How Do I File For Homestead Exemption In Virginia

A Homestead Deed must be filed on or before the fifth day after the date of the meeting of creditors or the exemption will not be allowed by the Bankruptcy Court. It went into effect on January 1 2011.

Homestead Exemptions And Taxes Madison Fine Properties

Homestead Exemptions And Taxes Madison Fine Properties

If you file Chapter 7 bankruptcy and the equity in your property is over the exemption limit it can be sold by the trustee toward your standing debts.

How do i file for homestead exemption in virginia. Except in limited circumstances creditors must obtain a judgment in order to garnish wages or bank accounts or. If you are a surviving spouse of a First Responder who has been killed in the Line of Duty your principal residence may be eligible for an exemption of your real estate taxes on your home and up to one acre in Virginia. Have income which is less than 150 of federal poverty guidelines based on the number of people in the household.

Virginia has opted out of the federal exemption scheme. According to data from the Center on Budget. Exemption for Surviving Spouse of a First Responder Killed in the Line of Duty.

Homestead Exemption if the person otherwise qualifies. Only one exemption can be granted for each owner-occupied residence. A person who is.

As such protection for both real and personal property in. The Virginia Homestead Exemption allows debtors to protect certain property from the debt collection process. There is no exemption solely because you are having difficulty paying your debts.

Not only does it protect the equity in your home but it can also protect personal property including your wages savings and other money that might be vulnerable to being garnished by a judgment creditor. See Table 1 below. Virginia homestead laws allow residents to designate up to 5000 worth of real estate including mobile homes as a homestead plus 500 for each dependent.

Pursuant to subdivision a of Section 6-A of. You can file a claim of exemption in state court without filing bankruptcy. Currently the Homestead Exemption under section 34-4 of the Code of Virginia permits an individual a householder to exempt from creditor process real and personal property up to 5000 in value or 10000 in value if the householder is 65 years of age or older plus an additional exemption of 50000 for each dependent a dependent is an individual who derives support from the householder and does.

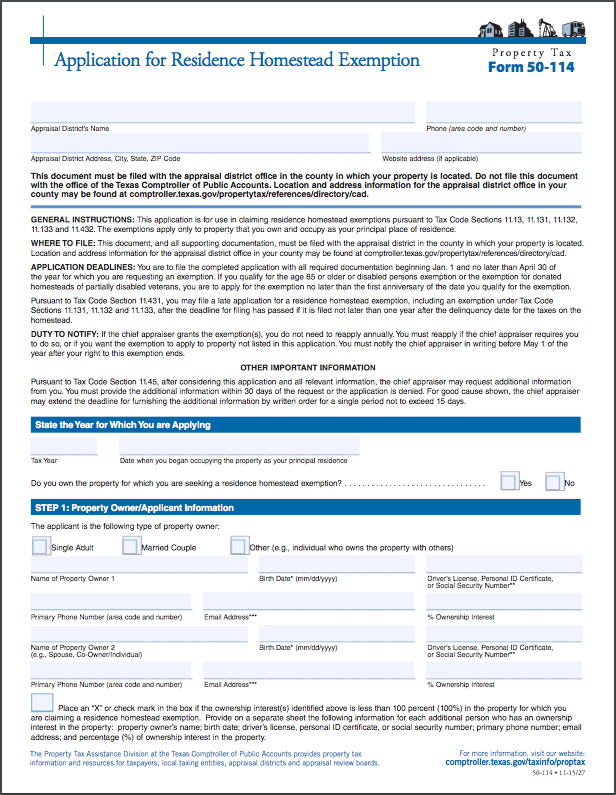

Property tax exemption for certain veterans. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the property is located Tax Code Sections 1113 11131 11132 11133 11134 and 11432. Real Property Tax Exemptions for Veterans On November 2 2010 by the citizens of the Commonwealth of Virginia ratified a proposed amendment adding Section 6-A to the Constitution of Virginia.

Real property means real estate. The first situation is in the filing of a Chapter 7 bankruptcy. Virginia Homestead Exemption can be combined with the current 500000 wildcard to possibly allow up to 3000000 in protection for equity in homes.

