How Much Is Personal Property Tax On A Car In West Virginia

However on the TurboTax list it states that these fees are not deductible in Virginia. The Commissioner of Revenues Personal Property Tax Division assesses all Arlington vehicle personal property taxes based on.

This will be a continuous tax to figure in your costs.

How much is personal property tax on a car in west virginia. This will depend upon the value of the car at the first of the year. Division of Motor Vehicles Vehicles Registrations Personal Property Tax Links. Personal Property Tax Links.

Its average effective property tax rate of 057 is the ninth-lowest state rate in the US as comes in at about half of the national average. The state is set by the West Virginia Constitution at 50 cents for class I 1 on class II and 2 on class 3 and 4. Bills in most Northern Virginia jurisdictions are due Oct.

Counties in West Virginia collect an average of 049 of a propertys assesed fair market value as property tax per year. Property Tax Rulings When the owner of property and the county assessor disagree over the classification of property or the taxability of property the question may be submitted to the Tax Commissioner for ruling as provided in West Virginia Code 11-3-24a. Vehicle sales and use tax is 3 of the sale price.

CarsDirect states that in addition to the sales taxes that you have to pay for cars at the point of purchase vehicles in Virginia are taxed annually as a property tax. So if your car costs you 25000 you multiply that by 3 to get your tax amount of 75000. Click the tabs below to explore.

West Virginia Code For more information please call 1-800-642-9066 West Virginia residents only. For transactions of less than 500 a flat 25 sales tax is payable. I live in Virginia and receive an annual personal property tax bill for my vehicle based on its value about 900 per year.

WV code sections 11-8-6b c and d dictate the division for counties cities. Contact the nearest county courthouse if questions arise concerning this tax or click here for links to all counties that currently have online tax. Use this calculator to compute your 2021 personal property tax bill for a qualified vehicle.

The Tax Commissioner must issue a ruling by the end of February of the calendar tax year. When you purchase a new car the dealer will collect the sales tax and remit it to the West Virginia State Tax Department using the Sales and Use Tax Return. Barbour Berkeley Boone Braxton Brooke Cabell Calhoun Clay Doddridge Fayette Gilmer Grant Greenbrier.

The West Virginia Division of Motor Vehicles has enabled this service to allow you to Renewal Your Vehicle Registration Check Your Drivers License Status Search for. For example you could trade-in your old car and receive a 5000 credit against the price of a 10000 new vehicle making your out-of-pocket cost only 5000. West Virginia has some of the lowest property tax rates in the country.

The first step towards understanding West Virginias tax code is knowing the basics. West Virginia has one of the lowest median property tax rates in the United States with only two states collecting a lower median property tax than West Virginia. In West Virginia the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax.

This means that you save the sales taxes you would otherwise have paid on the 5000 value of your trade-in. How does West Virginia rank. Page Content Please input the value of the vehicle the number of months that you owned it during the tax year and click the Calculate button to compute the tax.

West Virginia collects a 5 percent sales tax on all sales of new and used vehicles to be titled in the state. Proof of payment of the tax or an affidavit from the Assessor is required before license plate renewal. Vehicle Tax Rate Vehicle Personal Property Tax The tax rate for most vehicles is 457 per 100 of assessed value.

For properties included in a special subclass the tax rate is. This tax is continuous and. 5 for the tax formally called the tangible personal property tax which actually dates back to at least 1782 according to the Library.

Auto city rate s 6 is the smallest possible tax rate 24917 Auto West Virginia The average combined rate of every zip code in Auto West Virginia is 6. Personal property tax is assessed by the County Assessor and collected by the County Sheriff. Below we have highlighted a number of tax rates ranks and measures detailing West Virginias income tax business tax sales tax and property tax systems.

The County Boards set tax rate for 2020 the tax rate has been set at 500 per 100 of assessed value.

West Virginia S 20 Safest Cities Of 2021 Safewise

West Virginia S 20 Safest Cities Of 2021 Safewise

Paperwork Required Buying A Car In West Virginia 2020 Vinfreecheck

Paperwork Required Buying A Car In West Virginia 2020 Vinfreecheck

Property Site For Lots 8 9 Bowden Estates Drive Maxwelton Wv 24957 Lewisburg Clifton Gps Coordinates

Property Site For Lots 8 9 Bowden Estates Drive Maxwelton Wv 24957 Lewisburg Clifton Gps Coordinates

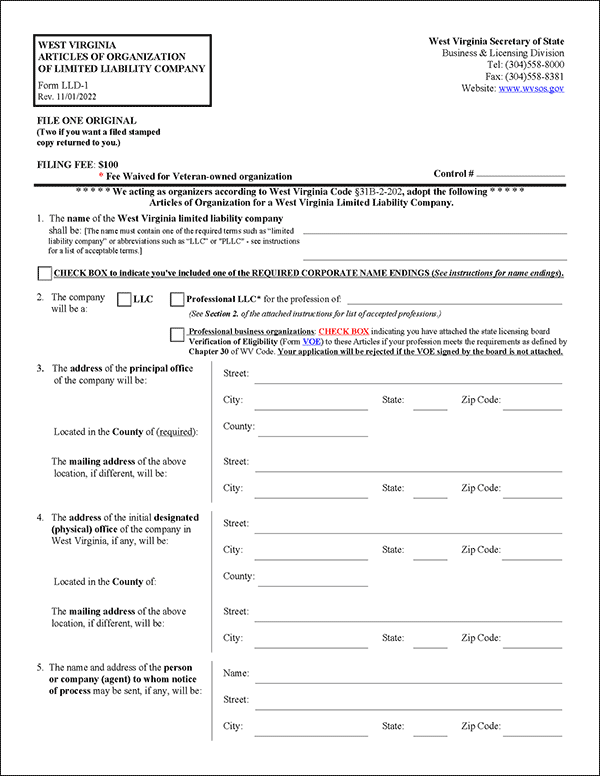

West Virginia Llc How To Form A West Virginia Llc Truic Guides

West Virginia Llc How To Form A West Virginia Llc Truic Guides

West Virginia Property Tax Calculator Smartasset

West Virginia Property Tax Calculator Smartasset

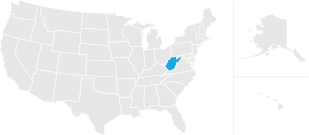

Free West Virginia Vehicle Bill Of Sale Form Pdf Formspal

Free West Virginia Vehicle Bill Of Sale Form Pdf Formspal

West Virginia Vehicle Registration Laws Com

West Virginia Vehicle Registration Laws Com

Free West Virginia Bill Of Sale Forms Pdf

Free West Virginia Bill Of Sale Forms Pdf

West Virginia Title Transfer Etags Vehicle Registration Title Services Driven By Technology

West Virginia Title Transfer Etags Vehicle Registration Title Services Driven By Technology

West Virginia Gun Laws Gunstocarry Guide

West Virginia Gun Laws Gunstocarry Guide

This Week In W Va History Wv News Wvnews Com

This Week In W Va History Wv News Wvnews Com

Labels: virginia

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home