Do Nonprofits Pay Sales Tax In Washington State

Not all 501 c 3 entities are automatically exempt from sales and use tax. In most states 501 c 3 entities must pay sales tax on their purchases and charge sales tax on the items they sell.

Https Www Sos Wa Gov Assets Charities Dor 20nonprofit 20june 202015 Pdf

Nonprofits are also exempt from paying sales tax and property tax.

Do nonprofits pay sales tax in washington state. Sales tax amounts collected are considered trust funds and must be remitted to the Department of Revenue. RCW 82044289 - Exemption -- Compensation for patient services or attendant sales of drugs dispensed pursuant to prescription by certain nonprofit organizations. They must pay sales tax on all goods and retail services they purchase as consumers such as supplies lodging equipment and construction services.

Generally nonprofit organizations must pay retail sales tax on all purchases of tangible personal property and must collect retail sales tax on their sales of such items. You still file a tax return. For additional information on the taxability of sales by agents auctioneers and other similar types of sellers see WAC 458-20-159.

The listing also includes some examples and links to additional resources. Non profit organizations in Washington State that have retail sales will be responsible for paying the BO taxes even though they may be exempt from federal taxes. RCW 820802573 - Exemptions -- Sales by a nonprofit organization for fund-raising activities.

Nonprofit organizations must pay sales tax to the seller at the time of purchase. Retail services are services subject to sales tax. When your non-profit organization sells an item to someone it may have to collect sales tax depending on the same laws and considerations.

RCW 8204635 - Exemptions -- Nonprofits providing legal services to low-income persons. Retail sales tax includes the state and local components of the tax. Again there are only a few exceptions to this collection requirement the most significant being fund-raising sales4.

In addition nonprofit organizations must collect sales tax on goods and services sold by the organization if the goods or services are otherwise subject to the sales tax. Nonprofit organization is exempt from use tax. In states such as Washington State nonprofits are required to collect and remit retail sales tax on their sales of goods and services.

Tax exemptions are available for qualified nonprofits but the exemption must be applied for and approved by the Washington state Department of Revenue. Construction services WAC 458-20-170 Constructing and improving new. Nonprofits Pay State and Local Taxes in Washington Unlike the Federal Government Washington State has no general tax exemption for nonprofits Potentially applicable taxes.

Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. Just dont pay tax on that particular activity. While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes.

The state use tax is complementary to and mutually exclusive of the state sales tax. The seller is liable to the Department of Revenue for sales tax whether or not it is collected. Generally nonprofit organizations are required to pay the sales or use tax on items of tangible personal property they purchase for their own use and on any construction performed for their organization.

They will be responsible to collect sales tax on retail sales and pay sales tax on the purchase of goods. No general exemption for nonprofit and religious organizations. Washington Business and Occupation BO tax City BO taxes Retail sales use taxes Real and personal property taxes State income franchise taxes other states.

If a nonprofit organization conducts taxable business activities in Washington it must register to do business within the state by. Below is a listing of service categories that are subject to sales tax when provided to consumers. Generally nonprofit organizations are taxed like any other consumer or business on their purchases or rentals of consumable supplies furniture equipment and retail services.

Washington State law does not give nonprofit organizations a blanket sales tax or use tax exemption. However some states allow certain types of nonprofit organizations a. The Washington State Department of Revenue responds in the following FAQ.

In addition nonprofit organizations must collect and remit retail sales tax on their sales of goods and retail services. Currently Washington does not grant nonprofits exemption from state sales tax. In others like Michigan exemptions offered to nonprofits for purchases of tangible personal property were expanded in 2013.

When your organization makes a purchase from a vendor it may or may not have to pay sales tax to that vendor depending on the laws in your state as well as the other considerations mentioned. Use tax is paid by the consumer when the retail sales tax was not. A nonprofit must pay business and occupation tax on its gross revenues as well as pay sales tax on services and goods it purchases from retailers.

The nonprofit organization is generally responsible for collecting and remitting retail sales tax on the gross proceeds of sales when selling items for another person.

