Jefferson County Wa Property Tax Rate

You can call the Jefferson County Tax Assessors Office for assistance at 360-385-9105Remember to have your propertys Tax ID Number or Parcel Number available when you call. Completion of Application for Senior Citizen and Disabled Persons Exemption from Real Property Taxes.

Remember first installment property taxes are due soon.

Jefferson county wa property tax rate. JEFFERSON LAND TRUST - SNOW CREEK ESTUARY 31 FAIRMOUNT RD PORT TOWNSEND Jefferson. M ailed payments must be postmarked put in a drop box or paid online by Friday April 30th to avoid penalty and interest charges. 8436260 NATURE CONSERVANCY excludes personal property Exempt.

When contacting Jefferson County about your property taxes make sure that you are contacting the correct office. Jefferson County Arkansas 101 E Barraque St Pine Bluff AR 71601. Please complete and submit the form by April 30 2021 to the Jefferson County Treasurer.

Businesses with a significant reduction in revenue in 2020 from 2019 may apply for an extension. You can search your Real Estate Taxes by Property ID Owner Name or Property Address and Personal Property Taxes by Business Tax Number or Business Name. Treasurerjefferson county courthouse311 s.

Stacie Prada Jefferson County Treasurer. IRONDALE 4 BLK 109 LOTS 20 TO 22. Down menu on the next payment screen.

The form is titled 2021 Request for Real Property Tax Due Date Extension Payment Agreement Due to Revenue Loss Provided in ESHB 1332 Fill-in 64-0116. Beginning in 2020 Income Threshold 3 is based on the county median household income of the county where the residence is located. State law doesnt allow the county treasurer to collect property taxes until the tax roll has been certified.

Visa Debit for Property Taxes only not Water Sewer Assessments You must select Visa Debit in drop. Jefferson County has a reputation as a wonderful place to live visit and conduct business. Jefferson County - GA - Tax makes every effort to produce and publish the most accurate information possible.

Center avenue rm 107jefferson wi 53549phone 920 674 7250fax 920 674 7368email business hoursmonday friday8 00 a. The tax roll is certified mid-January of each year. Tony Washington County Tax Collectors Office County Collector.

E-check We do not accept HR Block cards as they require a 30 day hold. Refer to RCW 8452080 RCW 8456010 and RCW 8456020. The Jefferson County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Jefferson County and may establish the amount of tax due on that property based on the fair market value appraisal.

However this material may be slightly dated which would have an impact on its accuracy. Taxpayer dollars allow the county to deliver vital services but continued increasing demand for services has created a significant financial challenge. Any errors or omissions should be reported for investigation.

Business Extension Available. The median property tax also known as real estate tax in Jefferson County is 213800 per year based on a median home value of 30850000 and a median effective property tax rate of 069 of property value. Mailed payments must be postmarked put in a drop box or paid online by Friday April 30th.

The Sheriffs Office collection of the 2020 Taxes starts on November 2 2020. You must own and occupy the home in Jefferson County for which the exemption is claimed in total fee owner as a life estate including a lease for life or by contract purchase by December 31st of the assessment year. JEFFERSON LAND TRUST 1033 LAWRENCE ST PORT TOWNSEND WA 98368-9647.

Jefferson County Assessors Office Services. However the quality services the county provides to residents and local businesses come at a cost. Create an Account - Increase your productivity customize your experience and engage in information you care about.

No warranties expressed or implied are provided for the data herein its use or. 1st Half Property Taxes are Due April 30th. All other debit cards are charged at 25 395.

