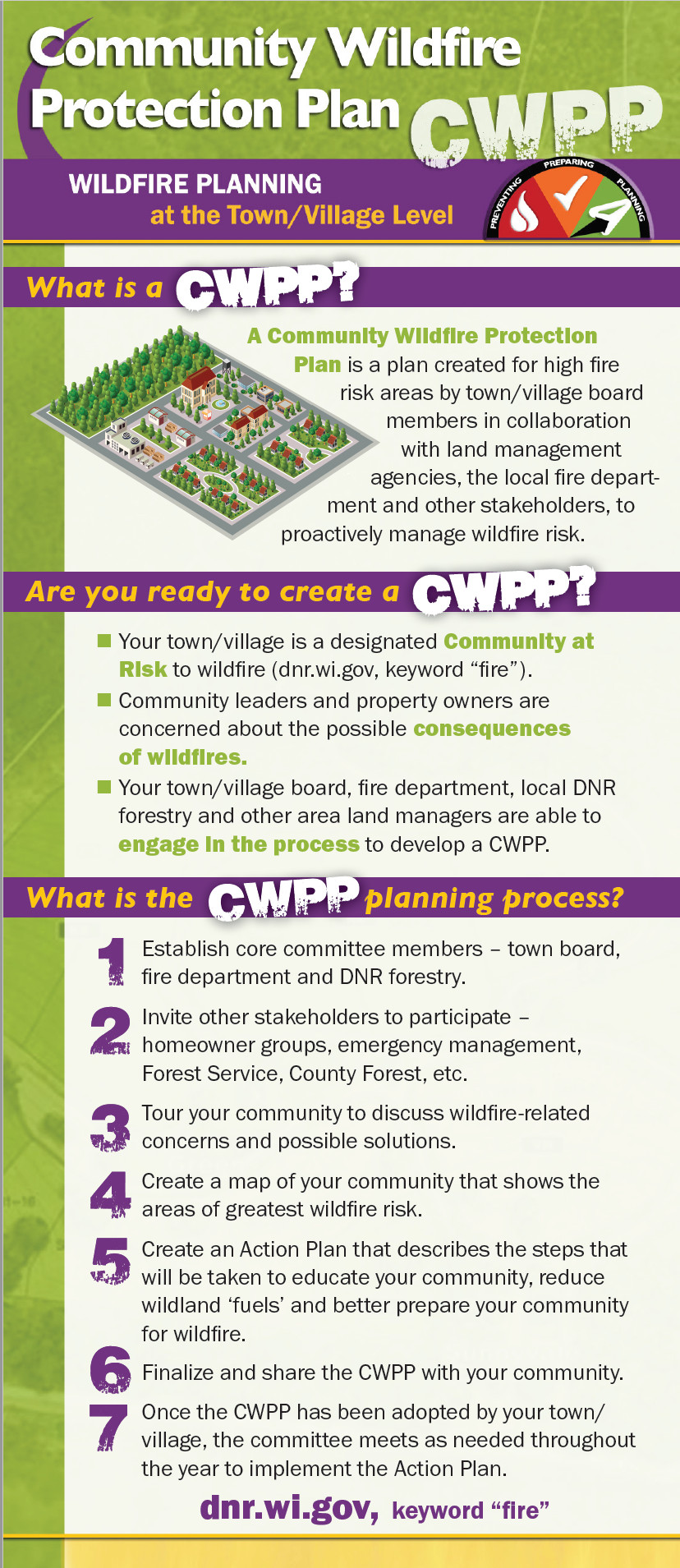

Property Taxes Jackson County Wi

Village of Jackson PO Box 637 Jackson WI 53037-0637. The Jackson County Treasurer has compiled the following resources to assist you with questions and inquiries related to tax information.

Town Of Brockway Sanitary District 1

Town Of Brockway Sanitary District 1

The maps and data are for illustration purposes and may not be suitable for site-specific decision making.

Property taxes jackson county wi. These records can include Jackson County property tax assessments and assessment challenges appraisals and income taxes. Find property records for Jackson County. The change will reflect a larger 2021 tax liability.

Paying taxes online takes just a few minutes. Property Taxes Mortgage 9010200. The Town of Jackson worked with Burnett County and has developed an in depth Comprehensive Land Use Plan.

