Property Transfer Tax In Jamaica

SCHEDULE Paragraph 2. The process of releasing inheritance is regulated by the Government of Jamaica.

How To Calculate The Savings From Reduced Stamp Duty And Transfer Tax Dig Jamaica

Transfer tax which is borne by the seller was previously assessed at rate of 5 has now been.

Property transfer tax in jamaica. Real estate agents fee is generally 3 to 5 plus 165 GCT and is negotiable. The type of home does not matter. The Transfer Tax Declaration of Secrecy Regulations 1977 LN.

TAJ to host Transfer Tax expert in Jamaica. Stamp duty which was previously assessed ad valorem as a percentage at a rate of 2 for the buyer and 2 for the seller a total of 4 per transaction will now be reduced to a flat fee of 5000. Upon registration of the transfer the estate and interest.

The first tax cut replaced all ad valorem stamp duties applicable for official documents with a. Lets look at what those reductions could mean in dollar value when purchasing or selling property. But while Minister Without Portfolio Dr Horace Chang announced that the adjustments were pending he did not indicate the size of the cuts or the time frame in which it would be done.

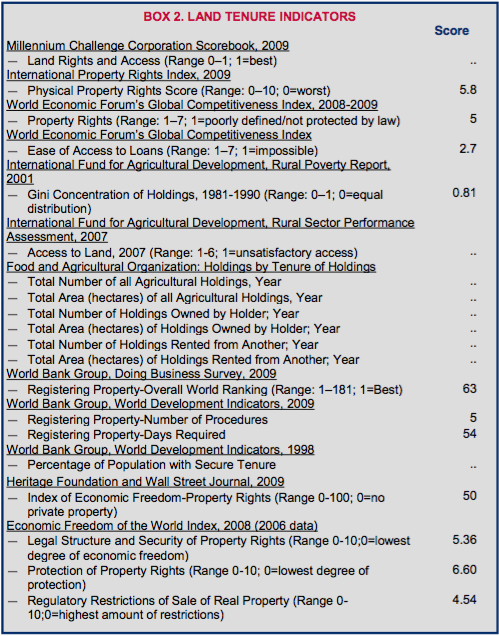

There is a relief an amount of 1000000 relief where the value of the land is 15000000 or less. This is currently levied at the rate of 5 of the gross consideration payable for the property or the market value in certain circumstances. Stamp Duty.

The House of Representatives on Tuesday December 10 passed the. As per Paragraph 121 of the Transfer Tax Act property must be aggregated. Transfer taxes are calculated based on the sale price of your home and can range from 001 to over 4.

Transfer Tax Full 200. Increase in the Transfer Tax Estate Tax Threshold for Estates. Reduction in Transfer Tax Rate.

Of section 8 over the property at the time of its transfer by the settlor or entitling the trustee of my. The tax system of Jamaica is complex yet very efficient. Cost of Agreement for Sale 12 020.

For inter vivos in life transfers or gifts the tax rate is a flat 75. In Jamaica individuals are prone to pay Income Tax at the rate of 25 on their chargeable income not more than 6 million Jamaican dollars whereas chargeable income in excess of Jamaican dollars 6 million per annum is subjected to an income tax. 7500 Approximate Total Cost.

Stamp Duty 12 2500 Registration 12 025. Interest is calculated as per Paragraph 173 First Schedule of the Transfer Tax Act. TRANSFER TAX 7 2 In relation to any property held by a person as nominee for another person or as trustee for another person absolutely entitled as against the trustee or for two or more persons who are so entitled in possession whether as joint tenants or tenants in common or as a trustee or.

The Transfer Tax Act imposes transfer tax on the transfer of certain property including Jamaican real estate shares and securities in Jamaican companies. State county and city transfer taxes might all apply depending on the tax laws in your area. 6 per annum shall be paid upon any of the tax outstanding from and after the expiration of twelve 12 months of the date of death of the deceased to the date of payment.

Using this form the registered proprietor of land lease or mortgage Transferor may transfer same pursuant to Sections 88 93 of the Registration of Titles Act. The transfer act states that transfer tax is 75. TAJ Supporting Local Businesses through Taxpayer Education.

