Pay Personal Property Tax Virginia Henrico

Pay via the Treasurers Local Payment Call Center at 757 385-8968. Box 105155 Atlanta Ga.

7503 Schaaf Dr Henrico Va 23229 Realtor Com

7503 Schaaf Dr Henrico Va 23229 Realtor Com

Also if it is a combination bill please include both the personal property tax amount and VLF amount as a grand total for each tax account number.

Pay personal property tax virginia henrico. Tax rates differ depending on where you live. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. In-depth Henrico County VA Property Tax Information.

The personal property tax rate set annually by City Council is 345 per 100 of assessed value or 345 except for Aircraft which is taxed at a rate of 106 per 100 assessed value or 106 Aircraft 20000 pounds or more are taxed at a rate of45 cents per 100 of assessed value. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxesinclude creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am.

This system is the property of the Commonwealth of Virginia. Paying Your Property Tax The Henrico County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

If you have questions about personal property tax or real estate tax contact your local tax office. When do I need to file a personal property return for my car or pickup. You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or your checking account.

Pay by Phone Pay Personal Property Tax Real Estate Tax Parking Tickets or Public UtilitiesStorm Water bills with a major credit card 25 fee or 100 whichever is greater. Non-confidential real estate assessment records are public information under Virginia law and Internet display of non-confidential property information is specifically authorized by Virginia Code 581-31222. You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website.

View history of QuickPay bill payments. The median property tax in Henrico County Virginia is 1762 per year for a home worth the median value of 230000. When a person initially acquires an automobile or truck andor moves that vehicle into Henrico County that person must file a personal property return.

Henrico County now offers paperless personal property and real estate tax bills. Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous taxes. Personal Property and Real Estate Tax Payment County of Henrico Tax Processing Center PO.

Get Virginia tax filing reminders and tax news for individuals and businesses. Virginia Tax Personal Identification Number PIN. Payments may be made to the county tax collector or treasurer instead of the assessor.

Utility Payments County of Henrico VA Utility PO. Personal property taxes are due May 5 and October 5. Schedule bill payments for a future date from your checking or savings account.

View outstanding tax bills. What is the tax due date for payment of personal property taxes in Richmond. Henrico County collects on average 077 of a propertys assessed fair market value as property tax.

June 5 of each tax year or within 60 days of the date of purchase whichever is later. 420 per 100 A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles. You can pay your personal property tax through your online bank account.

The assessment on these vehicles is. Personal Property Tax Rate. Henrico County has one of the highest median property taxes in the United States and is ranked 594th of the 3143 counties in order of median property taxes.

Pay outstanding tax bills from your savings or checking account. For example a vehicle purchased on February 1 would be included in the Citys annual billing for property taxes due on June 5. When you use this method to pay taxes please make a separate payment per tax account number.

Mail your payment to the following address. While the Real Estate Division has worked to ensure that the assessment data contained herein is accurate Henrico County assumes no liability for any errors omissions. Box 105634 Atlanta Ga 30348-5634.

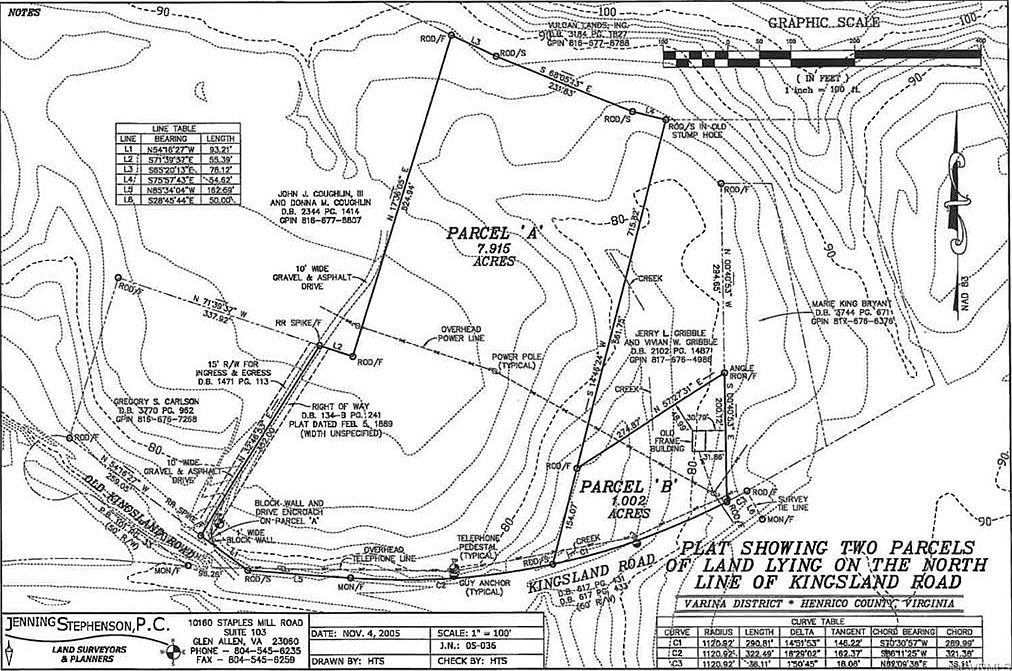

1700 Kingsland Rd Henrico Va 23231 Zillow

1700 Kingsland Rd Henrico Va 23231 Zillow

Virginia Henrico County 1700s To Early 1800s Goyen Family Tree

Virginia Henrico County 1700s To Early 1800s Goyen Family Tree

9412 Rhonda Dr Henrico Va 23229 Realtor Com

9412 Rhonda Dr Henrico Va 23229 Realtor Com

Meadow Farm Museum At Crump Park County Of Henrico Historic Homes House Styles Farm

