Property Tax Increase New York

Class 2 - 5293. Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year.

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

For tax years beginning on or after January 1 2021 and before January 1 2024 the top corporate income tax rate is increased from 65 to 725.

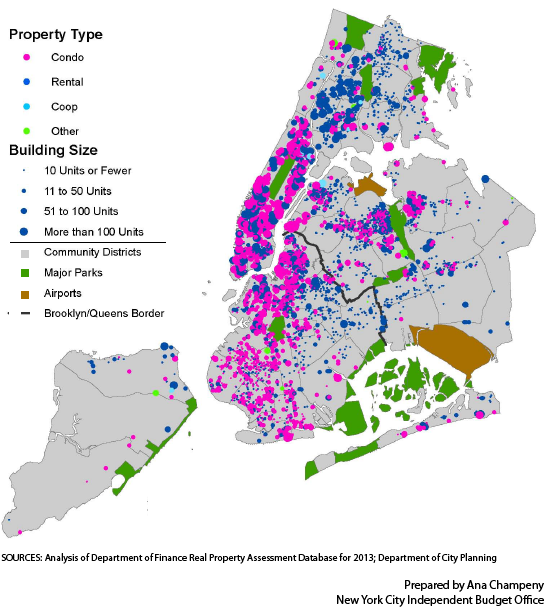

Property tax increase new york. 2021 Town and County Special District Rates print this page email this page back to top. Property tax rates imposed by school districts tend to be the highest at an average of 1764 per each 1000 in assessed value as of 2019. A New York City mayoral commission released a report last week that recommends massive changes.

From 2017 to 2019 property taxes increased. Real Property Tax Cap and Tax Cap Compliance. New York has one of the highest average property tax rates in the country with only three states levying higher property taxes.

New York Tax Increases and Changes. Two new brackets would also tax income over 5 million a year at 103 percent and income over 25 million a year at 109 percent. Real Property Tax Relief credit.

Property Records ACRIS Deed Fraud Alert. Class 4 - 4371. This new rate is applicable to income greater than 5 million.

Questions regarding tax base growth factors may be directed by email to Kristen Forte or Jason Ayotte. In Queens the rate is 088. City officials are proposing a massive overhaul of the property tax system that would result in changes for 90 of homeowners -- with some people facing significant increases while many in the.

Class 1 - 8516. Property Bills Payments. Under the proposed new tax rate the citys top earners could pay between 135 percent to 148 percent in state and city taxes when combined with New York Citys top income tax rate of 388.

New York Gov. Office of the State Comptroller. Of all the property taxes collected in New York it turned out that cities had the largest increase in recent years.

The average assessment increase was 15 then. When taking those exemptions into account effective property tax rates in New York City are around 088. Your property tax bill will equal your final assessment amount multiplied by the local property tax rate.

NYC is a trademark and service mark of the City of New York. The Veterans Exemption Property Tax Rate is the rate applied to the exempt amount to determine the tax benefit. In Manhattan New York County the rate is 095.

The assessor is not responsible for taxes - only for assessments. Property Tax Exemption Rates for Veterans for Tax Year 20172018. In Richmond County Staten Island the rate is 092.

Andrew Cuomo and state lawmakers are nearing a budget agreement that would increase corporate and income taxes by 43 billion a year and would make top earners in New York. New York States property tax cap. Owners of Brooklyn brownstones would see large property tax increases under proposed changes.

2020 Tax Rates For Monroe County Villages. The median property tax in New York is 375500 per year for a home worth the median value of 30600000. New York property tax rates are set by local governments and they therefore vary by location.

The budget would also increase taxes on corporations boosting the business income tax rate to 725 from 65 for three years through tax year 2023 for. To break it down further in Brooklyn Kings County the rate is just 066 less than half the state average. Your taxes will decrease assuming your school and municipal budgets remain stable and the tax levies do not increase Reassessments dont increase the amount of taxes that need to be collected by local governments.

Property Tax Bills. 2020-2021 School Tax Rates. 2021 Town County Tax Rates.

Data and Lot Information. Further reductions may be added if the veteran served in a combat zone or was disabled. Part III of the Revenue Act enacts a new credit for individuals with qualified adjusted gross incomes QAGI of less than 250000 if New York.

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Residents Of 421 Unfinished Housing Estates In Dublin Ireland More Commonly Known As Ghost Estates Qualified For An Ex Property Tax Water Damage Property

Residents Of 421 Unfinished Housing Estates In Dublin Ireland More Commonly Known As Ghost Estates Qualified For An Ex Property Tax Water Damage Property

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Tax Questions

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Tax Questions

Nyc Sunday Realestate Q S What Is A Flip Tax In New York City Residential Real Estate Nyc Real Estate Being A Landlord Real Estate

Nyc Sunday Realestate Q S What Is A Flip Tax In New York City Residential Real Estate Nyc Real Estate Being A Landlord Real Estate

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

The Results Are In The Mansion Tax Has New York City Real Estate Sales Plummeting

The Results Are In The Mansion Tax Has New York City Real Estate Sales Plummeting

