Property Rates Zero Rated Or Exempt

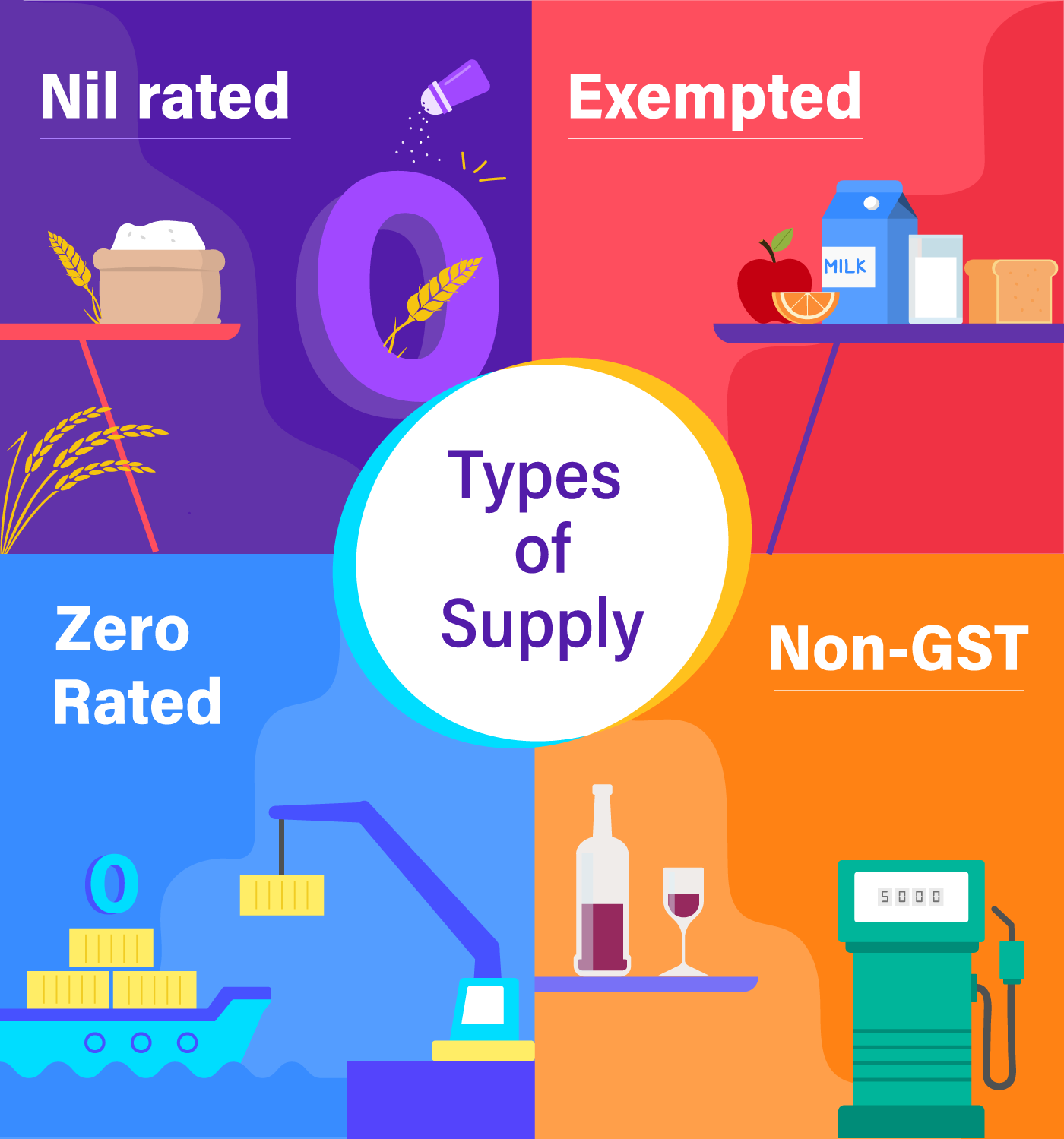

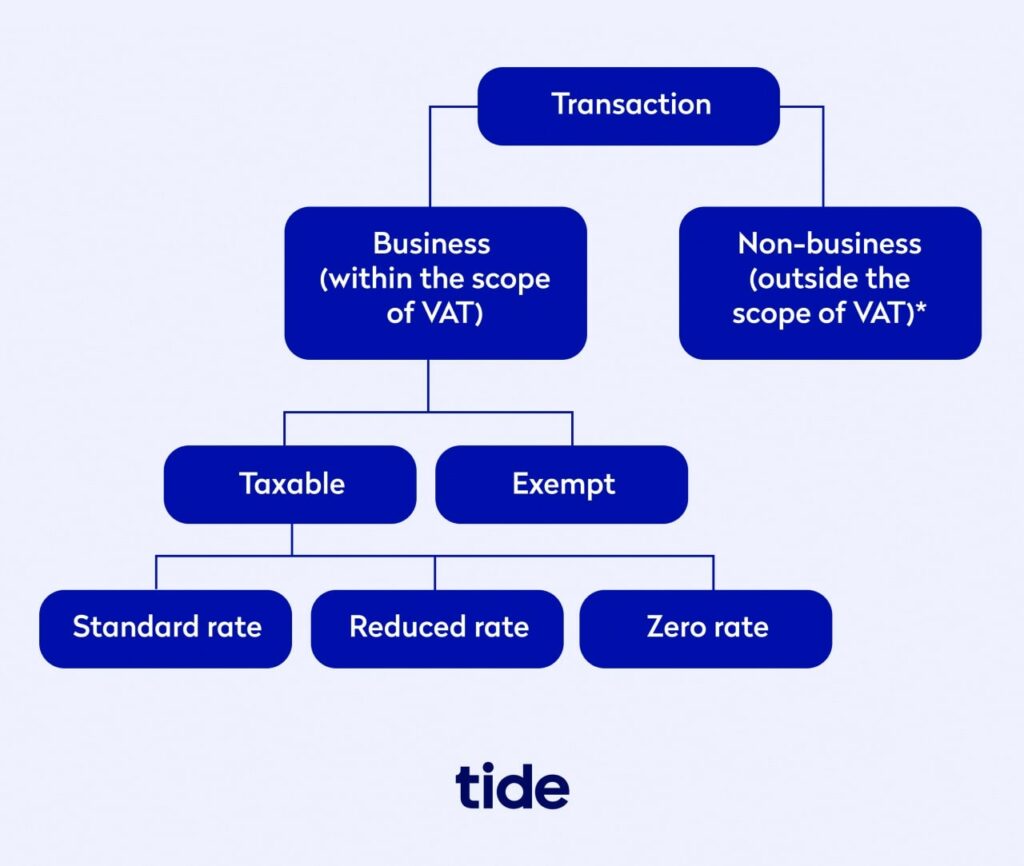

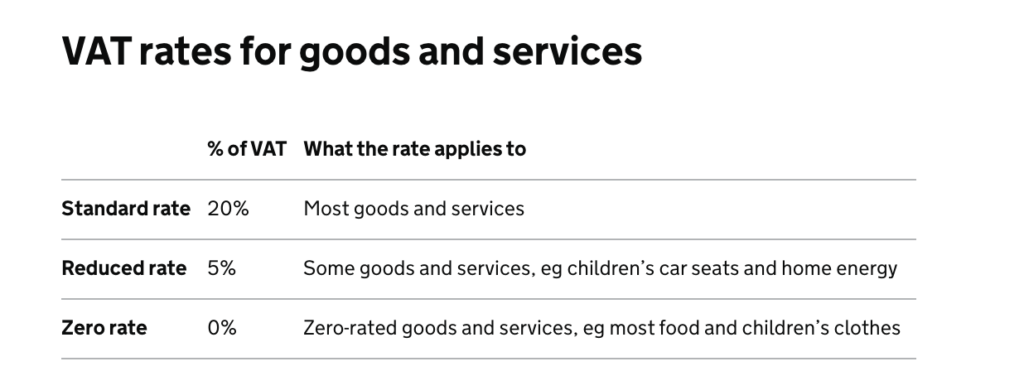

The rate of VAT to charge on Construction and Development Projects can often cause confusion as the supply may be chargeable at the standard rate 20 reduced rate 5 zero rate 0 or the supply may be exempt. Outside the scope is outside the scope.