In Virginia you must file a homestead declaration a form filed with the county recorders office to put on record your right to a homestead exemption before you file for bankruptcy to claim the homestead exemption. Elderly homeowners may apply for this exemption annually at the office of their county assessor from July 1 through October 1 provided that the applicant will be at least sixty-five years old by June 30 of the following year. Accordingly you will be allowed to claim only your own personal exemption on your separate Virginia return.

It allows the debtor to select any property whether real or personal to protect. If you claim an exemption you should i fill out the claim for exemption form and ii deliver or mail the form to the clerks office of this court. Participate in the Homestead Exemption program contact your county assessors office for more information Have paid their property tax and.

You have a right to a hearing within seven business days from the date you file your claim with the court. Contact your county or city recorder for information about filing a homestead declaration. Normally such an instrument is filed when an individual is going into bankruptcy or is anticipating a judgment against himher.

Homestead Exemption A Background. The current Virginia homestead exemption is the same across the state. Homestead exemptions dont exist in every US.

A Homestead Deed prevents creditors from attachinglevying ones personal property and equity in real estate. However Virginia requires residents seeking homestead exemptions to use Virginias specific state exemption laws. How the Virginia Homestead Exemption Works.

To use the Virginia Homestead Exemption your Homestead Deed must be filed before the deadlines. There are two primary circumstances where a Virginia Homestead Deed many be needed. If a resident is sixty-five years of age or older or a married couples files for an exemption together up to 10000 may be exempted under the homestead.

The Virginia Homestead Exemption is a powerful tool for getting your money back from a wage garnishment and a bank account garnishment. Find out what the deadlines are and other important informati. Part-Year Form 760-PY Filers If you use Filing Status 4 on your Virginia return each spouse must claim his or her own personal exemptions under the column showing their income.

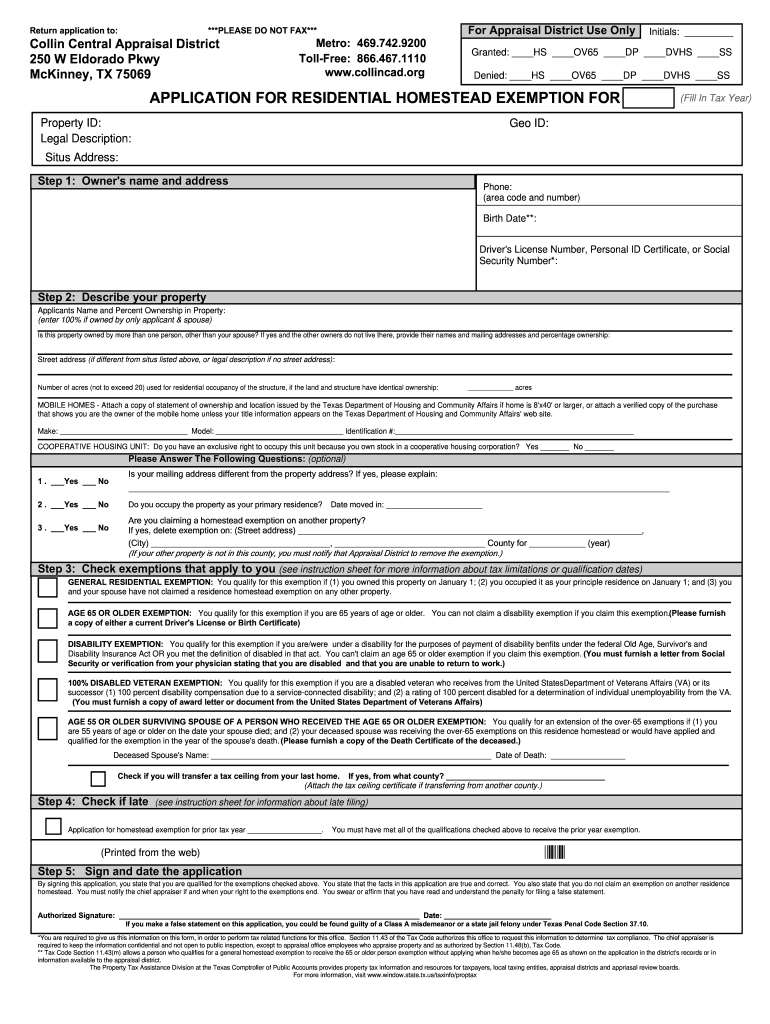

Collin County Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Collin County Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Virginia Homestead Exemption Application Fill Online Printable Fillable Blank Pdffiller

