Personal Property Tax By State List

All states that impose property taxes have specific penalties for those who fail to pay those taxes in full and on time. If you use personal that not exempt you must complete a PersonalProperty Tax Listing Form by April 30 each yearListing forms are available from your local county s office.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Effective Real-Estate Tax Rate.

Personal property tax by state list. All real and tangible personal property with limited exceptions is subject to property tax. Many state pages also provide direct links to selected income tax return forms and other resources. Ad Valorem Property Tax.

Failure to Pay Personal Property Tax. Annual Taxes on 2175K Home State Median Home. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st.

All Personal Property Taxes are due by December 31st of each year. Sales and excise taxes. However public service business property is assessed based upon operations as of December 31 each year.

Filing personal property tax returns. Business personal property tax by state. Some states tax business personal property while others do not.

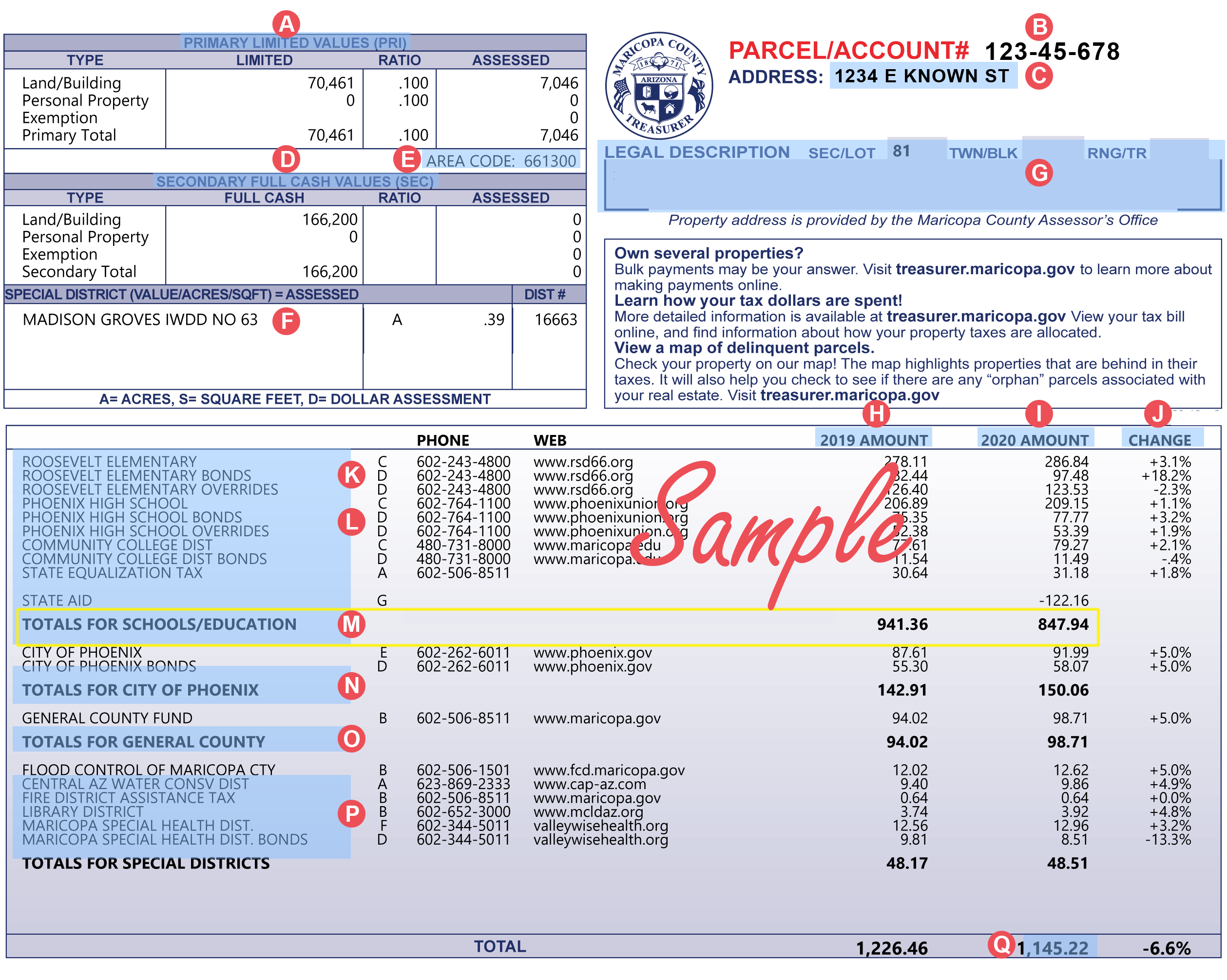

This publication answers common questions about Arizona property taxes on personal property that is valued by the County Assessor. As of July 1 each year the ownership use and value of property are determined for the next calendar tax year. For info on 2011 federal income tax and federal tax refunds visit the federal income tax and federal tax refund pages.

