Oregon State Property Tax Rates By County

All personal property must be valued at 100 percent of its real market value unless otherwise exempt ORS 307020. The median property tax in Oregon is 224100 per year based on a median home value of 25740000 and a median effective property tax rate of 087You can look up.

Oregon Property Tax Important Dates Annual Calendar Ticor Northwest

Clackamas County collects the highest property tax in Oregon levying an average of 281400 085 of median home value yearly in property taxes while Gilliam County has the lowest property tax in the state collecting an average tax of 95600 096 of median home value per year.

Oregon state property tax rates by county. For a nationwide comparison of each states highest and lowest taxed counties see median property tax by state. To find detailed property tax statistics for any county in Oregon click the countys name in the data table above. The first step towards understanding Oregons tax code is knowing the basics.

Oregon is ranked number fifteen out of the fifty states in order of the average amount of property taxes collected. Effective average tax rate. The median property tax in Oregon is 224100 per year for a home worth the median value of 25740000.

Because the calculations used to determine property taxes vary widely from county to county the best way to compare property taxes on a. Property taxes rely on county assessment and taxation offices to value the property calculate and collect the tax and distribute the money to taxing districts. How does Oregon rank.

This data is based on a 5-year study of median property tax rates on owner-occupied homes in Oregon. That was the case in Oregon until 1997 when voters went to the ballot box to rein in property tax increases. The rate depends on the tax rate approved by local voters and the limits established by the Oregon Constitution.

Personal property is taxable in the county where its located as of January 1 at 1 am. Tax rates for timber harvested in 2021 Forest products harves t tax FPHT 41322 per thousand board feet MBF Small tract forestland STF severance tax. 6 days ago.

View bar chart State Summary Tax Assessors Oregon has 36 counties with median property taxes ranging from a high of 281400 in Clackamas County to a low of 95600 in Gilliam County. Linn Countys average effective property tax rate is 122. Counties in Oregon collect an average of 087 of a propertys assesed fair market value as property tax per year.

Property tax is set by and paid to the county where your property is located. At that rate taxes on a home worth 150000 would be 1830 a year. Tax amount varies by county.

Most properties are taxed by a number of districts such as a city county school district community college fire district or port. 700 per 1000 of real market value for residential homes and land giving Josephine County the lowest property tax rate in the state. Oregon Real Estate Transfer Taxes.

This western Oregon county has the second-highest average effective property tax rate in the state. To compare Columbia County with property tax rates in other states see our map of property taxes by. Each states tax code is a multifaceted system with many moving parts and Oregon is no exception.

An In-Depth Guide For. The states Measure 50 pegged tax. For more details about the property tax rates in any of Oregons counties choose the county from the interactive map or the list below.

57 people watched 467600 For example if you want to purchase a home in the popular burgeoning city of Portland Oregon which falls within the boundaries of Washington County and pay the median selling price of 467600 the total transfer tax will come to 46760. Property tax rates differ across Oregon. Below we have highlighted a number of tax rates ranks and measures detailing Oregons income tax business tax sales tax and property tax systems.

Oregon Department of Revenue Programs Individuals Personal income tax rates and tables Personal income tax rates and tables Menu Oregongov. The property tax system is one of the most important sources of revenue for more than 1200 local taxing districts in Oregon. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor.

Based on population statistics Douglas County is ninth largest county in Oregon. The average effective property tax rate in Douglas County is 084.

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

1854 Multnomah County Oregon United States Seat Portland Area 1 127 Km Multnomah Portland Oregon L26751 Multnomah County County United States

1854 Multnomah County Oregon United States Seat Portland Area 1 127 Km Multnomah Portland Oregon L26751 Multnomah County County United States

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes By State County Lowest Property Taxes In The Us Mapped

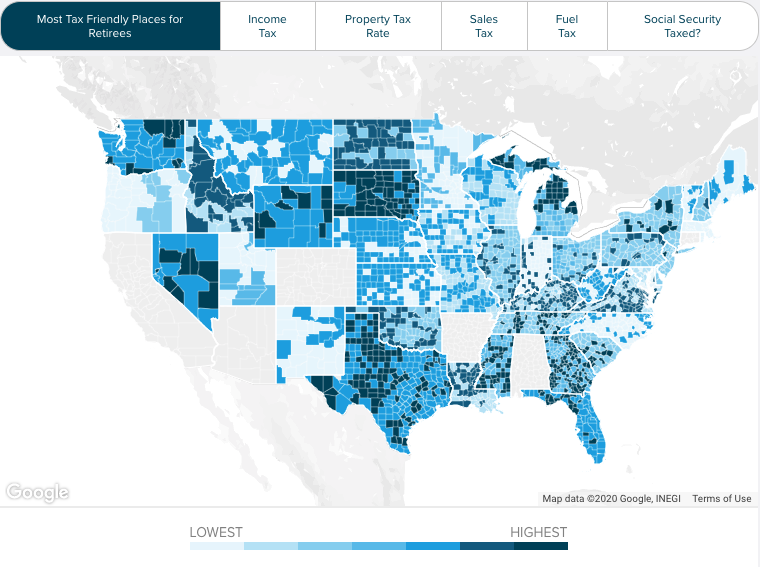

Kiplinger Tax Map Retirement Locations State Tax Map

Kiplinger Tax Map Retirement Locations State Tax Map

Understanding Your Property Tax Bill Clackamas County

Understanding Your Property Tax Bill Clackamas County

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Colorado S Low Property Taxes Colorado Fiscal Institute

Colorado S Low Property Taxes Colorado Fiscal Institute

How High Are Cell Phone Taxes In Your State Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

Oregon Revenue Online Https Oregonrevenueonline Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyrefund Irs Taxes Tax Free Tax

Oregon Revenue Online Https Oregonrevenueonline Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyrefund Irs Taxes Tax Free Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home