Highest Property Tax Rates In Ohio

89 rows To find detailed property tax statistics for any county in Ohio click the countys name in the data table above. 326016 4413 of excess over 110650.

The States Where People Are Burdened With The Highest Taxes Zippia

The States Where People Are Burdened With The Highest Taxes Zippia

2693 Ohios property taxes are high enough to earn it a place in the top 10 but its residents pay the lowest average annual tax of any state on this list.

Highest property tax rates in ohio. The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300. Hawaii has the lowest property tax rate among states of 027. But in California the tax rate is much.

Data sourced from the US. 241612 3802 of excess over 88450. Combining all local and county taxes there the overall rate is 4219 per 100000 of home value for 2020 taxes being billed in 2021.

2693 Ohios property taxes are high. Median property taxes paid. Median household income owner-occupied homes.

166213 Average annual property tax paid. Franklin County collects on average 167 of a propertys assessed fair market value as property tax. 2 - The Shaker Square neighborhood of.

52 rows The total property tax as a percentage of state-local revenue is 1693 while the property. In Ohio the tax property rate is the 12th highest in the country at 156. Lake County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

31618 2850 of excess over 22150. Average effective property tax. 166213 Average annual property tax paid.

94603 3326 of excess over 44250. Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property. The median property tax also known as real estate tax in Lake County is 243300 per year based on a median home value of 15810000 and a median effective property tax rate of 154 of property value.

The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work. The highest rates are in Cuyahoga County where the average effective rate is 244. Franklin County has one of the highest median property taxes in the United States and is ranked 252nd of the 3143 counties in order of median property taxes.

Average effective property tax. Ohio homeowners paid an average annual property tax of 2616 last year or an effective tax rate 168 percent ranking No. A median house in Ohio valued at 129900 brings in 2032 in property taxes.

Effective property tax rate. 9 on the Top 10 list of highest tax rates slightly ahead of Rhode. The average effective property tax rate in Ohio is 148 which ranks as the 13th-highest in the US.

This data is based on a 5-year study of median property tax rates on owner-occupied homes in Ohio conducted from 2006 through 2010. However residents can still expect to pay high taxes due to high median home costs in Hawaii. Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of median home value yearly in property taxes while Monroe County has the lowest property tax in the state collecting an average tax of 69200 08 of median home value per year.

Ohio homeowners paid an average annual property tax of 2616 last year or an effective tax rate 168 percent ranking No. 162 November 2020 average home value. There are 26 states with property tax rates below 100.

The exact property tax levied depends on the county in Ohio the property is located in. 162 November 2020 average home value. However tax rates vary significantly between Ohio counties and cities.

Effective property tax rate. Here are the numbers for Ohio. 9 on the Top 10 list of highest tax rates slightly ahead of Rhode.

Alabama has the second-lowest property tax rate with 042 coupled with some of the countrys lowest home prices. Per capita property taxes. Click through the following slides to see.

CLEVELAND Ohio - Property tax rates in Ohio range from 850 per 100000 of home value on Kelleys Island to 4355 a year in one area outside of Dayton. Census Bureau The Tax Foundation and various state and local.

U S Homeownership Rate Rises To Highest Point In 8 Years Home Ownership High Point Mortgage Interest Rates

U S Homeownership Rate Rises To Highest Point In 8 Years Home Ownership High Point Mortgage Interest Rates

The 10 States With The Best Quality Of Life 10 Things Life Good Things

The 10 States With The Best Quality Of Life 10 Things Life Good Things

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Here S How Biden S Tax Plan Would Affect Each U S State

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Cities With The Highest And Lowest Costs Of Living Cost Of Living City Financial Tips

Cities With The Highest And Lowest Costs Of Living Cost Of Living City Financial Tips

Mapped The Cost Of Health Insurance In Each Us State Healthcare Costs Health Insurance Humor Health Insurance

Mapped The Cost Of Health Insurance In Each Us State Healthcare Costs Health Insurance Humor Health Insurance

