Lucas County Ohio Property Tax Estimator

The following lists the formulas that the State of Ohio has authorized for the calculation of property taxes. Estimate the net proceeds at closing.

Mark Baumann On Twitter Real Estate Tips Rent Vs Buy Budgeting

Mark Baumann On Twitter Real Estate Tips Rent Vs Buy Budgeting

Lucas County has one of the highest median property taxes in the United States and is ranked 435th of the 3143 counties in order.

Lucas county ohio property tax estimator. The median property tax on a 12240000 house is 128520 in the United States. 1 the manufactured homes cost to the owner. 419 213-4322 The property and tax information on this site represents data as of the current tax year.

Yearly median tax in Lucas County. House bill 920 - 1581. Lucas County Auditor Anita Lopez 419 213-4322.

This western Ohio County has among the highest property tax rates in the state. The median annual property tax payment is 2511. 165 of home value.

Max 165 character description. Lucas County collects on average 165 of a propertys assessed fair market value as property tax. Our Ohio Property Tax Calculator can estimate your property taxes based on similar properties.

The median property tax on a 12240000 house is 166464 in Ohio. The median property tax in Lucas County Ohio is 202000. If you need to complete a deed transfer we recommend contacting a company that offers E-Recording who may assist you for a fee.

Total 1988 taxes levied including prior years delinquencies ranged from 25772 in Preble County to 914555 in Lucas County. Call our office at 4192134406 or email us at outreachcolucasohus. Find property records for Lucas County.

10 rollback - 337. Annually the Auditor accounts for each levy in Lucas County creates the tax duplicate then after authorization from Ohio Department of Tax Equalization forwards data to the Lucas County Treasurer. Lucas County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Information provided is deemed a reliable point of reference but is not guaranteed and should be independently verified. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Lucas County. Or 2 the market value at the time of purchase whichever is greater.

The Lucas County Sales Tax is collected by the merchant on all qualifying sales made within Lucas County. All of the Lucas County information on this page has been verified and checked for accuracy. Enter the amount you intend to pay to see the non-refundable fees associated with each payment type.

105 Main Street Painesville OH 44077 1-800-899-5253. Groceries are exempt from the Lucas County and Ohio state sales taxes. Taxes with reductions is calculated by deducting the tax rollbacks and reductions from the base tax and is an estimate of what the current owner pays.

Auditor 419-213-4406 Board of Elections 419-213-4001 Canine Care Control 419-213-2800 County Commissioners 419-213-4500 Sheriff 419-213-4908. This calculator will estimate the Ohio title insurance premium Ohio conveyance fee transfer tax and seller assist cost if applicable. The Treasurer sends the bills and collects taxes based on the duplicate.

The assessed value of the manufactured home is equal to 40 percent of the depreciated value of either. Outreachcolucasohus TEXT a question. The Lucas County Treasurer is the guardian of the taxpayers money and is responsible for the accurate accounting and proper handling of over 625 million each year.

The median property tax in Lucas County Ohio is 2020 per year for a home worth the median value of 122400. 7 is the smallest possible tax rate 44843 Lucas Ohio The average combined rate of every zip code in Lucas Ohio is 7. Transfer Conveyance List of Professional Companies to E-Record Auditors departmental phone numbers are listed below.

The Lucas County Treasurer serves as the chief investment officer in charge of managing an average daily portfolio of. Market Value x 35 Assessed Value Example. The median property tax also known as real estate tax in Lucas County is 202000 per year based on a median home value of 12240000 and a median effective property tax rate of 165 of property value.

The median property tax on a 13460000 house is 141330 in the United States. The median property tax on a 13460000 house is 183056 in Ohio. This calculator should be useful for Ohio Realtors and OH home sellers.

100000 x 35 35000 Assessed Value x Tax Rate1000 Current Real Estate TaxYear Example. The countys average effective property tax rate is 218 which ranks as the second-highest out of Ohios 88 counties. Situated along the Michigan border and Lake Erie in northern Ohio Lucas County has property tax rates that are higher than both state and.

