How To Check My Property Tax Bill Online

Your property tax account number. ENTER ONE OF THE FOLLOWING TO VIEW PROPERTY TAX RECORDS.

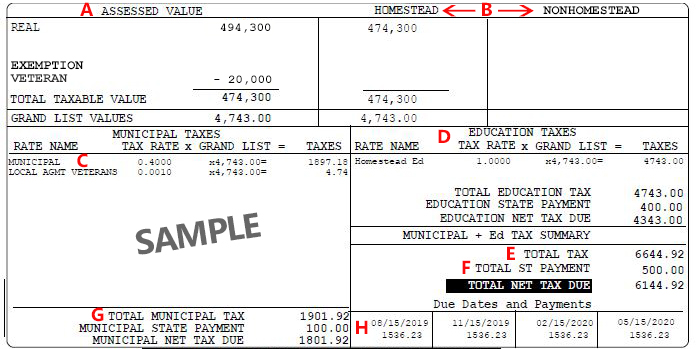

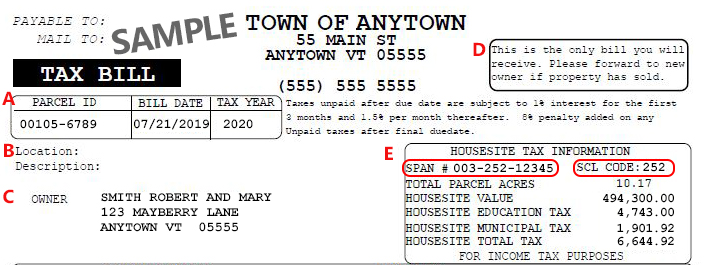

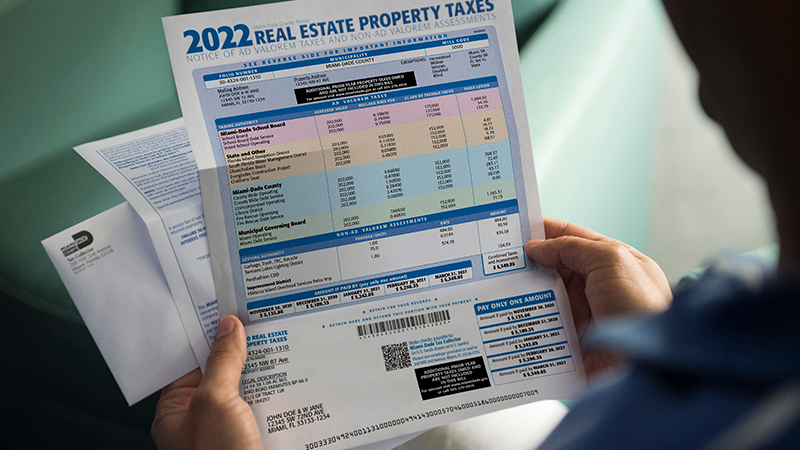

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Real Estate Tax Payment PAMS offers customers an easy and secure way to view print and pay their Real Estate Tax bills online.

How to check my property tax bill online. Property tax bills and receipts contain a lot of helpful information for taxpayers. If you have further questions please contact our office at 951955-3900 or e-mail your questions to. Property Tax Appeal Board Refunds.

