How To Determine Fair Rental Value Of Commercial Property

Both assume that fair rental value is determined at arms length that is objectively and between unrelated parties. To determine how much rent to charge a tenant many landlords use the 1 rule which suggests charging 1 of the homes value for rent.

Commercial Property Manager Resume Samples Commercial Property Manager Resume Interested In Working In Pro Manager Resume Resume Skills Property Management

Commercial Property Manager Resume Samples Commercial Property Manager Resume Interested In Working In Pro Manager Resume Resume Skills Property Management

For homes with five or more bedrooms add 15 of the 4-bedroom price for each additional room.

How to determine fair rental value of commercial property. The GRM also helps you check the rent to value ratio of your commercial property in. Frequently shortened to The Cost Approach this is a much more complicated route of valuing commercial real estate properties. The 50th percentile would be the median price.

Figuring your fair rental value FRV is an essential part of claiming a housing allowance as the federal income tax exclusion is limited to the lesser of. The final step is to then divide the NOI by the average yield rate the amount investors can hope to get as a return at the end of the year. To calculate the value of a commercial property using the Gross Rent Multiplier approach to valuation simply multiply the Gross Rent Multiplier GRM by the gross rents of the property.

Well first you need to determine if the asking price meets the standard of fair market value. Capitalization or cap rate. For commercial property this can range between six and 12 per cent depending on the property type age and location.

To do this you need to know how much the landlord is charging per square foot of space. The amount officially designated in advance as housing allowance. You then research the properties in the immediate vicinity and find out what the going rate per square foot is for those properties.

By design Fair Market Rents are slightly below the median. Property Value Annual Gross Rents x Gross Rent Multiplier 1280000 160000 x 8 GRM In this example using a GRM of 8 a property that generates 160000 per year in gross rental income would be valued at roughly 128 million. 3 Ways to Find Fair Rental Market Value Calculation 1.

The fair market rental value including furnishings and appurtenances such as a garage plus furnishings and utilities. If it is a new-build property the value will be based on the expected annual income. You need to know two things to value commercial properties.

Once you know both of these to determine a. Traditional Media Outlets Local newspapers local advertisements word of. The Replacement Cost Approach.

FMR prices are the 40th percentile rates in an area. Determine the best ways to collect rent from your tenants. FMRs are established by the US.

Divide this by the cap rate 8 and you will come to your fair market value price of 3750000. Department of Housing and Urban Development HUD. The Net Operating Income or NOI and its.

The factors and mechanics applied in determining the fair market rental value will have a significant effect on the final amount of the fair market rent. The amount actually spent on eligible housing expenses. Heres How to Estimate the Value of Commercial Real Estate.

To calculate the property value just reverse the formula. Look up online average GRM for your area and building type. For example a home valued at 220000 would rent for 2200 per month.

Value of Property Gross Rental Income Gross Rent Multiplier. Fair market rents are determined by the propertys size type and location. However there are many factors to consider when setting a rental price such as local rent control laws the cost of similar rentals in the.

The courts have allowed two methods for figuring fair rental value. Calculating the Property Value Using GRM. How to calculate the Gross Rent Multiplier.

Gross Rent Multiplier Value of Property Gross Rental Income. The fair rental value of a furnished property as a whole should be used not the fair rental value of a property plus the fair rental value of the furniture.

U S Commercial Real Estate Valuation Trends

U S Commercial Real Estate Valuation Trends

How To Easily Determine The Market Value Of Commercial Property Phoenix Partners Chartered Surveyor

How To Easily Determine The Market Value Of Commercial Property Phoenix Partners Chartered Surveyor

Should You Spend Money On A Rental Property Renovation Rental Property Property Renovation Real Estate Investment Fund

Should You Spend Money On A Rental Property Renovation Rental Property Property Renovation Real Estate Investment Fund

Set A Fair Market Rent Without Guessing For A Full Review Of Rentfax And Other Pro Rent Estimate Tools Check Being A Landlord Real Estate Investing Investing

