Property Tax On Cars In Md

Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax. The tax is imposed on movable property such as automobiles or boats and its assessed annually.

Liens And Levies Md Va Pa Strategic Tax Resolution Tax Debt Irs Taxes Debt Relief

Liens And Levies Md Va Pa Strategic Tax Resolution Tax Debt Irs Taxes Debt Relief

For more information on Personal Property Tax Clearance Certificates call 410-887-2411.

Property tax on cars in md. In addition to taxes car purchases in Maryland may be subject to other fees like registration title and plate fees. Some dealerships also charge a have the option to charge a 99 dollar dealer processing fee. Send a check made payable to Baltimore County Maryland to.

A personal property tax is imposed by state or local tax authorities based on the value of an item of qualifying property. An excise tax will be charged on the basis of 6 of the vehicles book value or 6 of the purchase price on the notarized Bill of Sale for vehicles 7 years old or newer. The tax levies are based on property assessments determined by the Maryland Department of Assessments and TaxationSDAT.

Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. Armed Services veterans with a permanent and total service connected disability rated 100 by the Veterans Administration may receive a complete exemption from real property taxes on the dwelling house and surrounding yard. Maryland like more than 12 of the states does not have a personal property tax on automobiles.

In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments. Proof of ownership - The vehicles current title has to be properly assigned to you. For older vehicles the tax is calculated on the purchase price.

To title and register yo ur newly purchased used vehicle you will need to submit the following documents along with payment for taxes and fees. In addition to tags title inspection fees the Maryland tax is 6 paid one time on the value of the vehicle at the time you register it. If the vehicle is registered in a state that imposes no tax the tax will be assessed at 6 of the value of the vehicle.

MD 6 VA 4 the difference is a 2 tax rate. Not ALL STATES offer a tax and tags calculator. It is an ad valorem tax meaning the tax amount is set according to the value of the property.

Personal property generally includes furniture fixtures. Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment. How to Calculate Maryland Car Tax Step 1- Know the Specific Maryland Car Taxes.

The Department of Assessments and Taxation must appraise each of these properties once every three years. Marylands minimum excise tax charged is. Assessments are certified by the Department to local governments where.

Census Bureau and residents of the 27 states with vehicle. Updated February 26 2021. The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland.

Property Tax Exemption- Disabled Veterans and Surviving Spouses. The specific tax laws in Maryland you should pay attention to are the. Depending on where you live property taxes can be a small inconvenience or a major burden.

Select 2020 Income Tax Forms from the Forms drop down menu or link from the RELIEF Act Page The EITC Assistant is also available to help you determine eligibility for this important tax credit Click on the RELIEF Act tab from the landing page or from the COVID menu on mobile devices for more information BREAKING NEWS. Its also called an ad valorem tax. Step 2- Find the Value of the Car.

Revised Individual forms for Tax Year 2020 are available now. Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. There are 24 local State assessment offices one in each county and Baltimore City.

State Property Tax Exemption Benefits. Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to. In Maryland there are more than two million property accounts.

400 Washington Avenue Room 150. If the title was issued in Maryland it can be used as your application for titling and registering the vehicle. The average American household spends 2471 on property taxes for their homes each year according to the US.

However any portion that is a personal property tax an annual tax based on value is deductible. These veterans also may apply at any time and do not have to. See below for states that do and dont offer these services In addition CarMax offers a free tax and tag calculator for some states only.

This calculator can help you estimate the taxes required when purchasing a new or used vehicle. Business Personal Property Taxes. Maryland collects a 6 state excise tax on the purchase of all vehicles.

A higher-valued property pays more tax than a lower-valued property. Office of Budget and Finance. A Personal Property Lien Certificate is available for 55.

The fastest way to calculate how much you will have to pay for auto sales tax in. View solution in original post 1. Vehicles from a state with a lower tax rate than Marylands 6 will be taxed at the rate of the difference between the two states.

How To Find A Good Property Management Company Management Company Management Property Management

How To Find A Good Property Management Company Management Company Management Property Management

The Best And Worst States For Retirement Ranked Huffpost Life Best Places To Retire Retirement Retirement Strategies

The Best And Worst States For Retirement Ranked Huffpost Life Best Places To Retire Retirement Retirement Strategies

Snow Hill Md Snow Hill Street View Hometown

Snow Hill Md Snow Hill Street View Hometown

878 Washington Blvd Baltimore Md 21230 230 000 3 Br 3 Ba 1 Ba Huge New Construction Home 5year Tax Phase In Cove Lighting Estate Homes Rooftop Deck

878 Washington Blvd Baltimore Md 21230 230 000 3 Br 3 Ba 1 Ba Huge New Construction Home 5year Tax Phase In Cove Lighting Estate Homes Rooftop Deck

Does Car Insurance Decrease Or Increase As A Car Gets Older Car Insurance Finance Guide Getting Old

Does Car Insurance Decrease Or Increase As A Car Gets Older Car Insurance Finance Guide Getting Old

Free Maryland Motor Vehicle Dmv Bill Of Sale Form Pdf

Free Maryland Motor Vehicle Dmv Bill Of Sale Form Pdf

Forsale In Canton 2529 Fait Ave Baltimore Md 21224 Don T Miss Out Schedule A Tour Today Features 2 Bedrooms 1 Baths Back Patio H In 2020

