How Do You Calculate Property Tax In Georgia

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia. The median property tax on a 19420000 house is 194200 in Gwinnett County.

Georgia has a 4 statewide sales tax rate but also has 310 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3523 on top of the state tax.

How do you calculate property tax in georgia. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Before sharing sensitive or personal information make sure youre on an official state website. Georgia Mortgage Intangibles Tax Calculator.

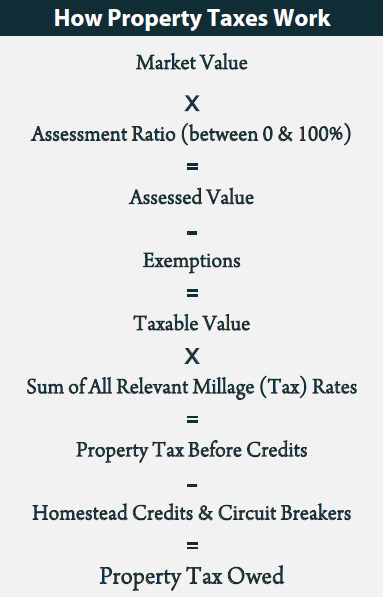

160 rows The amount of property taxes you pay in Georgia depends on the assessed value of your home which is based on but not equal to your homes market value. 100000 x 40 40000 Exemptions such as a homestead exemption reduce the taxable value of your property. To use this tool you will need your cars.

The property value is the full market value appraised by the Assessors. So if your home is worth 200000 and your property tax rate is. This tax is based on the value of the vehicle.

If you live in Alpharetta Roswell Milton College Park East Point you need to figure what the city taxes are in addition to the county tax. State of Georgia Transfer Tax. Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property.

Millage rates are typically expressed in mills with each mil acting as 11000 of 1000 of property value or 1 total. To arrive at the assessed value an assessor first estimates the market value of. Atlanta Title Company LLC 945 East Paces Ferry Road Suite 2250 Resurgens Plaza Atlanta GA 30326.

The tax applies to realty that is sold granted assigned transferred or conveyed. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To calculate your estimated taxes you will add up your total tax liability for the yearincluding self-employment tax income tax and any other taxesand divide that number by four.

Local state and federal government websites often end in gov. All property in Georgia is taxed at an assessment rate of 40 of its full market value. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Gwinnett County.

The median property tax on a 19420000 house is 161186 in Georgia. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. 160 rows Georgia Property Tax Since counties and cities collect real estate taxes and assess.

The median property tax on a 19420000 house is 203910 in the United States. Millage can be thought of as a proportional system of measure. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. A property selling for 55000000 would incur a 55000 State of Georgia Transfer Tax. To determine assessed value assessors in each county first appraise every home in the county in order to figure out the market value of each piece of real estate.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free Georgia Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Georgia. The cities of Atlanta Sandy Springs and Johns Creek have their taxes billed along with the Fulton County tax bills. The Department of Revenue offers a Georgia sales tax calculator that allows residents to calculate their Title Ad Valorem Tax on a vehicle.

Our Georgia Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Georgia and across the entire United States. This means that depending on your location within Georgia the total tax you pay can be significantly higher than the 4 state sales tax.

