New Jersey Vehicle Property Tax

See below for states that do and dont offer these services In addition CarMax offers a free tax and tag calculator for some states only. Sales Taxes that are rolled into the lease.

Wallethub Ranks Virginia S Vehicle Property Tax As 2nd Most Expensive In Us

Find out how to do stuff.

New jersey vehicle property tax. The standard measure of property value is true value or market value that is what a willing knowledgeable buyer would pay a. There also would not be a tax for the gift itself since New Jersey has no state gift tax. New Jerseys real property tax is an ad valorem tax or a tax according to value.

52 rows Supplemental Govermental Services Tax based on vehicle value. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Boat pleasure See chart below.

Nuevos Conductores de NJ. There is no property tax on cars in NJ which is surprising since we are taxed to death on just about everything else. The dealership the lessor is responsible for collecting and remitting the Sales Tax to New Jersey.

Active Military Service Property Tax Deferment Sales Tax Resident Service Members. 4400 74 courtesy 94 personalized Code 81. Tax amount varies by county.

If you are a resident service member stationed out-of-State and buy a car outside of New Jersey but wish to title the vehicle in New Jersey you may defer payment of Sales Tax until the vehicle is brought to New Jersey. Cars need to be inspected every 2 years and its free of charge if you go to a state facility youll have to pay if you get the inspection done at a service station. For vehicles that are being rented or leased see see taxation of leases and rentals.

The dealer charges 975 in transportation costs. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. A lessor pays 16500 for a new vehicle after an 800 trade-in credit on an older vehicle.

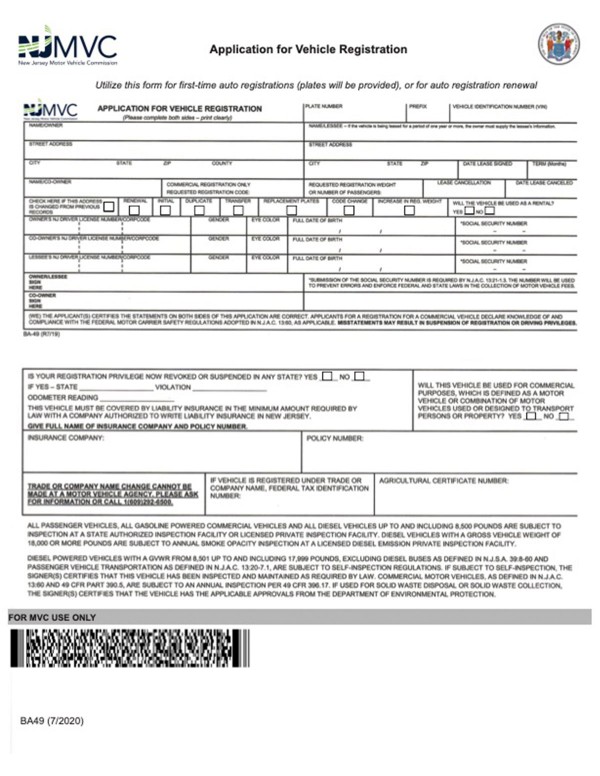

I already gave the information to the Motor Vehicle Commission. Payment for the sales tax fee. Less Fees imposed by the New Jersey Motor Vehicle Commission.

The rate in 2017 was 6875. Help Something Went Wrong. Location Closures and Updates Find out how to fix a suspension problem.

In addition to taxes car purchases in New Jersey may be subject to other fees like registration title and plate fees. Motorcycle pleasure- effective 7609 Autocycle. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

Why did I receive this notice. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. The New MVC CHEAT SHEET Find out what locations are closed.

Not ALL STATES offer a tax and tags calculator. Motorized bicycle moped 1500. 85 rows 2019 Senior Freeze Property Tax Reimbursement Deadline Extended Again View Press.

There are several vehicles exempt from sales tax in New Jersey. New Jersey collects a 7 state sales tax rate on the purchase of all vehicles. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land.

110 for a financed vehicle with two liens. The person who leases the motor vehicle from the dealership the lessee is responsible for paying Sales Tax on the transaction. Dont come in until youve checked.

If you need assistance with calculating the tax please call the New Jersey Division of. To claim your exemptions you must visit a motor vehicle agency. A motor vehicle lease is subject to Sales Tax unless a valid exemption applies.

This will qualify the vehicle as exempt from sales taxes Power said. As of January 1 2018 the rate is 6625 on the purchase price of a new or used vehicle. Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to.

Low Speed Vehicles LSVs 4650 initial 3400 two model years or older Code 53. License plates are included. Suspensions pdf Find out how to fix another kind of problem.