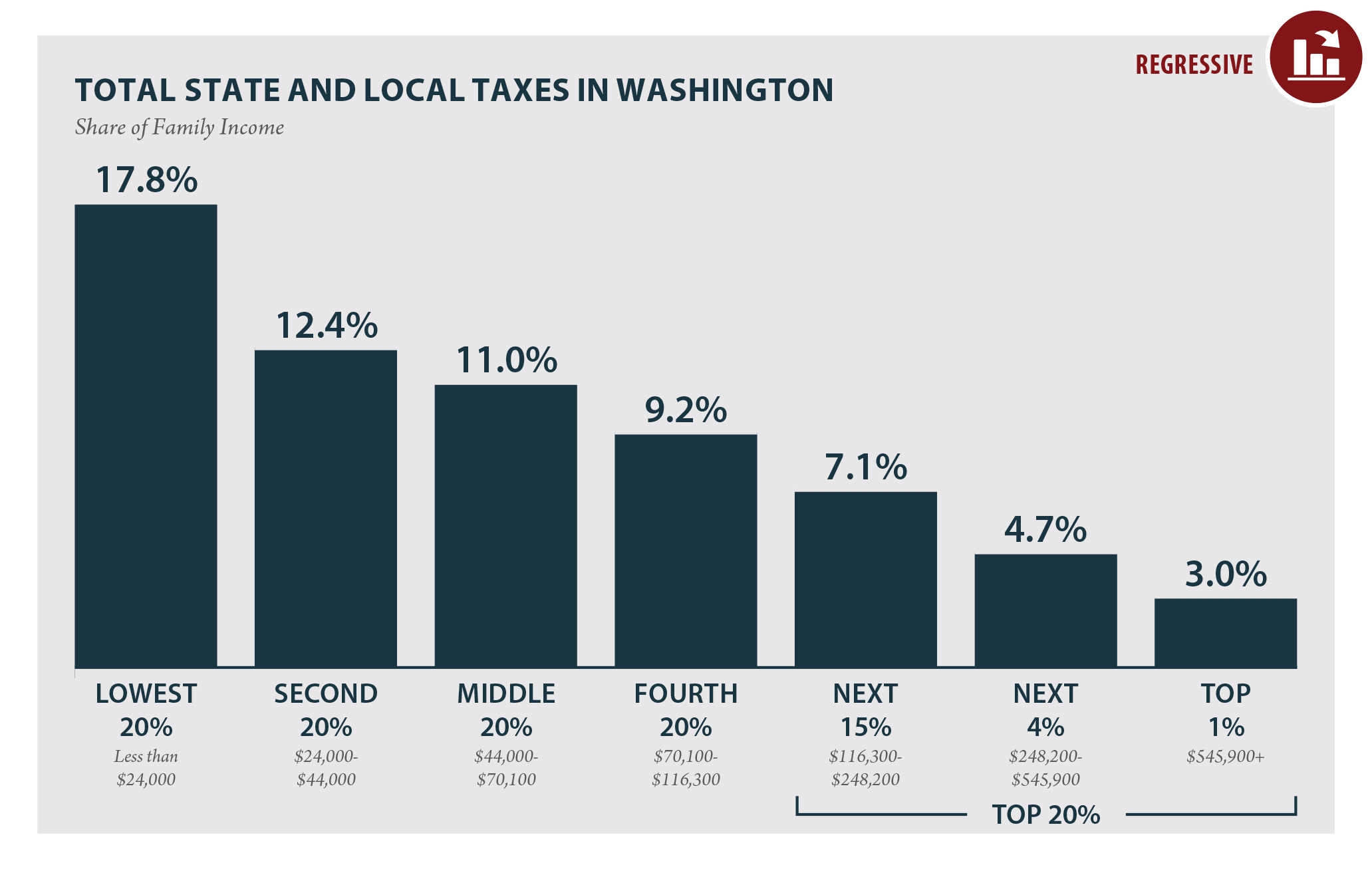

Kuow How Bad Are Washington State Taxes The Worst In The Country Apparently

Kuow How Bad Are Washington State Taxes The Worst In The Country Apparently

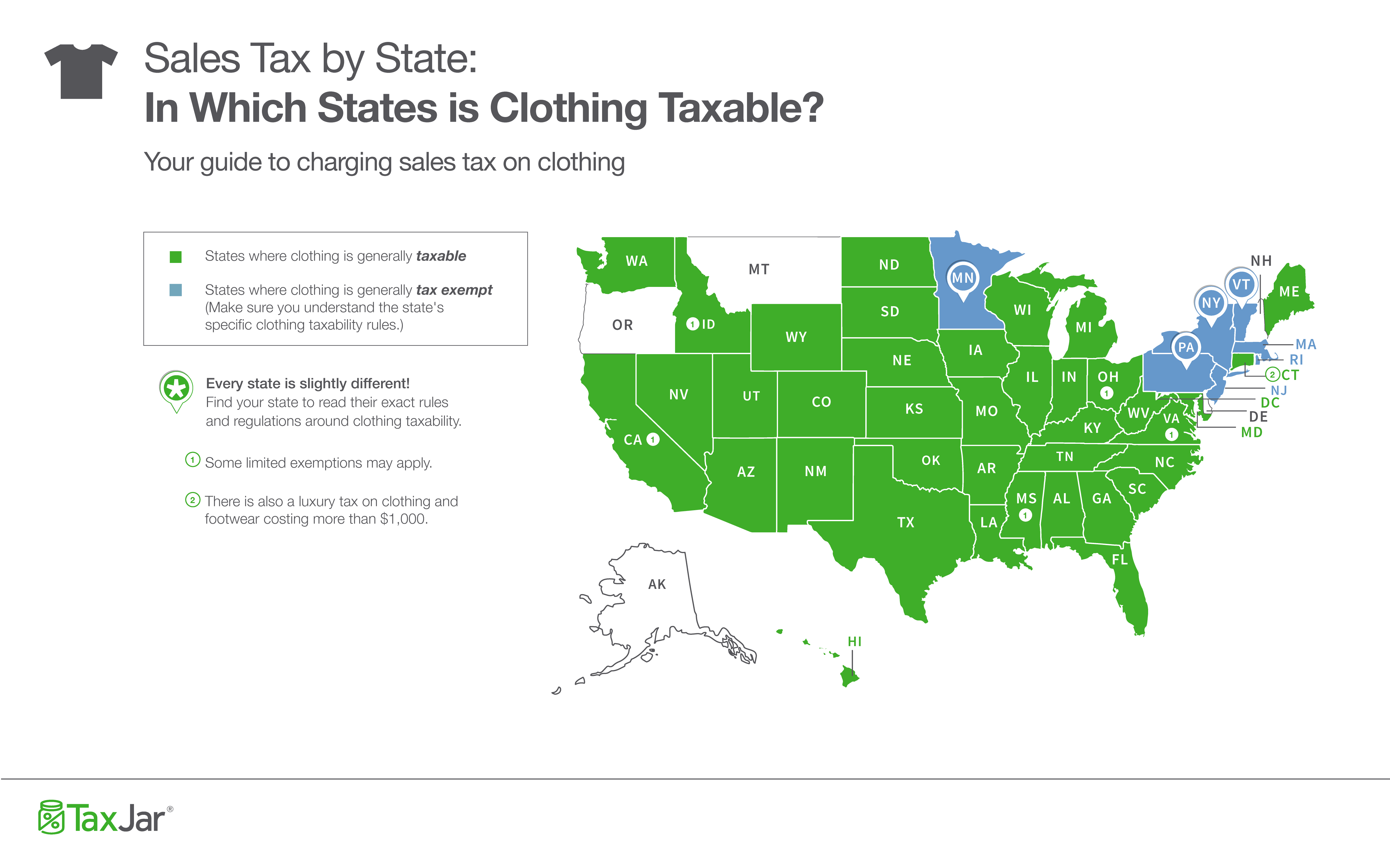

Which States Require Sales Tax On Clothing Taxjar Blog

Which States Require Sales Tax On Clothing Taxjar Blog

How High Are Cell Phone Taxes In Your State Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