Chapter 3 Exemptions And Zero Rating Equity Arguments Value Added Tax International Practice And Problems

Chapter 3 Exemptions And Zero Rating Equity Arguments Value Added Tax International Practice And Problems

Zero Rated vs Exempt VAT is the value added tax that is charged when selling goods and.

Property rates zero rated or exempt. The supply of goods and services are generally subject to VAT at the standard rate 20 unless such supply is specifically zero-rated or exempt in terms of the VAT Act. The first sale or long lease of a garage or other parking facility is zero-rated if the garage or parking facility is within the site of a building designed as a dwelling or number of dwellings and. Zero-rated for the purposes of section 17 are supplies of capital equipment and machinery used in the mining forestry agriculture construction and manufacturing industries.

Hi there would appreciate some feedback regarding what tax codes you would use for Council Tax rented properties and Property Rates T9 or T2 in sage. VAT On Construction And Development Projects. Zero-rated to VAT exempt examples.

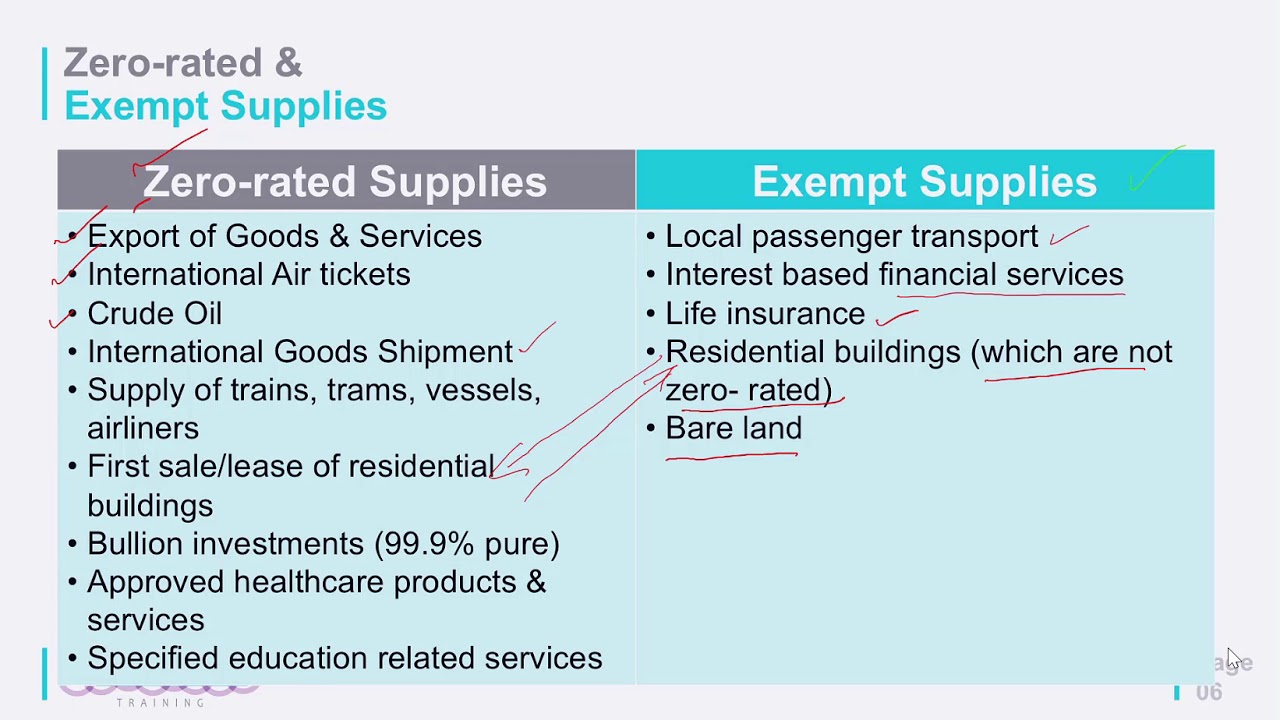

The sale is also zero-rated when only part of a taxable activity able to operate separately is sold as a going concern. For everything except zero-rated or exempt supplies you must determine which GSTHST rate to charge. A common trap that businesses fall into is where they normally make zero-rated taxable supplies but change their mind often due to economic circumstances and end up making exempt supplies and do not consider the implication on VAT recovery.

