Property Tax Sale Bexar County

For more information on property values call BCAD at 210-242-2432. Browse data on the 37867 recent real estate transactions in Bexar County TX.

Http Www Bexar Org Agendacenter Viewfile Agenda 06242014 155

Pecos La Trinidad.

Property tax sale bexar county. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a. If you would like to download a PDF of the full list of foreclosure notices click here. Northeast - 3370 Nacogdoches Rd.

Bexar County Property Tax Rate Information As mentioned the average Bexar County property tax rate is a bit higher than that of the state sitting at 199. Properties are now auctioned between the Bexar County Courthouse and the Paul Elizondo Tower near the intersection of E. This table shows the total sales tax rates for all cities and towns in Bexar County including all local taxes.

The Bexar Appraisal District identifies the property to be taxed determines its appraised value whether to grant exemptions the taxable owner and mailing address and which taxing jurisdictions may tax the property. The total sales tax rate in any given location can be broken down into state county city and special district rates. Search land for sale in Bexar County TX.

Texas law authorizes the sale of tax deed properties at the Bexar County tax deed sale auction on the first Tuesday of each month. Electronic payments will be pending until it clears from your bank account. Find lots acreage rural lots and more on Zillow.

Texas has a 625 sales tax and Bexar County collects an additional NA so the minimum sales tax rate in Bexar County is 625 not including any city or special district taxes. The buyer of the tax lien has the right to collect the lien plus interest based on the official specified interest rate from the property owner. Palacios CPA PCC Chief Deputy of Financial Reporting Department and Operations Marilyn Gonzales Director Motor Vehicle Registration Department.

Bexar County Tax Assessor-Collector. Enjoy the pride of homeownership for less than it costs to rent before its too late. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Zillow has 4934 homes for sale in Bexar County TX. Downtown - 233 N.

Explore Texas Read Texas FAQ. Main Avenue on the first Tuesday of each month. The certificate is then auctioned off in Bexar County TX.

These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more. Search for county information. When a Bexar County TX tax lien is issued for unpaid past due balances Bexar County TX creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties.

Northwest - 8407 Bandera Rd. Future Sales are properties that have had a tax judgment taken against them but are currently not scheduled for a tax sale. The Bexar County Appraisal District BCAD sets property values and is a separate organization from the Bexar County Tax Assessor-Collectors office.

Tax Delinquent Tax Lien. Bexar County Payment Locations. Gutierrez PCC Director Property Tax Department Richard Salas Esq.

Property Tax Payment Options. Bexar County collects on average 212 of a propertys assessed fair market value as property tax. Explore sales in our major states.

Great for discovering comps sales history photos and more. Southside - 3505 Pleasanton Rd. Unpaid real estate taxes creates a.

However the city of San Antonio which accounts for a large portion of Bexar County and is one of the biggest cities in Texas has an average rate of 274. The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. There are currently 829 red-hot tax lien listings in Bexar County TX.

Nueva Street S. Bexar County has one of the highest median property taxes in the United States and is ranked 282nd of the 3143 counties in order of median property taxes. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

For your convenience the Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check eCheck. Lisa Anderson PCC Chief Deputy of Administration and Operations Stephen W. Bexar County Texas relies on the revenue generated from real estate property taxes to fund daily services.

What Happens During A Property Tax Foreclosure Sale

What Happens During A Property Tax Foreclosure Sale

Bexar County Cancels July S Foreclosure Sale Due To Covid 19

Bexar County Cancels July S Foreclosure Sale Due To Covid 19

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Http Www Bexar Org Agendacenter Viewfile Agenda 07082014 159

Https Www Sanantonio Gov Portals 0 Files Nhsd Tif Agreements T11 Cedarstreettownhomes Pdf

Evictions Property Tax Foreclosures In Bexar County Suspended Due To Covid 19 Concerns The Daily

Evictions Property Tax Foreclosures In Bexar County Suspended Due To Covid 19 Concerns The Daily

