How To Claim Federal Carbon Tax Rebate

This can be done by dealing with the IRD directly or through a Tax Agent. The study by the fiscally-conservative think tank also disputes federal estimates last year that a 170-per-tonne carbon tax in 2030 will lead to a very small reduction in Canadas annual.

A Plan For Tax Fairness United For A Fair Economy

A Plan For Tax Fairness United For A Fair Economy

Although part of the same program each area has its own specificities and energy-related issues and the charges and rebates for each one of them take this into account.

How to claim federal carbon tax rebate. Lets take a closer look at some of the benefits of the solar tax credit and how you can claim it. To claim a tax refund a personal tax summary must be filed. Asked about OTooles claim that his carbon pricing system wasnt a carbon tax the MP said If it quacks like a duck looks like a duck and smells like a duck its a duck.

Reduces your individual carbon footprint. Many people have questions about how the new law impacts their families and businesses. Now it will increase by 15 per tonne beginning in 2023 until it reaches 170 per tonne.

History and will allocate 22 trillion in support to individuals and businesses affected by the pandemic and economic downturn. The best part is that you can claim both the rebate and the federal tax credit together. Three months in 2020 January to March and 12 months April 2020-March 2021.

Reduces our use of coal and other fossil fuels. Tapping the sun for power offers several benefits. Claim your Carbon Tax Rebate when you file your Income Tax return.

By using 200 pages of weasel words they somehow argued that carbon tax is not a tax to get around that. The federal Liberal government will begin levying its carbon tax on greenhouse gas-emitting fuels today in the four provinces that have refused to take part in the pan-Canadian climate framework. Under the Coronavirus Aid Relief and Economic Security CARES Act up to 1200 rebates are provided for individuals 2400 for joint filers with an additional 500 for each qualifying child with the.

The carbon tax rebate in Alberta will work similarly as in the other provinces with a federally imposed carbon tax. Carbon taxes are a form of carbon pricing. The federal carbon tax is not a tax says Gideon Forman Climate Change and Transportation Policy Analyst for the David Suzuki Foundation.

However the first rebate payment claimed by Albertans will account for a 15-month period. Congresss latest coronavirus relief package the Coronavirus Aid Relief and Economic Security CARES Act is the largest economic relief bill in US. Who qualifies for carbon tax rebate.

Tax benefits of going solar. Federal carbon tax rebates in Canada. A carbon tax is a tax levied on the carbon content of goods and services predominantly in the transport and energy sectorsCarbon taxes intend to reduce carbon dioxide CO 2 emissions by increasing prices thereby decreasing demand for such goods and services.

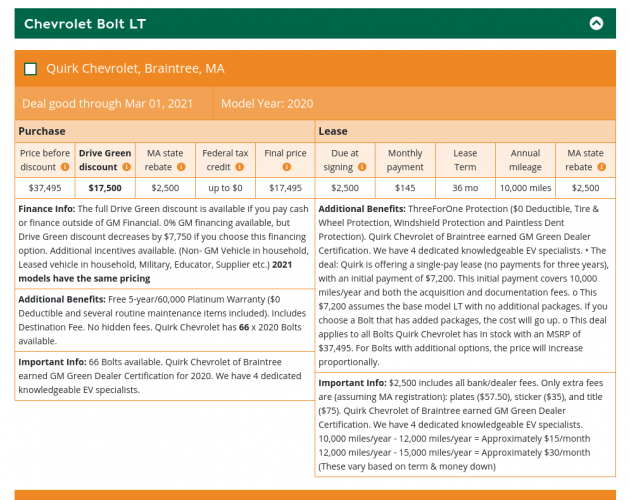

Like the federal tax credit the amount of the cash rebate is determined by how dependent the vehicle is on gasoline. The Climate Leadership Council estimates its carbon tax would finance 2000 in carbon dividends a year for a family of four and the 80 lowest-income families end up better off. To offset this you can claim a supplementary benefit equal to 10 percent of your.

Mar 27 2021 0819 34 The SCC violated the constitution because it allowed a tax to be unevenly applied across the country. Americans are receiving rebate checks as part of the federal governments economic response to the COVID-19 crisisbut in a few states at least some of those checks could be taxed. So now any tax can be referred to as a pricing mechanism and applied differently in each province.