Zero-rated for the purposes of section 17 is a supply of all-terrain vehicles for use in the mining forestry agriculture and manufacturing industries and by Toshaos. Anything else is standard-rated unless its outside the scope. The majority of items in the country are subject to five percent VAT which is currently the standard rate.

To be a going concern the sale must meet the following criteria. It is true that a municipal rate as defined in section 1 1 of the Value-Added Tax Act levied on rateable property of an owner is zero rated refer to section 11 2 w. Municipalities are vendors and therefore make taxable supplies.

Hi Julie CT is a statutory charge and therefore Outside the scope of Vat so T9. What is the difference between zero rating and exempting a good in the VAT. Zero-rated items have a 0 rate applied to them.

In this category VAT is not applied at all on the goods and services soldpurchased. So if letting domestic property is your only business activity then you typically cant register for VAT. For a zero-rated good the government doesnt tax its sale but allows credits for the value-added tax paid on inputs.

The supply of the service is therefore by the municipality to the owner of the property and not to the tenant. Example Taxable supplies other than zero-rated Example Taxable supplies other than zero-rated. When charging Value Added Tax or VAT in UAE rates that are charged greatly depend on what the products or services are.

Theres also Schedule 7A that lists those things that are lower-rated. A vendor dealing with exempted VAT goods cannot claim input tax. It must be the supply of the whole or stand-alone part of a taxable activity from one registered person to another.

Zero-rated Supplies for Purposes of Section 17 The Guyana Revenue Authority hereby advises taxpayers that based on the Amendments to the Value-Added Tax Act Cap 8105 the following is the revised list of zero-rated supplies as contained in Schedule 1 to the Act. In this category the taxable goods and services are subject to a Vat rate of 0 instead of 5. However there are two other categories.

Exempt VAT. A zero-rated supply is a taxable supply on which VAT is levied at the rate of 0. Theres a different way to report exemptions if your property is in Wales.

If a good or business is exempt the government doesnt tax the sale of the good but producers cannot claim a credit for the VAT they pay on inputs to produce it. Taxable supplies other than zero-rated Most property and services supplied in or imported into Canada are subject to GSTHST. This article aims to summarise the underlying rules that determine which rate of VAT should be used.

Items given a zero-rate are considered highly necessary or critical components in a supply chain and therefore the 0 rate makes them more affordable for buyers. The zero-rated to VAT exempt trap. Schedule 9 VATA 1994 lists those things that are exempt and Schedule 8 lists those things that are zero-rated including water supplies.

No output tax will be payable to HM Revenue Customs in respect of zero-rated supplies. Thanks Julie _____ Julie. Empty properties You do not have to pay business rates on empty buildings for 3 months.

Retailers that sell zero rated goods can reclaim VAT on any purchases that are directly related to the sale of zero rates goods. Mon Jun 13 2320 2011. Now when it comes to freehold sales of new domestic property it is usually zero-rated meaning no VAT is charged but in this case the builder can recover VAT on the costs related to construction.

One the other hand retailers of exempt goods cannot claim back the VAT on the purchases related to exempt goods.