Forsale In Canton 2529 Fait Ave Baltimore Md 21224 Don T Miss Out Schedule A Tour Today Features 2 Bedrooms 1 Baths Back Patio H In 2020

Forsale In Ellicott City 8416 Jenn Nicole Court Ellicott City Md 21043 Don T Miss Out Schedule A Tour Today Features 4 Bedrooms 4 Bat In 2020

Forsale In Ellicott City 8416 Jenn Nicole Court Ellicott City Md 21043 Don T Miss Out Schedule A Tour Today Features 4 Bedrooms 4 Bat In 2020

226 Lanvale Street W Baltimore Md 21217 Restored Bolton Hill Townhouse On Coveted W Lanvale St 5 Bedrooms 2 5 Brick Patios Refinish Wood Floors Property

226 Lanvale Street W Baltimore Md 21217 Restored Bolton Hill Townhouse On Coveted W Lanvale St 5 Bedrooms 2 5 Brick Patios Refinish Wood Floors Property

Under Contract In Leisure World Md 3534 Twin Branches Patio Condo Leisure

Under Contract In Leisure World Md 3534 Twin Branches Patio Condo Leisure

The United States Of Sales Tax In One Map Map States Government

The United States Of Sales Tax In One Map Map States Government

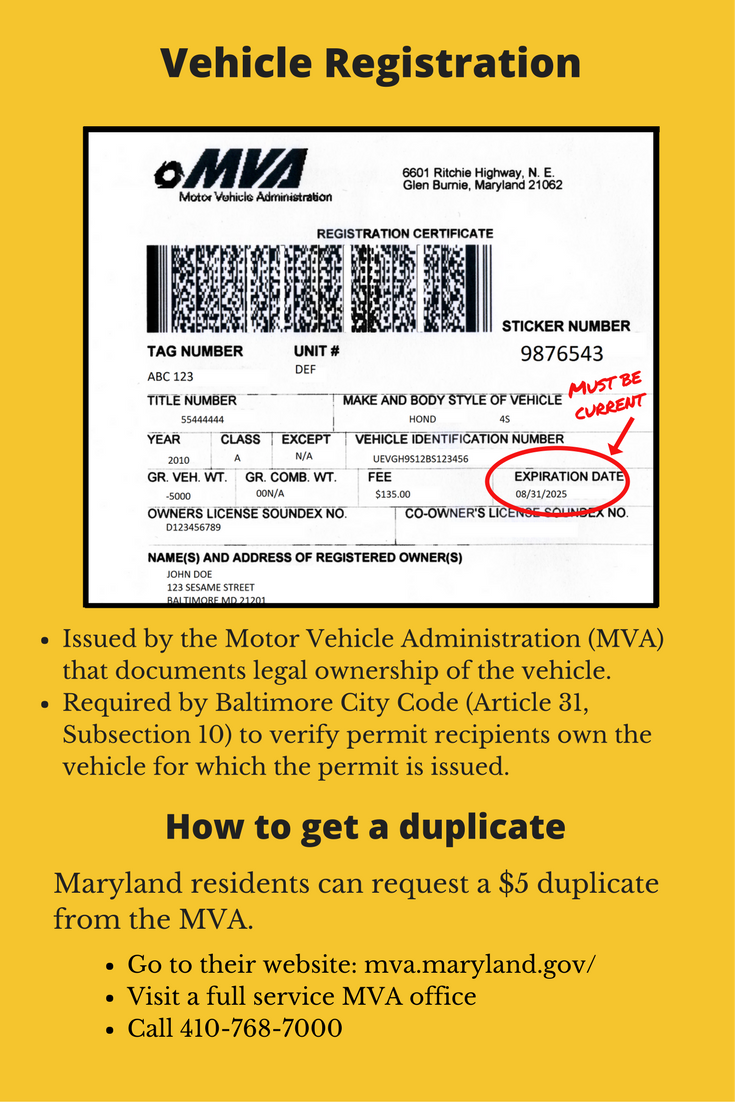

Required Customer Documents Parking Authority

Required Customer Documents Parking Authority

6639 6663 Belair Rd Baltimore Md 21206 Storefront Property For Lease On Loopnet Co Commercial Real Estate Commercial Property For Sale Commercial Property

6639 6663 Belair Rd Baltimore Md 21206 Storefront Property For Lease On Loopnet Co Commercial Real Estate Commercial Property For Sale Commercial Property

Real Estate Classes In Baltimore Md Here S What You Can Choose From Real Estate Classes Real Estate School Maryland Real Estate

Real Estate Classes In Baltimore Md Here S What You Can Choose From Real Estate Classes Real Estate School Maryland Real Estate

Memory Lane The H A M B Historic Baltimore Dundalk Maryland Essex Maryland

Memory Lane The H A M B Historic Baltimore Dundalk Maryland Essex Maryland

Maryland Car Tax Everything You Need To Know

Maryland Car Tax Everything You Need To Know

6639 6663 Belair Rd Baltimore Md 21206 Storefront Property For Lease On Loopnet Co Commercial Real Estate Commercial Property For Sale Commercial Property

6639 6663 Belair Rd Baltimore Md 21206 Storefront Property For Lease On Loopnet Co Commercial Real Estate Commercial Property For Sale Commercial Property

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home