Does Massachusetts Have Capital Gains Tax

So the current rule stays in place you can exclude up to 250000 as a single filer and 500000 for joint married filer in capital gain on the sale of your primary residence if you lived there for 2 out of the last 5 years. Nonresidents file Form 1-NRPY Massachusetts Nonresident or Part-Year Resident Income Tax Return.

What S Your Tax Rate For Crypto Capital Gains

What S Your Tax Rate For Crypto Capital Gains

The same rule applies to nonresidents who owned property in the state.

Does massachusetts have capital gains tax. Tax year 2020 File in 2021 Nonresident. Does Massachusetts Have an Inheritance Tax or Estate Tax. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

However in most cases you dont have to pay taxes on the first 500000 of capital gain on a home or 250000 if youre married and filing separately. The tax rate is about 15 for people filing jointly and incomes totalling less than 480000. Interest and dividends reported on Massachusetts Schedule B.

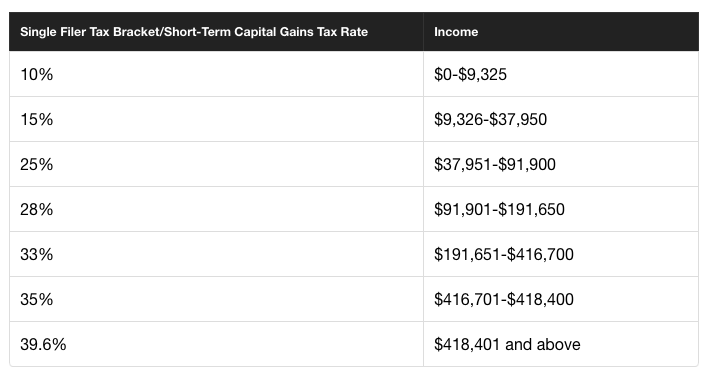

It can jump to 20 if your combined income exceeds this amount. For the tax year 2016 the rates on taxable income are as follows. Short-term capital gains are those from the sale of assets youve owned for less than one year.

There are however certain types of capital gains that are taxed at. In the lowest brackets a 10-12 tax rate can turn into 0. Someone in the uppermost tax bracket can go from a 37 tax rate on a capital gain to a 20 rate.

A 515 rate that applies for the 2015 tax year to wages interest and dividends and long-term capital gains. If you sell your home for more than you paid for it you have a capital gain and in theory you have to pay capital gains tax. Net capital gains Dividends interest wages other income.

Capital Losses Federal. Capital gains reported on Massachusetts Schedule B is 12. This is really great news for the Massachusetts real estate market.

These are taxed at 12. Gains and 1000 against interest and dividends Carry forward is allowed. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Certain capital gains are taxed at a higher rate of 12 percent. As a nonresident you need to file income tax returns with Massachusetts if your Massachusetts gross income from sources within Massachusetts is greater than either 8000 or the prorated personal exemption youre entitled to whichever is less.

If the due date falls on a Saturday Sunday or legal holiday the due date is. Massachusetts taxes both income and most long-term capital gains at a flat rate of 5. On or before April 15 for calendar year filings.

Gains on the sale of property used in a trade or business 4797 property held for one year or less. On or before April 15 for calendar year filings. Any Massachusetts resident who has an estate valued at more than 1 million between property and adjusted taxable gifts is required to file a Massachusetts estate tax return.

Massachusetts levies a 51 percent tax on both earned and unearned income. Mass MA follows the code of 1105 and allows you to offset losses against. Massachusetts imposes 2 tax rates.

Deductible against gains in part against income Carry forward available. The 15th day of the 4th month for fiscal year filings. 2 T The tax rate on Part A taxable income consisting of short-term capital gains and long-term gains on collectibles is 12.

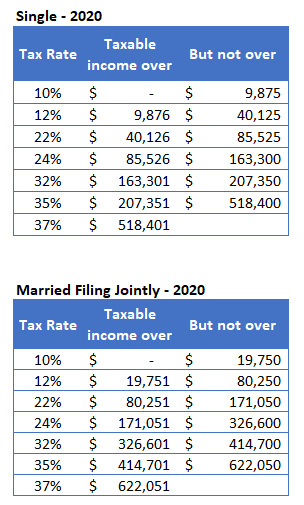

The 15th day of the 4th month for fiscal year filings. Massachusetts Capital Gains Tax Rates Massachusetts taxes all income at a flat rate of 5 in tax year 2020 with the exception of short-term capital gains. Earned income includes salaries wages tips and commissions and unearned income includes interest dividends and capital gains.

Everyone whose Massachusetts gross income is 8000 or more must file a Massachusetts personal income tax return on or by April 15th following the end of every tax year. Unlike your primary residence you will likely face a capital gains tax if you sell for a profit. Certain capital gains are taxed at 12.

Part A gross income consists of interest except interest from Massachusetts banks dividends gains from the sale or exchange of capital assets held for one year or less and long-term gains from collectibles. The 238 percent figure includes the top tax rate on capital gains plus the 38 percent tax on investment income for high-income taxpayers which helps fund the Affordable Care Acts health coverage expansions.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Senate Dems Propose Capital Gains Tax At Death With 1 Million Exemption

Senate Dems Propose Capital Gains Tax At Death With 1 Million Exemption

What Is Capital Gains Tax And When Are You Exempt Thestreet

What Is Capital Gains Tax And When Are You Exempt Thestreet

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

When Home Sellers Can Reduce Capital Gains Tax Using Expenses Of Sale Nolo Com Capital Gains Tax Capital Gain Research Paper

When Home Sellers Can Reduce Capital Gains Tax Using Expenses Of Sale Nolo Com Capital Gains Tax Capital Gain Research Paper

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gains Tax When Selling A Home In Massachusetts

Capital Gains Tax When Selling A Home In Massachusetts

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Real Estate Investing

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Real Estate Investing

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png) How Are Capital Gains And Dividends Taxed Differently

How Are Capital Gains And Dividends Taxed Differently

3 Things To Know About The Capital Gains Tax

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

How To Calculate Capital Gains Tax On Property How To Save Capital Gain Tax Capital Gain Capital Gains Tax Tax

How To Calculate Capital Gains Tax On Property How To Save Capital Gain Tax Capital Gain Capital Gains Tax Tax

Labels: capital, gains, massachusetts

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home