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

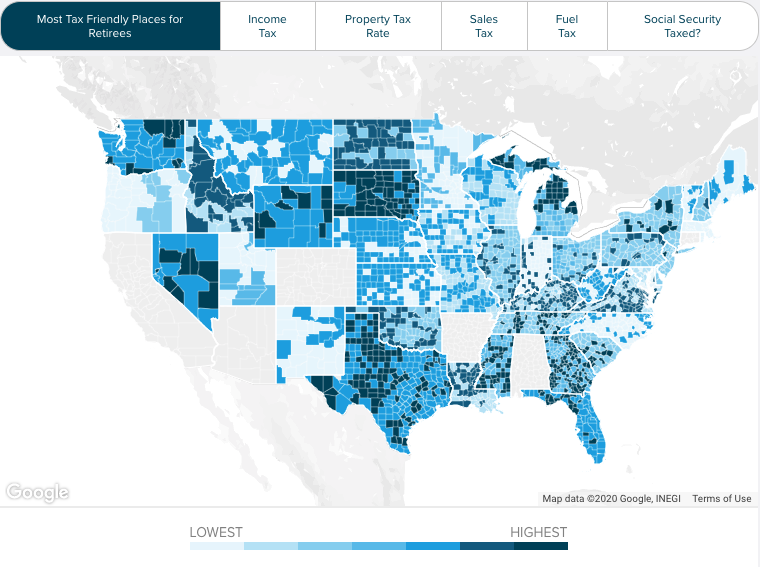

States With The Highest Lowest Tax Rates In The Us Fox Business

States With The Highest Lowest Tax Rates In The Us Fox Business

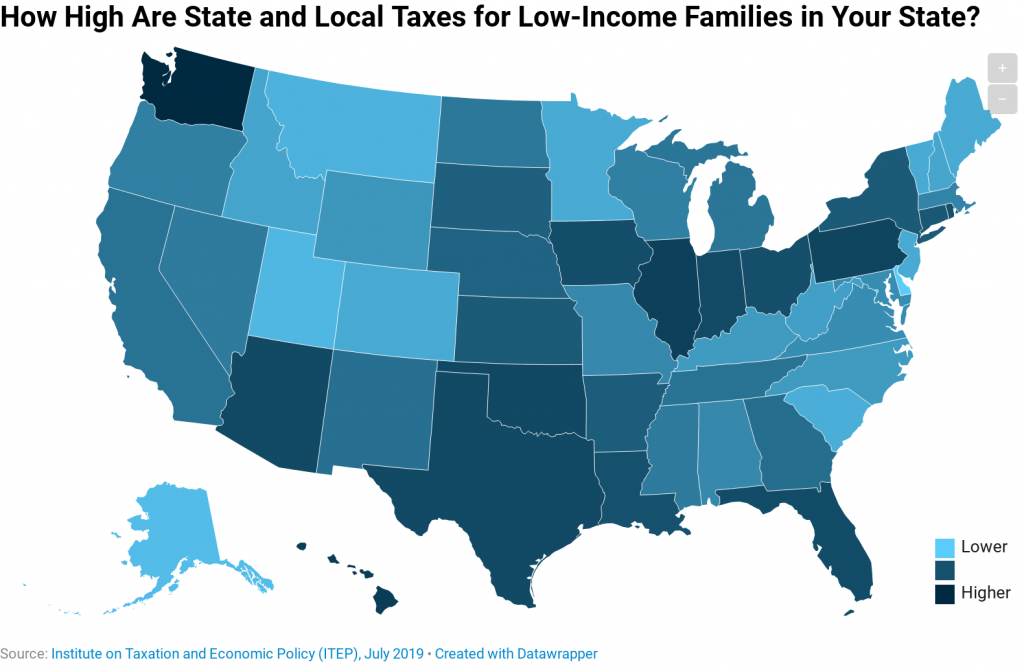

Which States Have The Highest Tax Rates For Low Income People Itep

Which States Have The Highest Tax Rates For Low Income People Itep

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home