101 West Barraque Suite 113 Pine Bluff AR 71601. Remember first installment property taxes are due soon.

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

My Property Tax Bill Keeps Going Up Why Does Jeffco Need To Ask For Money Jefferson County Co

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

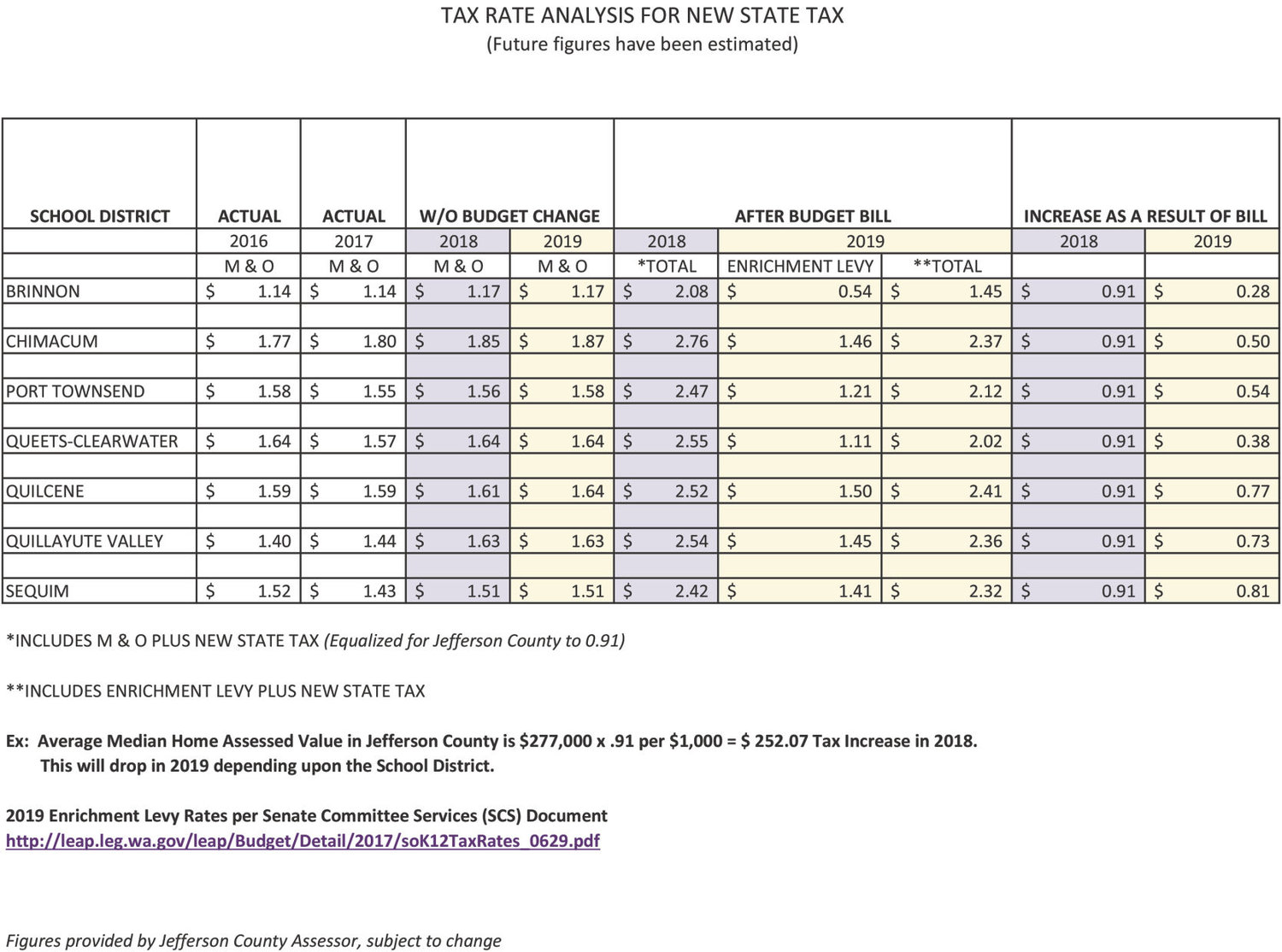

Assessor Property Taxes Could Rise Port Townsend Leader

Assessor Property Taxes Could Rise Port Townsend Leader

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Florida Property Tax H R Block

Florida Property Tax H R Block

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

As Boomers Age This Is Where The Most Homes Will Go On The Market Thestreet Forrest City Marketing Jefferson County

As Boomers Age This Is Where The Most Homes Will Go On The Market Thestreet Forrest City Marketing Jefferson County

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Property Tax Map Reforming Government

Property Tax Map Reforming Government

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home