Property Tax Search Bexar County

Assessor online records are updated only twice a year. 2021 data current as of Apr 16 2021 123AM.

Bexar County Tx Official Website

100 Dolorosa San Antonio TX 78205 Phone.

Property tax search bexar county. Northeast - 3370 Nacogdoches Rd. A list may be obtained through the Bexar County Clerks GIS Foreclosure Map or by visiting the Bexar County Clerks Deed Records Department located at the Paul Elizondo Tower Suite B109. Enter the last name and first name of the person on the case you are trying to locate.

If you would like to search by some other information please use the advanced search. Property Tax Overpayments Search. Based on the extent of the COVID-19 Coronavirus outbreak the Bexar Appraisal District highly encourages everyone to create an online account to have access to these services.

This Online Portal is also available to agents that have been authorized to represent an owner under section 1111 of the Texas Property Tax Code. Final processing may take several days. Electronic payments will be pending until it clears from your bank account.

Northwest - 8407 Bandera Rd. Reports Record Searches. Treasurer property tax payments are processed and updated every Sunday night.

Bexar County collects on average 212 of a propertys assessed fair market value as property tax. The County Clerk District Clerk court records search allows you to search for criminal and civil court case records in Bexar County. Bexar County property tax appeals and challenges.

Get Property Records from 2 Treasurer Tax Collector Offices in Bexar County TX Bexar County Tax Collector 233 N Pecos La Trinidad San Antonio TX 78283 210-335-2251 Directions Bexar County Tax Collector 640 Southwest Military Drive San Antonio TX 78221 210-335-6654 Directions Bexar County Building Departments. For more information on property values call BCAD at 210-242-2432. Map of Bexar County Tax Collector.

Bexar County TX Property Tax information. Within this site you will find general information about the District and the ad valorem property tax system in Texas as well as information regarding specific properties within the district. Property owners who have their taxes escrowed by their lender may view their billing information using our Search My Property program.

Bexar County Payment Locations. See Bexar County TX tax rates tax exemptions for any property the tax assessment history for the past years and more. For property information contact 210 242-2432 or 210 224-8511 or email.

The Bexar County Appraisal District BCAD sets property values and is a separate organization from the Bexar County Tax Assessor-Collectors office. Search Tax Records The Property Tax Search is provided as a public service for your convenience. BCSO Jail Activity Report.

Bexar County TX Property Tax Search by Address. Ownership and address records are updated weekly. For website information contact 210 242-2500.

Yearly median tax in Bexar County The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. Property Tax Payment Options. 2020 property taxes must be paid in full on or before unday January 31.

Property Tax Account Search. 2020 Property tax statements will be mailed the week of October 12th. Downtown - 233 N.

The office determines property tax values tax rates maintains and updates the local tax assessment rolls. Property tax assessments and reassessments. Find Bexar County residential property records including owner names property tax assessments payments rates bills sales transfer history deeds mortgages parcel land zoning structural descriptions valuations more.

Southside - 3505 Pleasanton Rd. Middle initial MI is optional. Pecos La Trinidad.

In-depth Property Tax Information. 2020 and prior year data current as of Apr 2 2021 653AM. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County.

See what the tax bill is for any Bexar County TX property by simply typing its address into a search bar. Return to Tax Home. Property owners may contact the Department of Assessment for questions about.

For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628. For your convenience the Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check eCheck.

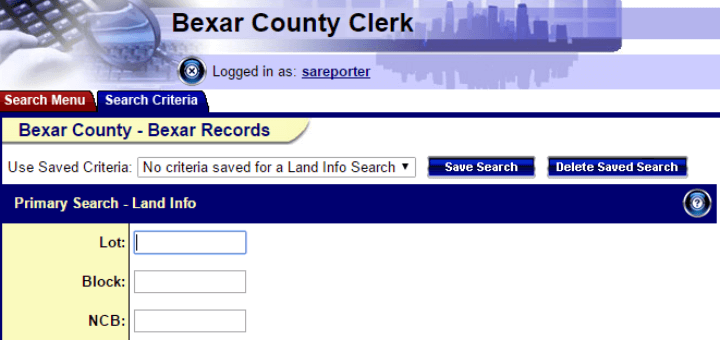

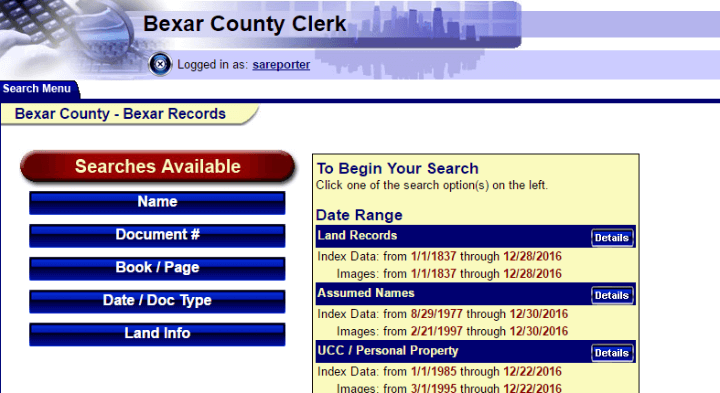

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

Https Www Bexar Org Documentcenter View 26900 Whats New At The Tax Office May 2020 Pdf Bidid

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Texas Property Search And Interactive Gis Map

Bexar County Texas Property Search And Interactive Gis Map

Bexar Homeowners React To County Wide Increase In Property Values Woai

Property Tax Information Bexar County Tx Official Website

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Public Record Searches Bexar County Tx Official Website

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Https Www Bexar Org Documentcenter View 26900 Whats New At The Tax Office May 2020 Pdf Bidid

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

Property Tax Information Bexar County Tx Official Website

Talking Taxes With Bexar County Tax Assessor Collector Albert Uresti Mpa Pcc At Bexar County Small Business And Entrepreneurship Department Webinar May 6 2020 San Antonio

Bexar County Tx Official Website

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

Public Record Searches Bexar County Tx Official Website

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home