It is usually a misconception that Jamaica beachfront houses for sale attract a much higher transfer. Transfer Pricing Workshop being held in Kingston. Transfer tax of 5 of property price is paid by the seller.

876 926-97489 876 920-2950876 960-9287. Tax Compliance Certificate TCC Taxpayer Registration Number. Exactly what your tax rate will be will depend on where you live.

The Jamaican Government has reduced the tax rate from 5 to. When the transfer is between related people the tax is imposed on the propertys market value. 2019 Tax Cuts Boost the Jamaican Real Estate Industry Stamp Duty Reduction.

Stock exchanges for the purposes of the Act in addition to the Jamaica Stock Exchange. Real Estate Agents Fee. 083 _____ Attorneys Fee 300.

Traditionally the seller pays the agents fee however it has become quite common recently to pass the cost to the buyer. In Jamaica the main taxes are Income Tax General Consumption Tax Custom Duties Property Tax Transfer tax and Stamp Duties. GCT Attorneys Fees 049.

The Transfer Tax payable on properties to be transferred from one owner to the other was reduced from five percent to two percent. The Jamaican Government is to reduce stamp duty and transfer tax on real estate transactions acceding to appeals from the Realtors Association of Jamaica RAJ. GCT on Agreement for Sale 0033.

August 20 2020. In his remarks Dr. Clarke explained that as part of the 201920 revenue measures the rate of transfer tax was reduced from five per cent to two per cent on inter vivos transactions and the threshold for the charging of transfer tax on death estate of a deceased person was increased from 100000 to 10 million.

However documents that have been dated before April 1 2019 will retain the previous transfer fee of five percent of the value of the property.

Pdf Property Transfer Tax And Stamp Duty

Pdf Property Transfer Tax And Stamp Duty

Pin On Tips For British Expats

Pin On Tips For British Expats

How To Calculate The Savings From Reduced Stamp Duty And Transfer Tax Dig Jamaica

Widcombe Estate Is A Gated 25 Acre Property With 32 Prime Lots For Sale In Phase 1 In The Hills Of Kingston 6 Conta Land For Sale House Styles Lots For Sale

Widcombe Estate Is A Gated 25 Acre Property With 32 Prime Lots For Sale In Phase 1 In The Hills Of Kingston 6 Conta Land For Sale House Styles Lots For Sale

This Is Your Opportunity To Be A Part Of The Newest Addition To Kingston S Skyline Join Us At Our Offices Friday Saturday And Sunda Jamaica Kingston Skyline

This Is Your Opportunity To Be A Part Of The Newest Addition To Kingston S Skyline Join Us At Our Offices Friday Saturday And Sunda Jamaica Kingston Skyline

Buying Property In Jamaica What To Expect Jamaican At Heart

Buying Property In Jamaica What To Expect Jamaican At Heart

Land Titles National Land Agency One Agency One Goal

Land Titles National Land Agency One Agency One Goal

Property Transfer Taxes On Real Estate Selected Countries Download Table

Property Transfer Taxes On Real Estate Selected Countries Download Table

Property Transfer Taxes On Real Estate Selected Countries Download Table

Property Transfer Taxes On Real Estate Selected Countries Download Table

Pdf Property Transfer Tax And Stamp Duty

Pdf Property Transfer Tax And Stamp Duty

How To Calculate The Savings From Reduced Stamp Duty And Transfer Tax Dig Jamaica

Pdf Property Transfer Tax And Stamp Duty

Pdf Property Transfer Tax And Stamp Duty

Prime Commercial Real Estate For Sale On Balmoral Ave The Property Comprises A Newly Renovated Building Of 17 800 Sq House Commercial Real Estate House Styles

Prime Commercial Real Estate For Sale On Balmoral Ave The Property Comprises A Newly Renovated Building Of 17 800 Sq House Commercial Real Estate House Styles

Buying Property In Jamaica What To Expect Jamaican At Heart

Buying Property In Jamaica What To Expect Jamaican At Heart

5 Reasons To Consider Purchasing Property In Jamaica Loop News

5 Reasons To Consider Purchasing Property In Jamaica Loop News

Pdf Property Transfer Tax And Stamp Duty

Pdf Property Transfer Tax And Stamp Duty

Pdf Property Transfer Tax And Stamp Duty

Pdf Property Transfer Tax And Stamp Duty

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home