How To Reduce Property Tax In Nj

If you own more than five acres of land and are eager to have your property assessed as farm land keep in mind that to be eligible for this property tax reduction the land must be in active. For more information visit the NJ Division of Taxation Website.

Tax Reform S 10k Property Tax Deduction Is Worthless Don T Mess With Taxes

On the towns website we quickly found the link to enter an online appeal with the countys board of taxation.

How to reduce property tax in nj. Matthew and Catherine own a home in. Here are five interventions to cut spending and reduce property taxes. A surviving spouse must be at least 55 years old and not re-married.

No need to bother your neighbors. A lot of research is involved as well as form and document collection. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Property tax bills can be found online in many areas since theyre public information. How To Lower Property Taxes in NJ and Appeal Them With DoNotPay Dealing with exemptions and appeals by yourself can be too much to handle. You also may qualify if you are a surviving spouse or civil union partner.

If these three ratios are not between 0 and 1 then divide them by 100. New Jersey allows for reduced property taxes if you meet certain requirements. Property Tax Exemption for 100 Disabled Veterans or Surviving Spouses.

The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. The claimant must be the owner and permanent resident in the dwelling and a legal resident of New Jersey. You may also need to contact your assessor or the authorities in the process.

Click on your county. At Irwin Heinze PA we help commercial and income-producing property owners across New Jersey reduce property tax liabilities cost-effectively. Under the program corporate office parks have received property tax breaks.

Get a copy of your property tax card from the local assessors office. Local Property Tax Relief Programs. Make sure you review your tax card and look at comparable homes.

But what makes a farm in New Jersey does not always mean neat rows of corn a barn and a rooster. Many New Jersey homeowners are entitled to a rebate or credit thats a percentage of the first 10000 in property tax that they paid last year. If the taxable value assigned to it is too high you might be able to get it reduced and thus save a bundle in property tax.

Below is a summary of the chief programs in New Jersey. For example if your tax ratios are 2486 2925 and 3364 then divide them by 100 to get 2486 2925 and 3364 Now they are between 0 and 1. Getting commercial industrial retail and multifamily residential rental property assessments reduced is a complicated process.

Go to the New Jersey Division of Taxation website through the link in the References section. Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. You might be overpaying.

It allowed us to create a login and enter the evidence including. Even just a 500 reduction in your annual tax bill would add up to 5000 in savings over a ten-year period. Basic homestead rebate or credit.

Eligibility Requirements and Income Guidelines. Give power back to the people of New Jersey. Find the three tax ratios for your city.

Check the basic info and look for any errors so you can request a correction or reevaluation. Reduce Your Liability In Commercial Real Estate Tax Assessments. 250 Senior Citizens and Disabled Persons Property Tax Deduction If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction.

New Jersey voters tried.

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Freehold Township Sample Tax Bill And Explanation

Freehold Township Sample Tax Bill And Explanation

Freehold Township Sample Tax Bill And Explanation

Freehold Township Sample Tax Bill And Explanation

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

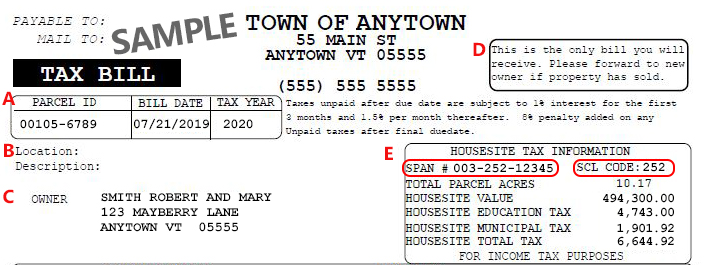

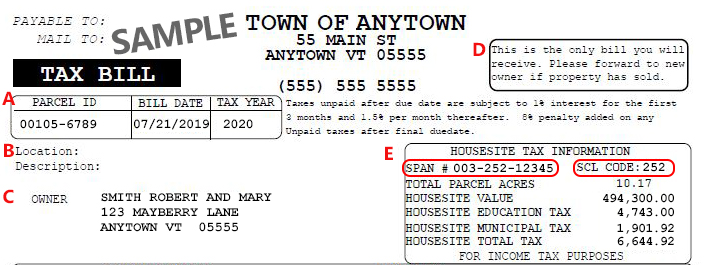

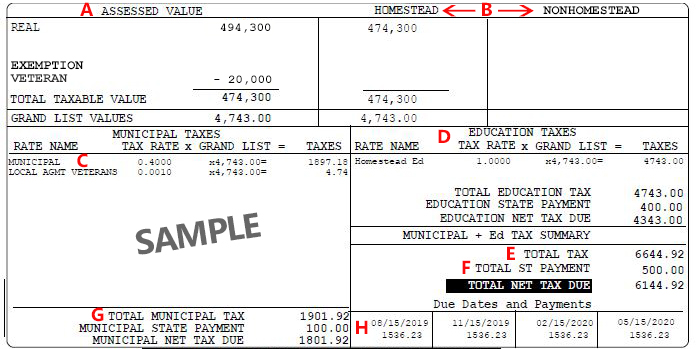

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Louisiana La Property Tax H R Block

Louisiana La Property Tax H R Block

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

Florida Property Tax H R Block

Florida Property Tax H R Block

Http Www Appraisercitywide Com 312 479 5344 Real Estate Appraisals In Franklin Park 60131 Certified Appraisers Franklin Park Homeowners Guide Water Tower

Http Www Appraisercitywide Com 312 479 5344 Real Estate Appraisals In Franklin Park 60131 Certified Appraisers Franklin Park Homeowners Guide Water Tower

Property Taxes How Much Are They In Different States Across The Us

Property Taxes How Much Are They In Different States Across The Us

Why Are Nj Property Taxes So Incredibly High When It Is The Most Densely Populated State In The Country Shouldn T Nj Residents Pay Less Property Tax Since There Are More People Per

See Toms Rivers Average Property Tax Bill And Tax Hike Toms River Nj Patch Sales Tax Ideas Salestax Property Tax Tax Return Montclair

See Toms Rivers Average Property Tax Bill And Tax Hike Toms River Nj Patch Sales Tax Ideas Salestax Property Tax Tax Return Montclair

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg) How To Pay Your Property Tax Bill

How To Pay Your Property Tax Bill

Labels: reduce

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home