Riverside County Ca Tax Collector Property Search

The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures. After entering your search please scroll down for the results.

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

Property information is maintained by the Assessors Office.

Riverside county ca tax collector property search. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments. It is our hope that this directory will assist in locating the site resource or contact information you need as a taxpayer in Riverside County. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce taxpayers to the organizations that handle the property tax process in Riverside County.

The Treasurer-Tax Collector issued the fifth largest number of secured tax bills in California with over 731000 in the 2005-2006 fiscal year which is just behind Orange San Diego Riverside and Los Angeles Counties. If you have further questions please contact our office at 951955-3900 or e-mail your questions to. All tax bills paid online or by the automated phone system are due by midnight on the delinquent date.

Perform a free Riverside County CA public tax records search including assessor treasurer tax office and collector records tax lookups tax departments property and real estate taxes. The Riverside County Treasurer - Tax Collector is proud to offer online payment services. The Assessor locates all taxable property in Riverside County identifies the owners and describes the property.

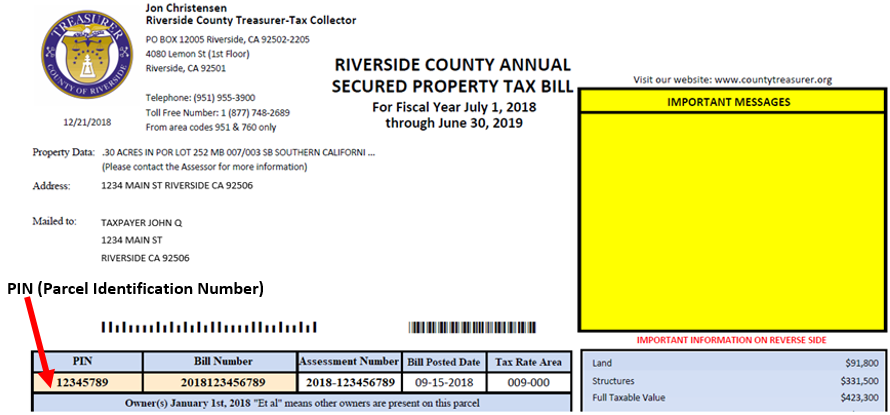

Searching by Assessment Number PIN. If you have questions or would like to correct any of the information regarding your parcel please contact the Assessors Office at 909 387-8307. You can search by Assessors Parcel Number APN Property Identification Number PIN or Property Address.

Certain property owners directly affected by COVID-19 may submit a Penalty Cancellation Request Form along with payment if they were unable to pay property taxes by the April 10 2020 December 10 2020 or April 12 2021 payment deadlines in accordance with the Governors Executive OrderTo qualify the property must be either. Only enter the first 9 digits excluding the. The Assessors primary responsibility is to value taxable property.

The Treasurer Tax Collector is committed to offering payment options to the public in the safest way possible. When searching by Assessment No only enter the first 9 digits. Effective March 22 2021 the Treasurer-Tax Collectors downtown Riverside office located on the 1st floor of the County Administrative Center will be open by appointment only.

Free Riverside County Property Tax Records Search. Add your property taxes to your Payment List. We STRONGLY encourage taxpayers to make their tax payments using either our online payment system make.

The Assessor determines a value for all taxable property and applies all legal exemptions and exclusions. Welcome to the Riverside County Property Tax Portal. Riverside CA 92501 Phone.

The Assessor must complete an assessment roll showing the assessed values for all property. Welcome to the County of Riverside Assessor Online Services. OFFICE OF THE TREASURER-TAX COLLECTOR RIVERSIDE COUNTY CALIFORNIA Home Search Last Search Results.

Please be advised that if for any reason you are unable to make your tax payment in an automated fashion over the phone or web you are still responsible to make payment timely in order to avoid penalties. The combined office is led by Jon Christensen a countywide publicly elected official serving the fourth largest county in California. The Riverside County Treasurer-Tax Collector is responsible for the billing and collection of property taxes and for the receiving processing investing and most importantly safeguarding of public funds as mandated by the laws of the state of California.

For best results when searching by Property Address please enter street number and street name eg123 Main. 951 955-6200 Live Agents from 8 am - 5 pm M-F Email. Search for your property tax.

The Riverside County Treasurer - Tax Collector is proud to offer online payment services. Decal number for Boat Aircraft or Mobile Home PLEASE NOTE. All tax bills paid online or by the automated phone system are due by midnight on the delinquent date.

