Property Tax Rate Raleigh Nc

Wake County is located in northern North Carolina. Wake Countys property tax rate is 534 cents per 100 of assessed.

Taxes 646512 1280 Irs Taxes Tax Services Tax Attorney

Taxes 646512 1280 Irs Taxes Tax Services Tax Attorney

By way of example that tax rate results in a total property tax for 2019 of 347670 for a property with a 300000 tax value.

Property tax rate raleigh nc. The 2016 county tax rate for Wake county was set by July 1 2016 at615. Its made up of 13 municipalities including Raleigh the states capital and the county seat. If you choose to purchase a home in the city you are responsible for both city taxes and municipal taxes.

County Property Tax Rates and Reappraisal Schedules County Property Tax Rates for the Last Five Years County and Municipal Property Tax Rates and Year of Most Recent Reappraisal. How Much Are Transfer Taxes in North Carolina. A single-family home with a value of 200000.

789 The property tax rate shown here is the rate per 1000 of home value. For example a 600 transfer tax would be imposed on the sale of a 300000 home. If the tax rate is 1400 and the home value is 250000 the property tax would be 1400 x 2500001000 or 3500.

How to calculate taxes Tax rates are calculated against each 100 in value. 25 rows The following property tax rates for are for 2010 and 2011 fiscal years. Property Tax Rate.

The property is located in the City of Raleigh but not a Fire or Special District. The countys average effective property tax rate is 082 meaning a homeowner whose home is worth 200000 would pay about 1640 annually in property taxes at that rate. Counties in North Carolina collect an average of 078 of a propertys assesed fair market value as property tax per year.

Seven counties in North Carolina are authorized to impose an additional. At least 1 letter of the first name is required. Use that figure in our example 1500 and multiply it by both Wake Countys property tax rate and Raleighs property tax rate.

Raleigh North Carolina and Durham North Carolina. Middle Last name to be searched must be entered in full. Property that was to be listed as of January 1 2016 would be subject to this tax rate.

Find out with a property appraisal in the Raleigh NC area Its tough to make informed smart decisions about the future of your property when you dont know exactly what its worth. Property value divided by 100. The current tax rate for property taxes in Raleigh is 4038 and the rate is assessed against each 100 value.

County Manager David Ellis had recommended. Tax Credits for Growing Businesses Article 3J. Raleighs is4382 meaning that a property owner in Raleigh will pay a tax rate of 11589 per hundred dollars of property valuation.

Calculate Your Property Taxes in These Other States. To obtain a statement of the property taxes paid for your vehicles visit NC DMV online. To assist taxpayers in person.

Transfer taxes in North Carolina are typically paid by the seller. Find important information on the departments listing and appraisal methods tax relief and deferment programs exempt property and procedures for appeals. This is the effective tax rate.

When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property. My house market value as of the last reappraisal was 200000. By hiring Property Valuation Services of Clayton Inc you can arrange for a property appraisal that will give you the information you need.

2021 Cost of Living Calculator for Taxes. COVID-19 Office Update The Tax Administration office is now open to the public Monday through Friday from 830 am5 pm. Statistical Abstract of North Carolina Taxes 2015.

The owner of a 300000 house will pay 216210 in county property taxes a 19890 increase. County rate 60 Raleigh rate 3552 Combined Rate 9552 Recycling Fee 20. The property records and tax bill data provided herein represent information as it currently exists in the Wake.

Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and Registration Taxes and an Online Tool to customize your own personal estimated tax burden. The median home value in Wake County is 265800 with a median property tax payment of 2327. This means property will be appraised at 6150 cents per 100 value.

The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000.

