What Is My Council Tax Property Reference Number

Full address as it appears on your bill please insert your postcode in the following format. All properties are assigned to a Valuation Band relating to the value of the property.

Find Your Council Tax Account Number Bracknell Forest Council

Find Your Council Tax Account Number Bracknell Forest Council

Your account reference is located at the top of the bill.

What is my council tax property reference number. We will only issue you with an account number after you have told us your are moving into a property. A UPRN will consist of comprehensive data of a property from the planning stages to demolition. It consists of numbers of up to 12 digits in length.

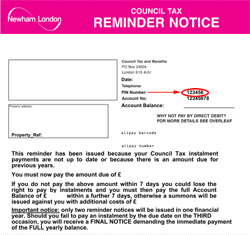

To make a payment you will need to know your reference number. Youll need both of these if you want to set up your account. Attention Council Tax Online Account Customers in receipt of Housing Benefit.

Theyll register you and send you a Council Tax bill. Find out the Valuation Band values. It will be a number that starts with an 8 this can be found on a bill or letter from us about council tax.

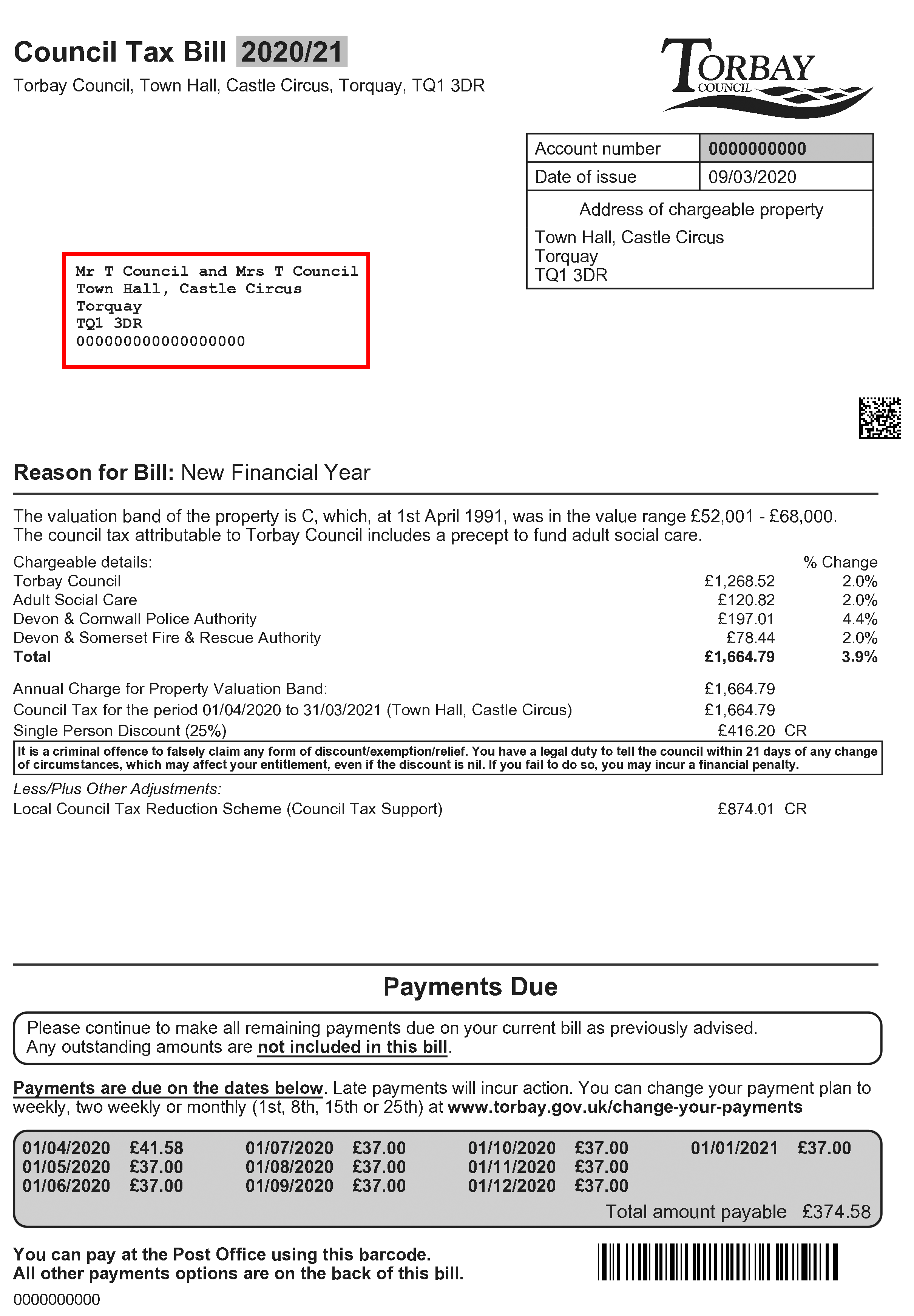

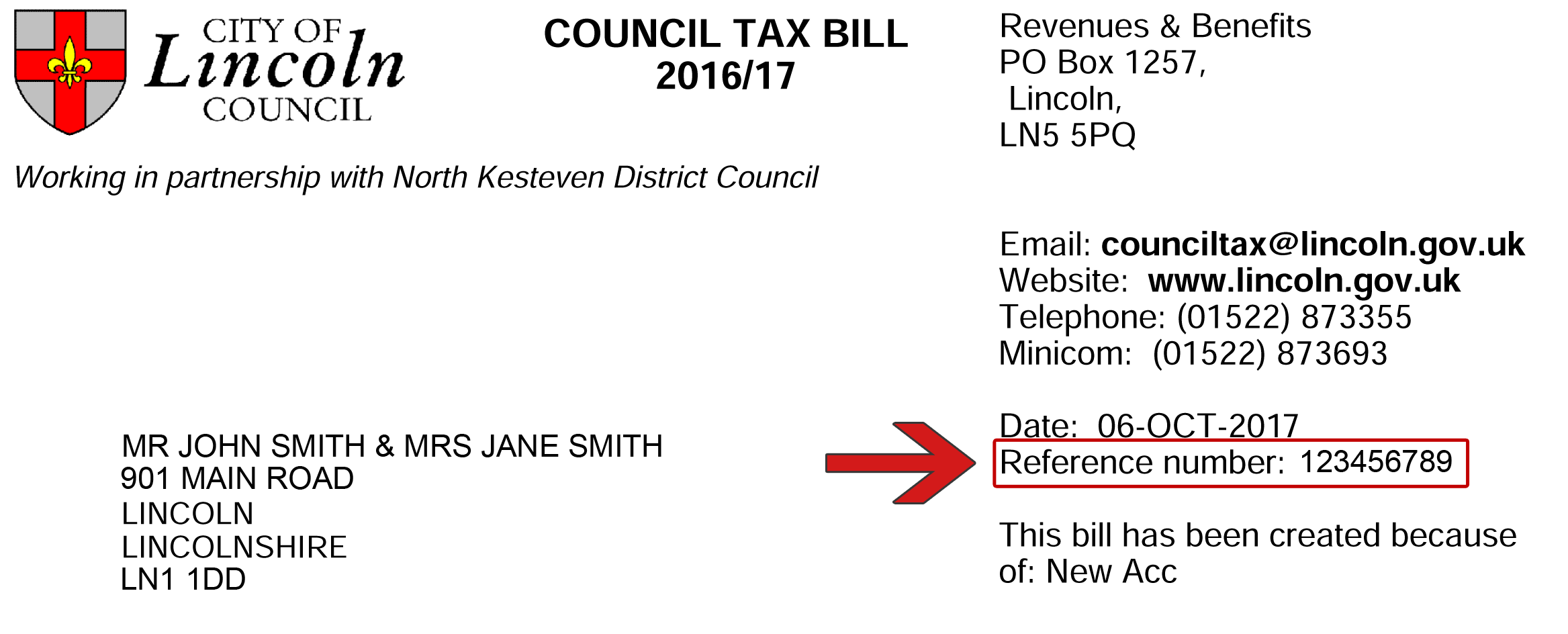

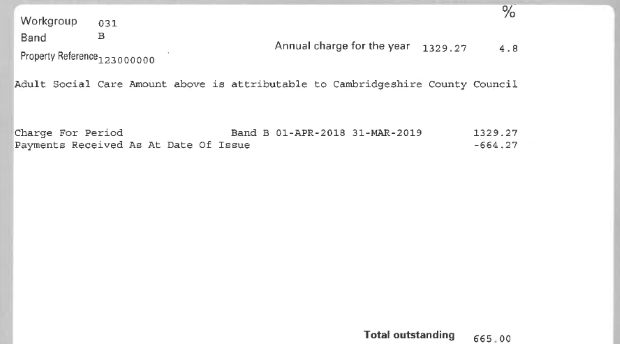

Local governments in the UK have allocated a unique number for each land or property. Your Council Tax reference account number and online key are printed in the top right corner of your latest bill or summons notice. Each dwelling subject to Council Tax is in one of eight bands according to their open market capital value at 1 April 1991.