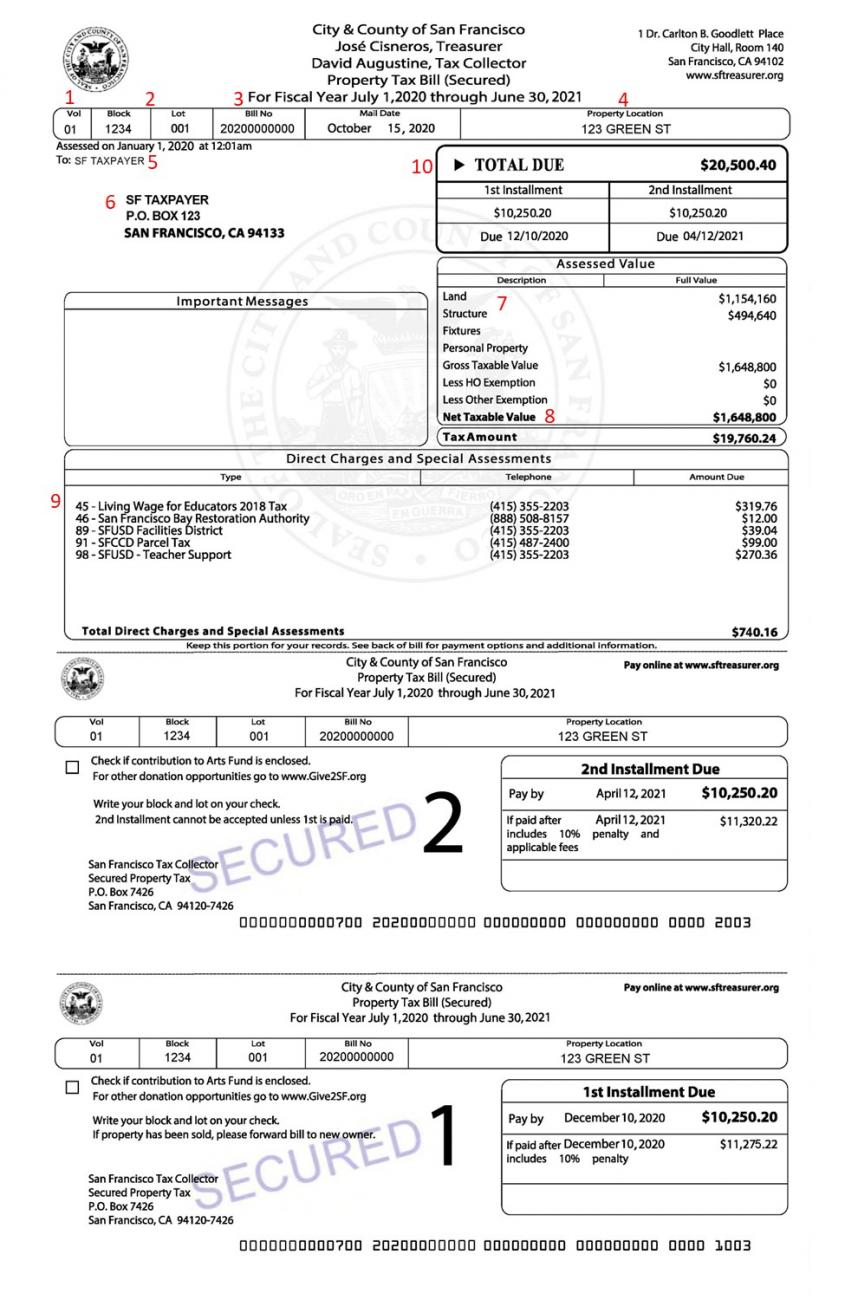

You can select property tax records to view andor make payment on-line by credit card or automatic deduction from your bank account as appropriate. You can always download and print a copy of your Property Tax Bill on this web site. For Unsecured Property Tax Bills each PIN.

Create or view your account. Property Tax Information Using the tax bill search you can browse billing and payment information for real estate personal business and motor vehicle accounts and select accounts to pay online. If a bank or mortgage company pays your property taxes they will receive your property tax bill.

Search for your bill using parcelbill number mailing address or unsecured bill number. And enter your Assessors Identification Number. Receive your bill by email.

When searching for an unsecured bill for businesses boats airplanes etc please search by the 4-digit year and 6-digit bill number. We encourage everyone to use other payment methods such as online eCheck and creditdebit card payments telephone creditdebit card payments or mail in your payment. Five months elapse before real property owners can be penalized for non-payment of taxes.

IMPORTANT - Property Tax Payments We are not accepting in-person property tax payments at this time. Statements of vehicle property taxes paid to the NC DMV at the time of registration are not available on the Countys web site. All tax payments are due before April 1 at which time the taxes become delinquent and additional charges will apply.