The federal government owes Canadian families in three provinces more than 200 million after underestimating how much it would raise from the carbon tax during the first year of. For example solar power. For Doug Ford the Court decision is the excuse he needs to move on.

Residents in rural areas will receive 10 more than residents who live in cities. Kenneys claim carbon tax damaged Alberta economy is refuted in court documents The new federal carbon levy will start at 20 per tonne increasing to 30 per tonne in April and 50 per tonne by 2022. The federal carbon tax was initially set to increase by 10 a tonne until it reached 50 per tonne in 2022.

Canadas Climate Action Revenue Incentive Program is a new initiative to combat climate change. David Gordon Wilson first proposed a carbon tax in 1973. The five provinces under the federal carbon tax are Ontario Manitoba Saskatchewan Alberta and New Brunswick.

The battle against the carbon tax has burned up a lot of time resources and energy and the premiers have now wrung from it about as much benefit as theyre going to get. And will pay more than your share of the fees levied by carbon pricing. If a personal tax summary is requested in a situation where tax would be owing a debt is created so correct calculations prior to this request are important and these core services are offered by third party.

Based on province a family of four could receive up to 600 in 2019. Unlike previous cases when the government proposed major policy changes it has not released any quantitative economic analyses of the impacts of the plan except to claim that the policy will. If President Biden wants a tax that helps the poor defrays the deficit and combats climate change there is one waiting in the wings.

The rebate can be claimed after the electric vehicle is successfully purchased or leased. The The federal governments Healthy Environment and Healthy Economy HEHE plan includes a 170-per-tonne carbon tax to be phased in over 9 years. Ontarians for example are increasingly of the view that the carbon tax makes sense.