The median property tax on a 12240000 house is 201960 in Lucas County. Contact Information The office of the Lucas County Auditor is open. Contact your county or citys property tax assessor.

419 309-7877 The Lucas County Auditor herself. Lucas County OH Property Tax Search by Address Want to see what the taxes are for a certain property. The Lucas County Ohio sales tax is 725 consisting of 575 Ohio state sales tax and 150 Lucas County local sales taxesThe local sales tax consists of a 150 county sales tax.

35000 x 99511000 348285 List of current and previous Tax Rates for Lucas County. Of the eighty-eight counties in Ohio Lucas County is ranked. If any of the links or phone numbers provided no longer work please let us know and we will update this page.

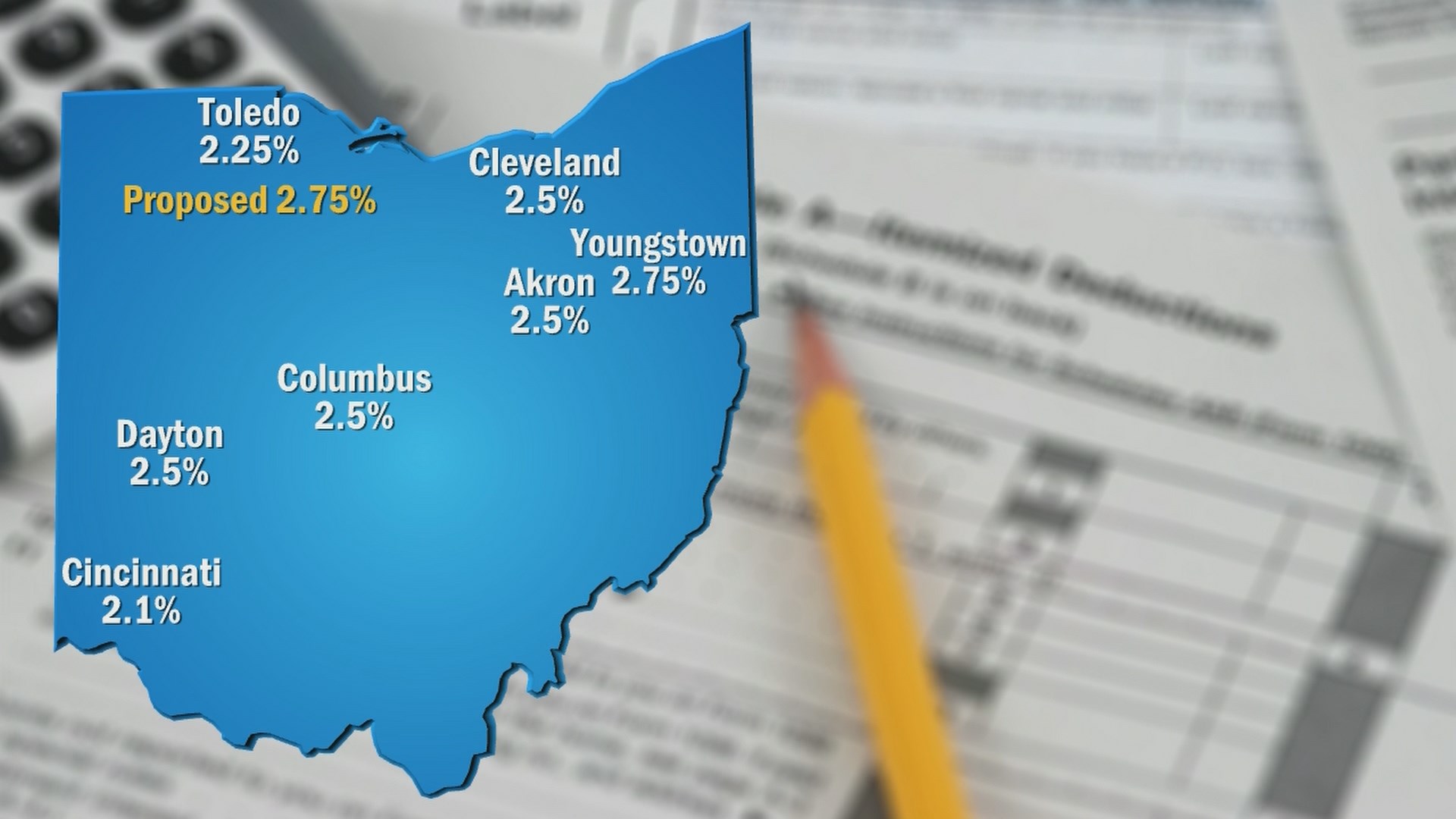

I Team How Toledo S Income Tax Compares To Other Ohio Cities

I Team How Toledo S Income Tax Compares To Other Ohio Cities

2151 Blackthorn Dr Toledo Oh 43614 Mls 6042433 House Prices Real Estate Property Prices

2151 Blackthorn Dr Toledo Oh 43614 Mls 6042433 House Prices Real Estate Property Prices

New Listing 1510 Ironwood Avenue Toledo Ohio Https 1510ironwoodave Danberry Com Toledo Private Mortgage Insurance Ironwood

New Listing 1510 Ironwood Avenue Toledo Ohio Https 1510ironwoodave Danberry Com Toledo Private Mortgage Insurance Ironwood

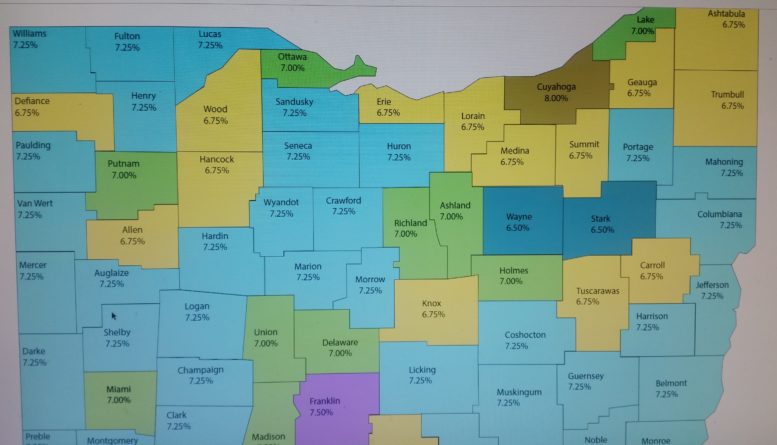

Wood County Likes Its Status On Low Sales Tax Island Bg Independent News

Wood County Likes Its Status On Low Sales Tax Island Bg Independent News

20 Best Places To Live On Only A Social Security Check In 2020 Best Places To Live Best Places To Retire Great Places

