What Is Considered Municipal Property

A municipality is wholly a creature of the legislature and possesses only such powers as are conferred upon it by the legislature. The effective tax rate is a combination of state county and municipal tax rates.

Learn More About The Appraisal Process With This Simple But Great Infographic Residential Real Estate Appraisal Real Estate

Learn More About The Appraisal Process With This Simple But Great Infographic Residential Real Estate Appraisal Real Estate

Homeowners then pay off those bonds through MUD tax.

What is considered municipal property. The property includes personal and real property i. Eminent domain is the legal process by which the government condemns or takes private property for public. In some instances they will visit properties to take measurements in the field but more often they use aerial imagery and computer software to calculate coverages from the office.

Will my taxes be higher in a MUD. A division accomplished by order of court 4. For the purpose of executing governmental powers properly and efficiently municipal corporations are given the power to acquire hold and manage property.

If you file separate returns each of you generally must report one-half of the bond interest. When an owner is unwilling to sell their land to the state or a municipality eminent domain may become necessary. If property ownership is transferred through sale or other legal methods a new easement agreement must be made.

The right of lien expresses the liability of certain property for a certain legal duty or a right to resort to it in order to enforce that duty. Donor had property for 5 years prior to gift. Depending on how the law is written this could also.

Even with the increasing sales of foreclosures in this current market the banks title insurance agents are not conducting Municipal Lien Searches on. MUD tax rates like all property tax rates vary according to property values and debt requirements. When a departments determines that a property is apparently blighted they notify the officer.

The program which must be enacted by municipal ordinance has age and income thresholds. If the property has established no particular situs the tax is assessed by the city or town. But even private property must sometimes yield to the need to acquire private property for certain governmental purposes.

A municipality may be designated as a city borough village or town except in the New England states New York and Wisconsin where the name town signifies a subdivision of the county. A division accomplished by devise will and testament 2. If you do not pay property tax then the municipal body can refuse to provide the water connection or other services and it may also initiate legal action to recover the due.

As the debt decreases MUD taxes may also decrease over time. This program allows municipalities to enact a property tax deferral program to help elderly homeowners keep their homes. If you reside in an area that does not have a municipal organization you may include amounts charged under the Provincial Land Tax Act or the Local Roads Boards Act or the Local Services.

A municipality is a political subdivision of a state within which a municipal corporation has been established to provide general local government for a specific population concentration in a defined area. For example for a property with a fair market value of 100000 the property taxes would be calculated by dividing the assessment by 100 and multiplying the product by the property tax. It is one of the major sources of revenue for municipal bodies.

Lien is a charge upon property for the payment or discharge of a debt or duty. A division accomplished by condemnation 3. If you and your spouse live in a community property state and hold bonds as community property one-half of the interest is considered received by each of you.

Rights-of-way are typical of this type because they pass through one property to another and are passed on with the property. Under the ordinance a property is considered blighted if the citys chief building official or health director determines that its condition threatens life or. What is NOT considered a Subdivision.

Appurtenant easements are attached to the property not the individual. Municipal lien is a lien by a municipal corporation against a property owner for the owners proportional share of a public improvement that specifically and individually benefits the owner. Beside box 61120 you should enter your total property tax paid for your principal residence for 2020 including the municipal and education property taxes.

Municipal Utility Districts are funded through bonds. The city or town in which the property is situated on January 1 assesses the personal property tax. Municipal Property Tax Deferral for Senior Citizens.

For more information about community property see Pub. Property tax allows the municipal bodies to get revenue for funding all the services that it provides. A Municipal Lien Search will thoroughly investigate any violations permits unrecorded liens taxes and utilities that are associated with the property.

Municipal property and municipal parks outside of the City of Toronto are the responsibility of the applicable municipal government where these lands are located. Private property is any land owned by individuals or corporations other than the government. A division accomplished by gift to a person related to the donor.

Usually this is the town hall or other government buildings. Commonly Municipal property is property that is own by the local government. Property tax rates are expressed as a dollar amount per 100 of assessment.

Municipal Property Tax Assistance. Municipalities use different approaches to estimate the impervious cover on each of the residential commercial and institutional properties their MS4 serves.