Set A Fair Market Rent Without Guessing For A Full Review Of Rentfax And Other Pro Rent Estimate Tools Check Being A Landlord Real Estate Investing Investing

How To Calculate Price Per Square Foot Commercial Lease Austin Tenant Advisors

How To Calculate Price Per Square Foot Commercial Lease Austin Tenant Advisors

U S Commercial Real Estate Valuation Trends

U S Commercial Real Estate Valuation Trends

U S Commercial Real Estate Valuation Trends

U S Commercial Real Estate Valuation Trends

Infographic For New Landlords Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Infographic For New Landlords Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Prepping Your Home For Renting A How To From Landmark Home Warrant Rental Property Management Real Estate Investing Rental Property Rental Property Investment

Prepping Your Home For Renting A How To From Landmark Home Warrant Rental Property Management Real Estate Investing Rental Property Rental Property Investment

Property Valuation Pdf Free Property Valuation Economics Books Time Value Of Money

Property Valuation Pdf Free Property Valuation Economics Books Time Value Of Money

Best Approaches To Commercial Real Estate Valuation

Best Approaches To Commercial Real Estate Valuation

U S Commercial Real Estate Valuation Trends

U S Commercial Real Estate Valuation Trends

5 Best Commercial Real Estate Valuation Methods In 2021

5 Best Commercial Real Estate Valuation Methods In 2021

How To Calculate Commercial Property Cap Rate For Investment Purposes Capitalization Rate Investing Rate

How To Calculate Commercial Property Cap Rate For Investment Purposes Capitalization Rate Investing Rate

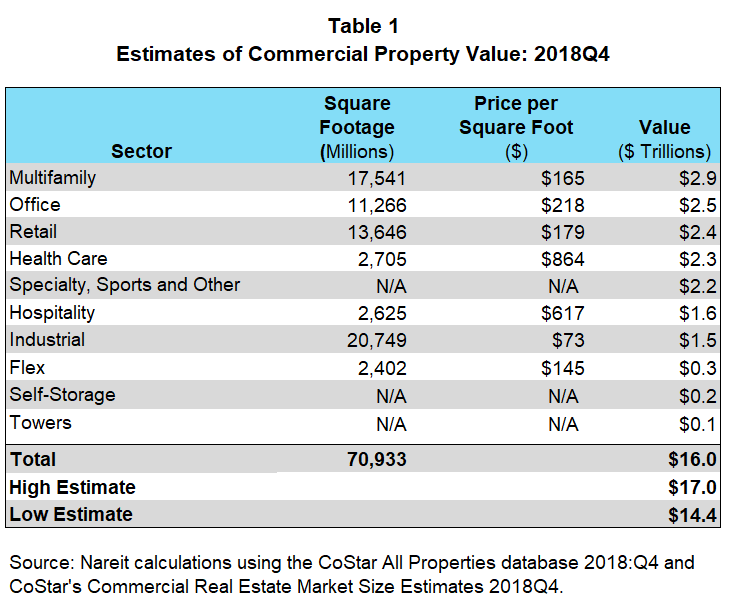

Estimating The Size Of The Commercial Real Estate Market In The U S Nareit

Estimating The Size Of The Commercial Real Estate Market In The U S Nareit

U S Commercial Real Estate Valuation Trends

U S Commercial Real Estate Valuation Trends

6 Important Steps For Renting Commercial Property In India

6 Important Steps For Renting Commercial Property In India

Moveyouroffice Com Real Estate Lease Real Estate Marketing Plan Commercial Real Estate Marketing

Moveyouroffice Com Real Estate Lease Real Estate Marketing Plan Commercial Real Estate Marketing

Here S An Infographic From Legaltemplates Thanks To Them For Submitting This Rental Property Investment Being A Landlord Real Estate Investing Rental Property

Here S An Infographic From Legaltemplates Thanks To Them For Submitting This Rental Property Investment Being A Landlord Real Estate Investing Rental Property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home