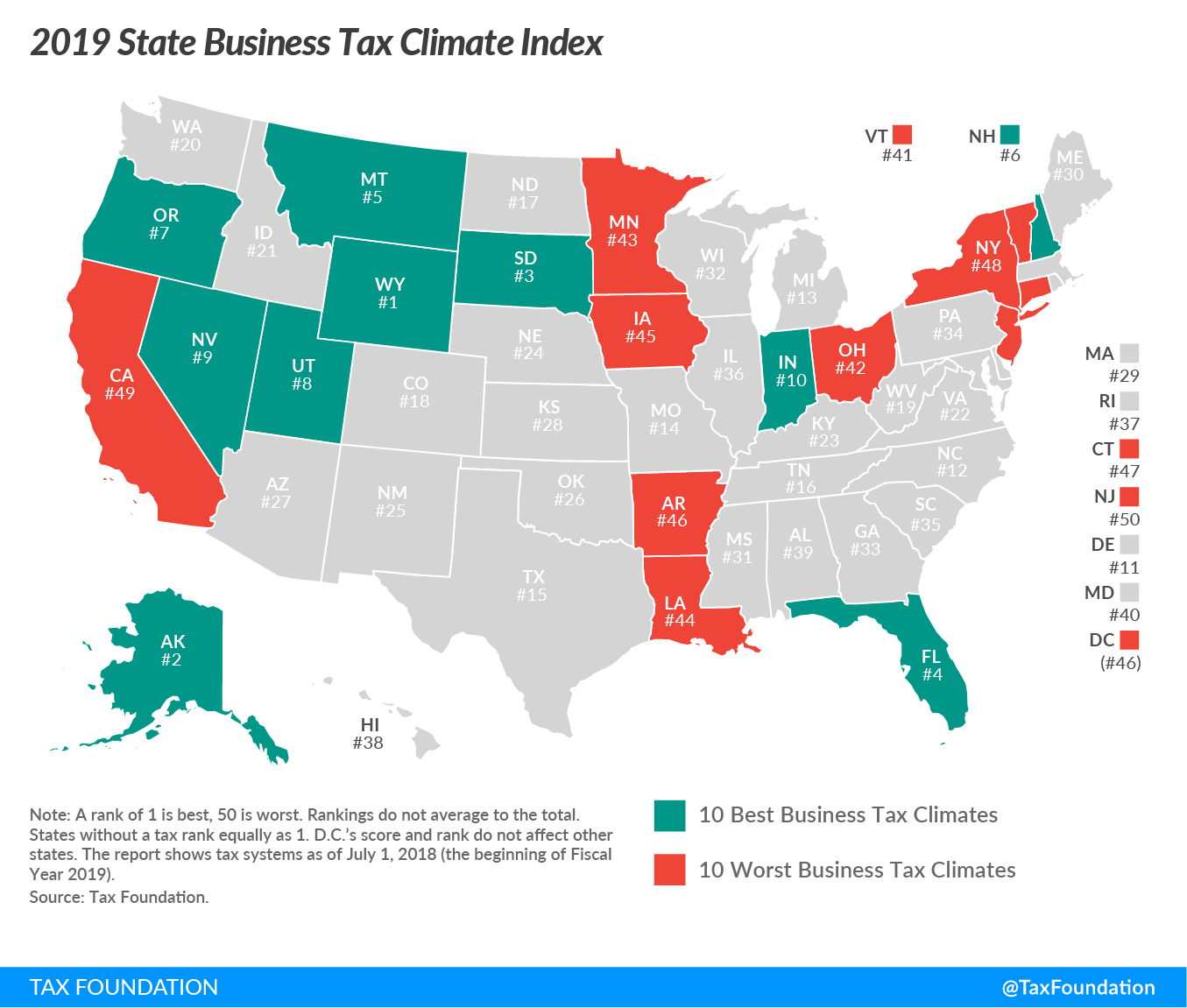

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

3 Form Usa 3 Important Life Lessons 3 Form Usa Taught Us Tax Return Irs Important Life Lessons

3 Form Usa 3 Important Life Lessons 3 Form Usa Taught Us Tax Return Irs Important Life Lessons

New Report Income Tax Amendment Would Put Schools Transportation Public Health At Risk Nc Policy Watch

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

Pin By Richard Callahan Realtor On Raleigh N C Startup Funding Startup Growth Female Entrepreneur

Pin By Richard Callahan Realtor On Raleigh N C Startup Funding Startup Growth Female Entrepreneur

Sales And Use Tax In Nc The Roper Group Inc

Sales And Use Tax In Nc The Roper Group Inc

Best Cities For Startups In The U S 2019 Ranked Start Up City Best Cities

Best Cities For Startups In The U S 2019 Ranked Start Up City Best Cities

Property Tax Nc Page 1 Line 17qq Com

Property Tax Nc Page 1 Line 17qq Com

Jim Mcalear On Twitter First Time Home Buyers Real Estate Infographic How To Plan

Jim Mcalear On Twitter First Time Home Buyers Real Estate Infographic How To Plan

North Carolina Income Tax Calculator Smartasset

North Carolina Income Tax Calculator Smartasset

North Carolina S Transition To A Low Tax State

North Carolina S Transition To A Low Tax State

Nc Property Tax Deadlines Bell Davis Pitt

Nc Property Tax Deadlines Bell Davis Pitt

States That Don T Tax Military Retirement Pay Military Benefits Military Retirement Pay Military Retirement Military Benefits

States That Don T Tax Military Retirement Pay Military Benefits Military Retirement Pay Military Retirement Military Benefits

The Best Worst Metros For Dating 2020 Rentonomics Richmond College Fun Dating Girls

The Best Worst Metros For Dating 2020 Rentonomics Richmond College Fun Dating Girls

Is Winter A Good Time To Buy A Home Nc Real Estate Real Estate Tips Home Inspection

Is Winter A Good Time To Buy A Home Nc Real Estate Real Estate Tips Home Inspection

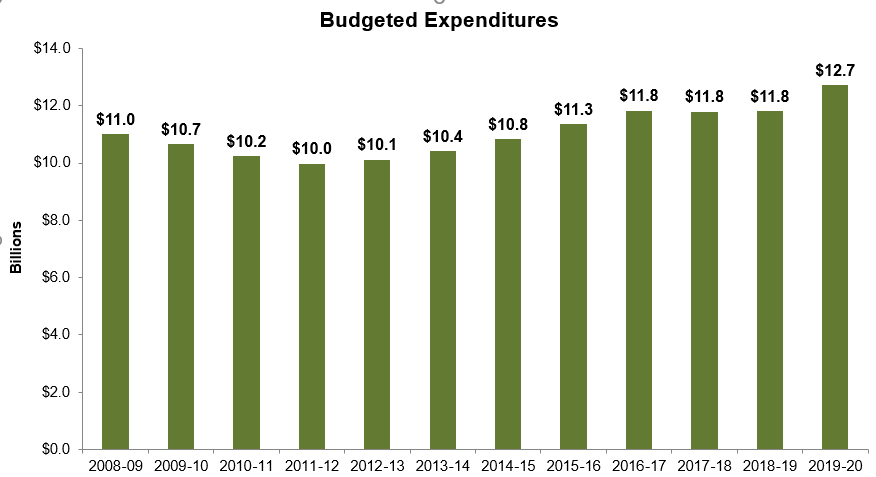

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

![]() Tax Rates Fees Wake County Government

Tax Rates Fees Wake County Government

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home