Understanding Bonds Investing Finance Investing Budgeting Money

Understanding Bonds Investing Finance Investing Budgeting Money

Why The Legal Description Is So Important In Land Surveys Proplogix Land Surveying Surveys Surveying

Why The Legal Description Is So Important In Land Surveys Proplogix Land Surveying Surveys Surveying

City Budgets In An Era Of Increased Uncertainty

City Budgets In An Era Of Increased Uncertainty

Isometric 3d City Map Infographic Vector Illustration Dimensional Plan Infographic Map Isometric Map Isometric

Isometric 3d City Map Infographic Vector Illustration Dimensional Plan Infographic Map Isometric Map Isometric

10 Rock Solid Reasons Why You Should Be Investing In Land Investing In Land How To Buy Land Investing

10 Rock Solid Reasons Why You Should Be Investing In Land Investing In Land How To Buy Land Investing

India S Kolkata Municipal Corporation Kmc S Plan To Roll Out A Unit Area Assessment Uaa System Of Property Valuation Municipal Corporation Make More Money

India S Kolkata Municipal Corporation Kmc S Plan To Roll Out A Unit Area Assessment Uaa System Of Property Valuation Municipal Corporation Make More Money

Pin Slamming How To Avoid Unexpected Property Taxes Proplogix Real Estate Fun Property Tax Real Estate Buying

Pin Slamming How To Avoid Unexpected Property Taxes Proplogix Real Estate Fun Property Tax Real Estate Buying

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Municipal Property Assessment Corporation Wikipedia

Municipal Property Assessment Corporation Wikipedia

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

City Budgets In An Era Of Increased Uncertainty

City Budgets In An Era Of Increased Uncertainty

Delaware Rental Agreement Samole Lease Form Download Free Printable Rental Legal Form Template Or Waiver In Different E Legal Forms Lease Rental Application

Delaware Rental Agreement Samole Lease Form Download Free Printable Rental Legal Form Template Or Waiver In Different E Legal Forms Lease Rental Application

India S Greater Hyderabad Municipal Corporation Ghmc Is Facing Legal Action From Some Resident Groups To Force Ghmc Legal Property Tax Municipal Corporation

India S Greater Hyderabad Municipal Corporation Ghmc Is Facing Legal Action From Some Resident Groups To Force Ghmc Legal Property Tax Municipal Corporation

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Puneville A Lifestyle Project In Pimpri Chinchwad Municipal Corporation Green Building Certification Property Real Estate

Puneville A Lifestyle Project In Pimpri Chinchwad Municipal Corporation Green Building Certification Property Real Estate

What Is Occupancy Certificate More Property Approval Terms Real Estate Terms Buying Property Real Estate

What Is Occupancy Certificate More Property Approval Terms Real Estate Terms Buying Property Real Estate

Rent Reference Letter Sample Unique Sample Personal Reference Letter For Rental Proper Reference Letter Simple Cover Letter Template Cover Letter Template Free

Rent Reference Letter Sample Unique Sample Personal Reference Letter For Rental Proper Reference Letter Simple Cover Letter Template Cover Letter Template Free

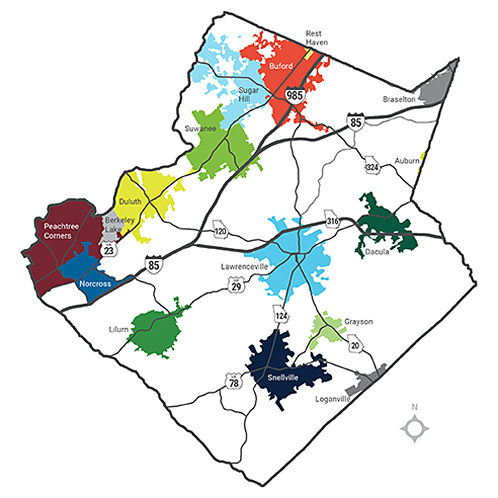

Municipalities Gwinnett County

Municipalities Gwinnett County

Tony Martinez Asks If You Have Considered The Possibility Of Purchasing An Investment Property With An Existing Tenant Discover Investing Mortgage Payoff Tax

Tony Martinez Asks If You Have Considered The Possibility Of Purchasing An Investment Property With An Existing Tenant Discover Investing Mortgage Payoff Tax

Labels: considered, municipal, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home