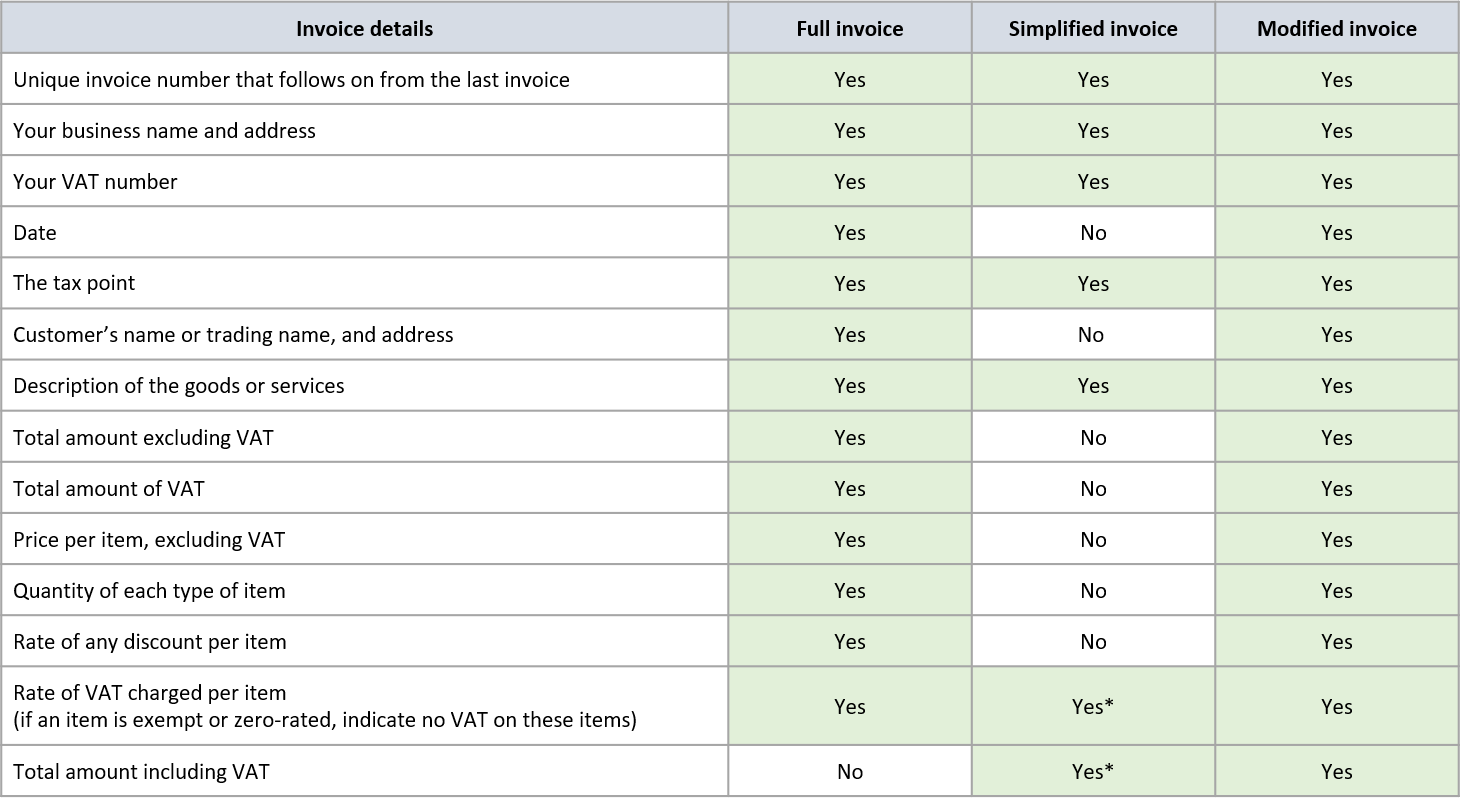

Zero Rated And Vat Exempt Products Or Services Your Invoices

Zero Rated And Vat Exempt Products Or Services Your Invoices

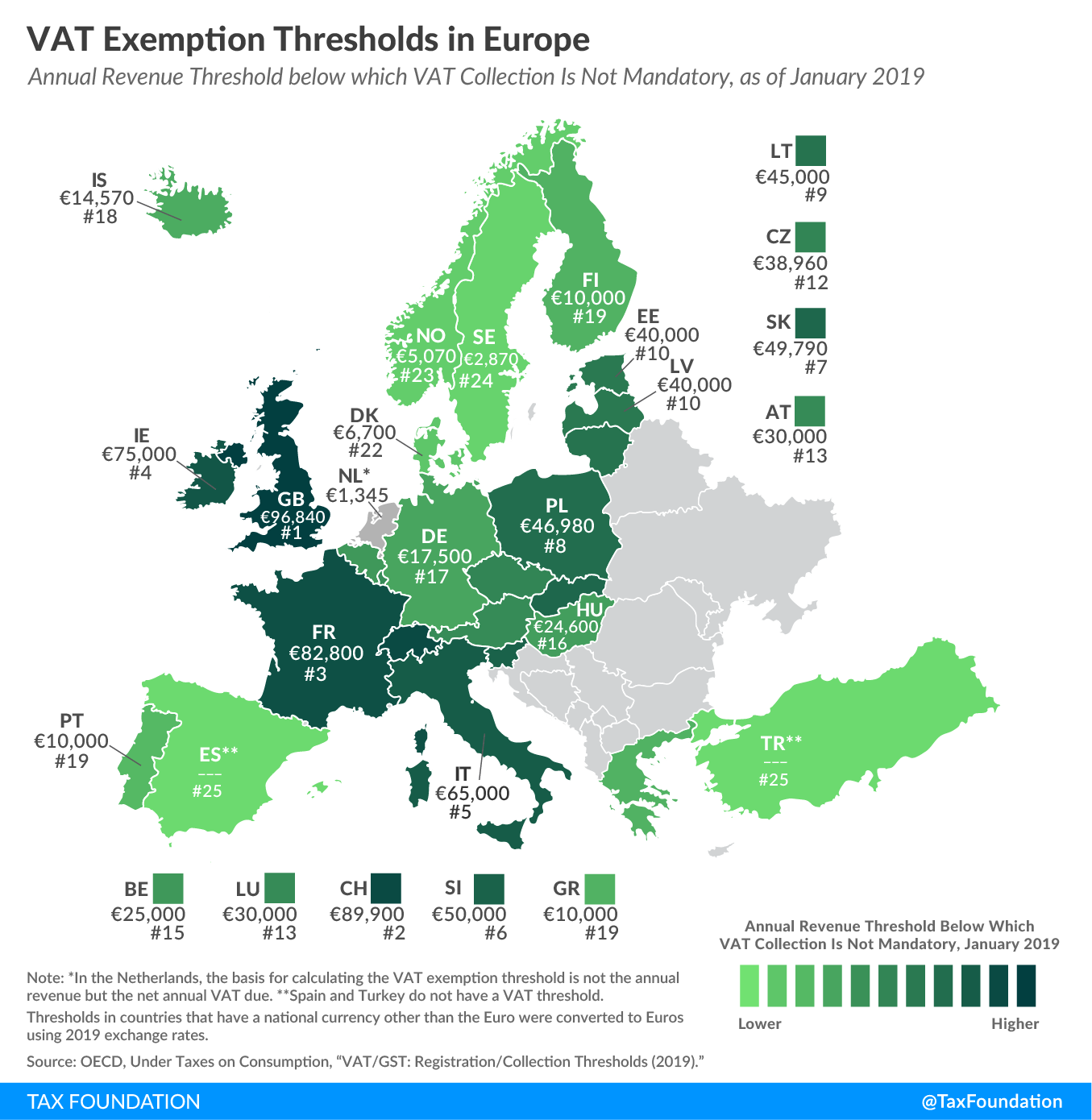

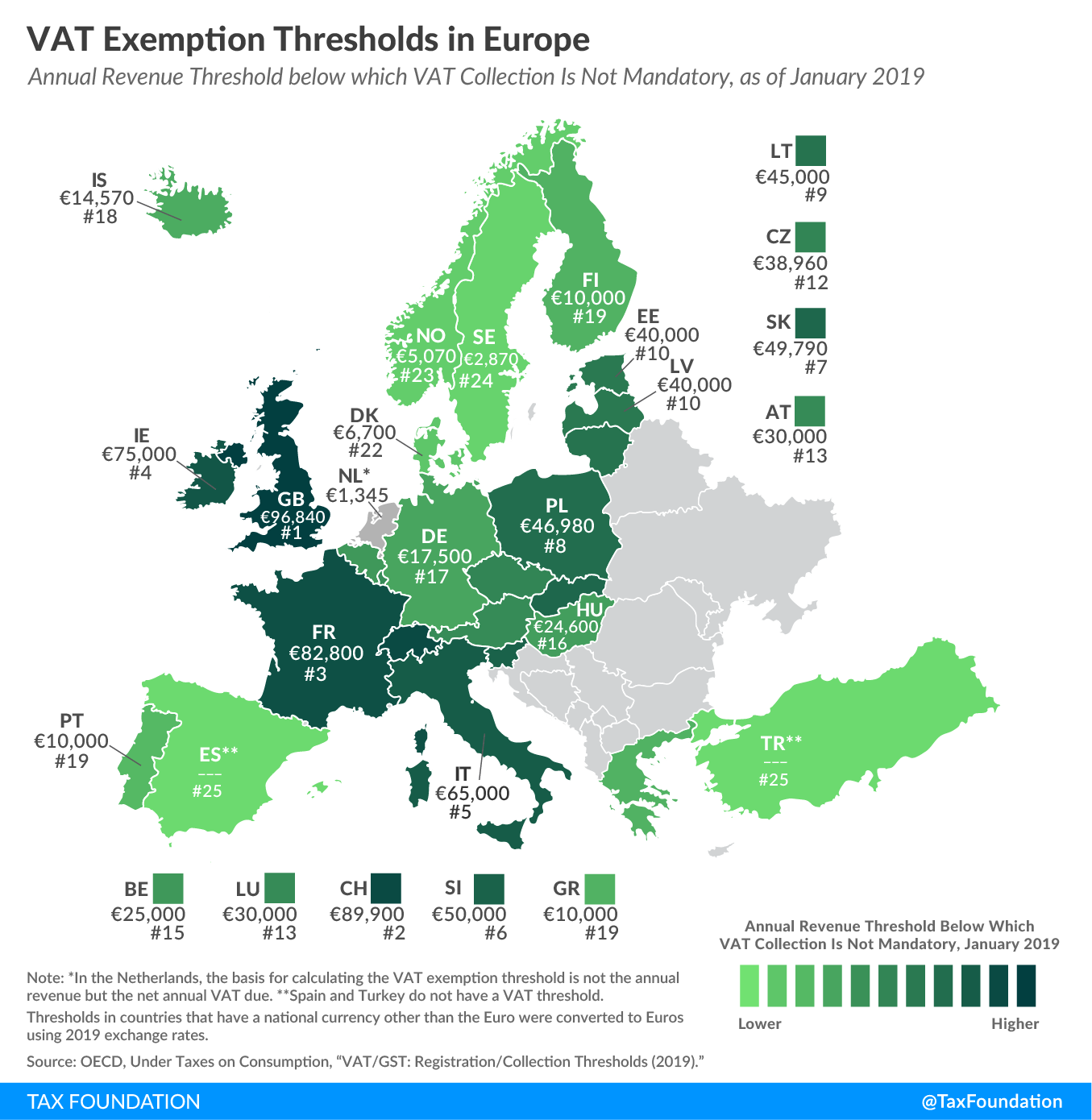

Eu Vat Thresholds Vat Exemption Thresholds In Europe

Eu Vat Thresholds Vat Exemption Thresholds In Europe

Chapter 3 Exemptions And Zero Rating Equity Arguments Value Added Tax International Practice And Problems

Chapter 3 Exemptions And Zero Rating Equity Arguments Value Added Tax International Practice And Problems

Difference Between Zero Rated And Exempt Supplies Rating Walls

Difference Between Zero Rated And Exempt Supplies Rating Walls

The Serviced Apartment Industry 4 Vat Rate Myth Apartbook

The Serviced Apartment Industry 4 Vat Rate Myth Apartbook

How The Local Government Vat Exemption Promotes Tax Increases In The Eu Epicenter

