Property Tax Relief Onondaga County

Register for the School Tax Relief STAR credit. Make payment online or mail to.

Exemptions From Real Property Taxation In New York State 2015 County City And Town Assessment Rolls

Exemptions From Real Property Taxation In New York State 2015 County City And Town Assessment Rolls

Municipality Enhanced exemption Basic exemption Date certified.

Property tax relief onondaga county. Commissioner of Finance PO Box 5271 Binghamton NY 13902 P. While property tax bills in the US. 1 equalization rates 2 local property assessments 3 total county tax levy and 4 sales tax credits.

The certificate is then auctioned off in Onondaga County NY. Properties in City of Syracuse. Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying senior citizens.

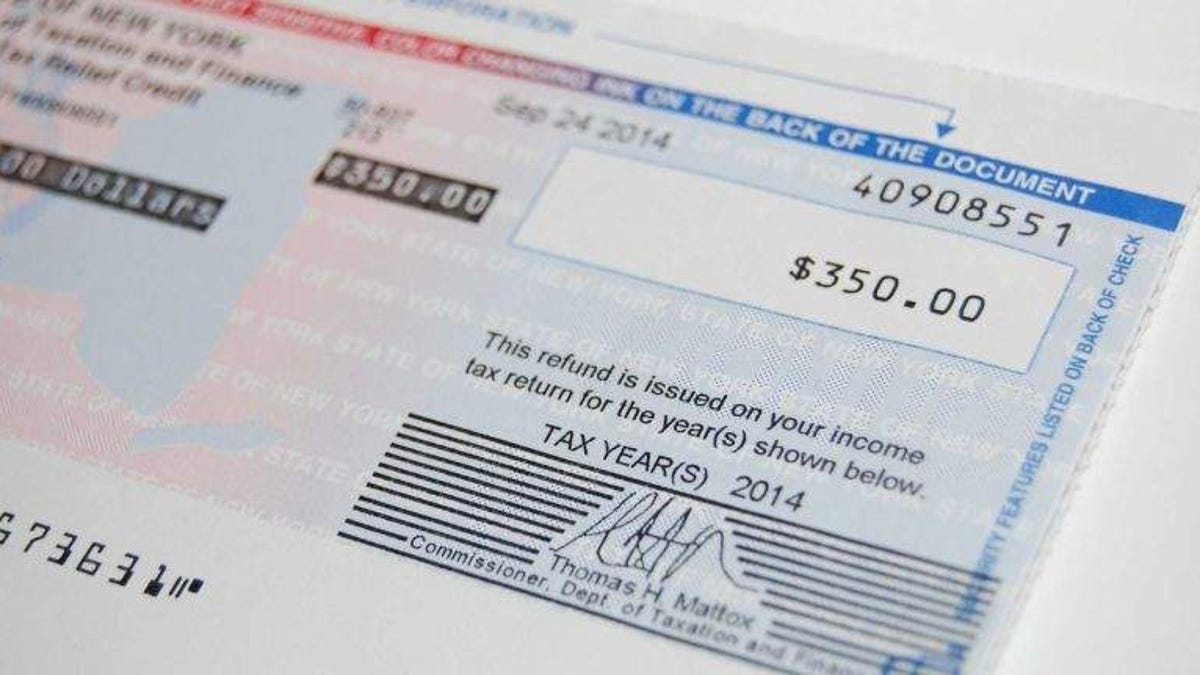

Property Tax Credit Lookup You can view and print the following information regarding your 2017 2018 2019 and 2020 property tax credit checks that have been issued. Using this measure 13 of the 16 highest taxed counties in the US. Property and tax information is available for the towns in Onondaga County.

Onondaga County this morning posted its application for landlords and tenants seeking rent relief from the coronavirus pandemic. Commissioner of Finance PO Box 5271 Binghamton NY 13902 P. The property tax relief credit was approved four years by Cuomo and the Legislature to reimburse middle-class homeowners for a portion of their school taxes based on.

This is accomplished by reducing the taxable assessment of the seniors home by as much as 50. Also New York State School Tax Relief Program provides homeowners who earn less than 500000 and own and live in their home with two types of. 21 rows Onondaga County.