Wisconsin Solar Incentives Rebates And Tax Credits Sunrun

Wisconsin Solar Incentives Rebates And Tax Credits Sunrun

30 Federal Tax Credit For Solar Panels And Solar Pool Heaters

30 Federal Tax Credit For Solar Panels And Solar Pool Heaters

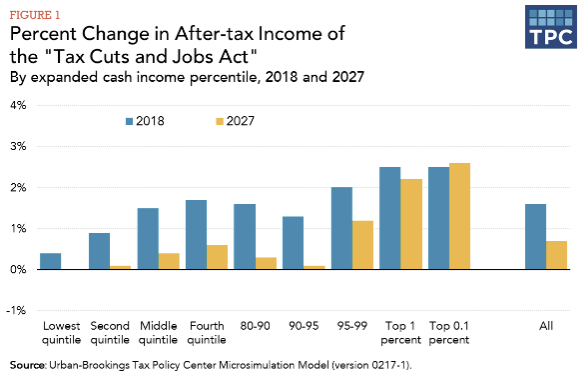

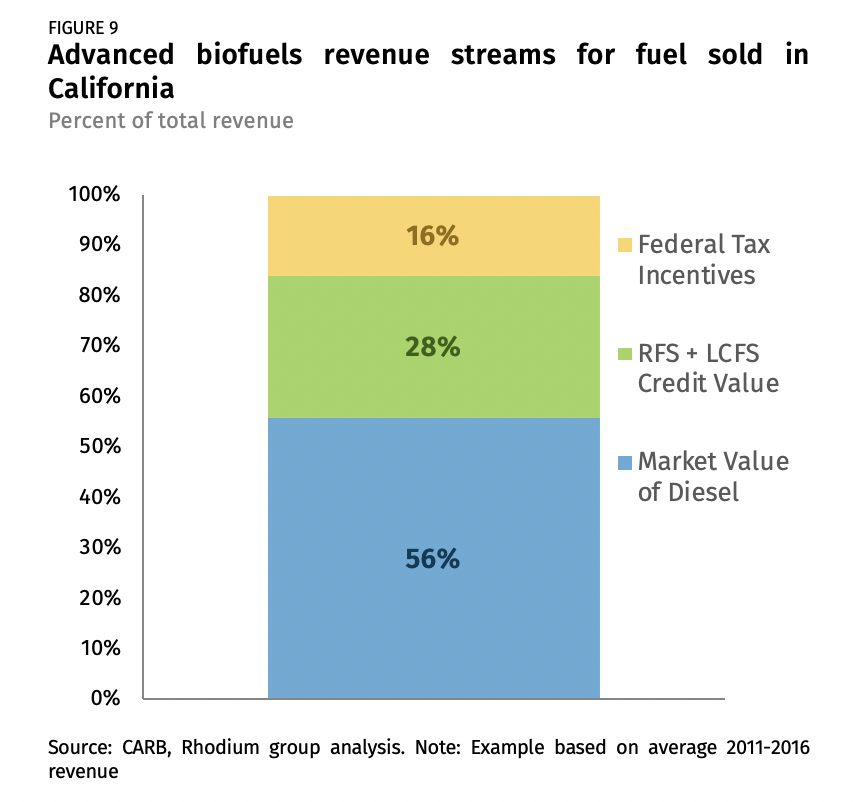

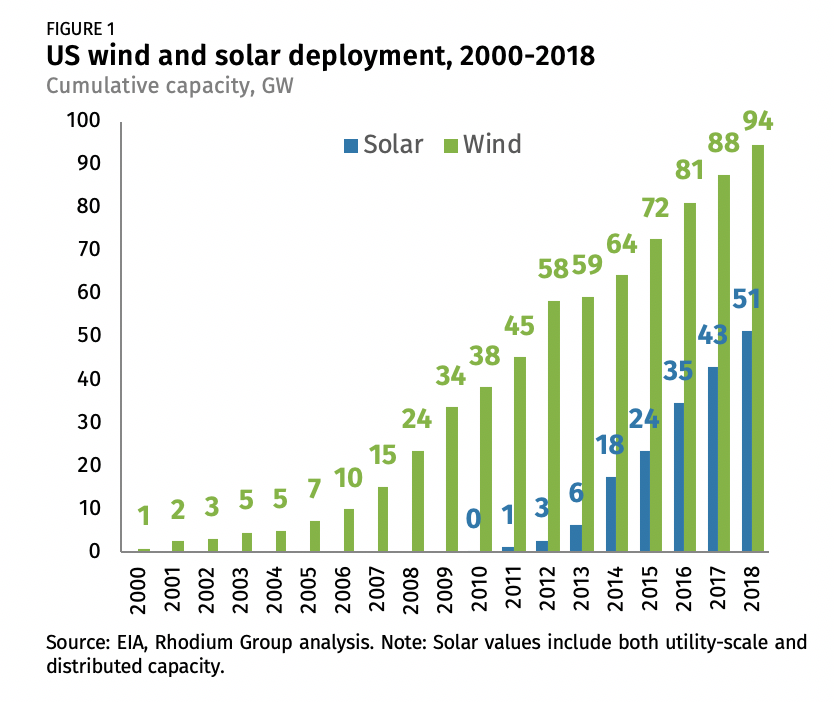

Can Tax Credits Tackle Climate Rhodium Group

Can Tax Credits Tackle Climate Rhodium Group

The Alliance For Green Heat Federal Tax Incentives For Wood And Pellet Stoves Sustainable Local And Affordable Heating

The Itc Awakens What The Extension Of A Key Federal Tax Credit Means For Solar Gtm Squared Federal Taxes Tax Credits Solar

The Itc Awakens What The Extension Of A Key Federal Tax Credit Means For Solar Gtm Squared Federal Taxes Tax Credits Solar

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

26 Solar Investment Tax Credit Good Energy Solutions

26 Solar Investment Tax Credit Good Energy Solutions

Federal Tax Incentives May Be Next For E Bikes

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Why Added Federal Tax Incentives For Evs Are Ridiculous In 2021 Torque News

Why Added Federal Tax Incentives For Evs Are Ridiculous In 2021 Torque News

Solar Renewables Investment Tax Credit

Solar Renewables Investment Tax Credit

Can Tax Credits Tackle Climate Rhodium Group

Can Tax Credits Tackle Climate Rhodium Group

Renewable Energy Will Be Consistently Cheaper Than Fossil Fuels By 2020 Report Claims Renewable Energy Wind Power Fossil Fuels

Renewable Energy Will Be Consistently Cheaper Than Fossil Fuels By 2020 Report Claims Renewable Energy Wind Power Fossil Fuels

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

The Federal Geothermal Tax Credit Your Questions Answered

The Federal Geothermal Tax Credit Your Questions Answered

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home