Agricultural Property Tax By State

I Generally Washington real property values are determined based on the true and fair value which includes criteria such as. This deduction applies to the land farm structures and farming equipment.

RP-305-a Fill-in Not applicable.

Agricultural property tax by state. Article 25AA Agricultural Districts Law. 19 rows Agricultural Assessment Application. The law also allows municipalities to 1 exempt up to half of the value of certain farm properties 2 expand state exemptions for farm machinery up to specified limits and 3 exempt farm buildings up to specified limits.

The Property Tax Law Summary relied on the knowledge and skills of many people including Property Tax Division experts Property Tax Research staff Minnesota House and Senate Research staff Appeals and Legal Services Division staff and property tax administration partners. Helping your business succeed is important to the California Department of Tax and Fee Administration CDTFA. Latest news for farmers and the farming industry.

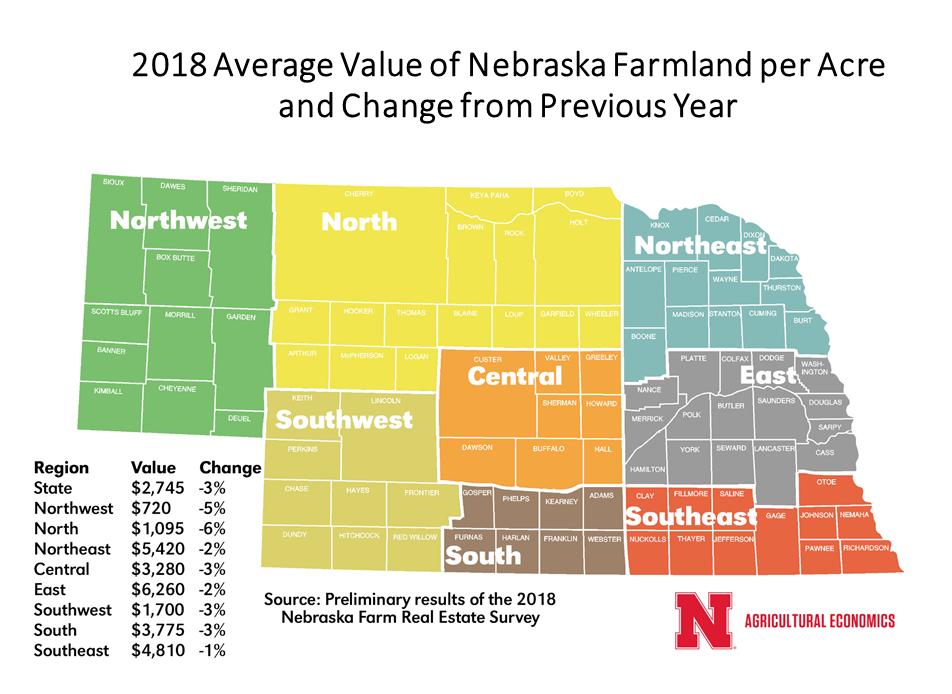

The size of agricultural property tax exemptions varies from state to state because property taxes arent administered at the federal level. An owner may apply for his or her farm to be valued based on its current use as opposed to its true and fair value. Agricultural property taxes paid as a share of net farm income for Nebraska.

MCL 2117ee provides for an exemption from certain local school operating taxes typically up to 18 mills for parcels that meet the qualified agricultural property definition. 1 Qualified agricultural property is exempt from the tax levied by a local school. Texas was the second-highest state for property taxes.

The value of farms and timberlands may be deducted from the taxable value of an estate as long as certain requirements are met. A tenant farmer may qualify for the farm deduction if. The mandatory exemptions cover farm products livestock machinery and tools.

Qualifications for agricultural tax exemptions vary from state to state too. Property Tax Classification as Farm and Agricultural Land. Paul MN 55146-3340 Revised February 2018 Minnesota Revenue Green Acres Program 1 Property Tax Fact Sheet 5 Fact Sheet 5 This fact sheet is intended to help you become more familiar with Minnesota tax.

Agriculture is exempt from these taxes. Words in blue are links to additional information and resources. Minnesota Agricultural Property Tax Law wwwrevenuestatemnus Property Tax Division Mail Station 3340 St.

Eligible farmers or corporations must be defined as an eligible farmer must own qualified agricultural property must pay eligible school taxes during the year. Conversion of agricultural lands. The Comptrollers Guidelines for Qualification of Agricultural Land in Wildlife Management Use PDF discuss the requirements that land must meet to qualify for wildlife management use to permit special agricultural appraisal as provided by Tax Code Section 23521 and are adopted by the Texas Comptroller of Public Accounts under Comptroller Rules 92001-92005.

Agricultural assessment annual reports. This guide helps farmers and those who sell goods or services to farmers understand how state taxes apply to Washingtons agricultural industry. Some states base eligibility on the size of the property while others set a minimum dollar amount for agricultural sales of.

Today the policies that govern the tax treatment of agricultural land vary from state to state. We recognize that understanding the tax issues specific to the agricultural industry and to those who sell farm and related supplies can be time-consuming and complicated and we want to get you the information you need so you can focus on growing your business. Maryland was the first state to adopt preferential tax programs for agricultural land in 1957 in response to the rapid urbanization from neighboring Washington DC with other states adopting similar programs in the decades that followed.

For specific questions about Washington excise taxes please. It is an unlimited deduction. State and local sales and use taxes on farm inputs and products such as feed seed equipment and chemicals motor vehicle sales and use taxes for vehicles specialized for agricultural production.

Proof of average gross sales. This State agency is responsible for assessing all real property throughout the State and has offices located in the. Property Tax Forms.

The average property tax paid by farmers nationally was 4902 in 2017 compared to 3752 per farm in 2012. Agriculture and open space land is appraised at a lower rate than for other types of property. We have a better property tax system because we work together.

State law has 10 mandatory property tax exemptions for items related to farming. The agricultural use assessment law and its corresponding programs are administered by the Department of Assessments and Taxation. Property tax is assessed on the value of real estate as determined by the county assessor.

The Farmers School Property Tax Credit enables farmers to receive a tax credit from the state personal income tax or the corporation franchise tax to reimburse some or all of the school district property taxes paid by the farmer.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home