Gwinnett County Property Tax History

Gwinnett Justice Administration Center 75 Langley Drive Lawrenceville GA 30046 Phone. Gwinnett County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Gwinnett County Georgia.

Notice of saleunder power.

Gwinnett county property tax history. 1 day agoGwinnett County Tax Commissioner Tiffany Porter is highlighting several actions her office has taken this year to address accessibility efficiency and operations costs as she reaches her first. Gwinnett County Tax Commissioner Tiffany P. Pickaway County Ohio Treasurers web site.

This site created and maintained by David Poluxt at First Byte Computer in Ashville OhioFirst Byte Computer in Ashville Ohio. For more information please visit the Gwinnett Countys Assessor and Tax Commissioner or look up this propertys current tax situation tax situation here or here. Liens on personal property may be filed at any time after the account becomes delinquent.

Serving also as an agent for the state of Georgia the tax commissioner registers and titles motor vehicles and disburses associated revenue. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Liens remain filed until taxes are paid in full and may affect personal credit.

7708228000 Open Records Request. R8001 001 or R8001 A 001 OR Property Owner Name OR. For information related to unemployment income please read FAQ 3.

The calculation of property taxes represents only what Gwinnett County Tax Commissioner bills. If the county board of tax assessors disagrees with the taxpayers return on personal property such as airplanes boats or business. It is also the first step in taking the property to tax sale.

Get FREE FRANKLIN COUNTY PROPERTY RECORDS directly from 30 Ohio govt offices 18 official property records databases. Your Parcel Number example. It is located in the north central portion of Georgia and is bordered by Forsyth County Hall County Jackson County Barrow County Walton County Rockdale County DeKalb County and Fulton CountyGwinnett County was named for Button Gwinnett one of the signatories of the Declaration.

For real property the Tax Commissioner must issue a 30-day notice to the property owner before filing the lien. Gwinnett County is the second most populous county in Georgia with a population of 920260. For info about the Notice Of Property Appraisals that all Pickaway County property-holders recently received click here.

Porter is a Constitutional Officer elected to bill collect and disburse personal and property taxes and to administer homestead exemptions. The tax commissioner is required to send a bill to whoever owned the property on January 1 and also to the new owner if the property was sold later that year. Gwinnett County Property Records are real estate documents that contain information related to real property in Gwinnett County Georgia.

The calculation of property taxes represents only what Gwinnett County Tax Commissioner bills. For more information please visit the Gwinnett Countys Assessor and Tax Commissioner or look up this propertys current tax situation tax situation here or here. Records include Franklin County property tax assessments deeds title records property ownership building permits zoning land records GIS maps more.

If you are submitting your return by mail metered mail will not be accepted as proof of a timely property tax return. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest.

These records can include Gwinnett County property tax assessments and assessment challenges appraisals and income taxes. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. The county board of tax assessors must send an annual notice of assessment which gives the taxpayer information on filing a property tax appeal on real property such as land and buildings affixed to the land.

Property Tax Other Information Tax Assessors Office The Tax Commissioner does not determine property value for taxation purposes and has no authority over that process. If the taxes for the year in which the property was sold go unpaid a tax lien is issued against the property. Steps to search for additional property information and sales in your neighborhood.

This responsibility falls to the Tax Assessors office which answers to the Board of Tax Assessors and the Gwinnett County Board of Commissioners. Search Help Search Hints. Enter one of the following in the search box above.