Go to your cart check out and pay your bill. To locate the amount of your Secured Property Taxes click the following link How much are my property taxes. Payment plan details if you have one.

Your check number. The Senior Citizen Real Estate Tax Deferral Program. This website provides current year and delinquent secured tax information.

You will need to use a Personal Identification Number PIN which is printed on both Secured and Unsecured Property Tax Bills. Your banks ABA routing number from your check Your checking account number. Use this convenient online service to view details about your tax bill upcoming due dates balances and more.

When searching for a current secured defaulted supplemental or escape bill please search either by the parcel number or the current mailing address. Your balance details by year. Each eCheck transaction is limited to 99999999.

Florida Statute 197162 offers taxpayers a discount paying their taxes early. As a reminder there is no cost for e-Check payments online. Beyond the amount of taxes you owe the bills indicate where your taxes are going and how much more is being collected by your local governments each year.

Services for Seniors Exemptions. There is no cost to you for electronic check eCheck payments. The Tax Office accepts e-checks credit cards and debit cards for online payment of property taxes.

You do not need to request a duplicate bill. To pay by e-Check you must have the following information. If you lost the original bill and are making a payment you can pay electronically or print out and send in the online copy with your tax payment.

The amount you owe updated for the current calendar day. Tax notices are mailed on or before November 1 of each year. The information on the bill can also help you determine whether your assessment is accurate.

PAMS in partnership with Invoice Cloud accepts ACHelectronic check electronic fund transfer from your checking or savings account and creditdebit card payments of bills. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. Your payment history and any scheduled or pending payments.

Digital copies of select notices from the IRS. You can access this new web site by clicking the link below or by directing your browser to. Key information from your most recent tax return.

Bills are generally mailed and posted on our website about a month before your taxes are due. Current year is available between October 1 and June 30 only. For Secured Property Tax Bills each PIN is unique for each Assessors Identification Number AIN.

ITS THE BEST WAY. It offers premium security and ease of use. Request tax deferral for seniors military.

Paying by e-check is free fast and easy. Your telephone number. Search your property tax history.

Your Economic Impact Payments if any. Your Secured Property Tax Bill contains your Assessors Identification Number AIN and Personal Identification Number PIN which you will need to complete the transaction. The payment amount.