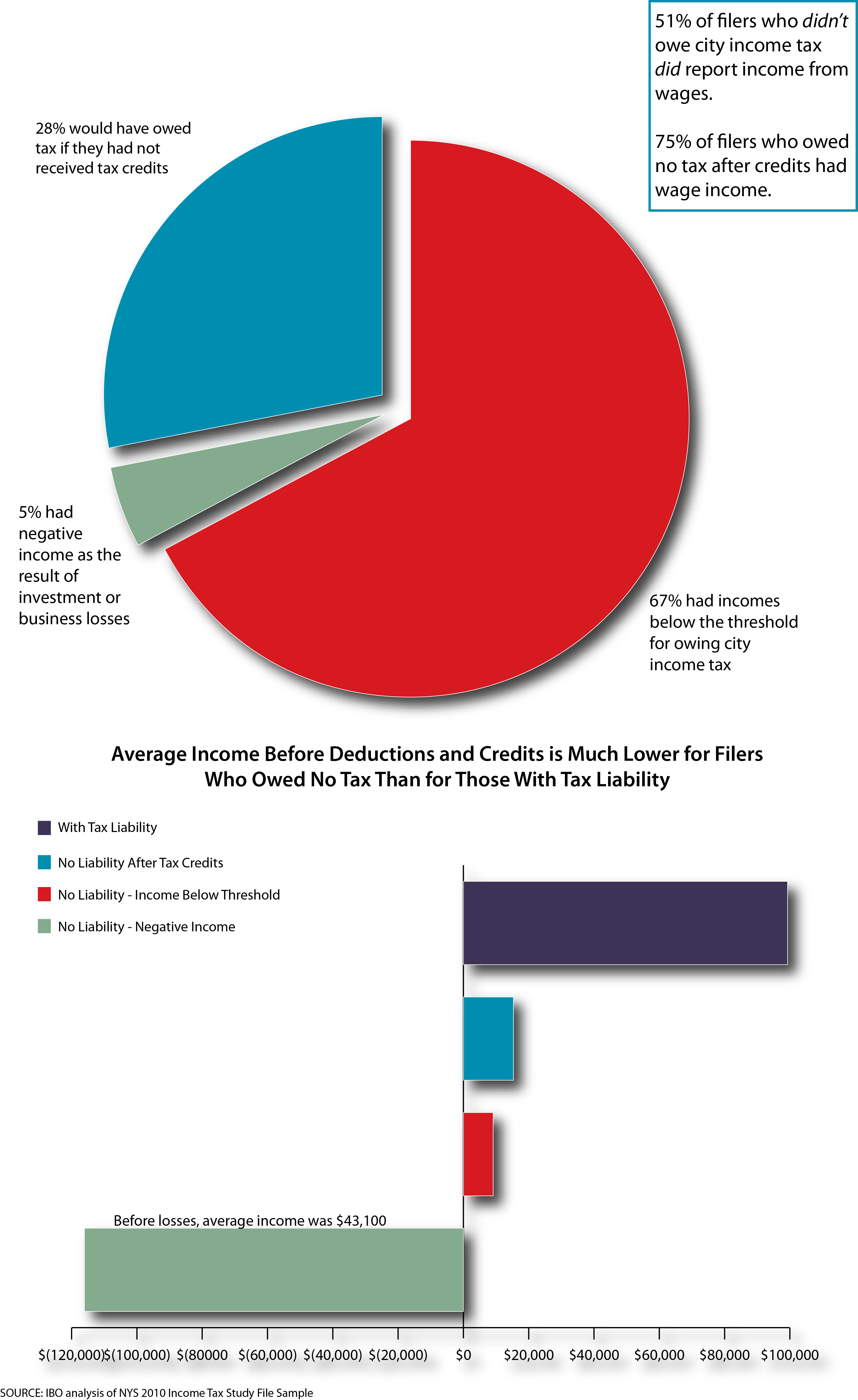

Taxes New York City By The Numbers

Taxes New York City By The Numbers

Eli Mashieh President Of City Line Properties Development Property Development Property Industry Buying Property

Eli Mashieh President Of City Line Properties Development Property Development Property Industry Buying Property

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Nyc In Foreign Flags Nyc Foreign New York City

Nyc In Foreign Flags Nyc Foreign New York City

Property Prices In Singapore Property Prices Property Singapore

Property Prices In Singapore Property Prices Property Singapore

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Taxes New York City By The Numbers

Taxes New York City By The Numbers

Resale Prices Of Condominium Units And Apartments Inched Up 0 3 Per Cent Last Month From October According To Data R Property Marketing Property Tax Singapore

Resale Prices Of Condominium Units And Apartments Inched Up 0 3 Per Cent Last Month From October According To Data R Property Marketing Property Tax Singapore

Harpta Maui Real Estate Real Estate Marketing Taxact

Harpta Maui Real Estate Real Estate Marketing Taxact

The Typical Austin Household Would Pay 173 More In City Taxes Utility Bills And Other Fees Next Year Under The 2013 14 Bu Budget Planning Budgeting City Jobs

The Typical Austin Household Would Pay 173 More In City Taxes Utility Bills And Other Fees Next Year Under The 2013 14 Bu Budget Planning Budgeting City Jobs

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Reforming The Tax Code And Protecting Homeowners Us Tax Incentive Tax Deductions

Reforming The Tax Code And Protecting Homeowners Us Tax Incentive Tax Deductions

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home