Highest Property Taxes In Columbus Ohio

In order to determine the states with the highest and lowest property taxes WalletHub compared the 50 states and the District of Columbia by using US. However tax rates vary significantly between Ohio counties and cities.

Property Tax Rates High In Ohio And Cincinnati Area

Property Tax Rates High In Ohio And Cincinnati Area

The exact property tax levied depends on the county in Ohio the property is located in.

Highest property taxes in columbus ohio. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. They range as high at 4355 a year per 100000 of home value nearly triple. If youre considering buying or selling a home in the Cleveland Ohio area Cuyahoga County contact Cecilia Sherrard with.

Taxes on real estate are due in January and June of each year. Per capita property taxes. How Does Columbuss Property Tax Compare to Ohios Average Property Taxes.

The highest rates are in Cuyahoga County where the average effective rate is 244. Real Estate Property Tax Rates Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property. Effective property tax rate.

Columbuss property taxes are incredibly high compared to the state average so those looking to save money may want to live just outside Franklin County which determines the pricing of the. In Ohio the average property tax paid by residents is 1553 percent or around 1553 per 100000 in valued property. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the.

CLEVELAND Ohio - Click through the following slides to see which places in Ohio have the highest property tax rates. Ohio homeowners paid an average annual property tax of 2616 last year or an effective tax rate 168 percent ranking No. And taxes on manufactured homes are due in March and July.

Combining all local and county taxes there the overall rate is 4219 per 100000 of home value for 2020 taxes being billed in 2021. Areas with steep real estate values naturally rank higher in annual property tax bills than those where moderately priced real estate is. In accordance with the Ohio Revised Code the Hamilton County Treasurer is responsible for collecting three kinds of property taxes.

32312 manufactured homes ORC. Delinquent tax refers to a tax that is unpaid after the payment due date. 89 rows Median Property Tax Median Home Value Home Value Median Income Income.

Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of median home value yearly in property taxes while Monroe County has the lowest property tax in the state collecting an average tax of 69200 08 of median home value per year. A county might have a 025 property tax rate but 025 of 1 million works out to a lot more than 025 of 100000. Property tax bills have been sent out to homeowners in Franklin County and for the first time Auditor Clarence Mingo has released data on a countywide scale instead of for just Columbus.

View bar chart State Summary Tax Assessors Ohio has 88 counties with median property taxes ranging from a high of 373200 in Delaware County to a low of 69200 in Monroe County. 9 on the Top 10 list of highest tax rates slightly ahead of Rhode. The average effective property tax rate in Ohio is 148 which ranks as the 13th-highest in the US.

For more details about the property tax rates in any of Ohios counties choose the county from the. Additionally tax rates are percentages of value. Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of median home value yearly in property taxes while Monroe County has the lowest property tax in the state collecting an average tax of 69200 08 of median home value per year.

Census Bureau data to determine real-estate property tax rates and applying assumptions based on national auto-sales data to determine vehicle property tax rates. 450306 and personal property ORC.