52 rows Source of General Income State Property Tax in Total property tax as a percentage of. This brochure explains how Assessors in Arizona use computerized systems to value single family residential property for property tax purposes. Each state or even each local jurisdiction such as a county will have its own specific form you must fill out to report your personal property tax.

The tax is imposed on movable property such as automobiles or boats and its assessed annually. The listing must identifyall taxable propertylocated in the county as of noon on. 45 rows State.

Twelve states do not tax business personal property. For example in Duval County the jurisdiction requires you to report all property on its tax form and provide the fair market value and cost of each item. A personal property tax is imposed by state or local tax authorities based on the value of an item of qualifying property.

Total taxes Tax per 1000. 2nd half installment Fall. Here are the states with the highest effective real-estate property tax rates.

If you want to compare all of the state tax rates on one page visit the list of state income taxes. However the state has an effective vehicle tax rate of 26 according to a property tax report published earlier this year by WalletHub which calculated taxes on a 25000 vehicle. June 15 of the year taxes are due if notice of assessment is mailed on or after May 1 of the assessment year.

Annual Taxes on 217500 Home. Personal Property Tax Forms. Only the Assessors Office can change the vehicles or addresses on a personal property tax bill.

For instance as of 2015 in Missouri the personal property tax rate is 335 for most types of person property except mobile homes which are taxed at a rate of 19. As a business owner its your responsibility to know whether or not your statelocality taxes business personal property. 1st half installment Spring.

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

States Moving Away From Taxes On Tangible Personal Property Personal Property Property Tax Moving Away

States Moving Away From Taxes On Tangible Personal Property Personal Property Property Tax Moving Away

