Aircraft Property Tax By State

WA has a yearly registration fee but its. Aircraft shall be returned to the county where primary home base is located.

Lift Aircraft Says 13 000 People Have Signed Up For Drone Rides Geekwire

Lift Aircraft Says 13 000 People Have Signed Up For Drone Rides Geekwire

But the use tax generally becomes an issue in the state in which the aircraft is based.

Aircraft property tax by state. Large private aircraft over 41000 pounds sold to nonresidents if the aircraft is not required to be registered in the state under chapter 4768 RCW. My intentions are also to offer a brief explanation of the new business friendly commercial interstate commerce regulation and some practical information concerning the California State Board of Equalization SBE the authority. The claim form BOE-260-B Claim for Exemption from Property Taxes of Aircraft of Historical Significance is available from the county assessor.

Aircraft regularly located in Orange County are assessed here regardless of where they are registered. There is an approx 1 of valuation varies slightly by county property tax on aircraft in CA. Too many 10K Bonanzas I guess.

One major cost in the purchase of any aircraft is the possible applicability of sales and use tax to the transaction. The state assumes if an aircraft is purchased from a seller and later brought into the state then use tax is owed. Personal property strata a.

Unique to State Taxes. If use tax is owed on the aircraft Texas will allow for a credit against the tax bill. Aircraft owners are required to file an annual Aircraft Property Statement with the Assessor providing details about the aircraft.

The claim must be filed with the assessor on or before February 15 for the preceding January 1 lien date to receive 100 percent of the exemption. You should have received a letter from the county asking for specific information on the aircraft so they could establish a proper valuation. A nonresident owner purchases an aircraft for 10000000 in another state.

A Florida use tax is imposed at a rate of 6. I evidence of delivery outside the state ii evidence of state sales tax paid to the state where the aircraft is primarily based and iii evidence of personal property tax paid to another state. This exemption provides a property tax exemption for aircraft that is made available for display in an aerospace museum.

However this position was uniformly rejected by the other states6 In 1987 the latter of the two courts changed their mind leaving only the dated 1969 case7 Since that timethe state courts have uniformly held that aircraft are taxable8 2. The aircraft is subject to property tax in California during the first 12 months of ownership. List the fair market value of all aircraft under taxpayer return column below.

State law requires that aircraft be assessed on January 1 of every year at the site where they are regularly or routinely located. Aircraft subject to registration are considered vehicles and are subject to sales and use tax. If purchased by a nonresident of California the aircraft is used or stored in California more than one-half of the time during the first 12 months of ownership.

Tools to rebut the application of state sales or use tax to an aircraft include. Aircraft- includes airplanes rotocraft and lighter than air vehicles. The owner pays the full 400000 of tax to that state.

Commercial airline aircraft are returned to the state revenue commissioner. The state of Texas treats the sale of an aircraft as a taxable transaction subject to state and local sales tax just like the sale or purchase of any other piece of tangible personal property. When and where are aircraft assessed for property taxes.

According to California Law airplanes and other aircraft are taxable and are subject to annual appraisal. I wouldnt be surprised if they had both a one-time sales tax on airplanes plus an annual property tax. The purpose of this article is to provide information how I received an exemption from California sales and use taxes on my own aircraft a 2001 Cessna Turbo 182.

However aircraft not purchased directly from a seller but brought into Texas are not presumed to be for use in Texas or subject to use tax. Sales of or charges made for labor and services rendered in respect to repairing cleaning altering or improving large private airplanes owned by nonresidents of this state. If the seller of the aircraft is a licensed vehicle dealer the seller is responsible to collect the tax at purchase.

That state charges a 4 sales tax on the purchase price for a total tax due of 400000 10000000 4. Any civil aircraft located in Utah must have a current certificate of registration to operate in the state. The aircraft then comes to Florida.

Ie subject to tax unless the taxpayer can establish objection to entitlement. Washington has a state sales tax Oregon has a state income tax but California has both. Information on location and ownership is obtained from the Federal Aviation Administration Airport owners and operators reports on-site inspections and other public and private sources.

018 Dedicated Aviation Fund. Thus sales-and-use tax often is the primary state tax focus of general aviation aircraft owners. Because of the portability of an aircraft it is generally easy to avoid sales tax on the purchase by closing in a jurisdiction with little or no tax or an applicable exemption.

To qualify for the exemption the aircraft must have been available for public display in an aerospace museum for a minimum of 90 days or more during the 12-month period that immediately preceded the lien date for the year.

What It Was Like To Fly And Land In Alaska Airlines First Commercial 737 Max 9 Flight Geekwire

What It Was Like To Fly And Land In Alaska Airlines First Commercial 737 Max 9 Flight Geekwire

Tata Sons In Talks To Buy Airasia S 49 In Joint Venture Low Cost Airlines Air India Express Tata Sons

Tata Sons In Talks To Buy Airasia S 49 In Joint Venture Low Cost Airlines Air India Express Tata Sons