I Team How Toledo S Income Tax Compares To Other Ohio Cities

I Team How Toledo S Income Tax Compares To Other Ohio Cities

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

From The Dayton Daily News 4 7 2017 Property Tax Rate High In Ohio And Dayton

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

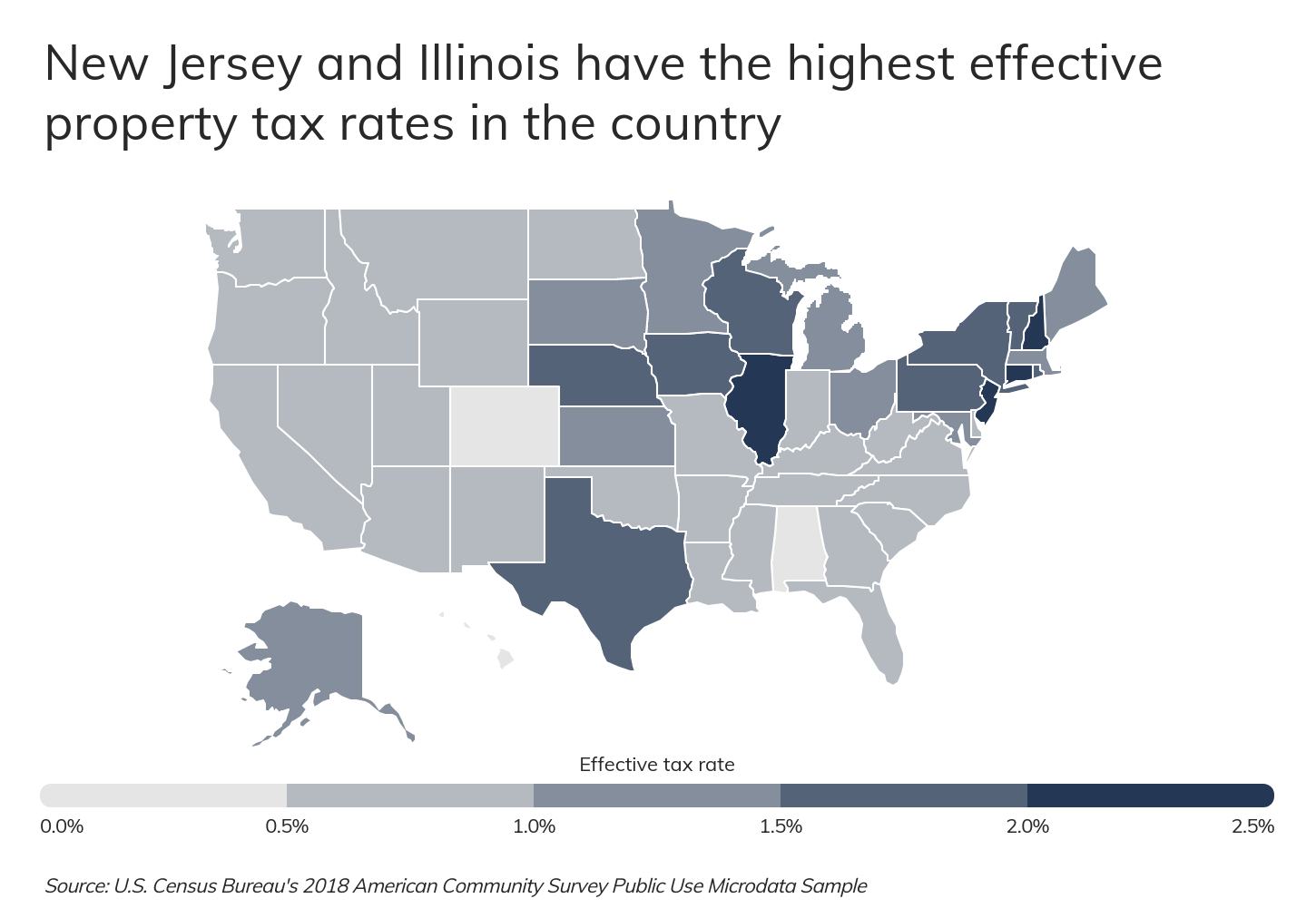

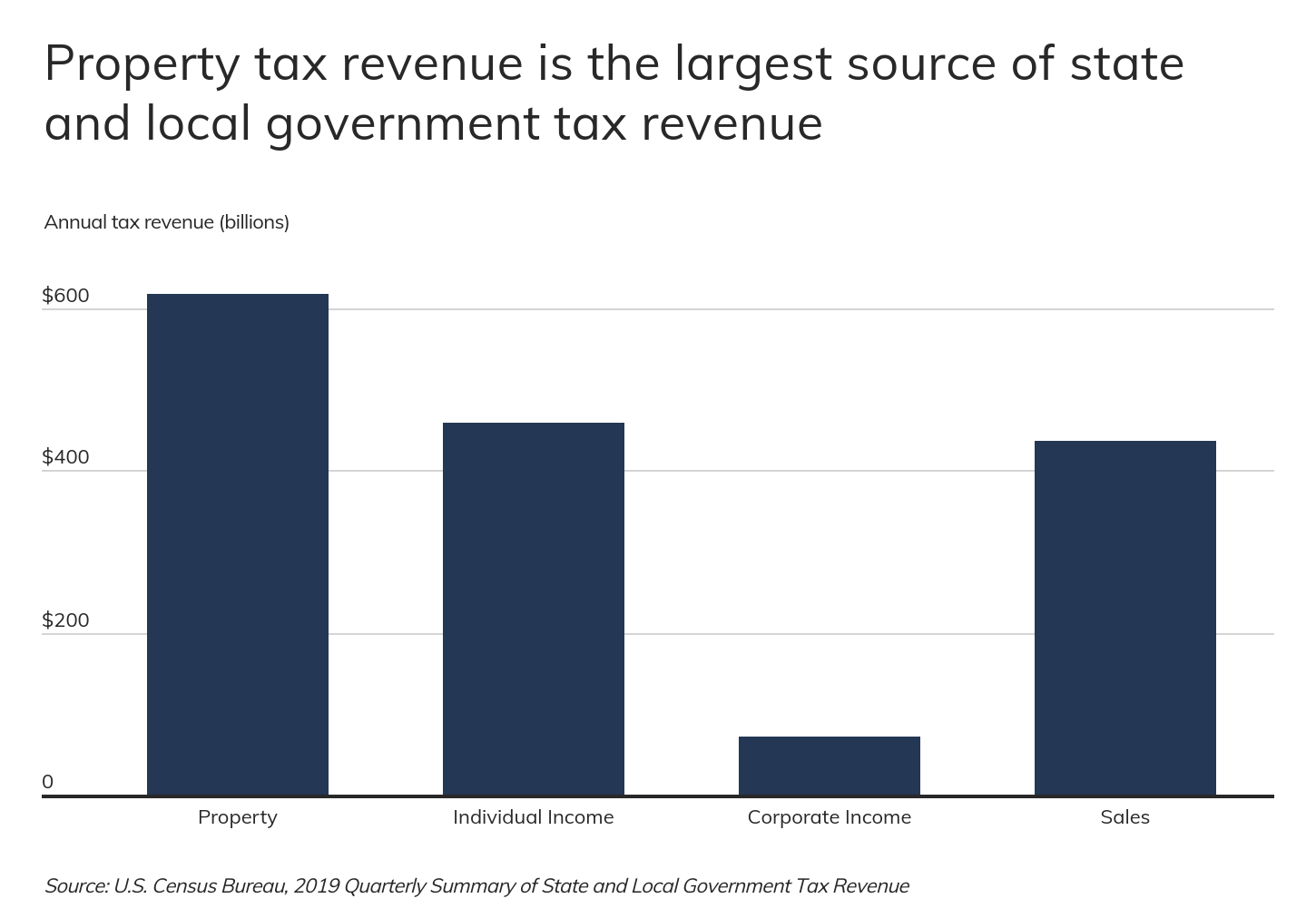

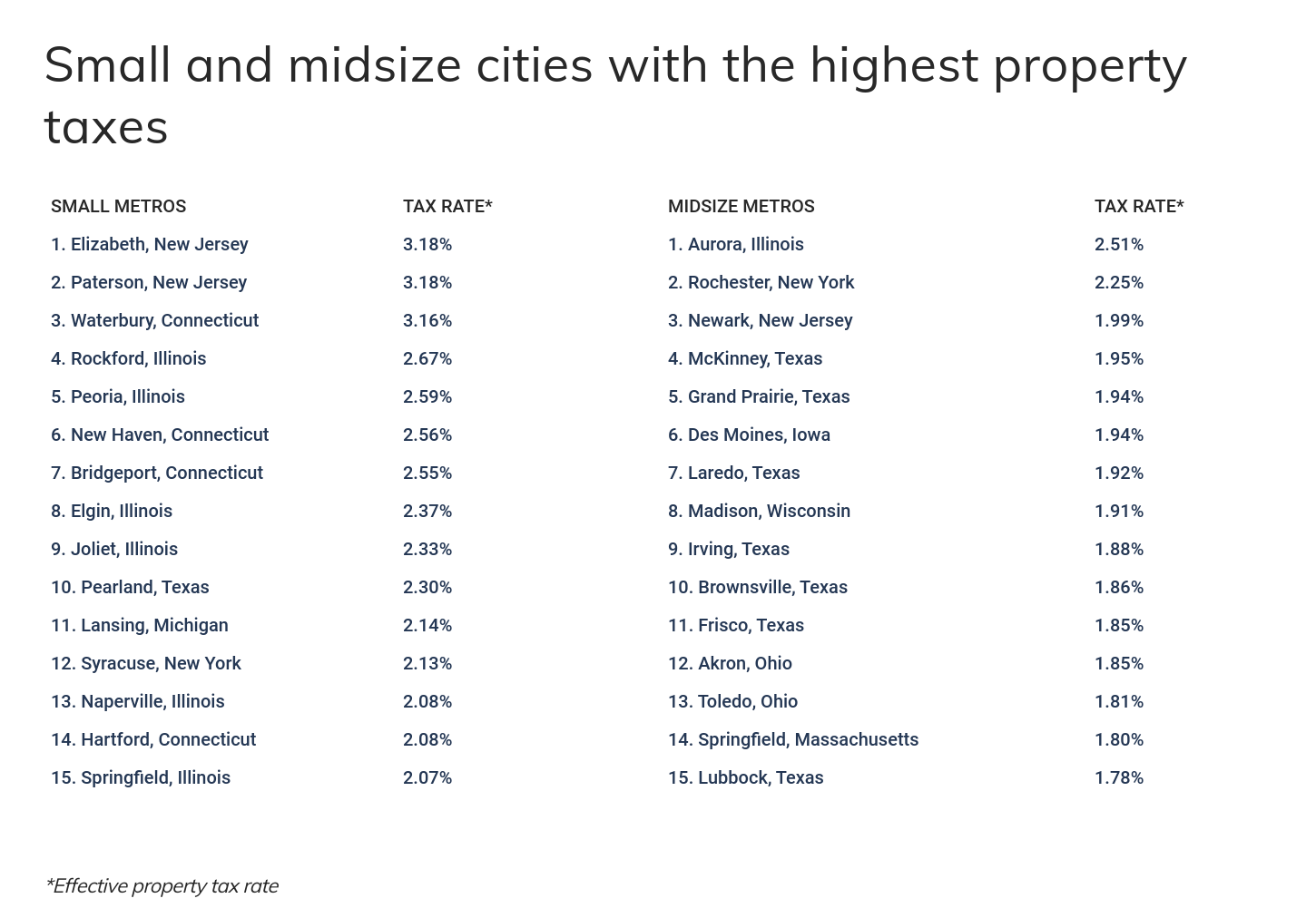

The Cities With The Highest And Lowest Property Taxes Real Estate Napavalleyregister Com

The Cities With The Highest And Lowest Property Taxes Real Estate Napavalleyregister Com

Property Taxes By City In Ohio Property Walls

The Cities With The Highest And Lowest Property Taxes Real Estate Napavalleyregister Com

The Cities With The Highest And Lowest Property Taxes Real Estate Napavalleyregister Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

The Cities With The Highest And Lowest Property Taxes Real Estate Napavalleyregister Com

The Cities With The Highest And Lowest Property Taxes Real Estate Napavalleyregister Com

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Taxes By City In Ohio Property Walls

Property Taxes By City In Ohio Property Walls

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Https Tax Ohio Gov Portals 0 Tax Analysis Tax Data Series All Property Taxes Pr6 Pr6cy16 Pdf

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home