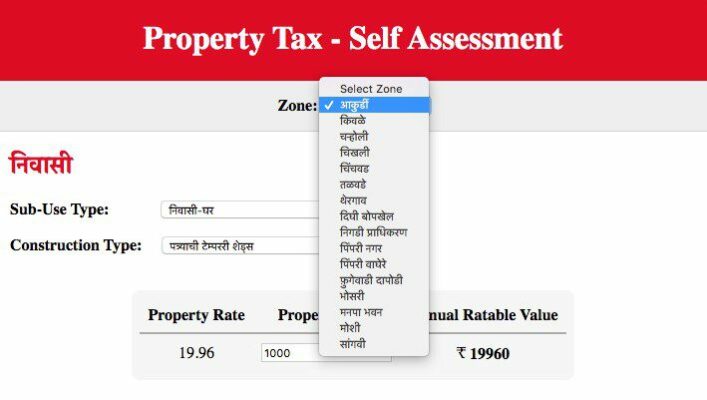

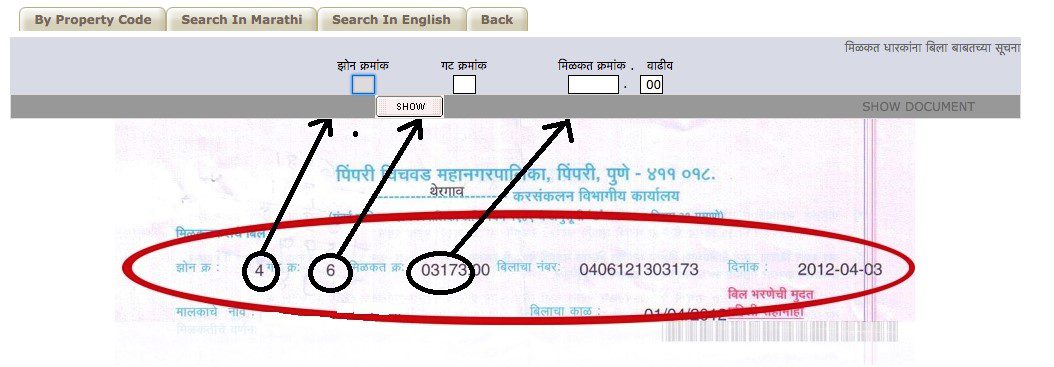

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Current Payment Status Lake County Il