Are in New York. It sometimes refers to actions that lower the tax rate that some taxpayers are obliged to pay. Commissioner of Finance PO Box 5271 Binghamton NY 13902 P.

Tax relief is a term used to describe a few different concepts in Onondaga County New York. 73 rows Town of Onondaga. Description STAR or Property Tax Relief.

WSYR-TV Onondaga County is offering help to landlords and tenants after the pandemic hit those paying rent pretty hard. If youve recently bought your home or youve never applied for the STAR benefit on your current home you may be able to save hundreds of dollars each year. The Basic STAR program exempts the first 30000 of the full value of a home from school property taxes for owner-occupied primary residences where the owners income is less than 500000.

Are on average less than 1 of home value taxpayers in Onondaga pay 25. Realtors and attorneys as your clients purchase new homes we encourage you to provide them with this printable one-page handout. Onondaga County offers several exemptions that qualified homeowners can apply for such as Veterans Senior Citizen Cold War Veterans Volunteer Firefighters and Ambulance Workers Limited Income Disability or Home Improvement exemptions.

Properties in City of Syracuse. Applications for rent relief. Make payment online or mail to.

Real Property Tax Law. There are four factors that influence the amount of county property taxes that a property owner in Onondaga County will pay. Properties in City of Syracuse.

Under the new law property tax increases will be capped at 2 percent or the rate of inflation whichever is less. When a Onondaga County NY tax lien is issued for unpaid past due balances Onondaga County NY creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. Make payment online or mail to.

Previous school tax bills are available on the Onondaga County website Homeowners who signed up for the STAR tax break to be applied as a. The county will use the online application to. More property tax topics.

The property and owner information is the most current information as provided by the Town Assessors. 5 hours agoONONDAGA COUNTY NY. Property assessment information may change during the year but does not become final for taxing purposes until the official filing of the town Final Assessment Roll on.

When the term tax relief is used in the media its typically in the context of a politician or someone running for elected office promising that theyll reduce tax rates.

Seniors In Ny Won T Have To Reapply For Local 2021 Property Tax Exemption If Towns Agree Syracuse Com

Seniors In Ny Won T Have To Reapply For Local 2021 Property Tax Exemption If Towns Agree Syracuse Com

Office Of The New York State Comptroller

Will You Get A Ny Property Tax Rebate Check This Winter Syracuse Com

Will You Get A Ny Property Tax Rebate Check This Winter Syracuse Com

How To Protest Property Tax 5 Property Tax Protest Tips For Harris County Harris County Property Tax Protest Hcad Pro Tax Protest Property Tax Tax Reduction

How To Protest Property Tax 5 Property Tax Protest Tips For Harris County Harris County Property Tax Protest Hcad Pro Tax Protest Property Tax Tax Reduction