Virginia Homestead Exemption Application Fill Online Printable Fillable Blank Pdffiller

What Is The Virginia Homestead Exemption Fisher Sandler Llc

What Is The Virginia Homestead Exemption Fisher Sandler Llc

Homestead Exemption Form Fort Bend County By Remax Integrity Issuu

Homestead Exemption Form Fort Bend County By Remax Integrity Issuu

Homestead Exemption Disabled Veterans Gudorf Law Group

Homestead Exemption Disabled Veterans Gudorf Law Group

What Is The Virginia Homestead Exemption Fisher Sandler Llc

What Is The Virginia Homestead Exemption Fisher Sandler Llc

Homestead Exemptions What You Need To Know Rachael V Peterson Your Realtor For Life

Texas Homestead Tax Disabled Veteran Home Exemption Information

Texas Homestead Tax Disabled Veteran Home Exemption Information

Why Is Closing By December 31 So Important For The Florida Homestead Exemption Usda Loan Pro

Why Is Closing By December 31 So Important For The Florida Homestead Exemption Usda Loan Pro

Increased Homestead Exemption In Virginia

Increased Homestead Exemption In Virginia

Virginia Homestead Exemption Too Low To Protect This Widow Northern Va Bankruptcy Lawyer Robert Weed

Virginia Homestead Exemption Too Low To Protect This Widow Northern Va Bankruptcy Lawyer Robert Weed

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

How To File For Florida Homestead Exemption Florida Agency Network

How To File For Florida Homestead Exemption Florida Agency Network

Homestead Exemption Reminder Usa Mortgage Pros

Homestead Exemption Reminder Usa Mortgage Pros

Florida Homestead Exemption Chrisluis Com

Florida Homestead Exemption Chrisluis Com

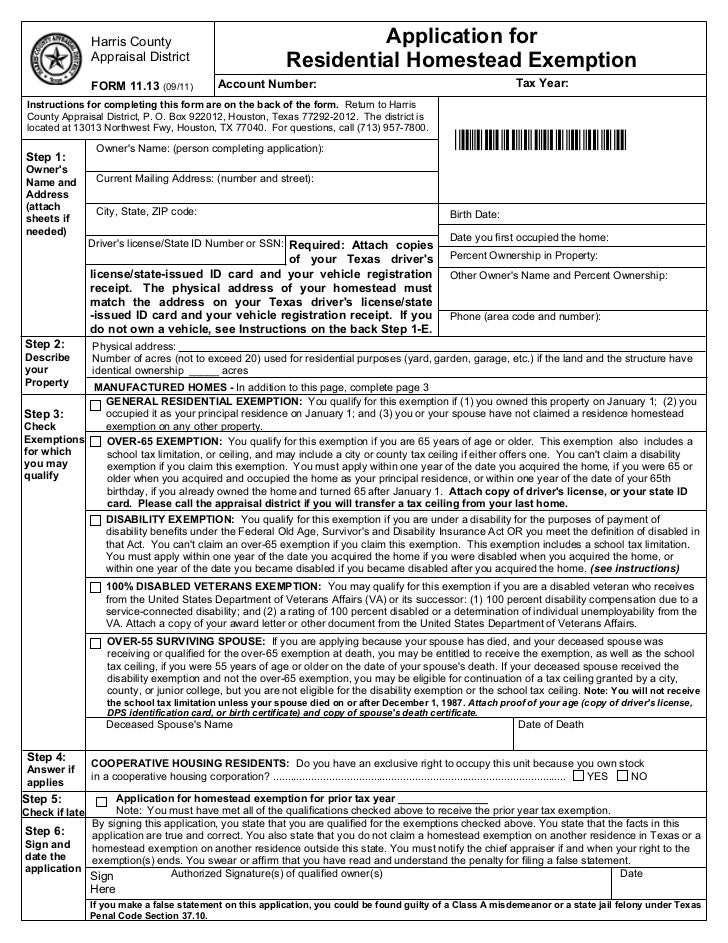

Harris Co Tx Homestead Exemption

Harris Co Tx Homestead Exemption

Florida Homestead Exemption Why You Need An Attorney Realty Times

Florida Homestead Exemption Why You Need An Attorney Realty Times

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home