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

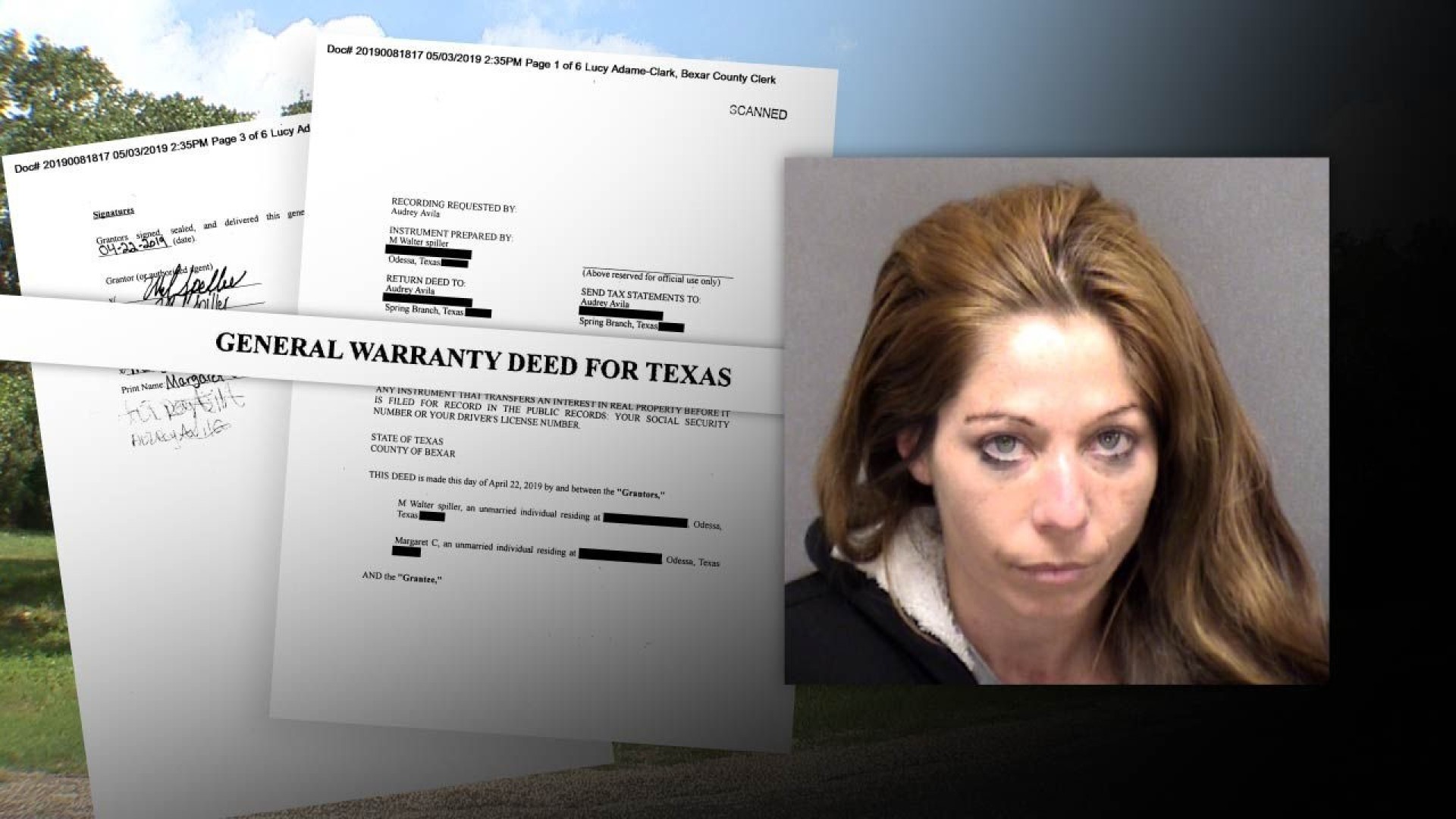

Squatter Accused Of Forging Signatures Of Dead Couple On A Fake Deed So Why Wasn T She Charged

Squatter Accused Of Forging Signatures Of Dead Couple On A Fake Deed So Why Wasn T She Charged

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Https Www Bexar Org Documentcenter View 16077 Bexar County Comprehensive Vehicle Policy Pdf

Taxes And Incentives Bulverde Spring Branch Texas Edf

Bexar County Tx Official Website

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Https Www Sanantonio Gov Portals 0 Files Nhsd Tif Agreements T30 Claystreethomes Pdf

Property Tax Information Bexar County Tx Official Website

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Property Tax Information Bexar County Tx Official Website

Http Www Bcad Org Data Uploaded File Pdfs 50 290 Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home