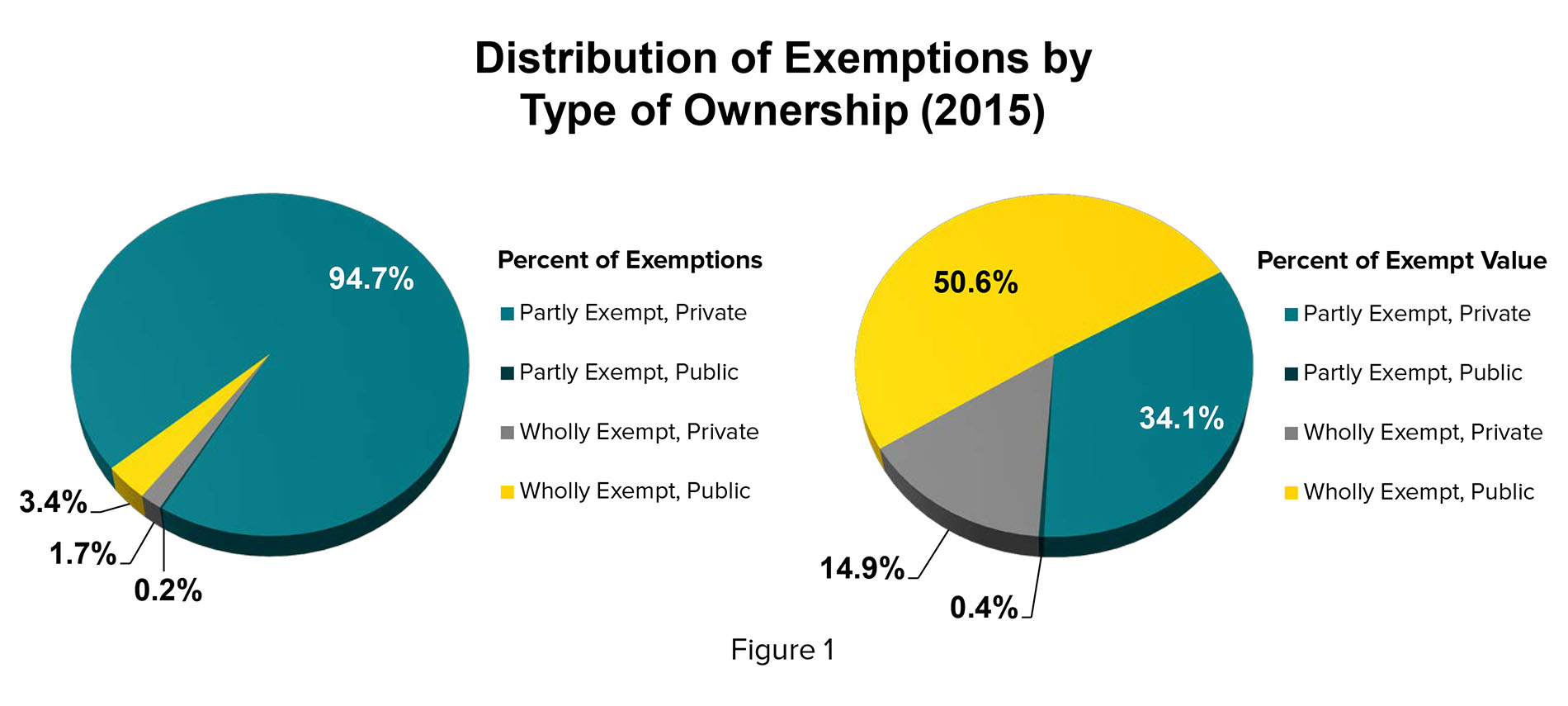

Https Www Osc State Ny Us Files Local Government Documents Pdf 2020 07 Property Tax Exemptions Pdf

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Http Www Ongov Net Legislature Documents 3 7 17sessionpacketwithadoptednos Ocr Pdf

Onondaga County Department Of Real Property Taxes

Check Your Mailbox For A Real Estate Tax Bill Department Of Revenue City Of Philadelphia

Check Your Mailbox For A Real Estate Tax Bill Department Of Revenue City Of Philadelphia

Stop Waiting For A 2nd Star Property Tax Break From Ny In 2020 The Check Isn T Coming Gar Associates Ny Real Estate Appraisal And Market Analysis Firm

Stop Waiting For A 2nd Star Property Tax Break From Ny In 2020 The Check Isn T Coming Gar Associates Ny Real Estate Appraisal And Market Analysis Firm

Coming Fall 2017 Embassy Suites By Hilton At Destiny Usa Destiny Usa Embassy Suites Building Hospitality Design

Coming Fall 2017 Embassy Suites By Hilton At Destiny Usa Destiny Usa Embassy Suites Building Hospitality Design

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Rental Property Tax Deductions Rental Property Management Real Estate Investing Rental Property Real Estate Rentals

Rental Property Tax Deductions Rental Property Management Real Estate Investing Rental Property Real Estate Rentals

The School Tax Relief Star Program Faq Ny State Senate

The School Tax Relief Star Program Faq Ny State Senate

Http Www Osc State Ny Us Files Local Government Documents Pdf 2019 02 Lysander Pdf

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

Some Syracuse Property Tax Bills Hide Good News With Mysterious Charges Syracuse Com

Onondaga County Department Of Real Property Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home