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

The Hidden Costs Of Owning A Home

The Hidden Costs Of Owning A Home

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

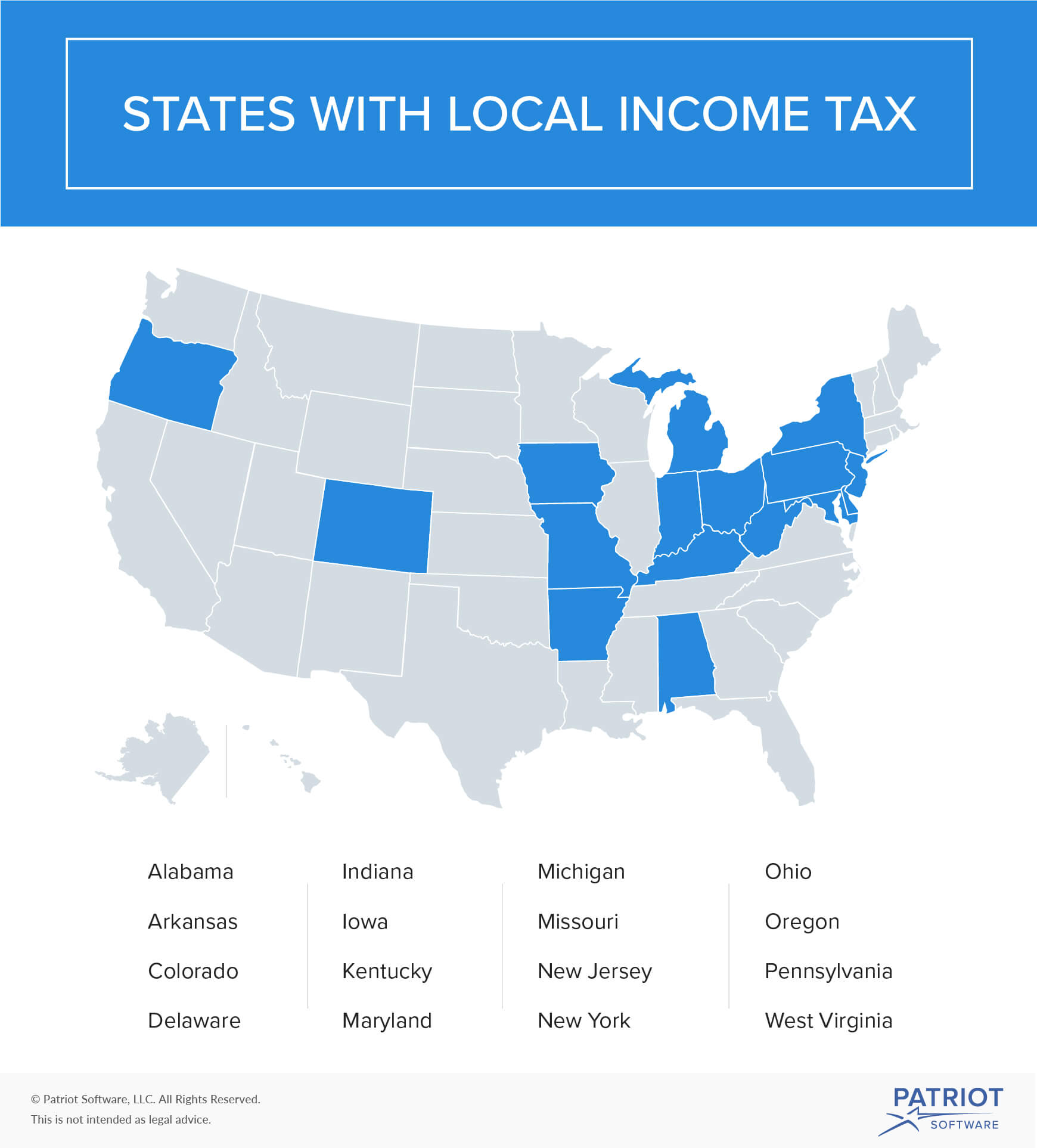

What Is Local Income Tax Types States With Local Income Tax More

What Is Local Income Tax Types States With Local Income Tax More

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

Which States Have The Lowest Property Taxes Property Tax History Lessons Historical Maps

Which States Have The Lowest Property Taxes Property Tax History Lessons Historical Maps