Washington State Benefits Of Limited Liability Corporations Legalzoom Com

Washington State Benefits Of Limited Liability Corporations Legalzoom Com

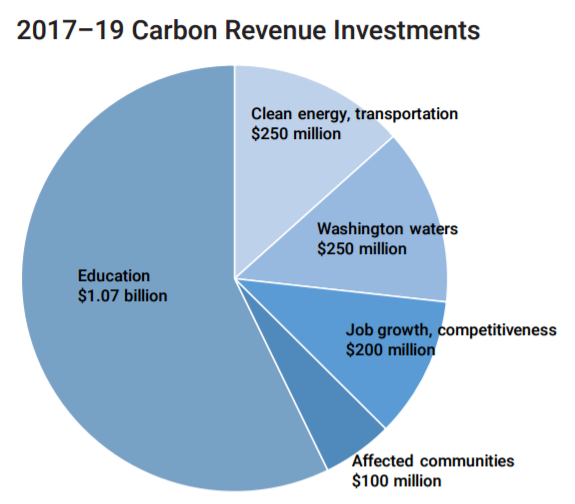

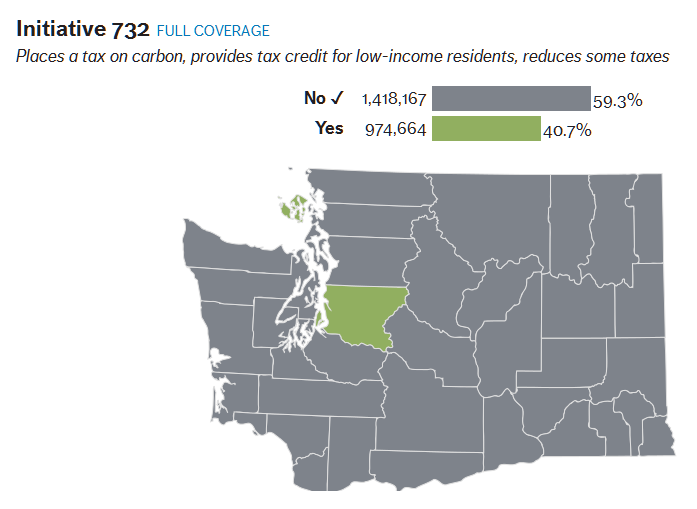

Washington S 2016 Carbon Tax Defeat

Washington S 2016 Carbon Tax Defeat

Map How Much 100 Is Really Worth In Every State Map States Cost Of Living

Map How Much 100 Is Really Worth In Every State Map States Cost Of Living

Washington S 2016 Carbon Tax Defeat

Washington S 2016 Carbon Tax Defeat

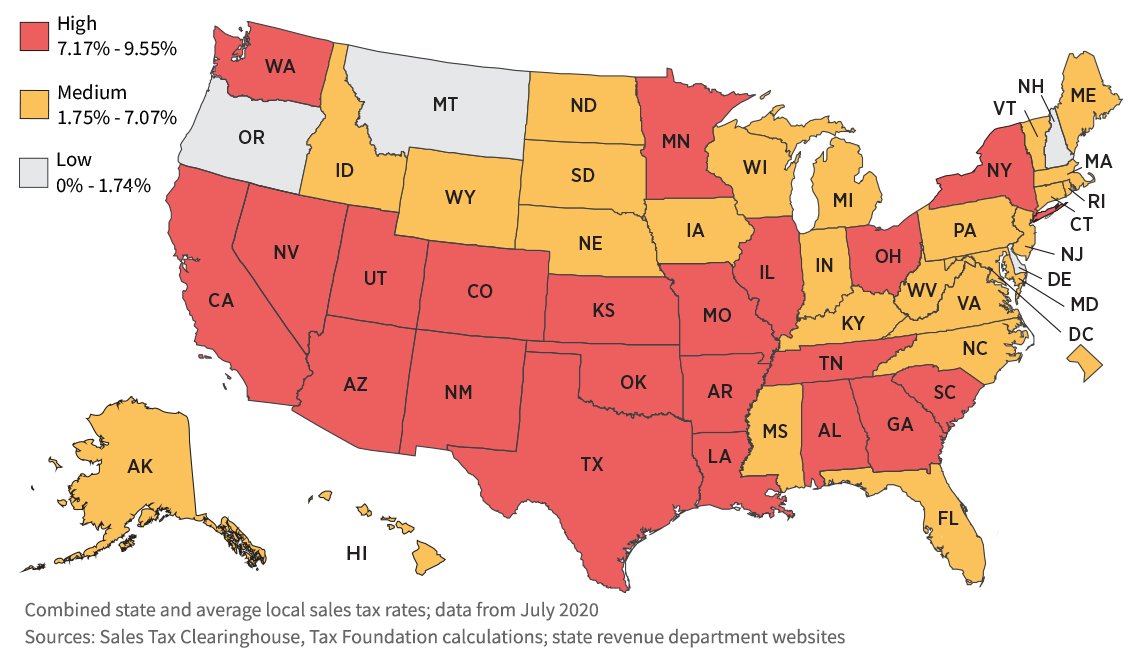

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

The Ins And Outs Of Reseller Permits In Washington State The Seattle Small Business Lawyer S Blog Small Business Lawyer Business Lawyer Small Business

The Ins And Outs Of Reseller Permits In Washington State The Seattle Small Business Lawyer S Blog Small Business Lawyer Business Lawyer Small Business

Minnesota Do Your Own Nonprofit The Only Gps You Need For 501c3 Tax Exempt Approval 23 By Kitty Bickford Chalfant Eckert Publishing Llc Non Profit Business Books Book Format