Where you can find your council tax account number You can find your council tax account number in the top right-hand area of the first page of a council tax bill or summons notice. Find out where your Council Tax goes and how much the District Council gets in our Council Tax Guide for 202122. This is based on how much the property was worth on 1 April 1991.

The trend towards making key national data open for all citizens and organisations to use within the UK is gaining momentum. The number is 7 or 11 digits long. If you are struggling to meet your council tax payments due to the coronavirus pandemic please contact us.

The Council Tax account reference number is shown on your Council Tax bill or any other correspondence that you have received from us about your Council Tax. What you should do if you have changed address. As of 26 October 2020 if you receive an email stating you have new mail in your Council Tax Online Account and you are also in receipt of Housing Benefit we will no longer be attaching your Housing Benefit notification above your Council Tax bill.

Your tax reference indicates which employer you are working for and appears on your payslip or letters from HMRC. Pay your council tax view your online account discounts and exemptions change of address housing benefit council tax bands. Council Tax is paid to the local authority council for the area where you live.

Find out the Council Tax band for a property in England Scotland or Wales by looking up the propertys postcode online Check your Council Tax band - GOVUK Cookies on GOVUK. Housing benefit and council tax reduction. You can also find details.

New homes built since 1991 are still valued on the basis of what they would have been worth in 1991. Council tax and coronavirus. To pay Council Tax contact your local council.

Though they sound the same a tax reference number shouldnt be confused with a Unique Taxpayer ReferenceThey are separate numbers relating to different things. The amount of council tax you pay depends on which council tax band your property is in. The Council decides on the Council Tax for each Band every year in FebruaryMarch.

You will find your Council Tax account reference on your bill. UPRN stands for Unique Property Reference Number and was created by the Ordnance Survey OS. Your Council Tax account number is an eight-digit number that starts with an eight.

Who qualifies for a discount exempt properties change to empty property discount. As a part of this initiative the Geospatial Commission has developed a new strategy setting out a coordinated approach to unlock economic social and environmental value from geospatial dataAs a result the Unique Property Reference Number UPRN has been made. To view details of your Council Tax account you will be required to provide the following information.

In these circumstances we recommend that you still contact the Council Tax Department in the first instance to discuss your account further. The Council Tax is based on the value of the subject property on 1 April 1991. I think my Council Tax Band is too high.

Your Council Tax Bill Explained

Your Council Tax Bill Explained

North Lincolnshire Council Council Tax Charges North Lincolnshire Council

North Lincolnshire Council Council Tax Charges North Lincolnshire Council

Your Bill Explained Torbay Council

Your Bill Explained Torbay Council

Your Council Tax Bill Bromsgrove Gov Uk

Your Council Tax Bill Bromsgrove Gov Uk

United Kingdom Oldham Council Tax Bill Template In Word Format Bill Template Templates Word Template

United Kingdom Oldham Council Tax Bill Template In Word Format Bill Template Templates Word Template

Your Council Tax Bill Explained Lbbd

Your Council Tax Bill Explained Rushcliffe Borough Council

Your Council Tax Bill Explained Rushcliffe Borough Council

Https Www Glasgow Gov Uk Chttphandler Ashx Id 44484 P 0

Https Www Glasgow Gov Uk Chttphandler Ashx Id 44484 P 0

Your Council Tax Bill Explained

Your Council Tax Bill Explained

How Much Is The Council Tax For My Property Property Walls

How Much Is The Council Tax For My Property Property Walls

How To Get Duplicate Property Tax Bill Property Walls

How To Get Duplicate Property Tax Bill Property Walls

My Accounts My Info City Of Lincoln Council

My Accounts My Info City Of Lincoln Council

Ibi Tax Explained Spanish Council Tax

Ibi Tax Explained Spanish Council Tax

Where Do I Find My Pin Personal Identification Number Where Do I Find My Pin Personal Identification Number Newham Council

Where Do I Find My Pin Personal Identification Number Where Do I Find My Pin Personal Identification Number Newham Council

Your Council Tax Bill Explained Middlesbrough Council

Your Council Tax Bill Explained Middlesbrough Council

Your Council Tax Bill Explained Cambridge City Council

Your Council Tax Bill Explained Cambridge City Council

Pay Council Tax By Direct Debit Wandsworth Borough Council

Pay Council Tax By Direct Debit Wandsworth Borough Council

![]() Where You Can Find Your Council Tax Account Number Islington Council

Where You Can Find Your Council Tax Account Number Islington Council

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home