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

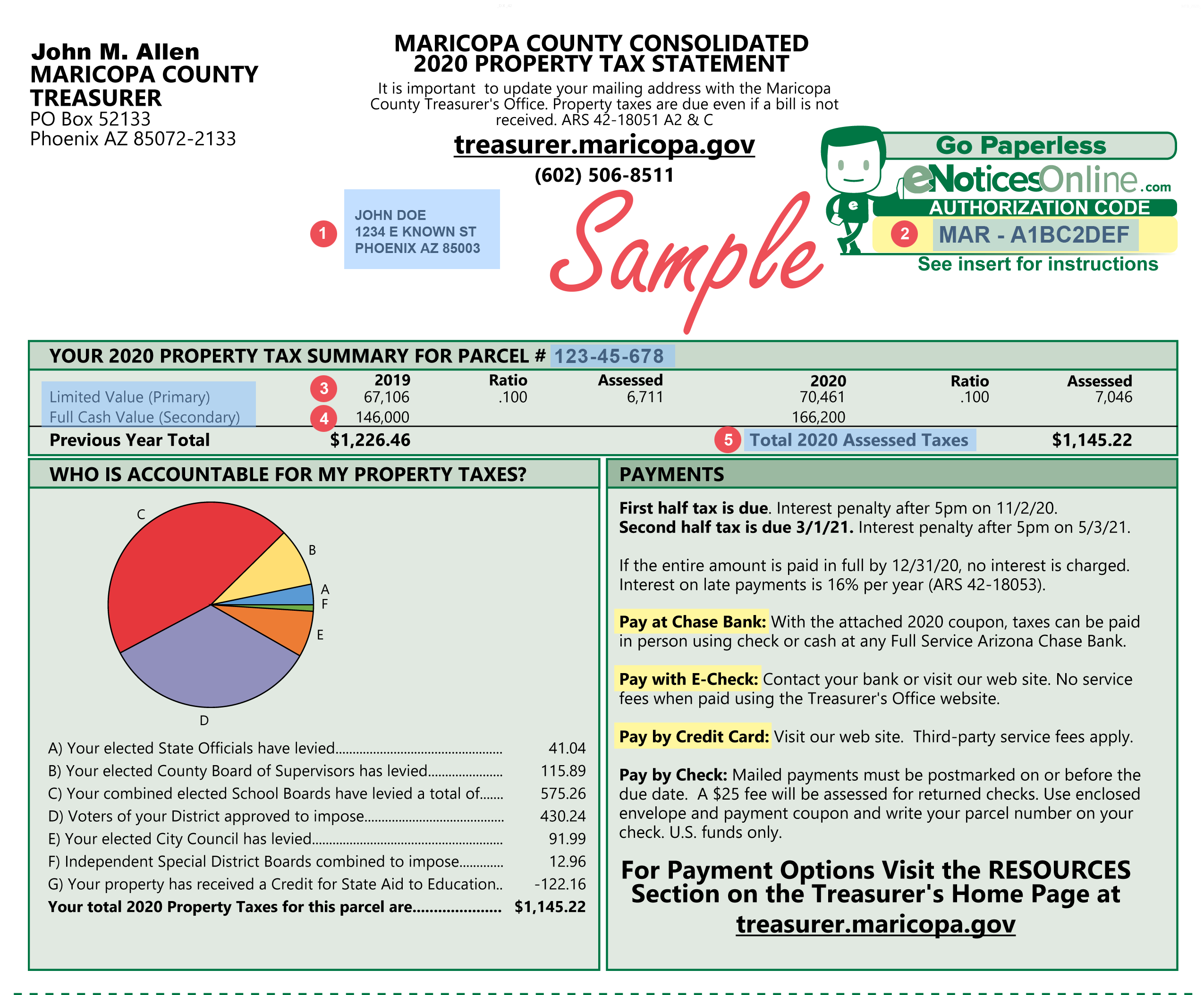

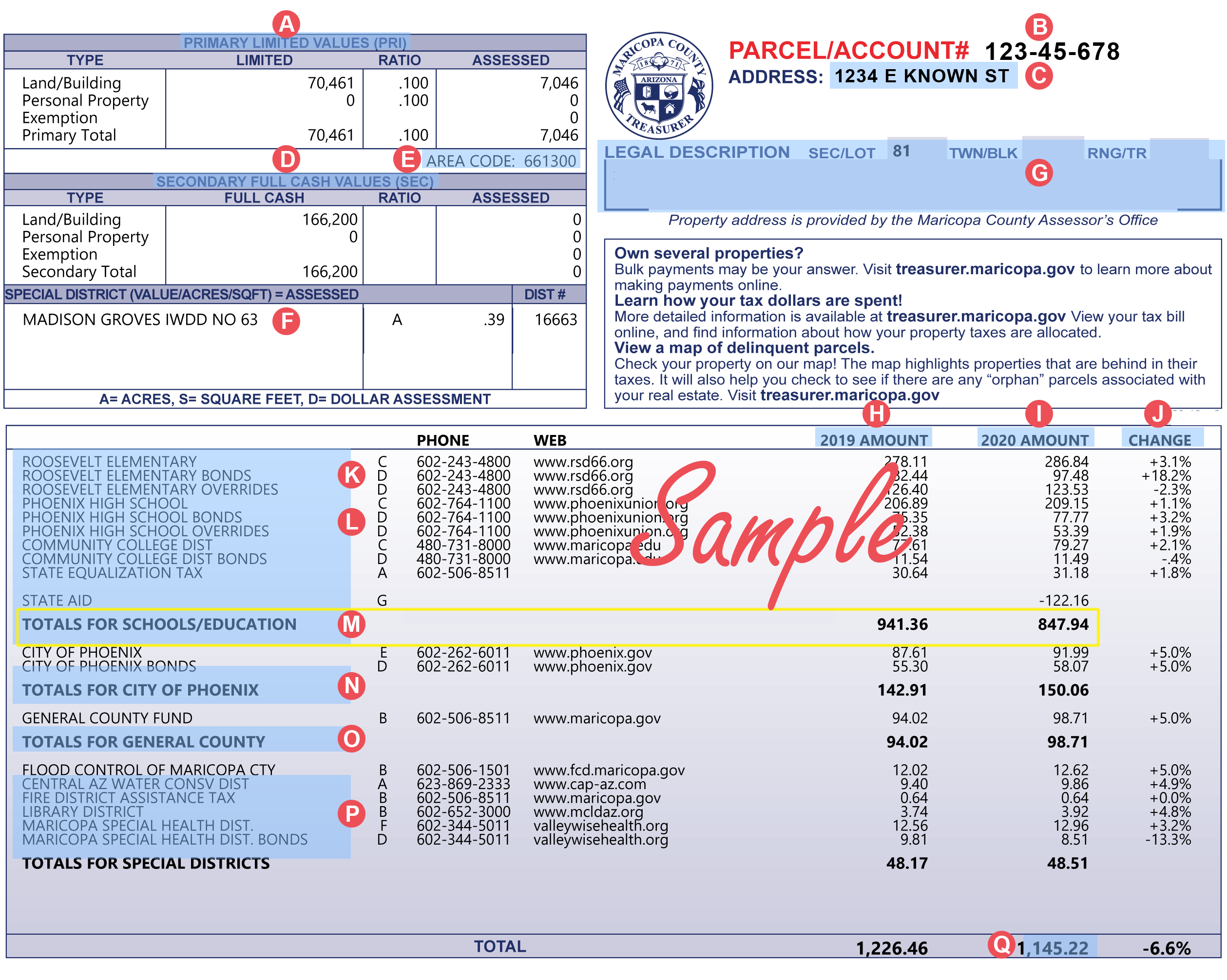

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

