Virginia Property Tax Prince William County

By creating an account you will have access to balance and account information notifications etc. When prompted enter Jurisdiction Code 1036 for Prince William County.

County Proposes Flat Real Estate Tax Rate New Cigarette Tax Data Center Hike News Princewilliamtimes Com

County Proposes Flat Real Estate Tax Rate New Cigarette Tax Data Center Hike News Princewilliamtimes Com

Resources and information on COVID-19 in Prince William County VA.

Virginia property tax prince william county. Press 1 for Personal Property Tax. Business are also assessed a business tangible property tax on items such as furniture and fixtures computers and construction equipment. Prince William County Property Tax Payments Annual Prince William County Virginia.

You can pay a bill without logging in using this screen. Prince William County has re-opened county facilities to the public as of Wednesday July 1 2020 in accordance with Governor Northams authorization of Phase 3. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Prince William County residents have a lot of thoughts and theyre not shy about sharing them. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. Box 1498 Richmond VA 23218-1498 Tax Due.

Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. How will I recieve my pets license and annual renewal notice. Text COVIDPWC to 888777 for COVID-19 alerts.

Pet owners can expect to receive an annual renewal notice from PetData in NovemberDecember. The tax rate is expressed in dollars per one hundred dollars of assessed value. Click here to register for an account or here to login if you already have an account.

The call center hours. Payment by e-check is a free service. The median property tax also known as real estate tax in Prince William County is 340200 per year based on a median home value of 37770000 and a median effective property tax rate of 090 of property value.

A convenience fee is added to payments by credit or debit card. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

All you need is your tax account number and your checkbook or credit card. The Assessments Office mailed the 2021 assessment notices beginning March 9 2021. 300000 100 x 12075 362250.

In-depth Prince William County VA Property Tax Information. Median Property Taxes Mortgage 3893. The COVID-19 Call Center provides information to residents concerning COVID-19 vaccines and assists with those who do not have access to a computer the internet or email.

Prince William County - 153 Refund. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and. Box 446 Farmville VA 23901 434-392-3231.

Prince George County - 149 PO. Prince William County Virginia. The Finance Departments public-facing offices are Taxpayer Services and Real Estate Assessments.

In Prince William County a personal property tax is assessed annually as of January 1 on automobiles trucks motorcycles trailers and mobile homes. Box 760 Richmond VA 23218-0760 703-792-6710. Taxpayer Services is fully operational for walk-in visitors with the exception of the Ferlazzo building location.

Dog licenses are no longer sold through the Taxpayer Portal. Box 155 Prince George VA 23875 804-722-8740. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of median property taxes. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes.

Prince William County Property Records are real estate documents that contain information related to real property in Prince William County Virginia. Median Property Taxes No Mortgage 3767. Monday Sunday 900 am.

Prince William County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Pulaski County - 155 52 West Main Street Ste 200. Prince Edward County - 147 PO.

3 rows Prince William County Property Tax Payments Annual Prince William County Virginia. The personal property tax which primarily applies to vehicles is proposed to remain at 370. Have pen paper and tax bill ready before calling.

Prince William County Va Recently Sold Homes Realtor Com

Prince William County Va Recently Sold Homes Realtor Com

Use Of Cash Bail Sees Sharp Decline In Prince William News Princewilliamtimes Com

Use Of Cash Bail Sees Sharp Decline In Prince William News Princewilliamtimes Com

Bland Family Of Stafford Prince William Loudoun Co S Va And Edgefield County Sc Goyen Family Tree

Bland Family Of Stafford Prince William Loudoun Co S Va And Edgefield County Sc Goyen Family Tree

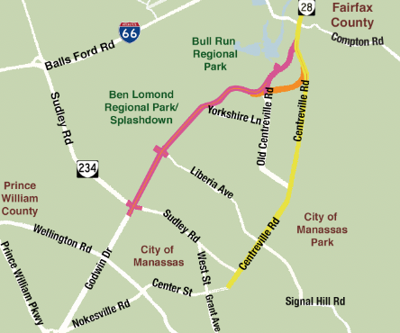

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Equestrian Center With A 1930 Farm House Equestrian Estate James City Farmhouse

Equestrian Center With A 1930 Farm House Equestrian Estate James City Farmhouse

Prince William Supervisors Approve Advertising Tax Rate That Would Hike Bills Headlines Insidenova Com

Prince William Supervisors Approve Advertising Tax Rate That Would Hike Bills Headlines Insidenova Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William Va Land For Sale Real Estate Realtor Com

Prince William Va Land For Sale Real Estate Realtor Com

Where Residents Pay More In Taxes In Northern Va Wtop

Where Residents Pay More In Taxes In Northern Va Wtop

Best Of Prince William 2019 By Insidenova Issuu

Best Of Prince William 2019 By Insidenova Issuu

Prince William Approves Tax Hike Amid Coronavirus Shutdown Job Losses

Prince William Approves Tax Hike Amid Coronavirus Shutdown Job Losses

Prince William Board Adopts 2020 Budget Keeps Tax Rate Flat Bristow Beat Bristow Beat

Prince William County 55 Communities In Dc Suburbs

2021 Best Places To Buy A House In Prince William County Va Niche

2021 Best Places To Buy A House In Prince William County Va Niche

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home