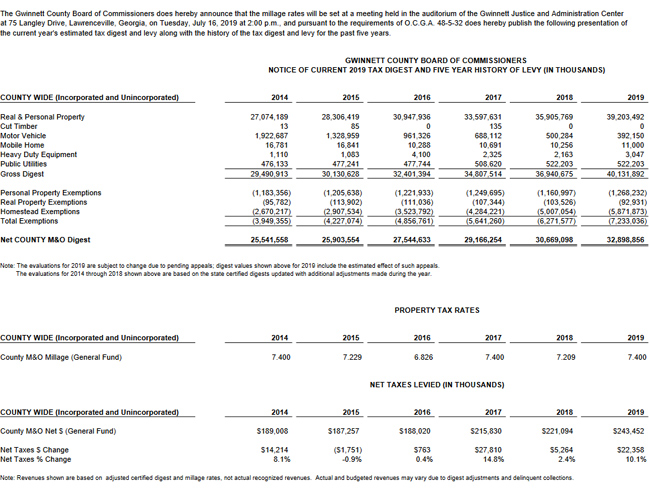

Gwinnett County Property Tax Bills To Be Mailed By Thur Accesswdun Com

Gwinnett County Property Tax Bills To Be Mailed By Thur Accesswdun Com

Vibrantly Connected Gwinnett County

Vibrantly Connected Gwinnett County

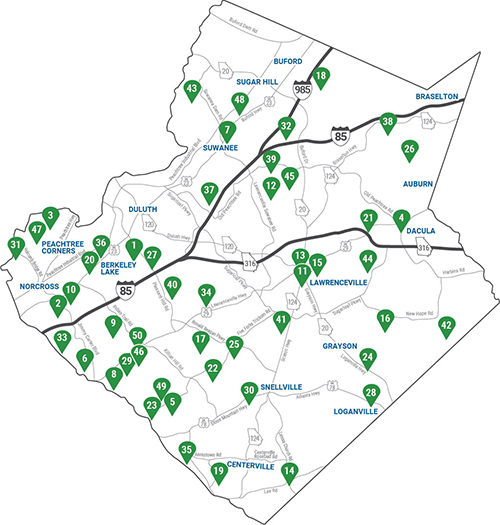

Explore Your Parks Gwinnett County

Explore Your Parks Gwinnett County

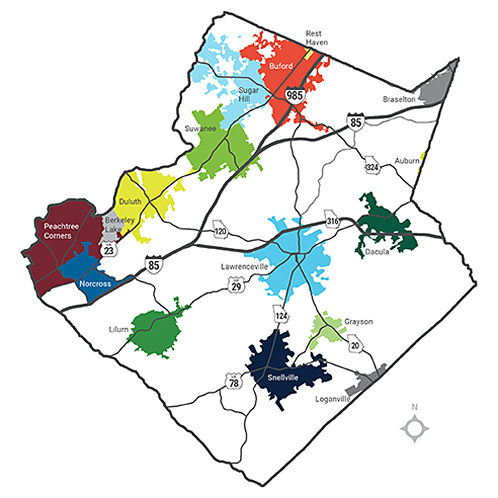

About Gwinnett Gwinnett County

About Gwinnett Gwinnett County

Municipalities Gwinnett County

Municipalities Gwinnett County

Gwinnett County Georgia Genealogy Familysearch

Gwinnett County Property Tax Records Online Property Walls

Gwinnett County Property Tax Records Online Property Walls

Vibrantly Connected Gwinnett County

Vibrantly Connected Gwinnett County

Gwinnett County Property Taxes Due By Oct 15 News Cbs46 Com

Gwinnett County Property Taxes Due By Oct 15 News Cbs46 Com

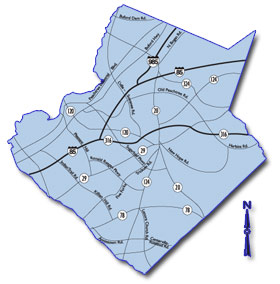

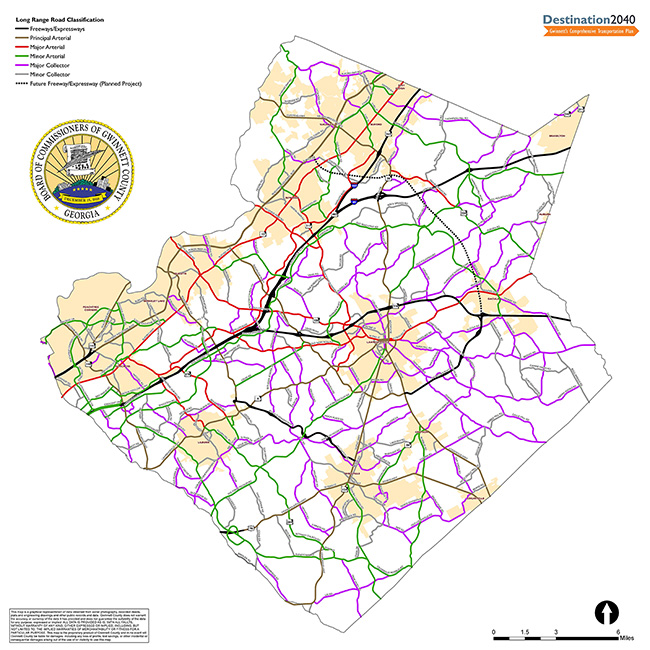

Long Range Road Classification Map Gwinnett County

Long Range Road Classification Map Gwinnett County

Gwinnett County Real Estate Gwinnett County Homes Atlanta Homes

Gwinnett County Real Estate Gwinnett County Homes Atlanta Homes

Hunter Butler Ethridge Cemetery Located On Bold Springs Road Wages Circle In Harbins District Gwinnett Cou Historical Society Gwinnett County Family History

Hunter Butler Ethridge Cemetery Located On Bold Springs Road Wages Circle In Harbins District Gwinnett Cou Historical Society Gwinnett County Family History

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home