20 Best Places To Live On Only A Social Security Check In 2020 Best Places To Live Best Places To Retire Great Places

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Buying A Home Has More Advantages Than Renting A Home Facts Realestate Rent Being A Landlord Renting A House

Buying A Home Has More Advantages Than Renting A Home Facts Realestate Rent Being A Landlord Renting A House

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Pin By Helen Wilson On I M Outta Here Travel Ideas And Plans Cedar Point Crowd Calendar Happy Travels

Pin By Helen Wilson On I M Outta Here Travel Ideas And Plans Cedar Point Crowd Calendar Happy Travels

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Here S How Many Hours You Need To Work To Pay Rent In Every State Minimum Wage Rent Wage

Here S How Many Hours You Need To Work To Pay Rent In Every State Minimum Wage Rent Wage

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Ohio Missing Adults Http Www Ohioattorneygeneral Gov Law Enforcement Local Law Enforcement Ohio Missing Persons Missing Dover Delaware Rent To Own Homes Ohio

Ohio Missing Adults Http Www Ohioattorneygeneral Gov Law Enforcement Local Law Enforcement Ohio Missing Persons Missing Dover Delaware Rent To Own Homes Ohio

Ohio Retirement Tax Friendliness Smartasset

Ohio Retirement Tax Friendliness Smartasset

3 Graphs That Show What You Need To Know About Today S Real Estate Market Real Estate Marketing House Prices Real Estate

3 Graphs That Show What You Need To Know About Today S Real Estate Market Real Estate Marketing House Prices Real Estate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home