Jackson County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Jackson County Wisconsin. CoadamswiusDepartmentsCounty TreasurerProperty Taxes left menu Town of Jackson Adams County WI Location Address. If you choose to pay your real property taxes in full the payment is due by January 31 to the local treasurer.

If any of the links or phone numbers provided no longer work please let us know and we will update this page. All of the Jackson County information on this page has been verified and checked for accuracy. Jackson County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Last day to file appeal to the Board of Property Tax Appeals. You will also be able to find links to many valuable websites. Treasurers Office Jackson County Courthouse 307 Main Street Black River Falls WI 54615.

First trimester tax payment due. Current Tax Cycle PDF Delinquent Tax Collection PDF Hardship Guidelines and Application. If you choose to pay your real property taxes in two installments tax bills over 100 the first installment is due to your local treasurer by January 31.

Property Taxes No Mortgage 6153200. The second installment is due to the Burnett County Treasurer by July 31. Vanessa Mortenson Deputy County Treasurer 715 284-0207 vanessamortensoncojacksonwius.

Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year. Seller indicates property has been changed from open to closed MFL status. This parcel is minutes from Robinson Creek and adjacent to the ATV trail.

Please contact PayIt Customer Support at. 398 State Road 82 Oxford WI 53952. The median property tax in Jackson County Wisconsin is 1962 per year for a home worth the median value of 121400.

Do NOT combine other payments with your taxes. Jackson County Courthouse 307 Main Street Suite B01 Black River Falls WI 54615. The median property tax in Jackson County Wisconsin is 196200.

The Jackson County WI Geographic Information Web Server provides online access to geographic and assessment record info currently maintained by Jackson County WI for individual parcels of property. The median property tax also known as real estate tax in Jackson County is 196200 per year based on a median home value of 12140000 and a median effective property tax rate of 162 of property value. This southeastern Wisconsin County has some of the highest property tax rates in the state.

Payments in full or first installment payments are collected by the Village of Jackson and are due on Sunday January 31 2021. Make Checks Payable to the Village of Jackson Treasurer. Property accessed via Jackson County lands.

Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County. The average effective property tax in Kenosha County is 220. The Plan for the Town of Jackson is full of interesting and valuable information.

Last day for tax collector to mail tax statements Owner Value Reviews process through December 1 BOPTA forms available at Jackson County Clerks Office. 2020 TAX PAYMENT INFORMATION. Our Town ordinances annual budget and election and tax information can also be found here.

Jackson County has one of the highest median property taxes in the United States and is ranked 472nd of the 3143 counties in order of median property taxes. Jackson County Treasurer 715 284-0206 tabithamichaudcojacksonwius. The countys average effective property tax rate ranks seventh in the state at 206.

Last day discount allowed for full or 23 tax payment. Town Hall Address Clerks Office 3146 Division Road Jackson WI 53037 Office Phone 262-677-4048 Town Clerks Email. Taxes not paid in full on or before December 31 will accrue interest penalties and fees.

Jackson County Property Tax Collections Total Jackson County Wisconsin. Its fast and secure. In the countys largest city Oshkosh the rate is about 1618 per 1000 of assessed value.

Jackson County collects on average 162 of a propertys assessed fair market value as property tax.

Tax Information For Town Of Jackson In Washington County Wisconsin

Tax Information For Town Of Jackson In Washington County Wisconsin

Town Of Franklin Jackson County Wi

Town Of Franklin Jackson County Wi

Https Dnr Wi Gov Topic Lands Pal Documents Pal Atlas2020 Pdf

Village Of Merrillan Official Website For The Village Of Merrillan Wisconsin

Jackson County Mo Property Tax Calculator Smartasset

Jackson County Mo Property Tax Calculator Smartasset

Village Of Merrillan Official Website For The Village Of Merrillan Wisconsin

Village Of Merrillan Official Website For The Village Of Merrillan Wisconsin

Clark County Wisconsin Genealogy Familysearch

Jackson County Tax Assessor S Office

Jackson County Tax Assessor S Office

La Crosse County Interactive Map Viewer

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

La Crosse County Interactive Map Viewer

Town Of Franklin Jackson County Wi

Town Of Franklin Jackson County Wi

.jpg)

.jpg)

.png)

.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home