Residents Pay The Lowest Property Taxes In These States

Residents Pay The Lowest Property Taxes In These States

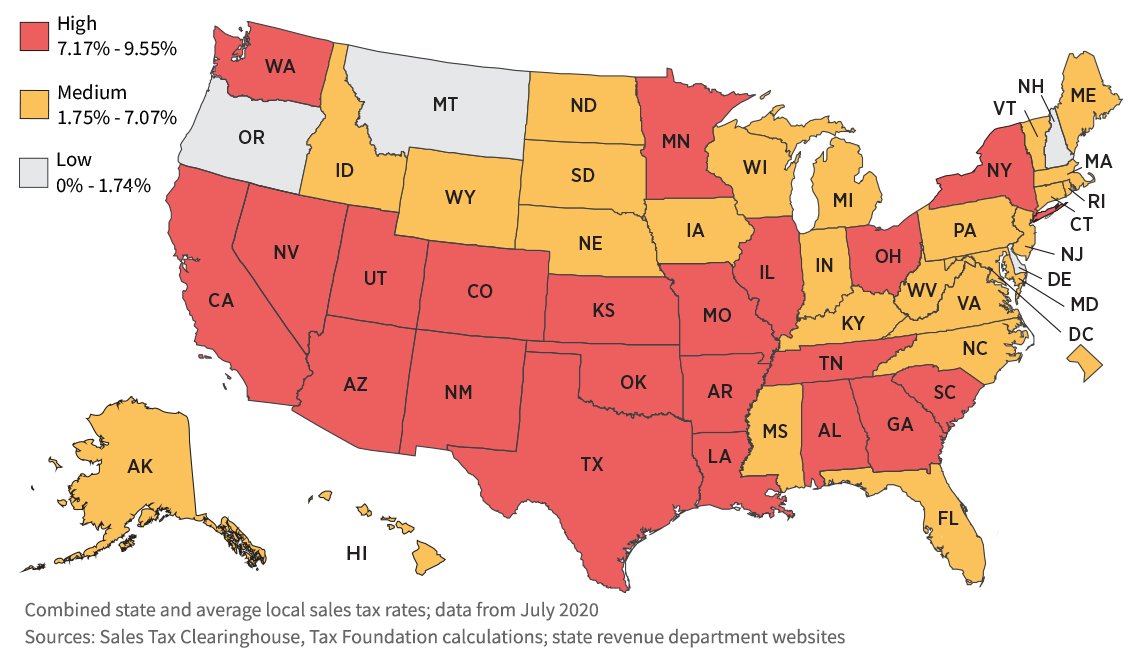

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

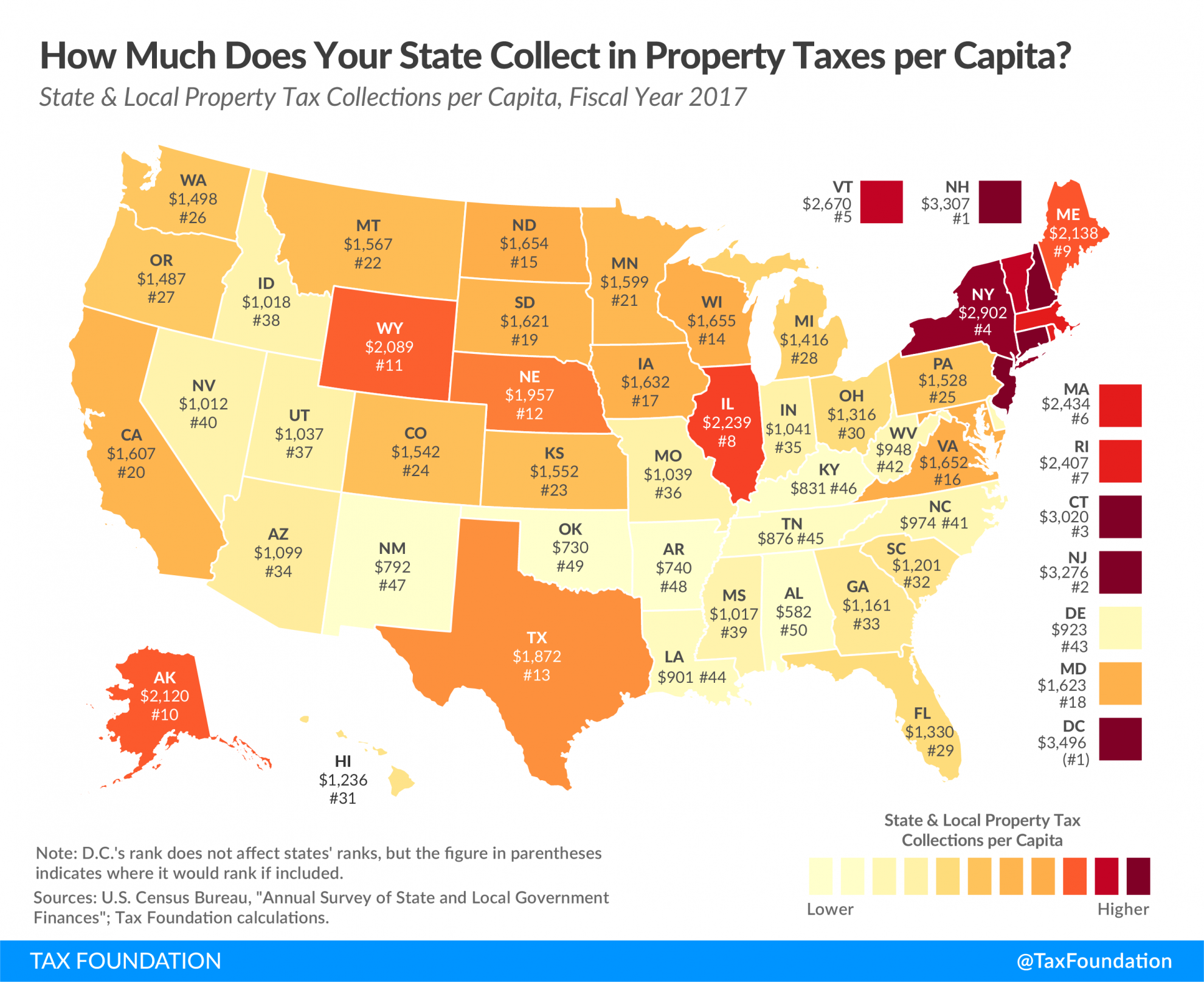

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home