Lowest Property Tax County In Ohio

But the median home there valued at 385500 raises 3104 in property taxes. 60 rows The tax bills are lowest in Cleveland East Cleveland Linndale Maple.

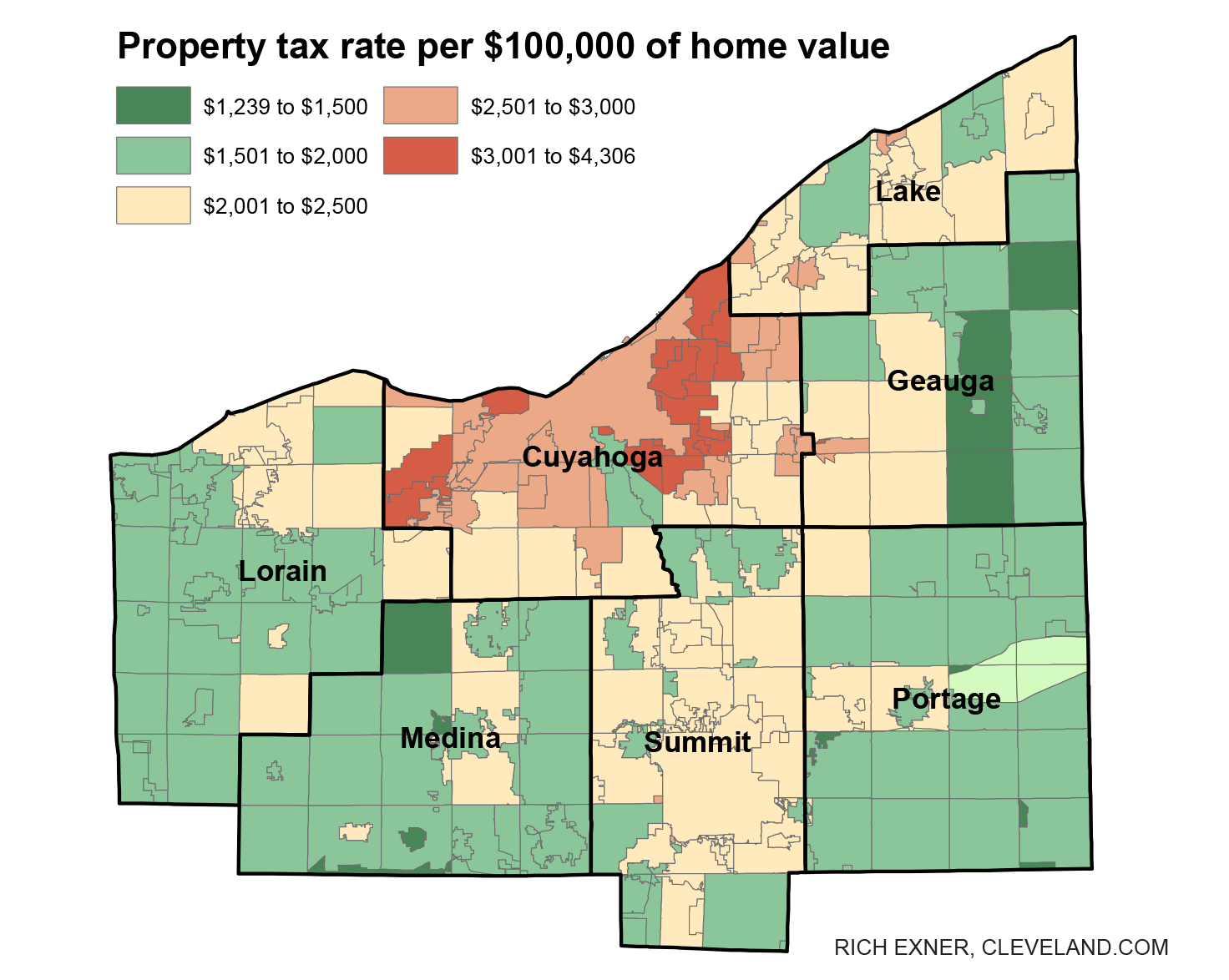

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

One of the lowest effective rates in the county can be found in Oxford within the Talawanda school district where the property tax bill for a.

Lowest property tax county in ohio. Lake County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of median home value yearly in property taxes while Monroe County has the lowest property tax in the state collecting an average tax of 69200 08 of median home value per year. 89 rows To find detailed property tax statistics for any county in Ohio click the countys name in.

County Name Tax Rate. Lucas County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. 73 rows And in Garfield Heights the typical bill is actually one of the lowest in the.

Lorain Property Tax Rates. Real Estate Info Taxes Real Estate Info Property Taxes The Greene County Real Estate Department maintains information on more than 73000 parcels of real estate and serves as the records which form the basis for the appraisal and tax assessment functions of the auditor. The median property tax also known as real estate tax in Lucas County is 202000 per year based on a median home value of 12240000 and a median effective property tax rate of 165 of property value.

Portage Property Tax Rates. The median property tax also known as real estate tax in Lake County is 243300 per year based on a median home value of 15810000 and a median effective property tax rate of 154 of property value. The average rate there is 1033 per 100000 of home value or just 38 percent of Cuyahoga Countys average rate.

Summit Property Tax Rates. Ashtabula Property Tax Rates. The highest rates are in Cuyahoga County where the average effective rate is 244.

The cost of living in Canfield is 38 less than the Ohio average and 128 less than the national average. The county with the lowest rate is Lawrence County which has an average effective rate of 087. Here are the reports for the seven counties.

If youre looking to move to the Buckeye State despite the slightly high property taxes check out our guide to. CLEVELAND Ohio - Garfield Heights now has the highest property tax rate in Northeast Ohio with homeowners paying 4135 a year per 100000 of. The median household income is 75556 and the median housing value is 167600.

Rates are the lowest on average in Lawrence County in southern Ohio. Lake Property Tax Rates. But in California the tax rate is much lower at 081 the 34th lowest in the US.

Geauga Property Tax Rates. This Mahoning County town of 7471 residents is marked by low crime rates a fairly low cost of living and close proximity to multiple local amenities. The exact property tax levied depends on the county in Ohio the property is located in.

Cuyahoge Property Tax Rates.

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Tax Rates Across The State

Colorado S Low Property Taxes Colorado Fiscal Institute

Colorado S Low Property Taxes Colorado Fiscal Institute

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Attom Data Solutions Releases 2020 Property Tax Analysis Rismedia

Attom Data Solutions Releases 2020 Property Tax Analysis Rismedia

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Easyknock The Guide To Georgia Property Tax Rates And Options

Easyknock The Guide To Georgia Property Tax Rates And Options

The Average Property Tax Rate In Kent County Is 0 49 Compared To Surrounding Property Tax Rates You Will Save In Dover Del Tax Retirement Benefits Delaware

The Average Property Tax Rate In Kent County Is 0 49 Compared To Surrounding Property Tax Rates You Will Save In Dover Del Tax Retirement Benefits Delaware

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Property Taxes How Much Are They In Different States Across The Us

Property Taxes How Much Are They In Different States Across The Us

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home