T he real property tax is Ohios oldest tax. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work. Creating an ad valorem tax definition In Latin ad valorem means according to the value Essentially an ad valorem tax is based on the value of a property or transaction regardless of its size weight or quantity.

The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors. You might not be familiar with what an ad valorem tax is but its one of the most common types of taxes and most people pay one or more ad valorem taxes on a regular basis. A good example of the ad valorem tax is a local property tax which is assessed annually on the value of an owners residence and property.

Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property. You may be most accustomed to hearing ad valorem in reference to property taxes such as real. Ad valorem taxes are the primary means by which local governments raise funds and their history goes back to ancient times.

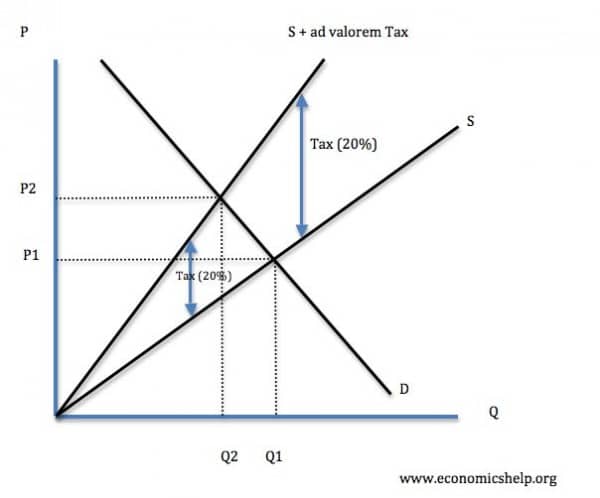

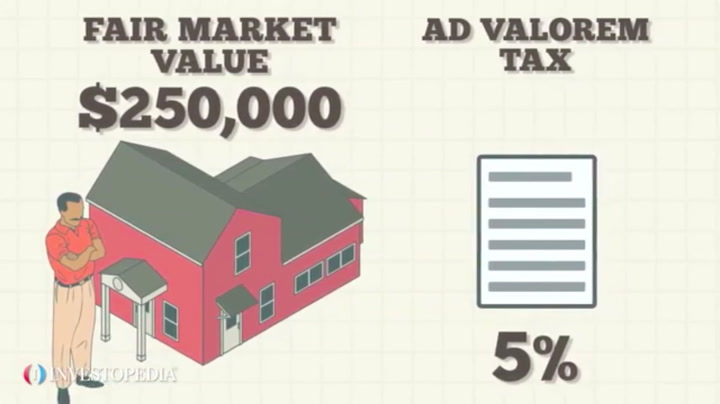

Ad valorem translates from Latin to according to value so it makes sense that ad valorem taxes are based on the assessed value of the item in question. Typically this tax is a percentage of an assessed value of. Real property taxes that are imposed by the states counties and cities are the most common type of ad valorem taxes.

An ad valorem tax is a form of taxation based on the value of a transaction or a property either real estate or personal property. Ad valorem taxes on tangible personal property of public utilities and on real property are levied by political subdivisions and local taxing districts and State law does not currently allow the imposition of a general ad valorem tax on tangible personal property other than that of public utilities. It is calculated by a local government where the property is located and paid by the owner of.

2 days ago. An ad valorem tax is a tax based on the value of real estate or personal property. It has been an ad valorem tax meaning based on value since 1825 and the Ohio Constitution has generally required prop erty to be taxed by uniform rule according to value since 1851.

The real property tax is Ohios oldest tax. The term ad valorem is derived from the Latin ad valentiam meaning to the value It is commonly applied to a tax imposed on the value of property. Property tax is an ad valorem tax assessed on real estate by a local government and paid by the property owner.

The most common ad valorem taxes are property taxes levied on real estate. It is more common than a specific tax a tax based on the quantity of an item such as cents per kilogram regardless of price. Many taxing units outsource collections to a single entity in the county.

It is generally calculated as a percentage of the value of the. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Coming from the Latin.

Ad valorem taxes can however be imposed upon Personal Property.

Tennessee Property Assessment Glossary

Tennessee Property Assessment Glossary

Ad Valorem Tax Meaning Examples Top 3 Types

Ad Valorem Tax Meaning Examples Top 3 Types

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Ad Valorem Tax Definition Bankrate Com

Ad Valorem Tax Definition Bankrate Com

Best Bare Knuckled Street Fight Victory San Francisco Association Of Realtors Transfer Tax Campaign Street Fights Fight Back Saw

Best Bare Knuckled Street Fight Victory San Francisco Association Of Realtors Transfer Tax Campaign Street Fights Fight Back Saw

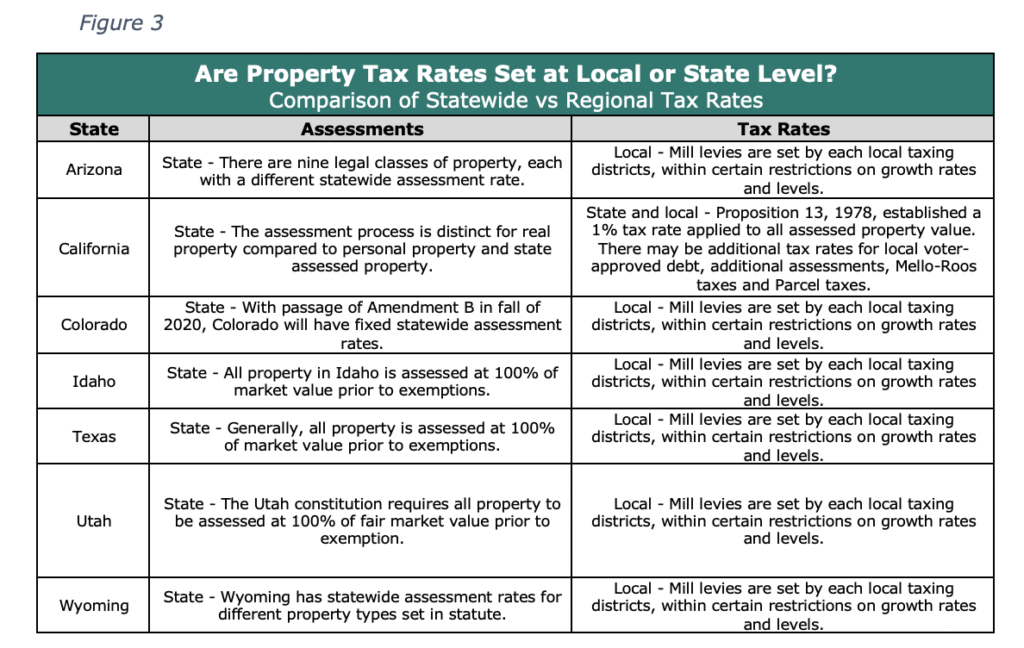

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Https Www Duluthga Net Updated 20faq Pdf

Understanding California S Property Taxes

Understanding California S Property Taxes

Ad Valorem Tax Definition Bankrate Com

Ad Valorem Tax Definition Bankrate Com

Labels: definition, property

:max_bytes(150000):strip_icc()/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1137448188-45959ad13a7f4625b3969fe1fb9295af.jpg)

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home