Weve changed the way we do business. New Jersey charges taxes and fees when you buy title and register a new or used car. If you wish to claim exemptions other than the ones listed below contact the MVC Sales Section of the New Jersey Division of Taxation at 609 984-6206.

Payment fee for registration will vary depending on the type of vehicle. The manufacturers suggested retail price. You must pay New Jersey car sales tax whether you purchase your vehicle in-state or out-of-state.

Free New Jersey Bill Of Sale Form Pdf Template Legaltemplates

Free New Jersey Bill Of Sale Form Pdf Template Legaltemplates

Dmv Fees By State Usa Manual Car Registration Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Virginia Sales Tax On Cars Everything You Need To Know

Virginia Sales Tax On Cars Everything You Need To Know

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

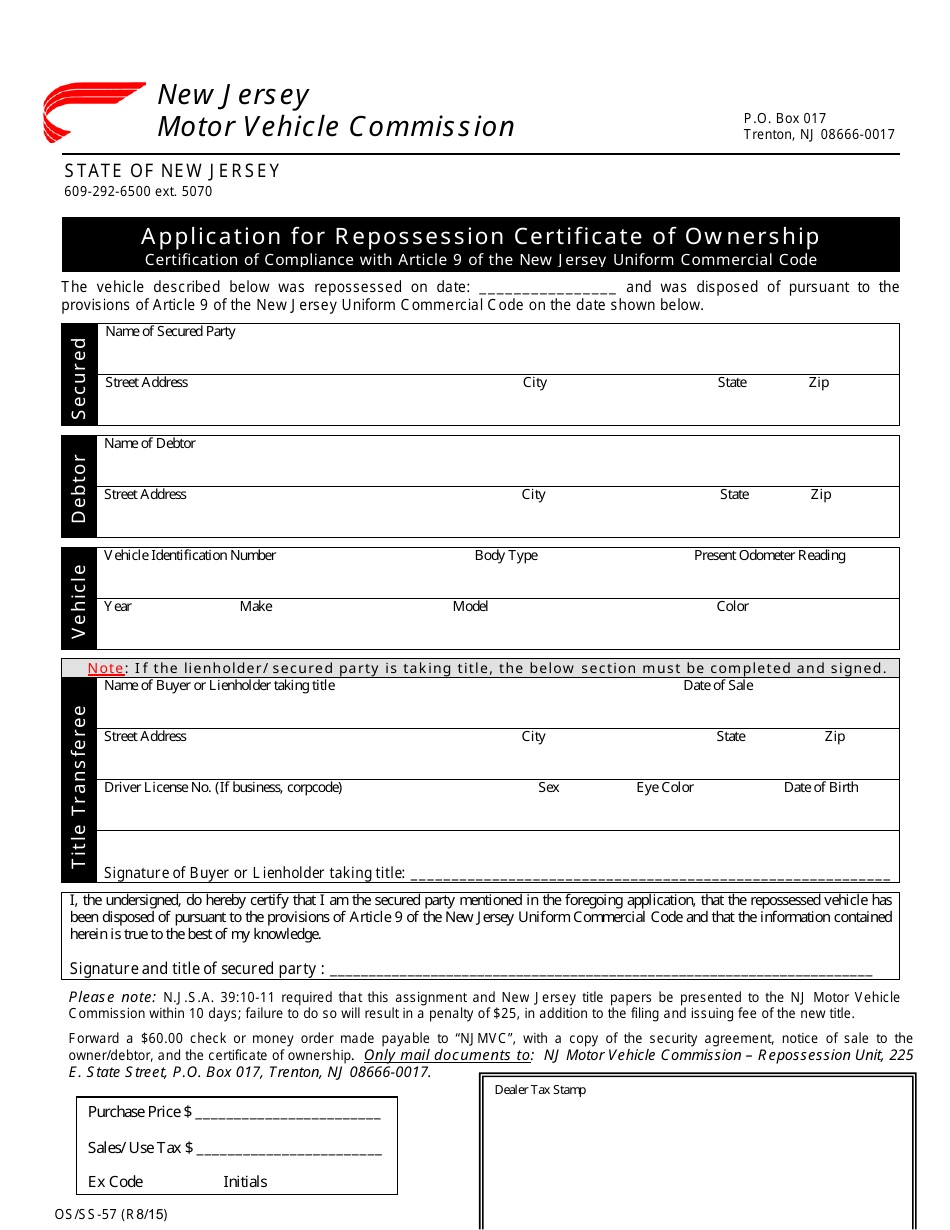

