Property Tax In California Vs Washington

Voter-approved property taxes imposed by school districts. CA has an unemployment rate of 93 whereas it is 60 in Washington.

4 Questions To Ask Before Buying A Home Ryan Serhant Property Tax Buying A New Home This Or That Questions

4 Questions To Ask Before Buying A Home Ryan Serhant Property Tax Buying A New Home This Or That Questions

By comparison in neighboring Oregon.

Property tax in california vs washington. WAs per capita GDP is 79570 which is higher than Californias 79315. But in California the tax rate is much lower at 081 the 34th lowest in the US. Real and Personal Property Tax.

The average effective property tax rate in California is 073. According to Zillow the median value for a home in Seattle is 783969. How Property Taxes in California Work.

In New Hampshire property taxes generate 38 of state revenues. 1373 average rate per 1000 of assessed value 128 Real Estate Excise Tax. Washington state fares better than California according to data released in October 2020.

Taxes for single-family homes condos and townhouses are calculated the same way says Larry Friedman co-founder and principal of SDF Capital a. He paid 75 in property taxes on his Boston home valued at 1250. In this video I made a comparison between California vs Texas Property Taxes.

For an in-depth comparison try using our federal and state income tax calculator. State Local Retail Sales Tax. That means buying a Seattle home is a lot more expensive today than it was last year.

Where does your property tax go. California vs Texas Property Tax and State Income Tax. Thats about eleven per cent more in spending.

Prices have increased 106 over the past 12 months in Seattle. 1907 average rate per 1000 of assessed value. For more information about the income tax in these states visit the California and Washington income tax pages.

Washington taxpayers pay 82. This tool compares the tax brackets for single individuals in each state. This compares well to the national average which currently sits at 107.

California property taxes are based on the purchase price of the property. Carl Sagan said Extraordinary claims require extraordinary evidence. State funding for certain school districts.

0862 of a percent to be. Property taxes imposed by the state. Property taxes make up at least 94 percent of the states General Fund which.

So when you buy a home the assessed value is equal to the purchase price. For income taxes in all fifty states see the income tax by state. The study found that Washingtons lowest earners pay 178 percent of their income in state and local taxes compared with 3 percent for the highest earners.

Today Boston has among the lowest city property tax rates in the nation. 21 rows Texas residents also dont pay income tax but spend 18 of their income on real estate taxes. Based on this chart Oregon taxpayers pay 84 of their total income to state and local taxes.

Buying a Home in Seattle. In 1798 Revolutionary War hero Paul Reveres property tax rate was 6 ouch. Tax Policy says in 2011 state plus local expenditures per capita were 9383 for California vs 8459 for Washington state.

03 Included in the 84 sales tax 062 flat rate payroll tax. That 150 difference needs some explaining. In 2018 the Legislature made additional changes to lower the levy rate for taxes in 2019.

To determine the residents with the biggest tax burdens WalletHub compared the 50 states across the three tax types of state tax burdens property taxes individual income taxes and sales and excise taxes as a share of total personal income in the state. State Rate 65 Vancouver Rate 19 Total. Which of the two states.

But the median home there valued at 385500 raises 3104 in property taxes. However the above chart provides a rather crude measurement of comparative state and local tax burdens since everybody is lumped together regardless of income.

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

How School Funding S Reliance On Property Taxes Fails Children Npr

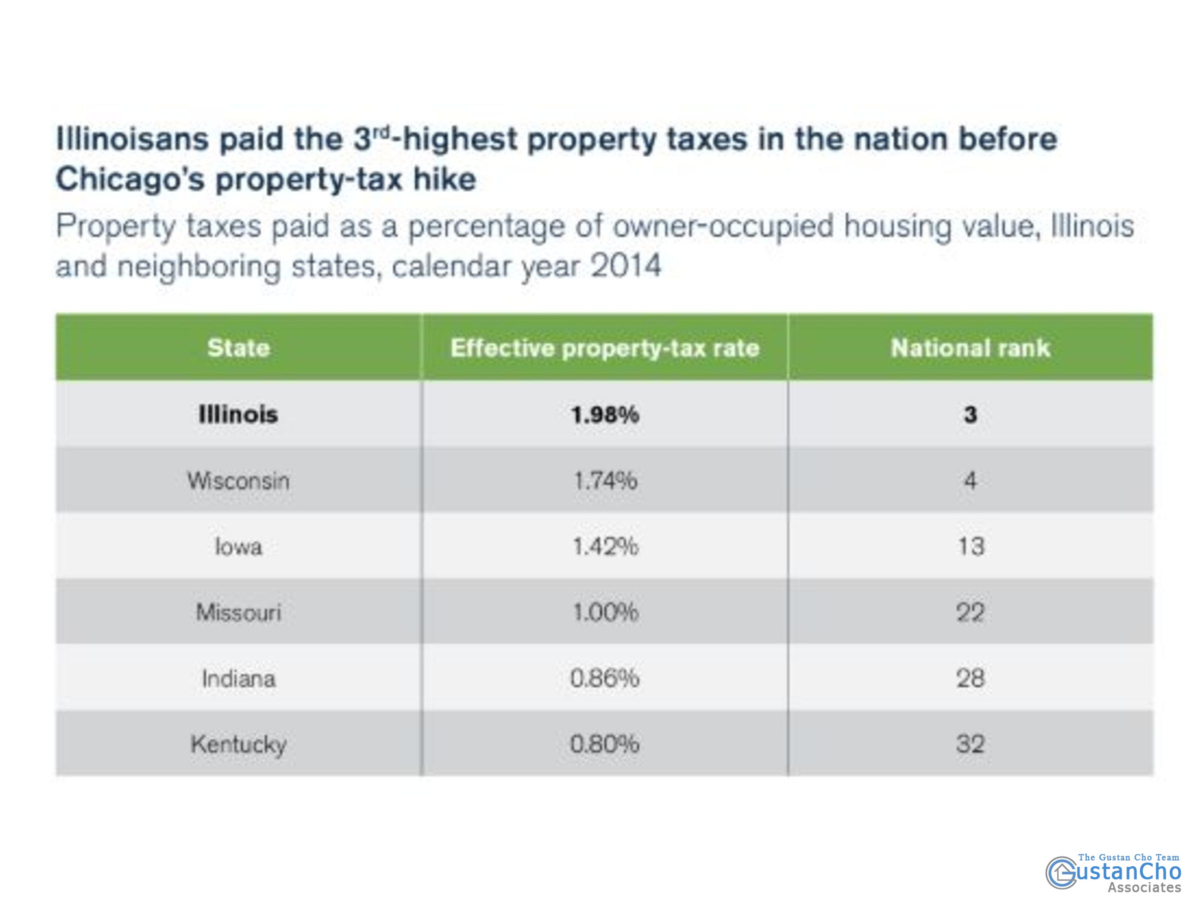

Illinois Ranked As Highest Taxed State In The Nation For Taxpayers

Illinois Ranked As Highest Taxed State In The Nation For Taxpayers

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Florida Property Tax H R Block

Florida Property Tax H R Block

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

States Without Property Tax In 2021 No But Here Are The Best Worst

States Without Property Tax In 2021 No But Here Are The Best Worst

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home