Meadow Farm Museum At Crump Park County Of Henrico Historic Homes House Styles Farm

Henrico County Government Henriconews Twitter

Henrico County Government Henriconews Twitter

9703 University Blvd Henrico Va 23229 Realtor Com

9703 University Blvd Henrico Va 23229 Realtor Com

0000002 Westham Station Road Henrico Va 23229 Mls Id 2101317 Joyner Fine Properties

0000002 Westham Station Road Henrico Va 23229 Mls Id 2101317 Joyner Fine Properties

Henrico County Coronavirus Tax Relief Virginia Cpa Firm

Henrico County Coronavirus Tax Relief Virginia Cpa Firm

12 Doverland Ct Henrico Va 23229 Realtor Com

12 Doverland Ct Henrico Va 23229 Realtor Com

7515 Century Dr Henrico Va 23229 Realtor Com

7515 Century Dr Henrico Va 23229 Realtor Com

109 Williamson Ct Henrico Va 23229 Realtor Com

109 Williamson Ct Henrico Va 23229 Realtor Com

1302 Ware Rd Henrico Va 23229 Realtor Com

1302 Ware Rd Henrico Va 23229 Realtor Com

104 Adingham Ct Henrico Va 23229 Realtor Com

104 Adingham Ct Henrico Va 23229 Realtor Com

Map Of Henrico County Virginia Showing Portions Of Chesterfield County Also City Of Richmond Library Of Congress

Geographic Information Systems Gis Henrico County Virginia

Geographic Information Systems Gis Henrico County Virginia

Covid 19 Testing Resources Henrico County Virginia

Covid 19 Testing Resources Henrico County Virginia

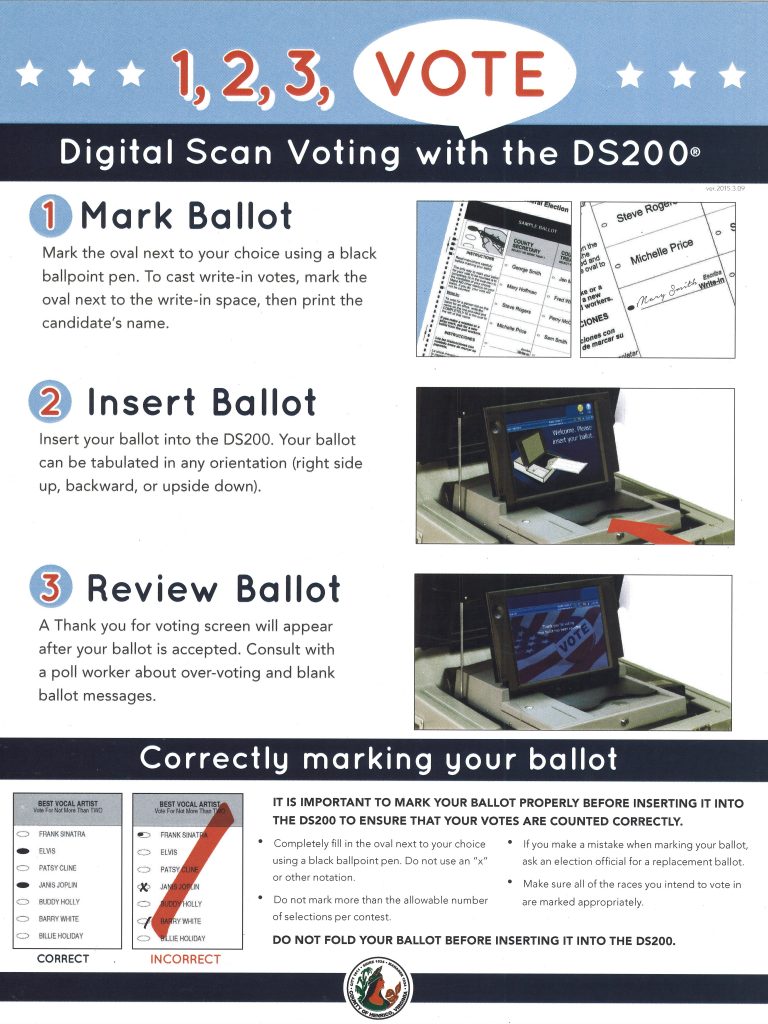

About Voting Equipment Henrico County Virginia

About Voting Equipment Henrico County Virginia

How Healthy Is Henrico County Virginia Us News Healthiest Communities

How Healthy Is Henrico County Virginia Us News Healthiest Communities

Free Document Shredding Electronics Recycling Henrico County Virginia

Free Document Shredding Electronics Recycling Henrico County Virginia

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home