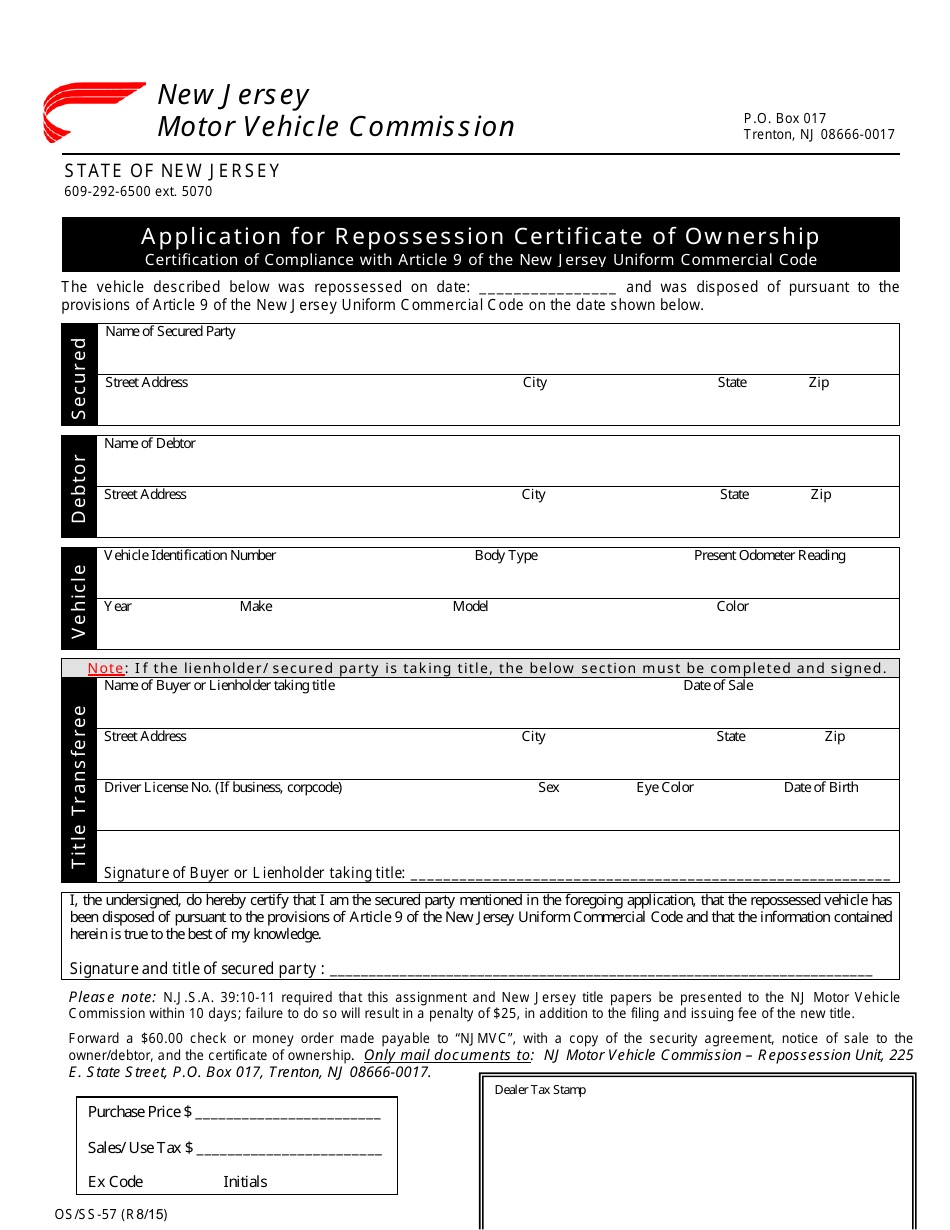

Form Os Ss 57 Download Fillable Pdf Or Fill Online Application For Repossession Certificate Of Ownership New Jersey Templateroller

Form Os Ss 57 Download Fillable Pdf Or Fill Online Application For Repossession Certificate Of Ownership New Jersey Templateroller

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

The States With The Lowest Car Tax The Motley Fool

The States With The Lowest Car Tax The Motley Fool

All About Bills Of Sale In New Jersey The Forms Facts You Need

All About Bills Of Sale In New Jersey The Forms Facts You Need

How To Transfer A Car Title In New Jersey

How To Transfer A Car Title In New Jersey

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Nj Car Sales Tax Everything You Need To Know

Nj Car Sales Tax Everything You Need To Know

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home