Georgia Retirement Tax Friendliness Retirement Calculator Property Tax Financial

Georgia Retirement Tax Friendliness Retirement Calculator Property Tax Financial

Property Tax City Of Commerce City Co

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

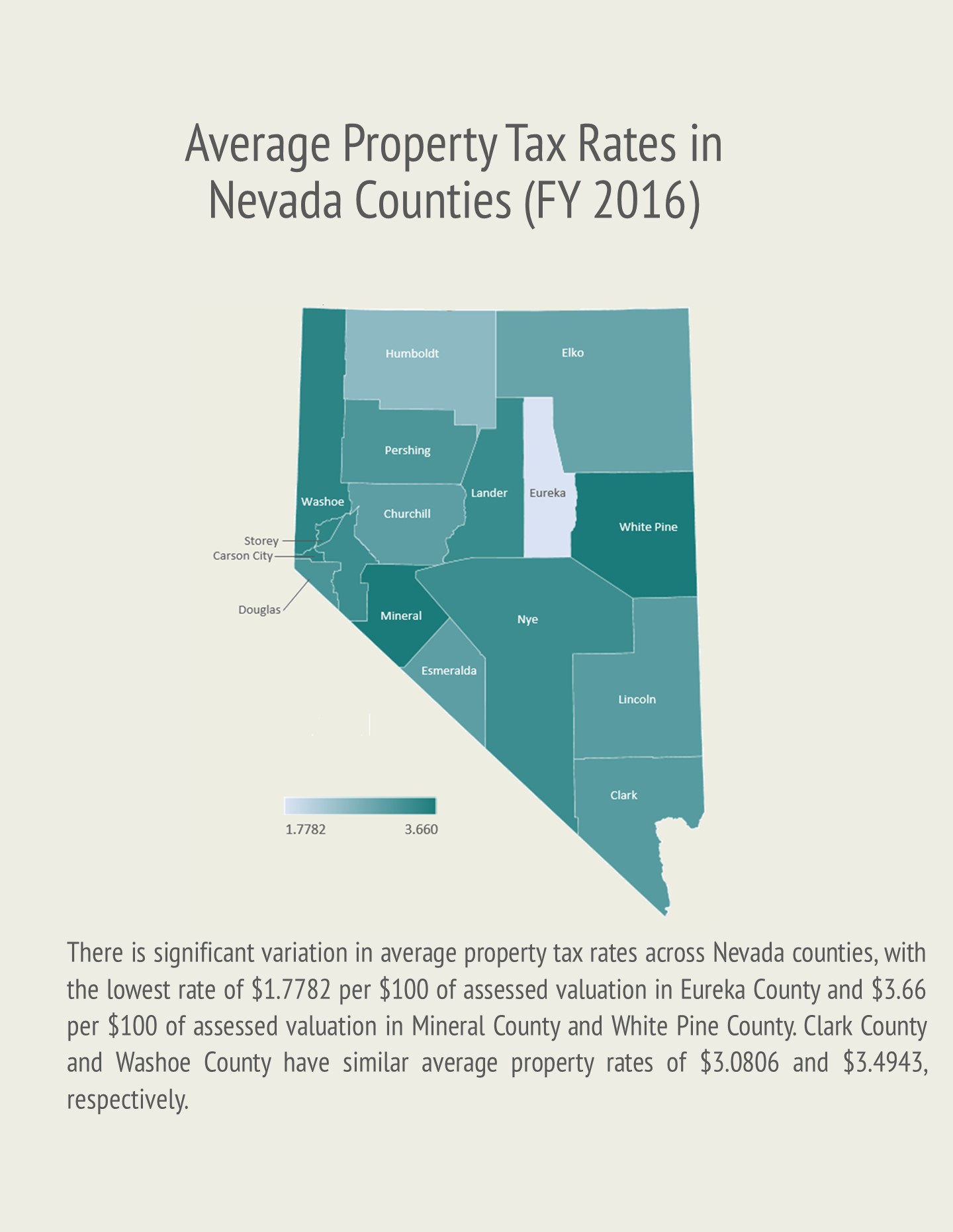

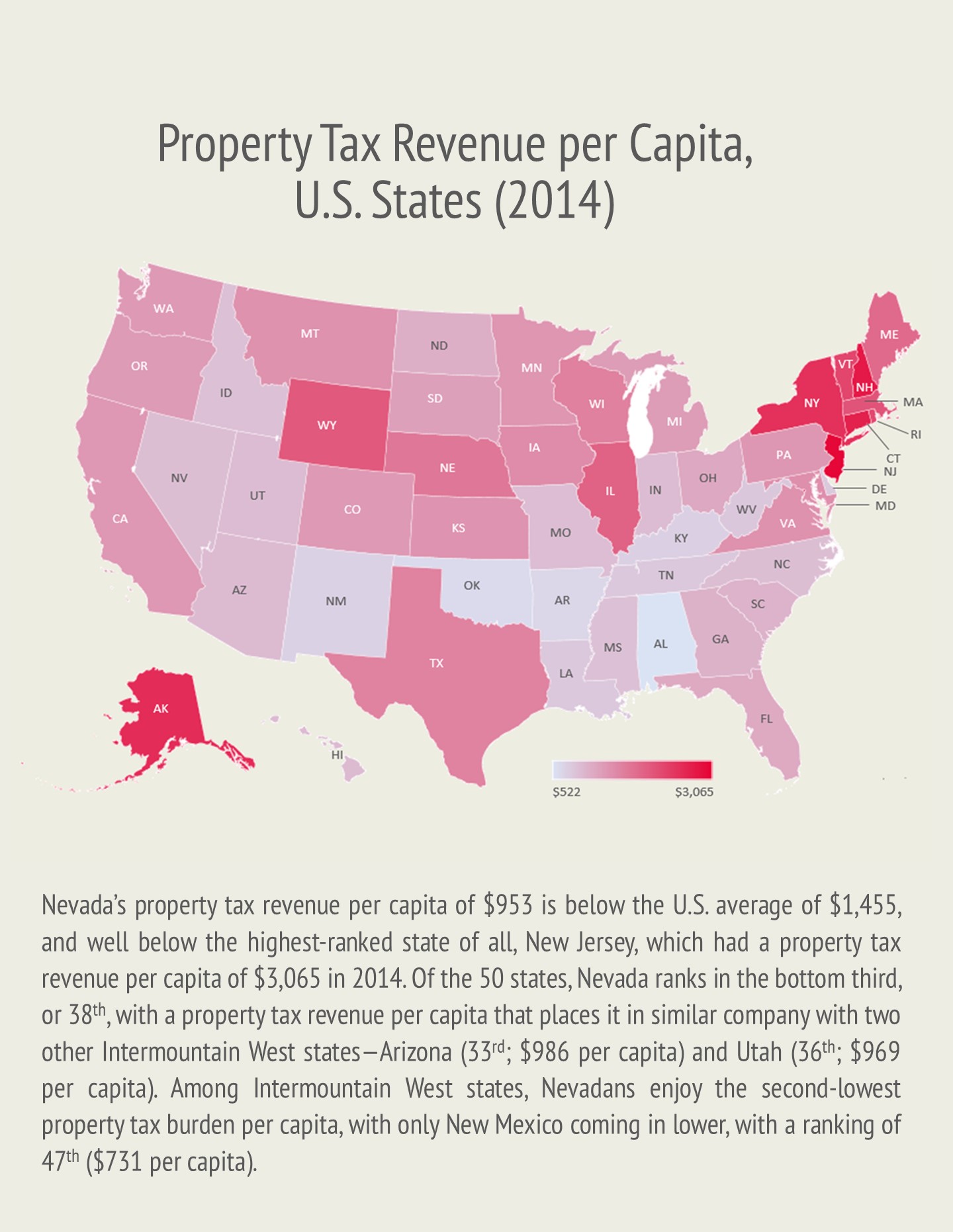

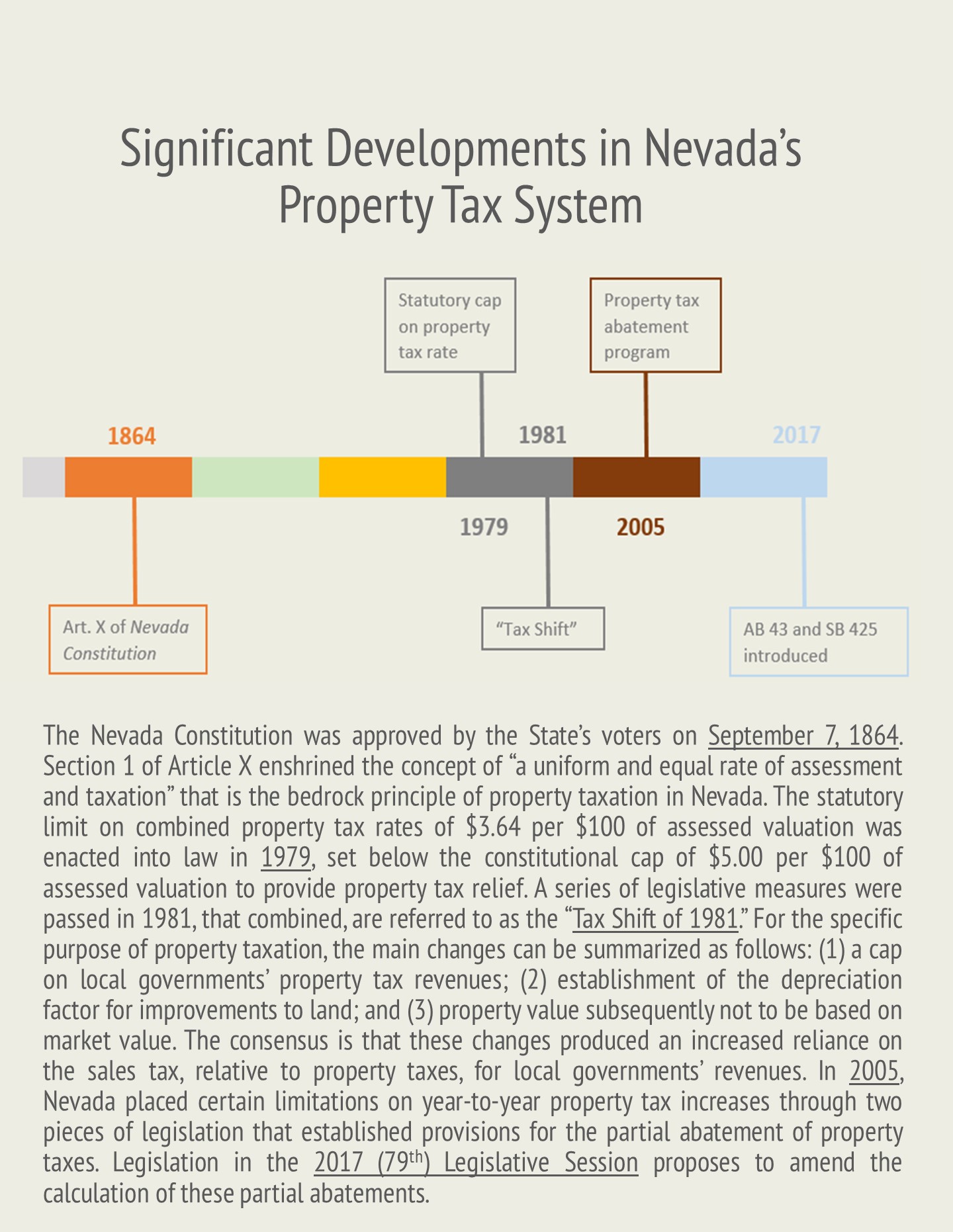

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes In Nevada Guinn Center For Policy Priorities