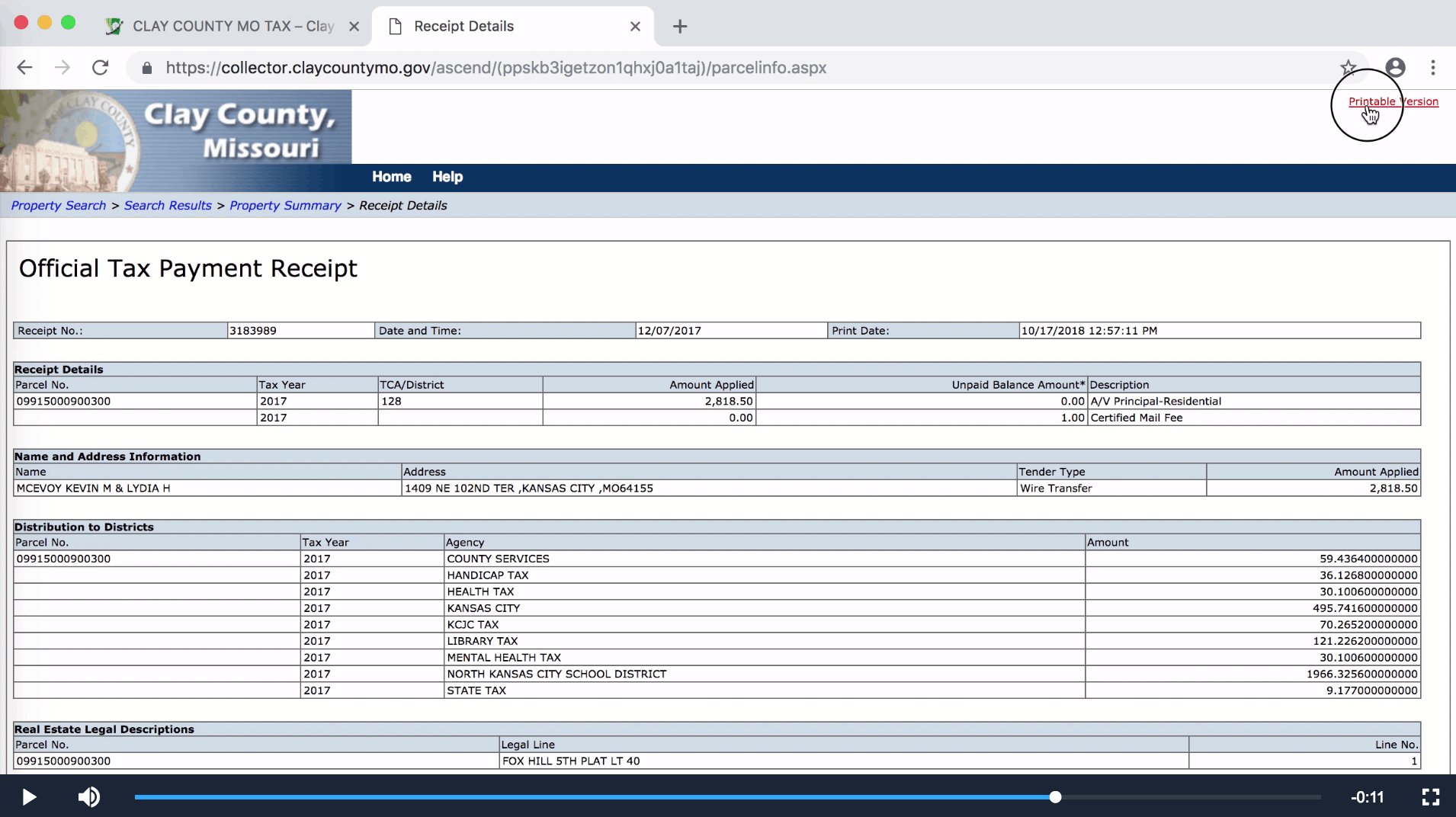

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

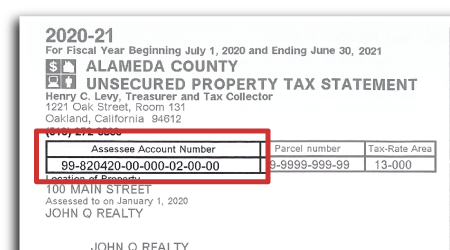

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Search Unsecured Property Taxes