An Introduction To The Standard Vat Method Inniaccounts

An Introduction To The Standard Vat Method Inniaccounts

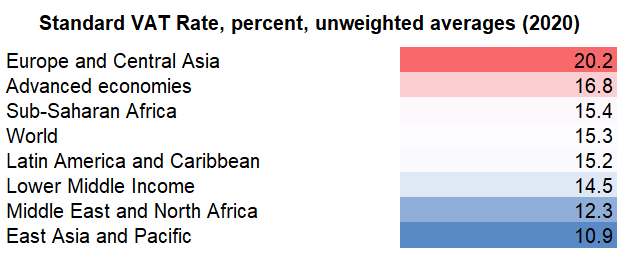

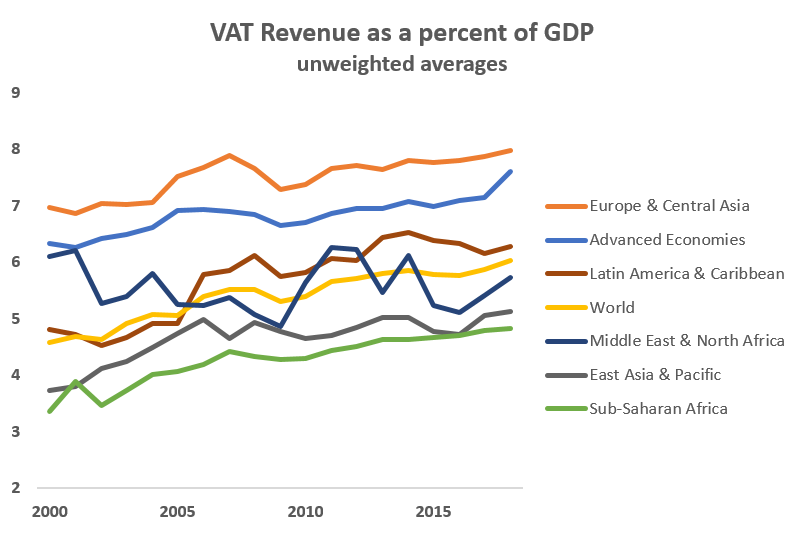

International Perspective The Vat And Housing Eye On Housing

International Perspective The Vat And Housing Eye On Housing

Vat Exemption Everything You Need To Know Tide Business

Vat Exemption Everything You Need To Know Tide Business

Vat Exemption Everything You Need To Know Tide Business

Vat Exemption Everything You Need To Know Tide Business

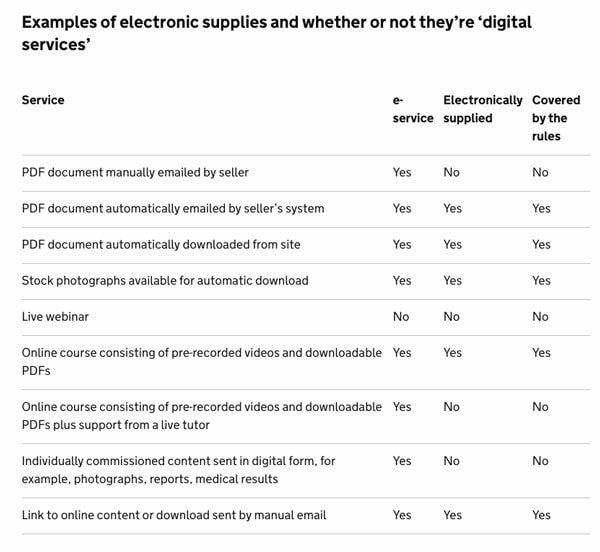

Vat For Artists Art Business Info For Artists

Vat For Artists Art Business Info For Artists

Chapter 3 Exemptions And Zero Rating Equity Arguments Value Added Tax International Practice And Problems

Chapter 3 Exemptions And Zero Rating Equity Arguments Value Added Tax International Practice And Problems

Vat For Real Estate In The Uae The Definitive Guide Practical Dhariba Com

Vat For Real Estate In The Uae The Definitive Guide Practical Dhariba Com

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

What Is Vat How Much Is It And How Much To Charge Tide Business

What Is Vat How Much Is It And How Much To Charge Tide Business

Difference Between Zero Rated Exempt Vat Supplies In Uae Youtube

Difference Between Zero Rated Exempt Vat Supplies In Uae Youtube

Difference Between Zero Rated Exempt Vat Supplies In Uae Youtube

Difference Between Zero Rated Exempt Vat Supplies In Uae Youtube

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home