Cam Frequently Asked Questions Nbaa National Business Aviation Association

Cam Frequently Asked Questions Nbaa National Business Aviation Association

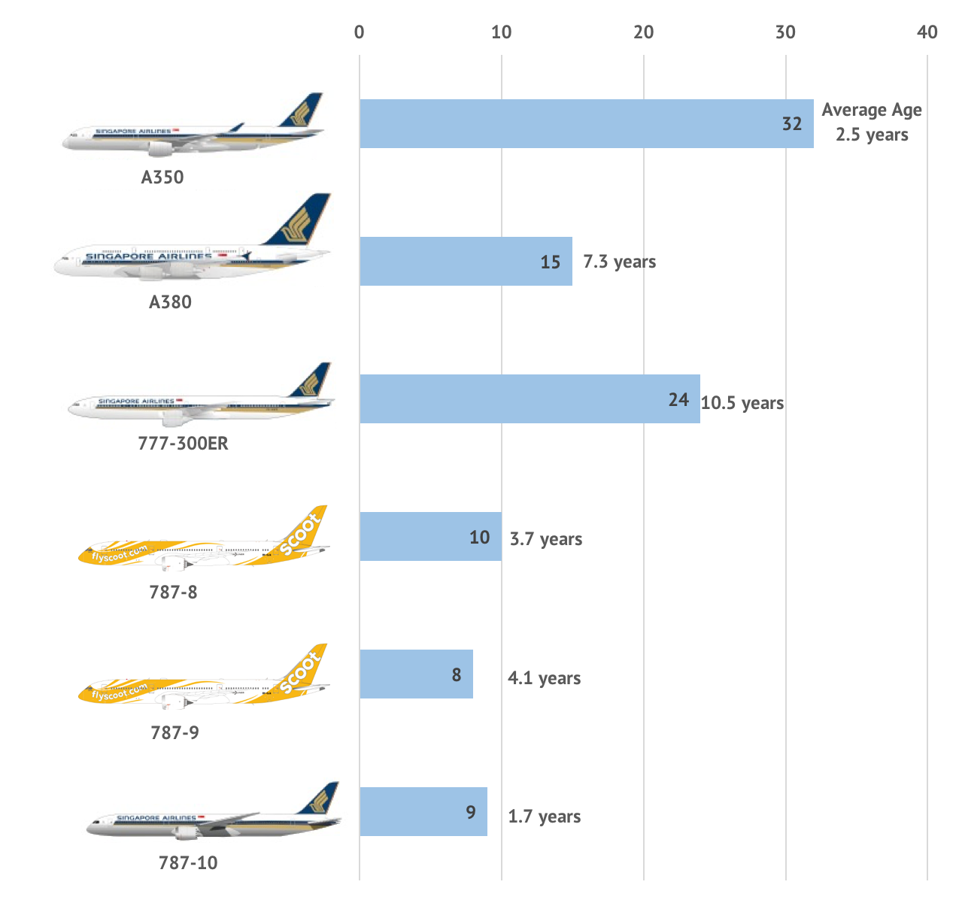

Singapore Airlines Seeks Fleet Flexibility In Talks For Deferrals And Sale And Leaseback On Aircraft

Singapore Airlines Seeks Fleet Flexibility In Talks For Deferrals And Sale And Leaseback On Aircraft

Radar Coverage And Ads B Coverage In Iceland Atc Bird Area Air Traffic Control Ads Iceland

Radar Coverage And Ads B Coverage In Iceland Atc Bird Area Air Traffic Control Ads Iceland

Douglas A 20 Havoc Princess Ruthie 47th Bombardment Group 84th Bombardment Squadron Memorial Service Fighter Bills

Douglas A 20 Havoc Princess Ruthie 47th Bombardment Group 84th Bombardment Squadron Memorial Service Fighter Bills

A Tax Collector Walks Into A Hangar Minimizing State Sales And Use Taxes When Purchasing An Aircraft Fafinski Mark Johnson P A

A Tax Collector Walks Into A Hangar Minimizing State Sales And Use Taxes When Purchasing An Aircraft Fafinski Mark Johnson P A

How Airplane Wings Work Commercial Aircraft Boeing 737 Passenger Aircraft

How Airplane Wings Work Commercial Aircraft Boeing 737 Passenger Aircraft

8 Details Required For Aircraft Bill Of Sale Bills Writing Words Paying Taxes

8 Details Required For Aircraft Bill Of Sale Bills Writing Words Paying Taxes

2007 Diamond Da42 L360 For Sale In Fl United States Www Airplanemart Com Aircraft For Sale Multi Engine Pi Airplane For Sale Outdoor Decor Outdoor Furniture

2007 Diamond Da42 L360 For Sale In Fl United States Www Airplanemart Com Aircraft For Sale Multi Engine Pi Airplane For Sale Outdoor Decor Outdoor Furniture

Flying Private The Cost And Benefits Of Luxury Travel Private Flights Small Private Jets Luxury Travel

Flying Private The Cost And Benefits Of Luxury Travel Private Flights Small Private Jets Luxury Travel

Pin On Aircraft Experimental Bombers And Ground Attack Aircraft

Pin On Aircraft Experimental Bombers And Ground Attack Aircraft

1950s Boac De Havilland Comet 4 De Havilland Comet Vintage Aircraft De Havilland

1950s Boac De Havilland Comet 4 De Havilland Comet Vintage Aircraft De Havilland

Pin On Aviation And Military Navy Army Marine Airforce

Pin On Aviation And Military Navy Army Marine Airforce

Report Knocks Oregon Property Tax System Property Tax Knock Knock Oregon

Report Knocks Oregon Property Tax System Property Tax Knock Knock Oregon

Davis Monthan Afb Tucson Az Largest Aircraft Boneyard In The World At The 309th Amarg Facility Tour Airplane Graveyard Airplane Boneyard Aircraft Modeling

Davis Monthan Afb Tucson Az Largest Aircraft Boneyard In The World At The 309th Amarg Facility Tour Airplane Graveyard Airplane Boneyard Aircraft Modeling

Singapore Airlines Seeks Fleet Flexibility In Talks For Deferrals And Sale And Leaseback On Aircraft

Singapore Airlines Seeks Fleet Flexibility In Talks For Deferrals And Sale And Leaseback On Aircraft

Top Private Aviation States Robb Report

Top Private Aviation States Robb Report

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home