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

What Is Property Tax 2020 Robinhood

What Is Property Tax 2020 Robinhood

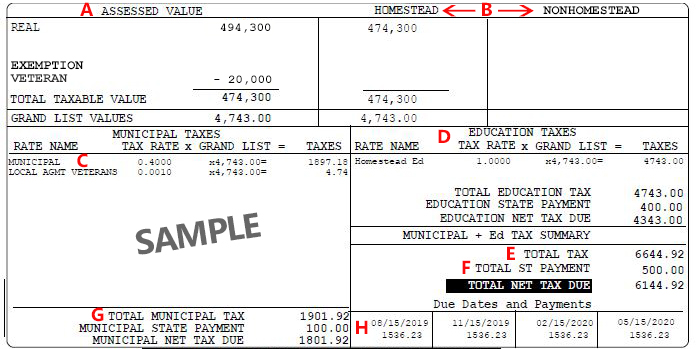

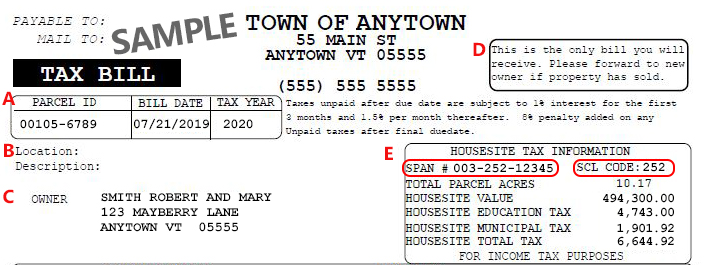

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes In Nevada Guinn Center For Policy Priorities

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes In Nevada Guinn Center For Policy Priorities

Tax Rates Gordon County Government

Tax Rates Gordon County Government

Median Property Taxes By County Tax Foundation

Median Property Taxes By County Tax Foundation

Easyknock The Guide To Georgia Property Tax Rates And Options

Easyknock The Guide To Georgia Property Tax Rates And Options

Lowest And Highest Property Taxes Tax Foundation

Lowest And Highest Property Taxes Tax Foundation

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home