Property Tax Search New York

The Department of Finance values your property every year as one step in calculating your property tax bill. New York NYC Finance Department 212 639 - 9675.

Digital Tax Map Main Menu New York City Department Of Finance

Local assessment officials.

Property tax search new york. Our property records tool can return a variety of information about your property that affect your property tax. Go to Data Online. Use our free New York property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

Exemptions. Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due. Property and tax information is available for the towns in Monroe County New York.

The property and owner information is the most current information as provided by the Town Assessors. Historic Aerials 480 967 -. New York Mapping GIS.

The public information contained herein is furnished as a service by Monroe County Real Property Tax Services. Find Property Borough Block and Lot BBL. The Municipal Profiles application provides property owners with access to data and information about their localities including local contact information.

New York NYC Tax Commission 212 669 - 4410. Property and tax information is available for the towns in Onondaga County. Find New York Tax Records New York Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in New York New York.

Assessor Real Property Tax Services Herkimer County Real Property Tax Service 108 Court Street Suite 3200 Herkimer NY 13350. New York NYC Register 212 487 - 6300. Bills are generally mailed and posted on our website about a month before your taxes are due.

Go to Data Online. A New York Property Records Search locates real estate documents related to property in NY. It is part of the Countys commitment to provide 24 hour7 days a week access to real property information via the Internet.

We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Property Tax Bills. Click Here to search Onondaga County property assessmentinformation.

You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. Find a Property Borough Block and Lot BBL or Address Create Cover Pages and Tax Forms to Record Documents Compute Property Transfer Taxes. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records and other documents.

New applicants who qualify for Basic or Enhanced STAR. Or log in to Online Assessment Community. The public information contained herein is furnished as a service by Onondaga County Real Property Tax Services.

Assessed Value History by Email. Search the Herkimer County property tax and assessment records by municipalities tax id name or street including final assessment tax rolls by town. Available information includes property classification number and type of rooms year built recent sales lot size square footage and property tax.

Data and Lot Information. Go to Data Online. See Property tax and assessment administration for important updates and access to New York State resources for assessors county real property tax directors and their staff.

You will receive a STAR credit in the form of a check rather than receiving a property tax exemption if you qualify for STAR. Go to Data Online. NYC is a trademark and service mark of the City of New York.

You will register with New York State instead of applying with your assessor. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. The Automated City Register Information System ACRIS allows you to search property records and view document images for Manhattan Queens Bronx and Brooklyn from 1966 to the present.

You can choose to display information at the state county town or city or village level. The property and owner information is the most current information as provided by the Town. Tax Records include property tax assessments property appraisals and income tax records.

Property Records ACRIS Deed Fraud Alert. If a bank or mortgage company pays your property taxes they will receive your property tax bill. The dollar value of the credit will be the same as the property tax.

View Your Property Assessment Roll Data FY2022 Tentative Property Assessment Data. Property Tax Information Orange Countys Image Mate Online system allows you to search Orange County property by owner name address tax map number or municipality. The STAR program continues to provide much-needed property tax relief to New York States homeowners.

Nassau County Department of Assessment 516 571-1500 General Information Provides information from the Department of Assessment on rules procedures exemptions and general information.

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

New York S Wealthiest Look For Exits As State Readies Hefty Tax Increase

New York S Wealthiest Look For Exits As State Readies Hefty Tax Increase

Property Title Search Find Deeds Mortgages And Liens

Property Title Search Find Deeds Mortgages And Liens

New York Taxes A Guide To Real Estate Taxes For Nyc Apartment Owners Cityrealty

New York Taxes A Guide To Real Estate Taxes For Nyc Apartment Owners Cityrealty

Acris How To Search Property Records In Nyc Tutorial Hauseit Property Records Nyc Real Estate Broker

Acris How To Search Property Records In Nyc Tutorial Hauseit Property Records Nyc Real Estate Broker

1133 Park Avenue 16e New York Ny 10128 Sales Floorplans Property Records Realtyhop Floor Plans Park Avenue Apartment Floor Plans

1133 Park Avenue 16e New York Ny 10128 Sales Floorplans Property Records Realtyhop Floor Plans Park Avenue Apartment Floor Plans

How To Get A Resale Certificate In New York Startingyourbusiness Com

How To Get A Resale Certificate In New York Startingyourbusiness Com

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

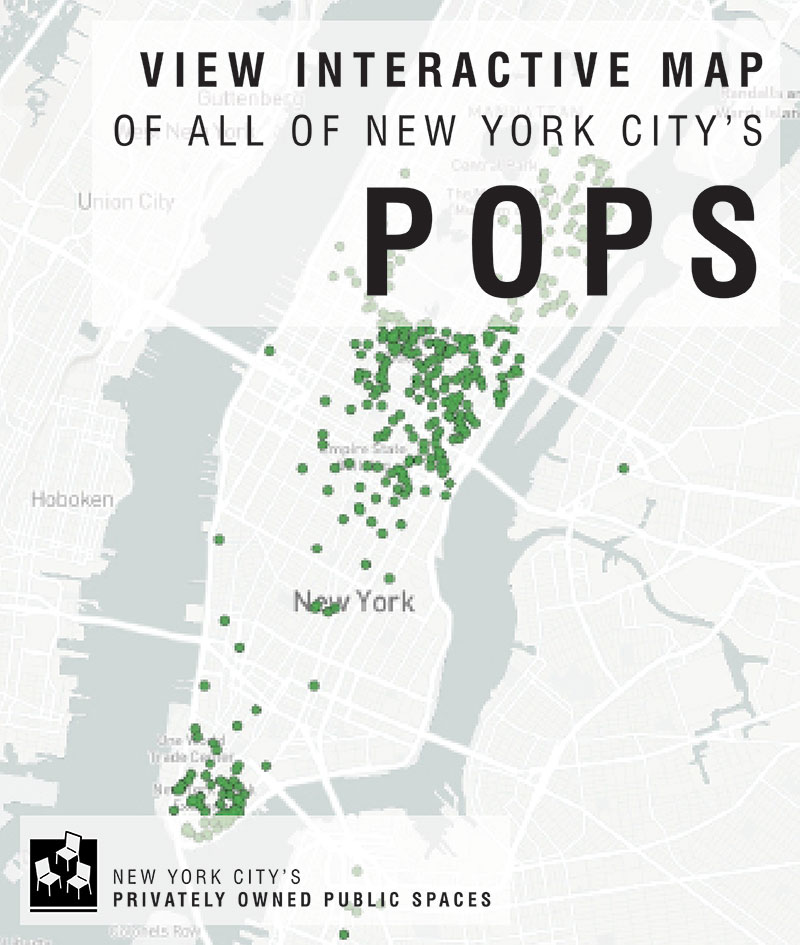

Privately Owned Public Space Overview Dcp

Privately Owned Public Space Overview Dcp

Closing Cost Estimator For Seller In Nyc Hauseit New York City

Closing Cost Estimator For Seller In Nyc Hauseit New York City

The School Tax Relief Star Program Faq Ny State Senate

The School Tax Relief Star Program Faq Ny State Senate

Shared Services In New York S Counties The Recession The State Imposed Property Tax Cap And The Governo Records Management Shared Services Government News

Shared Services In New York S Counties The Recession The State Imposed Property Tax Cap And The Governo Records Management Shared Services Government News

Real Property Assessment Info Wayne County Ny

Real Property Assessment Info Wayne County Ny

Parcel Information Orange County Ny

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home