Search Unsecured Property Taxes

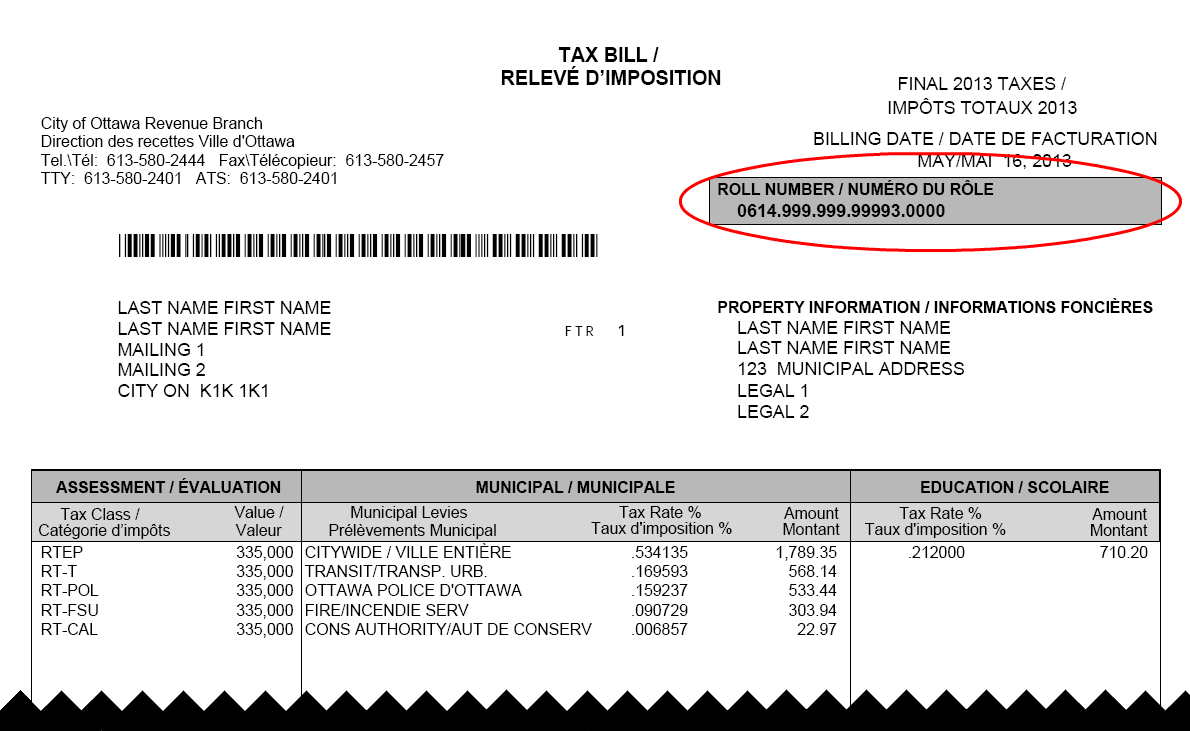

Pay Your Tax Bill City Of Ottawa

Pay Your Tax Bill City Of Ottawa

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home