Auditor Controller Treasurer Tax Collector County Of San Bernardino Countywire

Auditor Controller Treasurer Tax Collector County Of San Bernardino Countywire

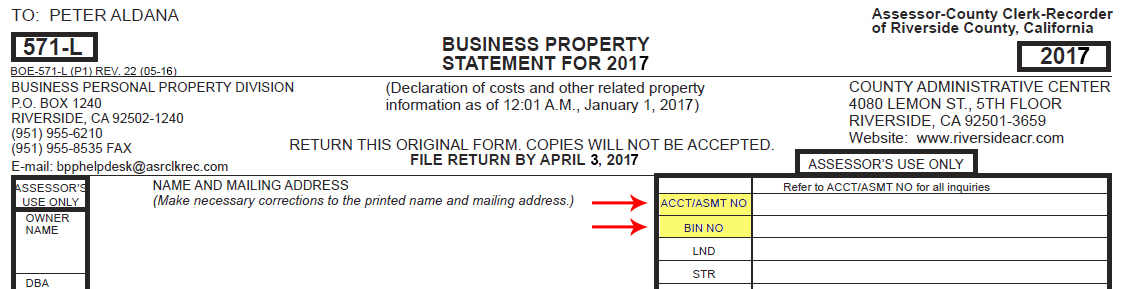

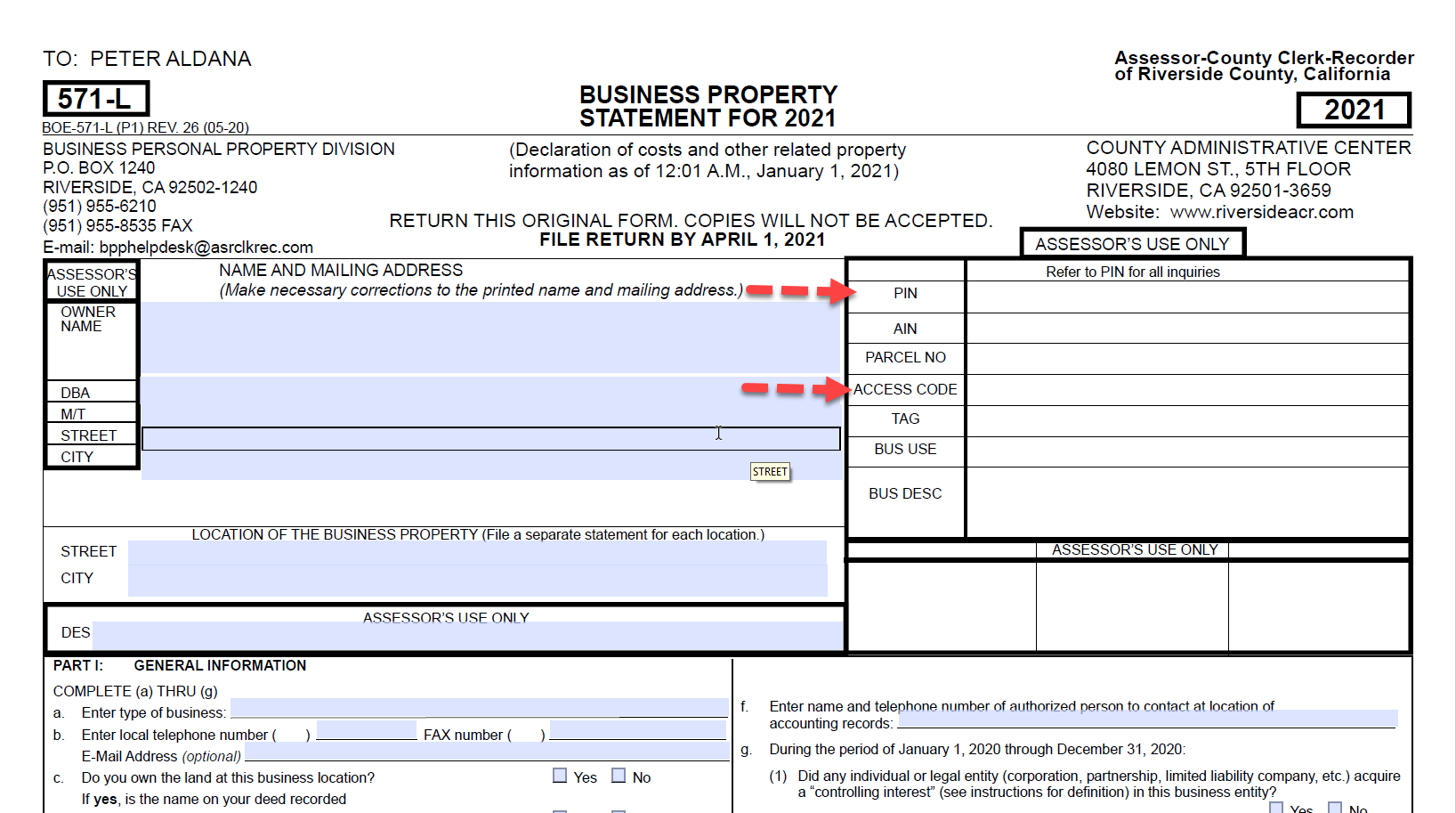

Riverside County Assessor County Clerk Recorder File Your Business Property Statement Online

Riverside County Assessor County Clerk Recorder File Your Business Property Statement Online

Riverside County Assessor County Clerk Recorder Business Personal Property

Riverside County Assessor County Clerk Recorder Business Personal Property

Meet Your Treasurer Tax Collector

Meet Your Treasurer Tax Collector

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

Property Tax For Riverside County Ca Property Walls

Property Tax For Riverside County Ca Property Walls

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

Riverside County Property Tax Records Riverside County Property Taxes Ca

Riverside County Property Tax Records Riverside County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

Riverside County Assessor County Clerk Recorder Home Page

Riverside County Assessor County Clerk Recorder Home Page

Riverside County Assessor County Clerk Recorder Peter Aldana

Riverside County Property Tax Records Riverside County Property Taxes Ca

Riverside County Property Tax Records Riverside County Property Taxes Ca

Tax Records Is Not The Definitive Source For Square Footage

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home