Minnesota Do Your Own Nonprofit The Only Gps You Need For 501c3 Tax Exempt Approval 23 By Kitty Bickford Chalfant Eckert Publishing Llc Non Profit Business Books Book Format

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Map 30 Year Mortgage Northern California

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Map 30 Year Mortgage Northern California

Referendum Proof Seattle Tax For Coronavirus Relief Housing Would Impact Multiple Business Sectors The Seattle Times

Referendum Proof Seattle Tax For Coronavirus Relief Housing Would Impact Multiple Business Sectors The Seattle Times

Democrats Include Capital Gains Tax In State Budget Proposals South Seattle Emerald

Democrats Include Capital Gains Tax In State Budget Proposals South Seattle Emerald

How Washington Rideshare And Delivery Drivers File State Taxes Rideshare Dashboard

Kuow How Bad Are Washington State Taxes The Worst In The Country Apparently

Kuow How Bad Are Washington State Taxes The Worst In The Country Apparently

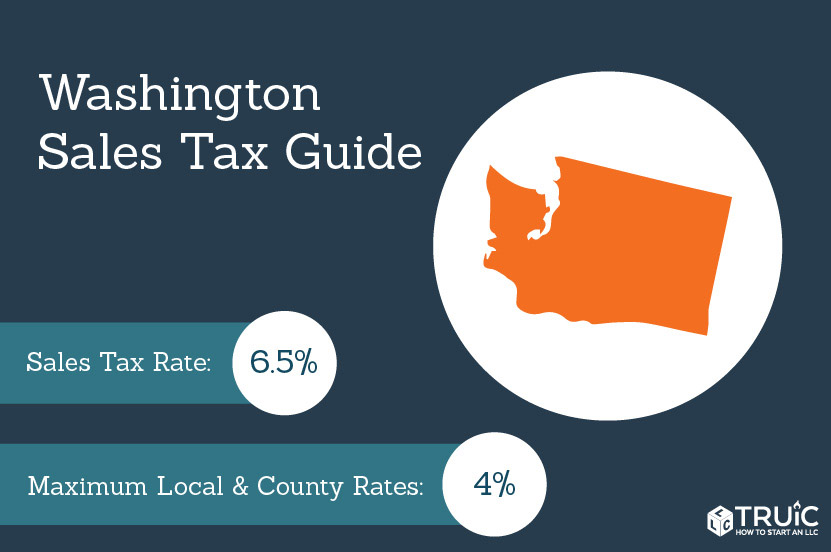

Llc Washington State How To Start A Washington State Llc Truic Guides

Labels: sales, washington

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home